Samsung throws further gas on the fire of weak handset and CAPEX not set but will be down versus 2017. Samsung reported revenues of KRW 60.56 Trillion and KRW 15.64 Trillion operating profit ($56B and $15B). Chips accounted for whopping KRW 11.55 Trillion in operating profit on revenues of KRW 20.78 Trillion ( $11B and $19B)….a… Read More

Tag: robert maire

EUV Continues Roll Out With Lumpy Quarters Ahead

ASML put up good results with revenues of Euro2.285B versus street of Euro2.22B and EPS of Euro1.26 versus street of Euro1.17. Guide is for Euro2.55B versus street of Euro2.46B but EPS of Euro1.16 versus street EPS of Euro1.35 on lower gross margins, slipping from 48% to 43%.

A couple of EUV systems have slipped out. This is not surprising… Read More

Intel to buy Micron – Trump Blocks IC Equipment Sales to China – Broadcom Fighting for QCOM

It has been reported over the holiday weekend that Intel is in talks with Micron over a proposed merger that would value Micron at $70 per share in a deal of a combination of stock and cash for Micron shareholders. It is said that the boards of both companies have already approved the deal.

Intel’s CEO Brian Krzanich said, “We… Read More

Will Broadcom become a Chipzilla or is the deal DOA?

The Broadcom bid for Qualcomm is the biggest, boldest semiconductor deal to date. Just when we thought semi M&A was cooling off, this deal is a years worth of deals rolled into one. Not only does this deal upset the current balance between chip suppliers and customers, it would create a giant entity smack in the middle of IOT, AI,… Read More

Choosing the lesser of 2 evils EUV vs Multi Patterning!

For Halloween this week we thought it would be appropriate to talk about things that strike fear into the hearts of semiconductor makers and process engineers toiling away in fabs. Do I want to do multi-patterning with the huge increase in complexity, number of steps, masks and tools or do I want to do EUV with unproven tools, unproven… Read More

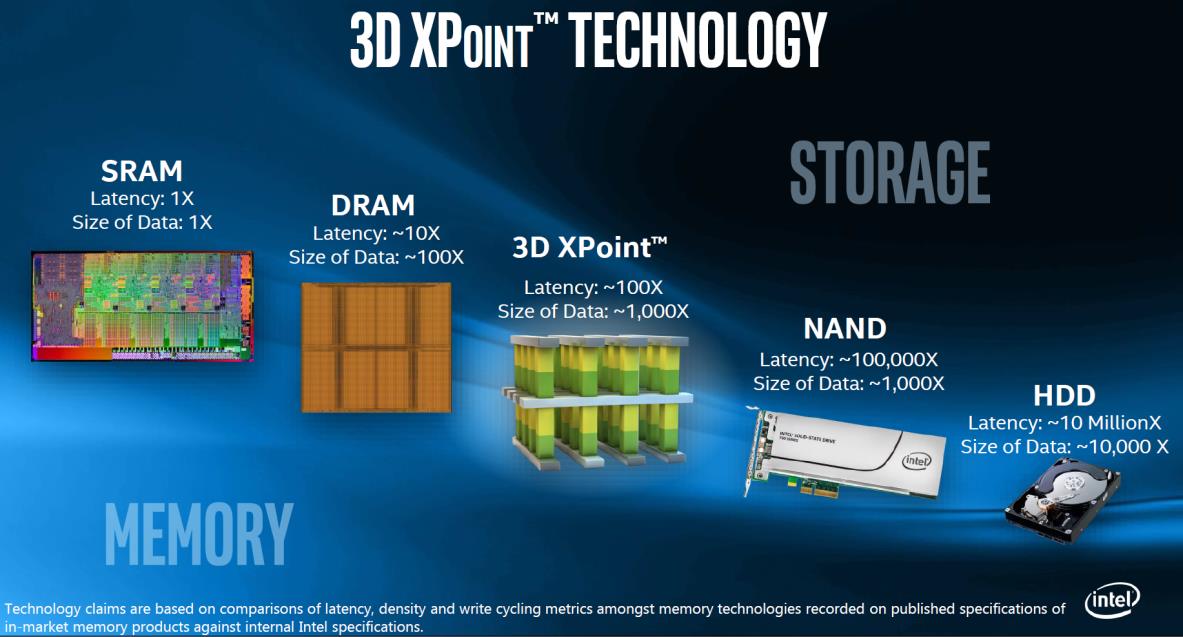

Do investors understand the new memory paradigm?

Micron put up a great quarter beating both quarterly expectations and guidance. Even though the stock was up 8% and we still think it has a long way to go as investors have not fully embraced the upside ahead in the memory market.… Read More

Deal Struck for Sale of Toshiba NAND to Bain Apple and Others

What does it mean for the skyrocketing memory sector? In a last minute plot twist, Bain capital appears to be the winner in the auction of the Toshiba memory unit. The Bain consortium includes a strange cast of characters including Apple, Dell, Seagate, Kingston Technology, Innovation Network Corp of Japan and Development Bank… Read More

What does the Lattice rejection mean for chip M&A?

Although the rejection of the Lattice deal was expected, it none the less has an impact on a number of dynamics in the chip industry and further M&A and consolidation. Freezing out China removes a “catalyst” in the market which help bid up values and add fear to both potential targets or those left out. Cross border… Read More

Can the iPhone rollout lift the industry?

We are in the midst of a number of cross currents buffeting the industry. The Korea risk seems to have escalated again and our government has thrown fuel on the fire by threatening trade agreements at the most inopportune timing possible. However we are also a week away from the roll out of one of the most anticipated Iphones ever which… Read More

Samsung Sloppy Sailor Spending Spree!

Last week, TEL (which is the Japanese equivalent to AMAT & LRCX) reported a June quarter which saw revenues drop to 236B Yen from March’s 261B Yen and saw earnings drop from March’s 47B Yen to June’s 41B Yen, a respective 9.3% decrease and a 12.8% decrease in earnings.

We don’t think this is attributable… Read More