LTE (Long Term Evolution) is the true 4G standard for cellular and, over time, wireless internet. In fact it is several different standards with different levels of performance. LTE will eventually be the only technology used in cellular, voice will simply be Voice-over-IP (VoIP, the same technology that companies like Skype and Vonage use to make “free” calls over the net). Right now, however, we are in a transition period known as CSFB for circuit switched fall-back. Since not all base-stations even have LTE and many do not have full capacity (a lot is still used for 3G) phones need to use regular 3G for calls at time, while using LTE for internet data access.

LTE is much higher bandwidth than 3G, which for us users is a good thing of course. But for people who need to build LTE, especially in the power limited environment of handsets, this performance comes at a price: power. It is tricky to build an LTE modem and its associated software and keep the power down. After all, people notice and get annoyed if their phone doesn’t last a day on a charge. They are less concerned if it lasts longer since most people put their phone on a charger on some daily routine.

So the challenge is to build an optimum software stack and processor to run the stack. A traditional microprocessor (think ARM) with general purpose software is far too power-hungry to be a solution. Not that ARM won’t be in your cell-phone, it will. It just won’t be running the air-interface modem.

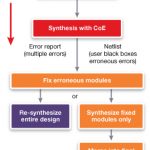

Tensilica and their software partner mimoOn today announced a partnership to provide the only comprehensive hardware/software licensable IP solution for LTE and LTE-A (advanced, higher bandwidth). Tensilica is now the exclusive DSP vendor for mimOn’s LTE UE (user-equipment) and eNodeB (base station) physical layer software products.

By creating a tight partnership in this way, it is possible to optimize the hardware software tradeoffs so that designers get a much more efficient solution. Power is always a big issue in handheld devices since it is something that, at least indirectly, the user notices. Phones get hot and batteries run down fast when it is too high. Just using generic software is more of a challenge since it cannot be co-optimized with the hardware.

In the longer term, just as WiFi is embedded in lots of things (for example, I just bought a bathroom scale that links to my WiFi router so that every time I use it it automatically gets logged and I can draw graphs of my weight) in the future LTE will be embedded in things in the same way, but higher bandwidth. So don’t just think AT&T, Verizon: LTE will spread to appliances, cars, thermostats and so on.

And on the regular cell-phone network things will change too. The increasing demand for cellular bandwidth means that more and smaller base stations will be required, especially indoors, leaving the big cell towers for the calls that cannot be offloaded.

By developing subsystems that are easy to adopt (meaning that you can add LTE to a system without a deep knowledge of LTE DSP processing) Tensilica and mimoOn (from Duisburg, Germany, by the way) can help accelerate this transition to LTE cellular and the LTE-enabled IoT (internet of things).