You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please,

join our community today!

-Supply chain issues finally catch up to Lam- Ongoing issue

-Problem from one main supplier to spread to more

-Causes low December Quarter and soft guide for March

-Quarters could be lumpy due to differed & revenue push outs

Lam Stews over supply Chain Issues

It sucks when you have all the demand in the world but can’t build… Read More

-AMAT -Supply chain can’t keep up with expanding business

-May be longer term issue which will limit upside

-Being tough on vendors may have come back to bite Applied

-Fixing supply chain will likely take longer than the current cycle

Supply Chain issues come home to roost

Applied Materials missed on both earnings and revenues… Read More

-Strong beat & guide- WFE up in 2021 & 2022-$160B combined

-Taking share in conductor etch & CVD

-Traditional Moore Scaling – No More?

-Foundry Logic leads followed by DRAM with weak NAND

Nice beat & guide & raise

Applied reported revenues of $5.58B with GM of 47.5% resulting in non-GAAP EPS of $1.63. … Read More

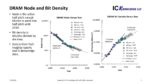

At the SPIE Advanced Lithography Conference in February 2021, Regina Freed of Applied Materials gave a paper: “Module-Level Material Engineering for Continued DRAM Scaling”. Applied Materials provided me with the presentation and was kind enough to set up an interview for me with Regina Freed.

I also spoke to Regina Freed last… Read More

Smartphone shipments have been dropping over the past few years, as shown in Chart 1, as a result of several factors, but primarily the slowdown in smartphone innovation while at the same time prices have kept increasing. Even with the much anticipated 5G in 2020, unimpressive speed gains coupled with a Covid-19 backdrop, smartphones… Read More

2020 has been a NAND growth year-2021 will be the year of DRAM. While foundry logic has gotten all the credit in 2020 the reality is that NAND has been up 2X in 2020 for semiconductor equipment provider Applied Materials (AMAT). It is expected that NAND will be flat in 2021 while DRAM will take over the growth slot with foundry/logic … Read More

- KLAC sports solid QTR & Guide- Foundry & Logic drivers

- Management remains dismissive of SMIC embargo

- Execution & financials are solid but macro headwinds remain

- Nice September Quarter

KLA reported revenue of $1.54B and Non GAAP EPS of $3.03 versus street expectations of $1.49B and EPS of $2.77. Guidance is for revenues… Read More

At SEMICON West, Applied Materials announced a new selective gap fill tool to address the growing resistance issues in interconnect at small dimensions. I had the opportunity to discuss this new tool and the applications for it with Zhebo Chen global product manager in the Metal Deposition Products group at Applied Materials.… Read More

Higher Foundry/logic exposure helps-

Little or no Covid or China trade impact-

Nice quarter but even better guide-

Applied reported revenues of $4.4B and NonGAAP EPS of $1.06, nicely above street estimates of $4.2B and $0.95 in EPS. Guidance is for revenues $4.6B +-$200M and EPS of $1.17+- $0.06, versus current expectations of… Read More

Two bits of recent news has excited people in the semiconductor manufacturing space. First TSMC (bit.ly/384joVr) announced their intention to invest $12 B dollars in a Fab in Arizona. Then came the Corona-driven bipartisan proposed $23B federal government investment in semiconductor manufacturing (nyti.ms/2YZzFqnl). … Read More