After attending the TSMC and Samsung foundry conferences I wanted to share some quick opinions about the foundry business. Nothing earth shattering but interesting just the same. Both conferences were well attended. If we are not back to the pre pandemic numbers we are very close to it.

TSMC and Samsung both acknowledged that there could be a correction in the first half of 2023 but over the next 5 years semiconductors and the foundry business will see very healthy growth rates. Very good news and I agree completely. The strength and criticality of semiconductors has never been more defined and the foundry ecosystem has never been stronger, absolutely.

At their recent Foundry Forum Samsung forecasted (citing Gartner) that by 2027 the semiconductor industry will approach $800B at a 9% Compound Annual Growth Rate and the foundry industry will experience a 12% CAGR. Samsung Foundry predicts advanced nodes (< 7nm) to outgrow the foundry industry at a 21% CAGR over the next five years and predicts its business will grow to approximately $26B by 2027 with a 20% CAGR.

It will be interesting to see what TSMC guides for 2023 during the Q4 2022 earnings call. Any guesses? Double digits (10-20%) growth is my guess. N3 will be in full production and it will be the biggest node in the history of TSMC, my opinion.

According to the World Semiconductor Trade Statistics (WSTS) the semiconductor industry is now expected to grow 4% in 2022 and drop 4% in 2023. After a 26% gain in 2021 this should not be a surprise. TSMC still expects 35% growth in 2022 and based on their monthly numbers that sounds reasonable.

For Samsung the FinFET era has come to an end with the R&D focus being on GAA. Samsung had a good run at 14nm even getting a piece of the Apple iPhone 6s business. And let’s not forget that Globalfoundries licensed Samsung 14nm so that success belongs to Samsung as well as GF.

Unfortunately, Samsung 10nm was an utter failure in both yield and PPAC (performance, power, area, cost). TSMC 10nm did not fair well either with the exception of Apple. The ROI between 14/16nm and 10nm just was not enough for most customers and the promise of 7nm was worth the wait.

7nm did much better and Samsung again came back to the competitive table. Samsung 14nm was still a stronger node but 8/7nm is doing very well. This can be seen with the current TSMC 7nm slump as Samsung is a cheaper alternative. Unfortunately, Samsung 5/4nm had serious PDK and yield problems so the lion’s share of the leading edge FinFET market went back to TSMC and will stay there, my opinion.

This leaves the door wide open for Intel Foundry Services to get back in the foundry game. IFS will be spending time with us at IEDM this coming week so we can talk more after that. If Intel executes on their process roadmap down to 18A this could get really interesting.

All three foundries are talking about GAA and Samsung is even in very limited production at 3nm GAA but personally I think the FinFET era will continue on for a few more years as we get the kinks worked out of GAA. In talking to the ecosystem at the conferences, HVM GAA is still years away and the PPAC (power/performance/area and cost) is still a big question. Based on the papers I have seen we should get a pretty good GAA update next week at IEDM. Scott Jones and I will be there amongst the media masses.

One of the more interesting battles between Samsung and TSMC became clear at the conferences and that is RF. I fully expect IFS to hit this market hard as well. Based on the talk inside the ecosystem, Samsung 8nm RF is a cheaper non EUV version of TSMC N6F and it seems to be experiencing a surge in popularity. TSMC N6F however is set to fill the N7 fabs so we should see a big push from TSMC in that direction. At the recent TSMC OIP analog automation, optimization, and migration were popular topics( TSMC OIP – Enabling System Innovation , TSMC Expands the OIP Ecosystem! ). But again, RF chips are very price sensitive so if the design specs can be met at Samsung 8RF and the ecosystem is willing then that is where the chips will go, my opinion.

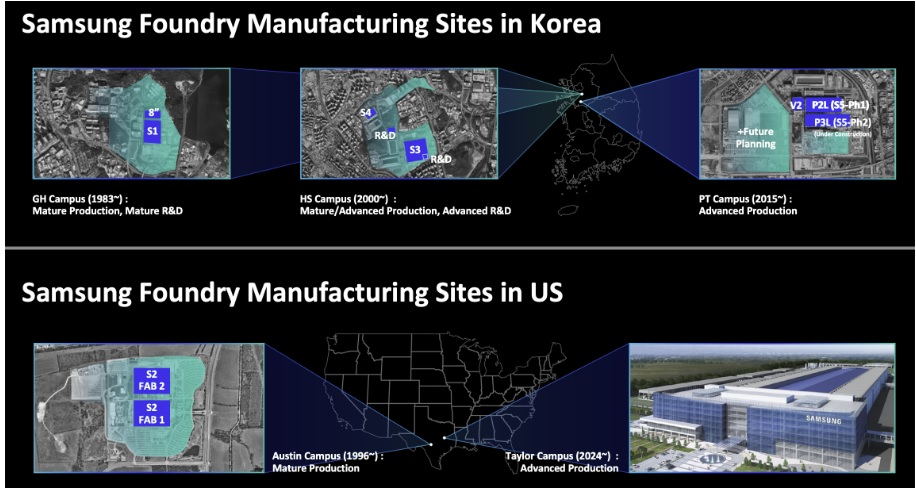

Capacity plans were discussed in detail at both conferences. If you look at TSMC, Samsung, and Intel fab plans you will wonder how they will be filled. TSMC builds fabs based on customer demand which now includes pre payments so I have no worries there. Samsung and Intel however seem to be following the Field of Dreams strategy as in “build it and they will come”. I have no worries there either. If all of the fab expansion and build plans that I have seen announced do actually happen we will have oversupply in the next five years which is a good thing for the ecosystem and customers. TSMC, Samsung, and IFS can certainly weather a pricing storm but the 2nd, 3rd, and 4th tier foundries may be in for rougher times.

Just my opinion of course but since I actively work inside the semiconductor ecosystem I am more than just a pretty face.

Also Read:

TSMC OIP – Enabling System Innovation

TSMC Expands the OIP Ecosystem!

Intel Foundry Services Forms Alliance to Enable National Security, Government Applications

Share this post via:

CEO Interview with Jerome Paye of TAU Systems