Don’t get me wrong, I’m a big fan of AMD, I buy AMD based products whenever possible to prevent an innovation stifling Intel monopoly. Unfortunately Silicon Valley coffee house conversations continue to paint a bleak picture for AMD, even with a recent stock surge on better than expected revenue guidance for the rest of 2011. I’m sure Wall Street coffee house conversations do not track with ours and here’s why:

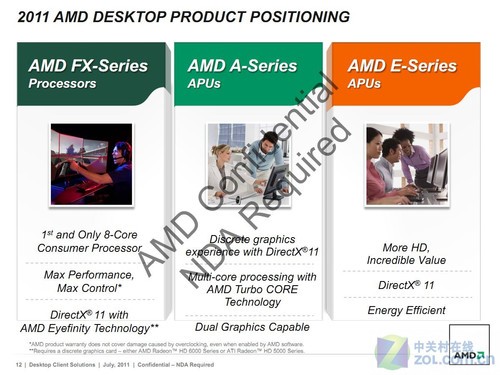

Intel has always been the semiconductor manufacturing technology leader but throughout the years AMD was very clever and kept pace. Unfortunately AMD went fabless last year and as a result will not be able to compete in the discrete microprocessor market (my opinion). AMD also has no mobile strategy so where will they be when tablets and phones replace laptops?

Today AMD is in production at 32nm SOI with the Ex AMD fab in Dresden which is very competitive with the current Intel 32nm HKMG process. Future AMD microprocessor generations however will use commercially available foundry processes which track a process node or two BEHIND Intel. You should also know that microprocessor manufacturing is unique and may not 100% adapt to a more generic foundry process.

Source: TechConnect

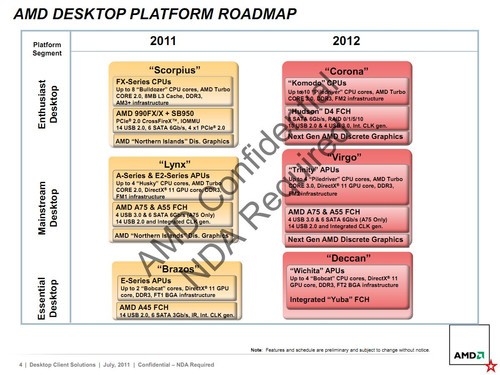

Mid next year AMD will have CPU/GPUs on 28nm HKMG processes but will they be price/performance competitive with the Intel 22nm Tri-Gate technology? The answer is probably NO, not in the discrete microprocessor market. Intel will also be the first to 450mm manufacturing which will bring a dramatic costs savings versus mainstream 300mm semiconductor manufacturing.

A glaring non-compete example is gross margins. How can AMD again achieve the 50%+ margin average required to compete profitably against Intel? AMD’s gross margins fell below 40% in 2008 and have yet to recover. As an example, take the most recent AMD Wafer Supply Agreement Amendment. A detailed analysis of this agreement is a blog in itself, especially with all of the redacted areas. Skip down to pages 8, 9, and 10 where the financial details are and tell me how AMD will even hit 40% gross margins in 2012. If you disagree let me know in the comment section and we can discuss in more detail.

To make a long blog short, AMD needs an exit strategy to be competitive with the Intel CPU dynasty. My first choice would be ATIC taking AMD private and integrating it with GlobalFoundries. Second choice would be for Samsung to buy AMD. Either way there would be a viable competitor to Intel. Or not, but it would certainly be fun to watch!

Don’t get me wrong, I’m not bashing ANYBODY here, I do this blog out of love. The SemiWiki mission statement is “For the greater good of the semiconductor design ecosystem”. I admire ATIC and what they have done for the semiconductor industry, I respect the accomplishments of AMD, and I’m the #1 fan of GlobalFoundries. But let’s be honest, Intel is a force to be reckoned with and we had all be better prepared for the coming war of microprocessors!

Note: You must be logged in to read/write comments

Share this post via:

CEO Interview with Jerome Paye of TAU Systems