Some things just really rile me up. Mark Zuckerberg testifying before Congress. Bernie Madoff explaining his investment strategy. Elon Musk inveighing against restrictions on free speech. But there is a new candidate for boiling my blood – word of a potential merger of vehicle data aggregators Wejo and Otonomo.

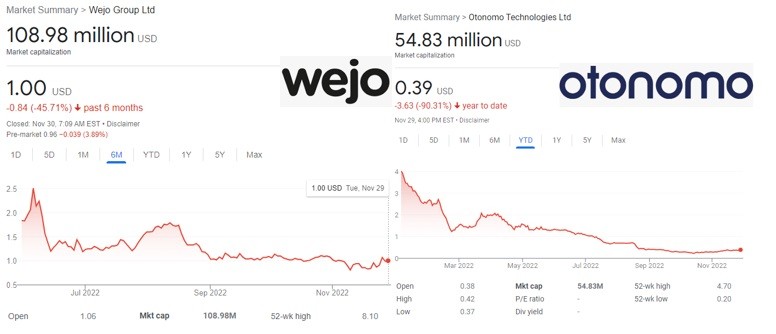

These two SPAC specters – now mere shadows of their original and farcically touted billion-dollar valuations – are rumored to be considering a merger, according to a report from Globes.co.il. The publication reports: “If such a merger were to be completed, Otonomo would be valued at $150M, significantly higher than its current market cap of just $52M but 96% lower than its valuation of $1.26B, when its SPAC merger was completed in the summer of 2021.”

This potential outcome is aggravating on multiple levels. Where do I start?

- There is no doubt that all sorts of investment advisors and, of course, the founders of these companies were richly rewarded for their efforts in spite of the dismal performance of their companies.

- Promises were made to investors and absurd claims were made to the press, industry analysts, and industry partners and customers.

- Good people were hired and indoctrinated to spread these same claims and promises – soon to be proven vastly misguided.

- At least two auto makers – General Motors and Volkswagen – were cynical enough to participate in the dissembling by sharing some of their anonymized vehicle data – giving Wejo, in particular, the thin patina of OEM-endorsed credibility.

- Some OEM partners – Ford Motor Company – have provided the further endorsement of adopting customer-facing solutions based on these data platforms.

- Both companies are reporting tens of millions of dollars in losses on a couple million in revenue.

- We’ve seen this movie before – SiriusXM bought OBDII/vehicle data company Automatic for more than $100M before ultimately shutting it down; Lear acquired Xevo for $320M before shutting it down; and so it goes.

- The hyperbolic claims regarding the value of vehicle data are either complete fiction or completely misunderstood. Clearly Wejo and Otonomo have not found the golden key. Both companies did not clearly disclose in the originating documents that their focus would be anonymized vehicle data – which actually possesses little or no value.

- The spectacular failure of these twin SPACs not only soured financial markets on SPACs generally, the dual debacles continuing to unfold in the market present a major stumbling block for future startups with potentially more legitimate propositions.

I don’t begrudge the money pocketed by some otherwise nice people leading and working for both companies. I have no doubt they are all well meaning and, at some level, actually believe every word they’ve been saying.

Merging these two companies in the interest of saving their combined operations is nothing more than setting up a double drowning. It’s clear the plan was flawed for both firms. There is no fix – quick or long-term – that can convert failure to success. Both companies are simply sailing toward oblivion.

Worst of all is the utter lack of an exit strategy. There is no way out. Not even a merger can save a bad idea. There is no foundation, no monetizable intellectual property, no industry being disrupted. Otonomo and Wejo are redundant and irrelevant. This is not a time to merge. It’s a time to purge.

Also Read:

Hyundai’s Hybrid Radio a First

Mobility is Dead; Long Live Mobility

Requiem for a Self-Driving Prophet

Share this post via:

A Century of Miracles: From the FET’s Inception to the Horizons Ahead