You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please,

join our community today!

-AMAT reported inline resulted helped by trailing edge & China

-Memory remains at very low levels- Foundry remains uninspiring

-China seems to be buying anything they are allowed to buy

-The recovery is too far out & unknown to handicap

Quarter was OK and Guidance also OK

Revenue was $6.63B and EPS of $1.86 versus reduced… Read More

The SPIE Advanced Lithography Conference was held in February. I recently had the opportunity to interview Steven Scheer, vice president of advanced patterning process and materials at imec and review selected papers that imec presented.

I asked Steve what the overarching message was at SPIE this year, he said readiness for … Read More

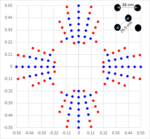

The “1.xnm” node on most roadmaps to indicate a 16-18 nm metal line pitch [1]. The center-to-center spacing may be expected to be as low as 22-26 nm (sqrt(2) times line pitch). The EXE series of EUV (13.5 nm wavelength) lithography systems from ASML feature a 0.55 “High” NA (numerical aperture), targeted… Read More

-Lam reported in line results on reduced expectations

-Guidance disappoints as memory decline continues

-Memory capex down 50% but still sees “further declines”

-Lam ties future to EUV maybe not good idea after ASML report

Lam comes in above grossly already reduced expectations

and misses on guidance

We always … Read More

-ASML weakness is evidence of deeper chip down cycle

-When ASML sneezes other chip equip makers catch a cold

-Will backlog last long enough? Will EUV demand hold up?

-“Unthinkable” event, litho cancelations, could shock industry

ASML has in line quarter but alarm bells ring on wavering outlook

ASML reported Euro6.7B… Read More

-Reports of further tightening of China SemiCap Restrictions

-Likely closing loopholes & pushing back technology line

-Dutch have joined, Japan will too- So far no Chinese reaction

-SVB is toast but repercussions may be far worse

Reports of tightening semiconductor sanctions on Friday

It was reported byBloomberg of Friday… Read More

-We attended the SPIE lithography Conference in San Jose

-No significant news or announcements on EUV

-Focus on 500WPM target and High & Hyper NA rollout

-AMAT overblown Sculpta-Not exactly what its cracked up to be

We have been attending SPIE for many years now and are happy to see a return to pre Covid levels… Read More

-Business will “drift down” over the course of 2023

-Not just memory is weak- China issue, foundry/logic slowing

-March guide worse than expected (Like Lam)

-Backlog likely saw push outs & cancelations but still long

Good quarter but weak guide

Much as we saw with Lam, KLA reported a beat on the December quarter… Read More

-Hynix reports worst downturn in 10yrs – Already in red ink

-If the #2 memory maker is already negative what does it say?

-Confirms our view of 2023 write off- maybe 2024 better?

-Micron Mangled? & Toshiba Toast?- Buyers advantage

Hynix posts record $1.4B loss- worst in 10 years

Not all that surprisingly Hynix reported… Read More

-US, Japan & Dutch agree to embargo some China chip equip

-Goes beyond just leading edge & will increase negative impact

-China might catch up in decades or invade Taiwan tomorrow

-Why the memory downturn could be longer than expected

Ganging up on China

It appears that the US has put together a coalition of the US, Japan and… Read More