![]()

– CHIPS Act more likely to be maimed & cut than outright killed

– Will Legislators reverse flow of equipment to Reshore from Offshore?

– Recent order cuts, Fab Delay & SMIC comments are all negative

– News flow for semi equipment all bad in front of AMAT

CHIPS Act Chops likely to occur under new administration

In the days leading up to the election, Trump made it crystal clear he thought the CHIPS Act was a “bad deal”. Then Mike Johnson, following his lead said he would probably want to repeal the CHIPS Act.

Even though some analysts and investors will say the incoming administration can’t do anything because deals are signed, there is certainly plenty that can be done to delay, prevent, modify, question and generally screw with even a done deal….especially if you are the new administrator, who writes the checks, of said deal.

We don’t think that the deal with Intel will get torpedoed but the TSMC deal has some risk. Samsung Texas will likely get done. Micron in Idaho is probably safe but the Micron Clay, New York fab is likely toast.

We think the administration will also look to undo the chip design center in California just to spite a Blue state and Newsome. Likewise Clay New York was Schumer’s baby in an also very blue New York state.

No matter what, its going to be different than anticipated as the incoming administration will influence it much as the outgoing administration influenced it.

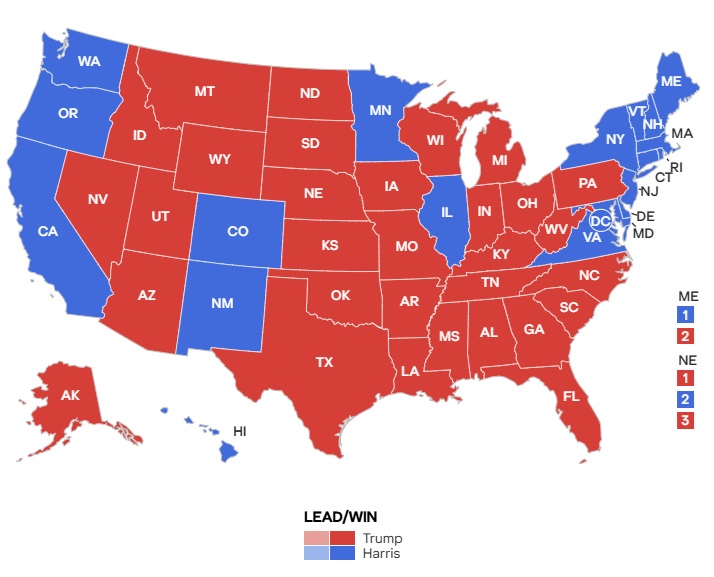

Take a look at the electoral map then look at the CHIPS Act map if you want an idea:

At the end of the day, reduced CHIPS Act spend is most directly less spend on semiconductor equipment as 90% of the cost of a new fab is in the equipment…

Cancellations & delays last week

We heard of some large cancellations coming out of a large US chip maker last week. Although likely anticipated its always a negative when it actually happens.

We also heard that Micron’s new Idaho Fab has been delayed. While this is not a near term issue it adds to the increasing headwinds. It also increases the chances of Micron’s Clay NY fab to be further delayed if not outright canned.

SMIC comments on China semi equipment indigestion

Adding to the cancelation/delay headwinds we heard from SMIC, China’s largest fab that orders for equipment coming out of China will be down as trailing edge capacity is over supplied.

Although this is something we already know and already heard about slowing China orders it is just confirmation that China is up to their eyeballs in equipment and already has way to much.

Over supply situations like this can take years to fix as not only is there too much current trailing edge supply but we also have a pipeline of equipment that hasn’t even been turned on yet.

The “Captain Obvious” award of the week goes to US legislators that finally figured out chip equipment is still be offshored, while trying to reshore chips.

US legislators sent letters to AMAT, LRCX, KLAC, Tokyo Electron & ASML asking what was up with their sales of chip equipment to China. But perhaps more importantly the letter asked about where the equipment is being made and the supply chain of that equipment.

This topic is something we have been talking about longer and more vocally than anyone else.

It seems insanely stupid and short sighted to “re-shore” semiconductors while you continue to “off-shore” the equipment made to produce them.

Wouldn’t it be just plain dumb to move chip manufacturing back to the US only to have equipment made by US companies in Asia imported back into the US where all the equipment used to be made?

Applied Materials has been the leader in moving production out of Texas to Singapore. Lam is not far behind in moving all its California and Oregon based manufacturing to Malaysia. Lam recently crowed about shipping its 5,000th chamber out of Malaysia.

Could the US finally get its act together and force chip equipment makers to reshore that which they have off shored so quickly just over the past few years? Its not like Taiwan or China stole the US equipment industry. The industry has been moving to Asia as fast as humanly possible for primarily financial reasons.

It would be yet another problem/headwind for equipment makers. The huge cost of moving only to have a large cost to move back. Lower margins and higher costs due to increased costs in the US that led them to leave in the first place.

The incoming administration could even put a tariff on imported chip equipment much as they will likely put a tariff on imported chips to force manufacturers to move back to the US as this is a core of the platform Trump was running on.

It could get ugly.

The Stocks

The recent election results raised all the boats in the stock market to new highs.

We would point out that the actual impact on the semiconductor and especially the semiconductor equipment stocks are not quite so positive especially over the longer run given both recent and future headwinds.

The CHIPS act will be likely negatively impacted, its only a question of how much. China and Tariffs will only get worse and likely impact chip production and equipment.

Near term headwinds continue to slow the overall market and most recent news is certainly negative.

It may not be a bad time to think about reducing exposure to some of the more impacted names in the space before everyone figures out the potential negative impacts.

Buckle up, things will change, a lot.

About Semiconductor Advisors LLC

Semiconductor Advisors is an RIA (a Registered Investment Advisor),

specializing in technology companies with particular emphasis on semiconductor and semiconductor equipment companies. We have been covering the space longer and been involved with more transactions than any other financial professional in the space. We provide research, consulting and advisory services on strategic and financial matters to both industry participants as well as investors. We offer expert, intelligent, balanced research and advice. Our opinions are very direct and honest and offer an unbiased view as compared to other sources.

Also Read:

KLAC – OK Qtr/Guide – Slow Growth – 2025 Leading Edge Offset by China – Mask Mash

LRCX- Coulda been worse but wasn’t so relief rally- Flattish is better than down

ASML surprise not a surprise (to us)- Bifurcation- Stocks reset- China headfake

Share this post via:

Comments

4 Replies to “More Headwinds – CHIPS Act Chop? – Chip Equip Re-Shore? Orders Canceled & Fab Delay”

You must register or log in to view/post comments.