Mentor continues to invest in conferences such as DAC, no matter the location, for which I am very grateful. They have a long list of activities this year but I wanted to point out my top three:

Wally Rhines has a talk in the DAC Pavilion which is first on the list. Wally’s expert industry perspective is the result of tireless research and endless customer meetings around the world and should not be missed. Wally will also be signing “From Wild West to Modern Life” books (last on the activity list) at the Mentor booth Monday at 5:00pm and Tuesday at 10:00am. There is a limited supply so I would get there early on either day. This is Wally’s first book, first book signing, and is your chance to get a piece of EDA history, absolutely.

FREE cappuccino from 9:00-2:00, and happy hour from 3:45-4:45 in the Mentor Booth. Hobnob with semiconductor professionals from around the world in the most casual setting. A great place to start and end your 56thDAC exhibition floor experience. I hope to see you there.

The 5G Myth vs. Reality Panel with Mentor, Synopsys and Cadence. Paul Mclellan and I were chatting about 5G at the Samsung Foundry event last week. His AT&T iPhone said he had a 5G connection while my Verizon iPhone said 4g. Identical phones different coverage. Marketing at its finest! This is an excellent opportunity to learn more about 5G from the semiconductor ecosystem, where electronics and 5G begins!

Activity List From Mentor Marketing:

The Design Automation Conference (DAC) is the premier conference for automated electronics design and verification technology. For 2019, DAC returns to sunny Las Vegas, Nevada at the Las Vegas Convention Center from June 2-5, 2019.

We’ve packed each day full of exciting activities and presentations featuring Mentor technical experts discussing the latest in cutting-edge design. You’ll find our experts in the conference program, in our booth (#334) hosting suite sessions and networking events, and in the Verification Academy booth (#617).

CONFERENCE PROGRAM

DAC Pavilion

Fundamental Shifts in the Electronics Ecosystem

MONDAY June 03, 10:30am – 11:15am | DAC Pavilion – Booth 871

Speaker: Wally Rhines – Mentor, a Siemens Business

Wally Rhines, CEO Emeritus of Mentor, a Siemens business, will examine major new market opportunities like AI/ML, automotive, 5G, etc. and how these markets will call for new design activity and the need for broader design tool innovation. He will also explore whether we are heading into a period of stability after three years of disruption or if the revolution will continue.

Straight Talk with Tony Hemmelgarn, Siemens Digital Industries Software CEO

MONDAY June 03, 11:30am – 12:00pm | DAC Pavilion – Booth 871

Moderator: Ed Sperling

Myth vs. Reality: What 5G is Supposed to Be, And What it Will Take To Get There

TUESDAY June 04, 11:30am – 12:00pm | DAC Pavilion – Booth 871

5G is trumpeted as the big enabler, providing massive throughput and a massive upgrade path for the mobile and mobility markets. It is a way for cars, phones and other connected devices to stream massive amounts of data to the cloud and back again. But 5G signals don’t travel very far, and they don’t penetrate objects. Devices built for this market will require extreme power management so they aren’t searching for signals constantly. Parts of them will always be on, which has an impact on design and reliability. And some parts, such as the antenna arrays, cannot even be tested using conventional means.

Panelists:

Neill Mullinger – Mentor, a Siemens Business

Peter Zhang – Synopsys

Ian Dennison – Cadence Design Systems

Paper Presentations

MONDAY, June 03

4.4 Electromigration Signoff based on IR-drop Degradation Assessment

8.4 Local Layout Effect Aware Design Methodology for Performance Boost below 10nm FinFET Technology

TUESDAY, June 04

18.4 A Lightweight Hardware Architecture for IoT Encryption Algorithm

WEDESNDAY, June 05

66.4 Virtual Methodology For Performance and Power Analysis of AI/ML SoC Using Emulation

69.4 Efficient Verification of High-level Synthesis IP

Posters

123.21 Metric Driven Power Regression – A Methodology based Metric Driven Approach for Power Regressions

123.25 River Fishing: Leverage Simulation Coverage to Drive Formal Bug Hunting

124.2 Comprehensive Analog Layout Constraint Verification for Matching Devices

124.7 Enabling Exhaustive Reset Verification in Intel Design

124.16 A Smart RTL Linting Tool with Auto-correction

124.25 Configurable Multi-protocol AUTOSAR-based Secure Communication Accelerator

125.12 Faster PV Signoff Convergence in P&R using RTD

125.14 Hybrid Methodology- An Innovative Methodology for Hierarchical CDC Verification

125.17 Functional Safety on A-R-M CPUs

EXHIBIT FLOOR

Mentor’s booth #334 is located on the west end of the exhibit floor. Check in daily for a host of technical sessions, networking events, panel discussions, a free cappuccino from 9:00-2:00, and happy hour from 3:45-4:45! You’ll also find Mentor verification experts in the Verification Academy booth (#617) for in-depth sessions on Portable Stimulus, UVM, and more.

Technical Sessions in the Mentor Booth

Each day, Mentor experts will be in the booth delivering technical sessions across:

- AMS Verification

- Analog/Mixed-Signal Verification

- Design & functional Verification

- Digital Design & Implementation

- IC Design & Test

You can view the complete list of technical sessions and pre-register here.

Expert Panel Discussions

Mentor experts will be moderating in-booth panels on both Monday and Tuesday directly following happy hour. Make sure to pick up a free glass of wine or beer before!

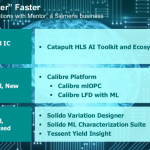

Design Smarter Innovations Faster using AI/ML and More with Mentor, a Siemens Business

MONDAY June 03, 4:00pm – 4:45pm | Mentor Booth #334

To enable our customers to deliver smarter innovations to market faster, Mentor, a Siemens business is actively delivering new solutions and use models that enable our customers to more readily develop AI-powered technologies. We are also integrating advanced machine learning algorithms into our existing tools to enable those tools to deliver better results faster. Come hear experts from across Mentor’s IC solutions portfolio describe what Mentor has to help customers deliver smarter IC innovations to market faster.

Panelists:

Ellie Burns, director of marketing, Calypto Systems Division

Vijay Chobisa, product marketing director, Mentor Emulation Division

Geir Eide, product marketing director, D2S Tessent Division

Amit Gupta, general manager, Solido, IC Verification Solutions Division

Steffen Schulz, vice president product management, D2S Calibre Marketing

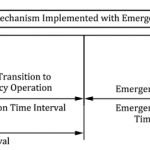

Functional Safety in Isolation – Can Safety Be Collaborative?

TUESDAY June 04, 4:00pm – 4:45pm | Mentor Booth #334

As companies strive for greater levels of autonomy, more capability will be required of automotive ICs living at the edge, and the challenge of ensuring functional safety is exacerbated. The mass public trusts companies to deliver safe products to the market, but can the industry deliver on that promise given the demand for rapid innovation and complexity within the automotive ecosystem and supply chain? The scope of functional safety extends beyond the product boundaries to systems of interlinked devices representing the complete transportation network. From IP to automobile, each product plays a role in the overall functional safety of the transportation network. New paradigms and methodologies are required to ensure functional safety across all levels of the automotive ecosystem.

Panelists:

Yves Renard, Functional Safety Manager, ON Semi

Ghani Kanawati, Technical Directory of Functional Safety, Arm

Matt Blazy-winning, Functional Safety Director, NXP

Book Signing with Wally Rhines

Wally Rhines will be at the Mentor booth signing copies of his new book, “From Wild West to Modern Life”, Monday at 5:00pm and Tuesday at 10:00am.