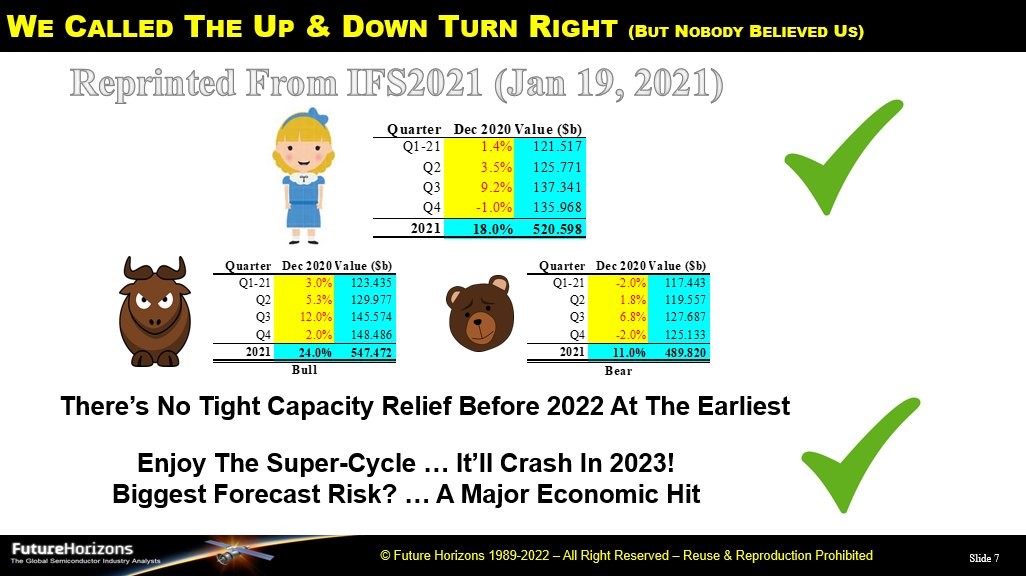

In 2021, we shocked the industry with our predictions of a double-digit ‘supercycle’ in 2022, followed by a crash in 2023. Despite industry skepticism, bordering on outright disbelief, our predictions were on point, based on decades of semiconductor experience and data analysis.

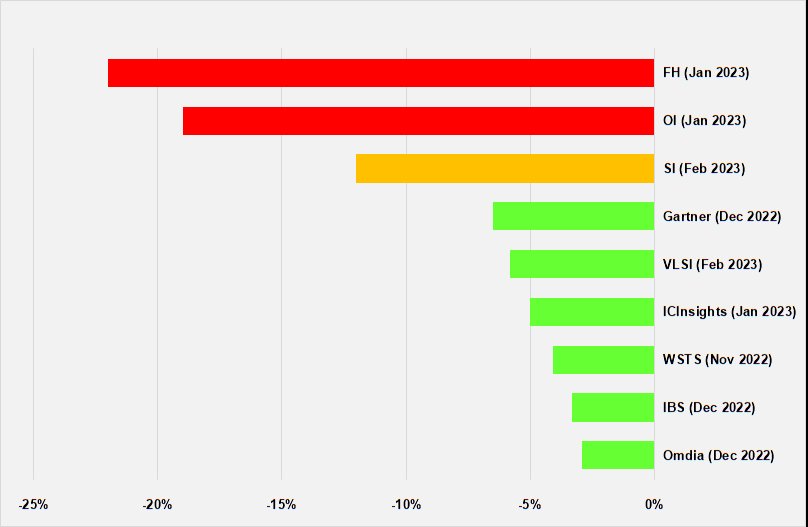

Now, as the industry finally accepts the impending crash, many still cling to the belief that their sector or application will be unaffected. As such, today’s debate has shifted from whether the market will go negative to whether it will be a single- vs double-digit decline.

We stand firmly by our belief that the market is heading for a 22 percent double-digit decline, despite, once again, being at odds with the industry consensus.

The Billion Dollar Question

At our recent January 2023 industry update webinar, we reconfirmed our May 2022 forecast for a 22 percent double-digit decline in 2023, despite the fact most (if not all?) other industry pundits were suggesting only a minor single digit decline, once again placing us well and truly out on a limb.

2023 SC Market Forecasts (By Value)

This now marks the third time in a row where we have been at odds with industry consensus.

We do not do this to be contrarian, we simply cannot see how the low single-digit forecasts can be achieved. For this to happen, the market would need to have already bottomed out and there is not a single piece of evidence, either anecdotal or factual, to substantiate that view. Almost two months into 2023, with the first quarter virtually in the bag, not a single individual, firm, or organization is forecasting the worst of the downturn is over.

The fact of the matter is the 2021-22 boom and 2023 bust are just a re-run of the infamous chip industry cyclicality … the seventeenth since the first cyclical downturn in 1961 … it’s just that the gap from the last cycle had been longer than normal, lulling the industry into a false sense of security that, for a whole sense of intellectually compelling reasons, the chip cycles had been tamed.

In retrospect, all that had happened was a week economy since the mid-2020’s financial meltdown had enabled the industry to dodge the bullet. The market boom and shortages would have hit home four years earlier, in 2018, had the chip market not collapsed in the second half of the year due to the US-China trade war and tariffs.

Back To Basics

Why are we so convinced the 2023 correction will be strong when everyone else thinks otherwise? Because the key industry fundamentals, namely unit demand, manufacturing capacity and IC ASPs, are all in bad shape.

First, driven by product shortages and extended delivery lead times, unit demand rises well above the long-term average and, as a result, inventory levels throughout the industry are at historically high levels. That’s akin to shipping ahead, and with lead times now falling, we already bought at lot of today’s needs yesterday.

Second, as demand falls away, ASPs start to plummet as suppliers drop prices in order to stimulate new demand.

Third, it takes a long time to add new production but eventually it catches up and lead times then start to fall triggering a liquidation of the now excess inventory. In the meanwhile, the new capacity buildout continues to gain momentum stoking capacity just when you don’t need it. It takes a minimum of four quarters to rein in CapEx when no longer needed.

So, we now have unit demand falling, an ASP rout in full swing and excess capacity yet to peak. It will take at least two to three quarters for this imbalance to stabilize which means the whole of 2023 is going to face strong headwinds.

Add to that a global economic outlook still clouded in fog and uncertainty, there is no way one can reasonably expect a single digit chip market downturn.

Time For Clear Heads & Action

That said, there is no need for panic or despair; the industry has been here several times before and, whilst these situations are always challenging and harsh, they are quite normal and natural and, ironically, a time when real market share gains are made. It’s just a classic semiconductor market downturn, treading a well-trodden path.

Time now to roll up one’s sleeves and do whatever’s necessary to survive in the near-term but without prejudicing the longer-term; whatever actions are taken now need to be with the inevitable 2024 upturn clearly and firmly in mind.

This is no time to panic, more a time for decisive action, cool heads and first mover advantage. It is time to get ready for the inevitably 17th industry upturn which is just around the corner.

Also Read:

The Semiconductor Market Downturn Has Started

Are We Headed for a Semiconductor Crash?

Share this post via:

Flynn Was Right: How a 2003 Warning Foretold Today’s Architectural Pivot