The ASIC business has always been a key enabler of the semiconductor industry but it is a difficult business. In my 40 years I have seen many ASIC companies come and go but I have never seen one like Alchip.

Alchip Technologies Ltd. was founded more than 20 years ago, about half way through my career. I know one of the founders, a fiercely competitive man equally matched with intelligence and charm. The founding Alchip team was from Simplex Solutions, a design and verification company, which was acquired by Cadence for $300M, a very big number in 2002.

Simplex had a close relationship with Sony (the Playstation 2 ASIC) and that relationship continued with Alchip. TSMC was also a key relationship for Alchip as an investor and manufacturing partner. TSMC at one time owned 20% of Alchip. At the same time (2002/2003) TSMC also invested in another ASIC provider Global Unichip (GUC) and is now the largest shareholder. As I mentioned, ASICs are a key semiconductor enabler and TSMC is a big reason why.

Bottom line: Alchip has passed the test of time with flying colors and is the one to watch for complex ASICs and SoCs, absolutely.

Here is their latest press release:

Taipei, Taiwan August 31, 2024 – Alchip Technologies’ Q2 2024 financial results set second-quarter records for revenue, operating income, and net income.

Second-quarter 2024 revenue notched a record $421 million, up 62.8% from Q2 2023 revenue of $258.5 million and up 26.2% over Q1 2024 revenue of $333.6 million. Operating income for the second quarter of 2024 was a record $51.2 million, representing an 80.2% increase over Q2 2023 operating income of $28.4 million, and a 32.8% increase over Q1 2024 operating income of $38.5 million.

At the same time, second-quarter 2024 net income set a record of $49.3 million, 105.8% higher than Q2 2023 net income of $23.9 million, and up 26.3% compared to Q1 2024 net income of $39 million. Earnings per share for Q2 2024 were NTD 20.1.

Commenting on the record results, Alchip President and CEO Johnny Shen cited revenue growth driven by higher-than-expected AI ASIC shipments to a major customer; in particular the shipments of AI ASIC to a North America service customer and the ramp-up of a 5nm AI accelerator to a North America IDM customer.

In total, AI and high-performance computing applications accounted for 91% of Q2 2024 revenue, with networking contributing 6%, niche applications adding 2%, and consumer uses accounting for the remaining 1%.

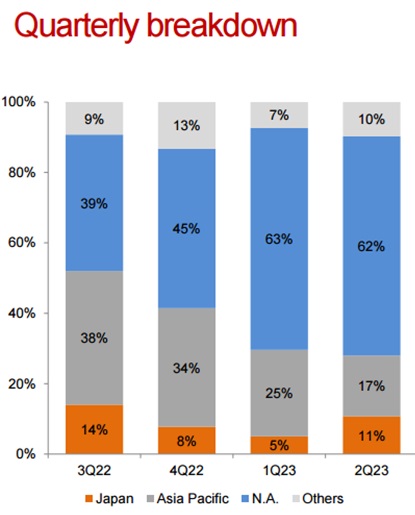

On a process technology basis, revenue derived from designs at 7nm and more advanced nodes accounted for 96% of Q2 2024 revenue and 95% of first-half 2024 revenue. The North America region accounted for 78% of Q2 2024 revenue, while the Asia Pacific region contributed 8%, with Japan and other regions made up the remaining 14%.

About Alchip

Alchip Technologies Ltd., founded in 2003 and headquartered in Taipei, Taiwan, is a leading global provider of silicon and design and production services for system companies developing complex and high-volume ASICs and SoCs. Alchip provides faster time-to-market and cost-effective solutions for SoC design at mainstream and advanced process technology. Alchip has built its reputation as a high-performance ASIC leader through its advanced 2.5D/3DIC design, CoWoS/chiplet design and manufacturing management. Customers include global leaders in AI, HPC/supercomputer, mobile phones, entertainment device, networking equipment and other electronic product categories. Alchip is listed on the Taiwan Stock Exchange (TWSE: 3661).

Also Read:

Collaboration Required to Maximize ASIC Chiplet Value

Synopsys and Alchip Accelerate IO & Memory Chiplet Design for Multi-Die Systems

The First Automotive Design ASIC Platform

Share this post via:

Comments

One Reply to “Alchip Technologies Sets Another Record”

You must register or log in to view/post comments.