I don’t know the story behind the name Alchip. I’ve been asking this question ever since its founding in 2003 and still haven’t found the answer. Wikipedia sometimes provides insights and stories behind names of companies, products and services but I couldn’t find any regarding the name Alchip. One thing is for sure. After its consistent recording breaking financial results for many years in a row, no one is going to confuse the “Al” in the name for what “Al” stands for in the periodic table of chemical elements.

Alchip just announced financial results for 2022, breaking records on revenue, operating income, net income and earnings per share (EPS). It was able to achieve this in spite of the lower-than-expected performance due to substrate shortage influencing Inference chip shipments to North America. NRE revenue accounted for 40% to 45% of total 2022 revenue, with ASIC sales accounting for 55% to 60%. That’s upwards of $184 million in NRE revenue and is significant in itself. This bodes well for Alchip’s future production revenue. Artificial Intelligence (AI) is becoming a major driver in the projected growth of the semiconductor market. System companies are getting directly involved in SoCs and working with companies such as Alchip to ensure differentiation and profitability of their products. The number of design starts are projected to continue to grow, driven by many growth applications. This also bodes well for Alchip’s future.

Success Requires Focus

In the ASIC industry, those who are consistently successful have to judiciously overcome many challenges thrown at them. Consistent success doesn’t arrive by happenstance or luck. It requires focused dedication to the ASIC model and ongoing strategic investments to stay on top. Alchip has always focused on delivering leading edge services to its customer base with high performance computing (HPC), AI, Networking and Storage markets as key markets to pursue. While high-end markets and customers can offer high rewards, they also demand high investments. Without a laser beam kind of focus, players will try to be everything for everybody resulting in their investments being spread too thin. Alchip on the other hand has shown significant growth in design wins in its target focus markets through its focus and business acumen.

Design Technology and Infrastructure

Alchip has stayed with the market trends and developed design technology, infrastructure and methodologies to service its focus markets. It has consistently stayed on top of supporting the latest process nodes from TSMC, the leading foundry. Not only has it developed capability to support 2.5D/3D packaging in general but has also been qualified to support TSMC’s CoWoS packaging technology. The company has developed and continues to enhance the following:

-

- Robust yet flexible design methodology

- Flexible engagement model (both commercial and technical)

- Best-in-class IP portfolio (access to third-party IP and in-house IP/customization)

- Heterogenous chiplet integration capability

- Advanced packaging and test capabilities

Results Speak for Themselves

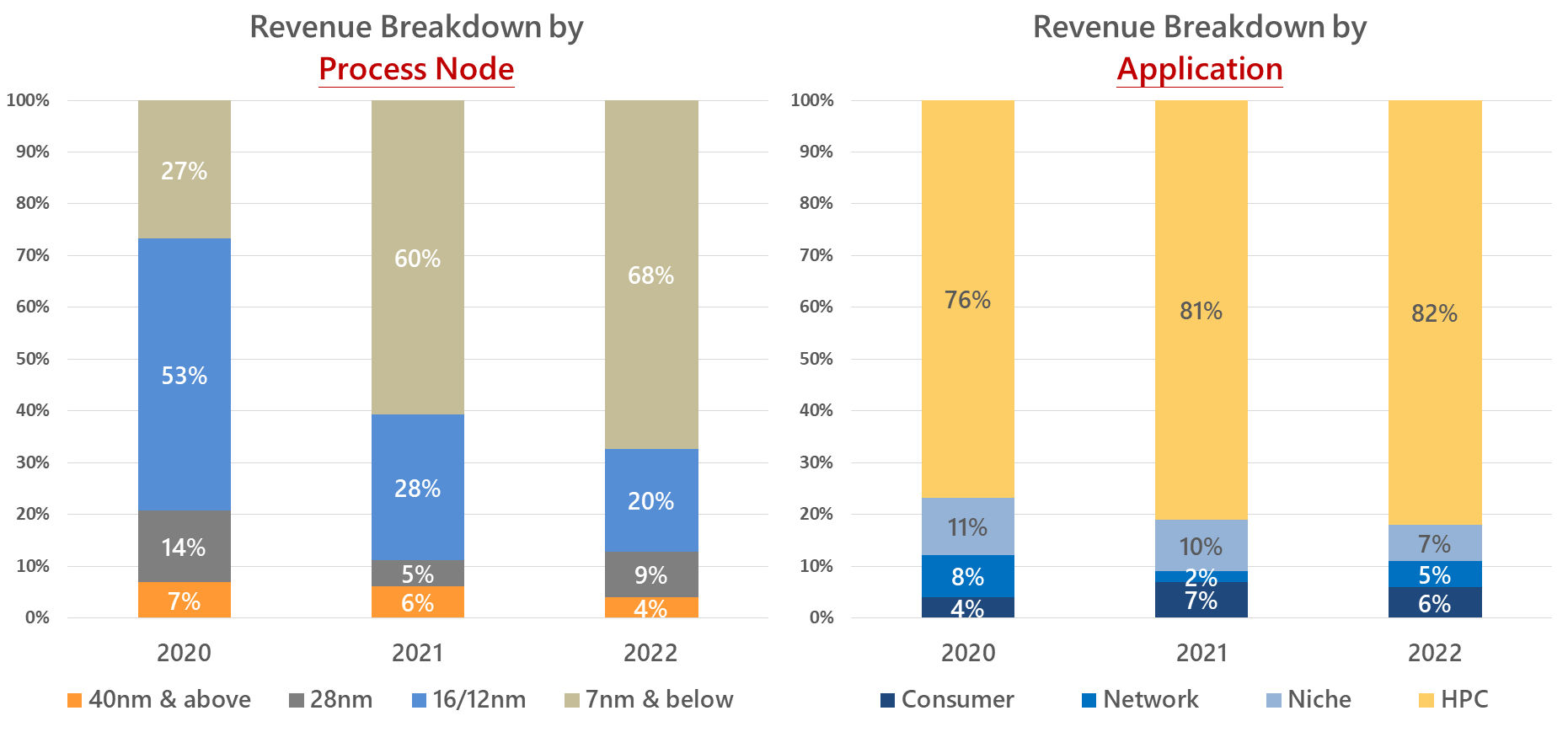

Over the last four years (2019 revenue not in the above graphic), Alchip’s revenue derived from the two leading-edge processes has grown from 60% to 88% in 2022. Over the same period, its revenue derived from the HPC market segment has grown from 59% to 82% in 2022. When Networking and Niche markets are added in, the share reaches a whopping 94%.

You can read the entire press announcement of Alchip’s 2022 financial results here.[Link once announcement goes public on May 1st]

About Alchip

Alchip Technologies Ltd., founded in 2003 and headquartered in Taipei, Taiwan, is a leading global provider of silicon and design and production services for system companies developing complex and high-volume ASICs and SoCs. Alchip provides faster time-to-market and cost-effective solutions for SoC design at mainstream and advanced, including 7nm, 6nm, 5nm and 4nm processes. Alchip has built its reputation as a high-performance ASIC leader through its advanced 2.5D/3D package services, CoWoS/chiplet design and manufacturing experience. Customers include global leaders in AI, HPC/supercomputer, mobile phones, entertainment device, networking equipment and other electronic product categories. Alchip is listed on the Taiwan Stock Exchange (TWSE: 3661).

Also Read:

Achieving 400W Thermal Envelope for AI Datacenter SoCs

Alchip Technologies Offers 3nm ASIC Design Services

Share this post via:

Comments

There are no comments yet.

You must register or log in to view/post comments.