You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please,

join our community today!

Semicap is in some ways the unsung hero of American global dominance in semiconductors. The US punches above its weight in terms of market share compared to demand, but specifically in three categories. EDA, IP, and Equipment.

I hope to write about everything there can be said about semiconductors, and EDA is a place I understand… Read More

-Production constraints push backlog up $1.3B to $8B

-Looks like $100B in WFE 2022 VS $80B in 2021

-Almost sold out for 2022- Could lead to continued growth 2023

-Insp/metrology up 68% Y/Y- Expect steady growth in 2022

Can’t keep up with demand….

Revenue came in at $6.27B and NonGAAP EPS of $1.89. A very slight beat of … Read More

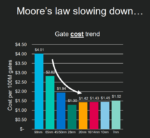

It Isn’t Transistory

There’s a quiet upheaval happening in the semiconductor industry. The rules that have always governed the industry are fraying, undoing assumptions that we took for granted, that was pounded into us in school. The irreproachable Moore’s Law, that exponential progress will make things cheaper, better,… Read More

-KLAC – great QTR & calendar year but supply chain impacted

-Management feels supply chain to improve after March Q

-Demand remains strong, driven by foundry/logic

-Process management is next best place in industry after litho

Great end to calendar year

KLA reported revenues of $2.53B with non GAAP EPS of $5.59 nicely… Read More

Too much demand- A “good” problem-Managing supply & capacity-Intel & Hi NA

–ASML great Q4 results-Demand off charts-Supply constrained

-Dealing with chain issues, putting out fires, expediting

-Looking forward to next gen High NA in 2024/2025

-Intel’s order doesn’t give advantage,… Read More

- Semicon West was Semicon Less- Less Customers & Vendor

- Everyone is busy as can be, maybe too busy to attend

- Those who were there, talk about supply chain issues & stress

- How long does the party last & where the money comes from?

Semicon West was Semicon Less….

We attended a “Hybrid” version of Semicon… Read More

KLA- great quarter driven by continued strong foundry/logic

No supply chain hiccups- Riding high in the cycle

Wafer inspection remains driver with rest along for the ride

Financials remain best in industry

A superb quarter

There was little to complain about in the quarter. Revenues of $2.1B and EPS of $4.64, both nicely beating… Read More

Lam- good quarter but supply chain headwinds limit upside

Memory seems OK for now but watch pricing

China will also weaken which may add caution

Performance remains solid as does technology prowess

The yellow caution flag in the Semi race impacts Lam as well

As we suggested two weeks ago and saw with ASML this morning, supply chain… Read More

ASML great QTR but supply chain will limit acceleration

Products are most complex with most extensive supply chain

Long term position fantastic but investors will be nervous

300M pushouts in DUV with EUV still on track

Good quarter but yellow caution flag is out for supply chain concerns

ASML reported great revenues of Euro5.2B… Read More

– If chips are “as good as it gets” so are the stock prices

– Are we at a near term ceiling that stocks have bounced off of?

– If growth slows do valuations also slow?

– Are we in a holding pattern waiting for a down cycle?

Second order derivative investing

As we have said many times in the past, investors… Read More