The recent (since 2016) news about Apple, China, FTC and other organizations positioning in respect with IP are concerning, as it seems indicating that Intellectual Property in general (Design IP and Technology IP) is at risk. Let’s consider several facts through different cases, involving ARM, Qualcomm, Imagination Technologies vs Apple, the Chinese government or various organization in Europe and the US.

ARM vs China

ARM is by far the #1 Design IP vendor, with $1, 660 million revenues in 2017. China is becoming to be an important semiconductor market, where chip design activity is fast growing with the Chinese government support. SoC design is characterized by CPU (or DSP, GPU) integration, ARM’s CPU market share is 86%. This makes ARM CPU almost unavoidable, especially for wireless application processor design. In May 2017, ARM – Softbank has created a joint-venture with “Chinese investors” (piloted by the Chinese government) at 49% (ARM) 51% (China). ARM had probably no other choice if the company wanted to continue to license IP in China, so they closed the deal.

We have learned from the press (EETimes) in June 2018 that “SoftBank Group, owner of microprocessor IP firm Arm, announced this week that the British firm will sell 51% stake of Arm’s China unit to Chinese investors and ecosystem partners for $775.2 million to form a joint venture for Arm’s business in China. Under the agreement, Arm will still receive a significant proportion of all license, royalty, software, and service revenues arising from Arm China.”

In other words, China has win the control of ARM IP business in China, thanks to a two steps maneuver… How would you call this, official theft, or weird business practices?

Apple vs Imagination Technologies

Apple was the #1 customer of IMG, licensing the company GPU IP since 2007. This GPU was integrated into Apple’ application processor integrated into iPad smartphone. For such IP licensing deal of such a critical IP, both engineering teams must work very closely, sharing information about the GPU architecture, integration and test strategies. That’s why when Apple has announced in 2017 that they will develop their own GPU, IMG was not only desperate to lose 50% of their GPU IP revenues, but also hanger because they thought that it was almost impossible for Apple to develop their own GPU without using architecture, test or integration related know-how acquired with IMG.

In term of strategy, that makes sense for Apple to develop their own IP, like CPU, GPU or even DSP. That was Qualcomm strategy: the CPU was ARM compatible (architecture license), the DSP was 100% Qualcomm (thanks to an acquisition), as well as the GPU. That’s the best to differentiate from the competition! The problem with the Apple/IMG case is that Apple did buy anything, and it could be difficult to imagine that Apple’s engineers will never use the know-how acquired when working with IMG GPU IP… The result is that IMG may disappear from the IP market, and the position from Apple is difficult to justify.

Qualcomm vs Apple

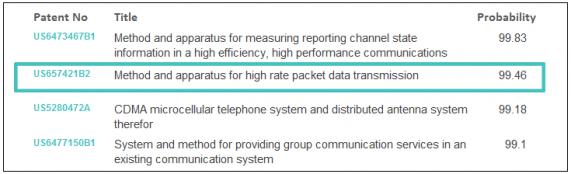

Another case is still unsolved: Apple has stopped paying royalty to Qualcomm for their wireless technology licensing. Qualcomm has invented the CDMA technology, not a surprise as one of the Qualcomm founders is Andrew Viterbi (you probably know the algorithms better than the person, as he has invented in 1967 the Viterbi algorithm to decode convolutionally encoded data). Without Qualcomm’s inventions, today’s smartphones wouldn’t be able to integrate 100 Mbit/s modem, allowing smooth download of movies, pictures, etc. In other words, without Qualcomm, today’s smartphones like iPhone would probably stay an elegant but not powerful object!

From the beginning, Qualcomm business model is to ask royalty as a percentage of the system selling price, not on the chip (application processor or modem) price. Apple, selling iPhone for $800 to $1000 is certainly paying higher royalty level than they would pay on a $25-$50 chip. But Apple is making incredibly high level of margin: evaluated to 70% to 80% of the iPhone price, depending on the amount of integrated flash. Apparently, paying a few $10 is too much for the company, so they have stopped paying royalty to Qualcomm. This case is currently reviewed by the court, but it shows how a large company like Apple, making huge profits with their iPhone sales, is just showing contempt for intellectual property, invention and design IP, which is a bit weird for a high-tech company…

Qualcomm vs China

Last but not least, this two years old case, now settled, between a Chinese organization (NDRC) and Qualcomm. The reason is still the high royalty level that Qualcomm was asking for their phone technology related patents, to Chinese companies. After months of negotiation between Qualcomm and NDRC, Qualcomm had no other choice than to cut by half the royalty the company was asking for to Chinese companies. The official result is that:

“Chinese enterprise will enjoy a lower SEP royalty rate (5% for 3G devices and 3.5% for 4G devices) and royalty base (65% of the net selling price of the device)”

Who is the winner, who is the victim? I let you decide, but for all these cases, the loser is certainly intellectual property, whether it’s Design IP (ARM, Imagination technologies) or technology patent (Qualcomm), and this becomes a real concern!

Eric Esteve (IPnest) June 15[SUP]th[/SUP] 2018

Share this post via:

Facing the Quantum Nature of EUV Lithography