AI explosion is clearly driving semi-industry since 2020. AI processing, based on GPU, need to be as powerful as possible, but a system will reach optimum only if it can rely on top interconnects. The various sub-system need to be interconnected with ever more bandwidth and lower latency, creating the need for ever advanced protocol… Read More

Author: Eric Esteve

AI Booming is Fueling Interface IP 23.5% YoY Growth

Design IP Market Increased by All-time-high: 20% in 2024!

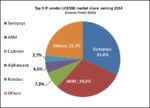

Design IP revenues achieved $8.5B in 2024 and this is an all-time-high growth of 20%. Wired Interface is still driving Design IP growth with 23.5% but we see the Processor category also growing by 22.4% in 2024. This is consistent with the Top 4 IP companies made of ARM (mostly focused on processor) and a team leading wired interface… Read More

AI Booming is Fueling Interface IP 17% YoY Growth

AI explosion is clearly driving semi-industry since 2020. AI processing, based on GPU, need to be as powerful as possible, but a system will reach optimum only if it can rely on top interconnects. The various sub-system parts (memory, processor, co-processor, network) need to be connected with interface links with ever more bandwidth… Read More

Semi Market Decreased by 8% in 2023… When Design IP Sales Grew by 6%!

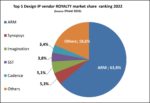

Design IP revenues had achieved $7.04B in 2023, with disparity between license, growing by 14% and royalty decreasing by 6%, and main categories. Processor (CPU, DSP, GPU & ISP) slightly growing by 3.4% when Physical (SRAM Memory Compiler, Flash Memory Compiler, Library and I/O, AMS, Wireless Interface) slightly decreasing… Read More

Will Chiplet Adoption Mimic IP Adoption?

If we look at the semiconductor industry expansion during the last 25 years, adoption of design IP in every application appears to be one of the major factors of success, with silicon technology incredible development by a x100 factor, from 250nm in 2018 to 3nm (if not 2nm) in 2023. We foresee the move to chiplet-based architecture… Read More

Interface IP in 2022: 22% YoY growth still data-centric driven

We have shown in the “Design IP Report” 2022 that the market share of the wired Interface IP category is a growing part of the total IP, and that this trend is confirmed year after year. The interface IP category has moved from 18% share in 2017 to 25% in 2022.

During the 2010-decade, smartphone was the strong driver for the IP industry,… Read More

Design IP Sales Grew 20.2% in 2022 after 19.4% in 2021 and 16.7% in 2020!

Design IP revenues had achieved $6.67B in 2022, after $5.56B in 2021, or 20.2% growth after 19.4% in 2021 and 16.7% in 2020. IPnest has released the “Design IP Report” in April 2023, ranking IP vendors by category (CPU, DSP, GPU & ISP, Wired Interface, SRAM Memory Compiler, Flash Memory Compiler, Library and I/O, AMS, Wireless… Read More

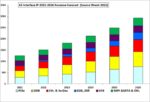

High-End Interconnect IP Forecast 2022 to 2026

The Interface IP market has grown with 21% CAGR from 2017 to 2021 and we review the part of this market restricted to the high-end of PCIe, DDR, Ethernet and D2D IP made of PHY and controller targeting the most advanced technology nodes and latest protocol release. We will show that an IP vendor focusing investment on the high-end interconnect… Read More

Interface IP in 2021: $1.3B, 22% growth and $3B in 2026

If you want to remember the key points for Interface IP in 2021, just consider $1.3B, 22%, $3B. Interface IP category has generated $1 billion 300 million in 2021, or 22.7% year to year growth, thanks to high runner protocols PCIe, DDR memory controller and Ethernet/SerDes. Even more impressive is the forecast, as IPnest predict… Read More

Stop-For-Top IP Model to Replace One-Stop-Shop by 2025

…and support the creation of successful Chiplet business

The One-Stop-Shop model has allowed IP vendors of the 2000’s to create a successful IP business, mostly driven by consumer application, smartphone or Set-Top-Box. The industry has dramatically changed, and in 2020 is now driven by data-centric application (datacenter,… Read More

CEO Interview with Jerome Paye of TAU Systems