2020 has been a NAND growth year-2021 will be the year of DRAM. While foundry logic has gotten all the credit in 2020 the reality is that NAND has been up 2X in 2020 for semiconductor equipment provider Applied Materials (AMAT). It is expected that NAND will be flat in 2021 while DRAM will take over the growth slot with foundry/logic … Read More

Tag: dram

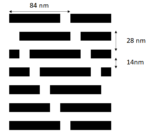

Application-Specific Lithography: a 28 nm Pitch DRAM Active Area

In the recent DRAM jargon, “1X”, “1Y”, “1Z”, etc. have been used to express all the sub-20 nm process generations. It is almost possible now to match them to real numbers which are roughly the half-pitch of the DRAM active area, such as 1X=18, 1Y ~ 17, etc. At this rate, 14 nm is somewhere around

Reliable Line Cutting for Spacer-based Patterning

Spacer-defined patterning is an expected requirement for advanced semiconductor patterning nodes with feature sizes of 25 nm or less. As the required gaps between features go well below the lithography tool’s resolution limit, the use of cut exposures to separate features is used more often, especially in chips produced… Read More

LithoVision – Economics in the 3D Era

Each year on the Sunday before the SPIE Advanced Lithography Conference, Nikon holds their LithoVision event. This year I had the privilege of being invited to speak for the third consecutive year, unfortunately, the event had to be canceled due to concerns over the COVID-19 virus but by the time the event was canceled I had already… Read More

Minimal Corona Impact on Chip Equipment Stocks

Very solid quarter driven by foundry/logic

AMAT reported a very solid quarter, beating the top end of guidance with foundry and logic being the primary drivers of spend. Revenues were $4.16B and EPS of $0.98 non-GAAP versus street of $4.11B and $0.93 EPS.

Guide not too wide… – $300M “Corona Cut”

More importantly,… Read More

Logic and Memory Make for a Recovery

- LAM- “Logic And Memory” make for a recovery-NAND (Samsung) & Logic (TSMC) + China

- Great Q4 Results & Q1 guide as memory restarts

- Logic strength continues-China is crucial to growth

- 2019 better than expected- 2020 WFE up about 5-8%

Lam reports nice finish to 2019 and start of 2020

The company reported revenues… Read More

Could TSMC’s spend be part of the seasonal pattern?

Is there more downside than upside in stocks?

Entering a seasonally weak period, then what?

Does China trade come back to haunt industry?

Cycle is past the bottom-But what kind of up cycle?

The most recent up cycle in the industry was a huge one, driven by a huge spend on NAND as SSD’s sucked up infinite number of devices. DRAM … Read More

The China trade issue is back with a vengeance!

Watching the boats go by in Shanghai-

As I write this note I happen to be looking out my hotel window over the Bund onto the brightly lit party boats cruising the Huangpu river that meanders through Shanghai. All is well here in China and the parties on the boats with millions of LEDs go on……

The view from China is that the… Read More

Micron beats subdued guidance on output cuts

2020 capex likely down at least 20% vs 2019 DRAM & NAND price drops versus slowing capacity. Investors happy cause it could have been worse.

Micron reported $1.05 in Non-GAAP EPS beating street consensus of $0.79 by $0.26. While this looks like a big beat, we would remind investors that estimates for the quarter were about… Read More

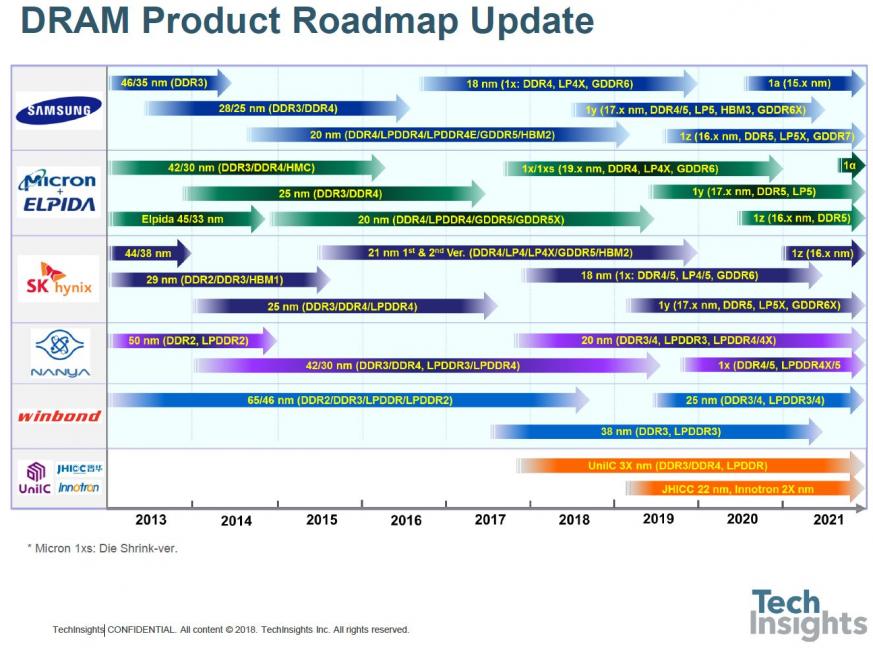

TechInsights Gives Memory Update at IEDM18 DRAM and Emerging Memories

On the Sunday evening at IEDM last year, TechInsights held a reception in which Arabinda Das and Jeongdong Choe gave presentations that attracted a roomful of conference attendees.

This is the second part of the review of Jeongdong’s talk, we covered NAND flash technology in the last post. Jeongdong is a Senior Technical… Read More