Washington and Brussels are in the midst of a policy funk over the possibility that China’s industrial policies could do to the market for legacy chips—or what some in the industry prefer to refer to as “mature-node semiconductors”—something similar to what happened with photovoltaics (PVs) over the past decade, and potentially to electrical vehicles (EVs) over the next decade. Namely, fears are rising that there could be “overcapacity” in semiconductors of the mature variety, a fear partly animated by seeing how Chinese subsidies on steel and PVs have affected global markets, generating a desire to be proactive in trying to address future potential areas of overcapacity.

And to be sure, Beijing has provided subsidies across the semiconductor supply chain, including to mature node manufacturing firms. The core concern is driven by China’s current plan to build mature-node fabs and the conclusion that this will result in overcapacity. The reality is more complex though, because mature-node semiconductors, it turns out, are very different from either PVs or EVs. In fact, this may not be the overcapacity problem anyone is looking for.

The Market Globally and in China

Let’s explore why concerns may be misplaced by looking first at the global market structure for mature semiconductor production, and then at China specifically.

The industry prefers the term “mature node” to “legacy chips” in discussing the topic. Mature nodes are typically regarded as those produced at nodes at the 28 nanometers (nm) level or above, the definition that the Commerce Department as part of CHIPS Act language and Bureau of Industry and Security (BIS) has used in requesting input from U.S. companies about their use of China-origin semiconductors. Semiconductors produced with these more mature processes are typically made at facilities where the equipment costs have been fully amortized, but they involve much lower profit margins than the most advanced semiconductors; these include central processing units (CPUs), graphics processing units (GPUs), and other application specific integrated circuits (ASICs) that are used in smartphones, for training AI models, or for other applications demanding high levels of performance and low levels of power consumption. Typically, memory chips are not included under the term “mature,” because most memory is produced and sold at more advanced nodes, where capacity, speed, and density are at a premium.

There are four critical basic elements of the market for mature-node semiconductors that are relevant to the debate regarding overcapacity:

First, the term “mature semiconductors” covers a range of different types of chips, each with its own supply and demand dynamics. These include both specific types of semiconductors, including logic, power, radio frequency, and mixed analog and digital semiconductors, and mature semiconductors used for specific types of end-uses, such as automobiles, robotics, drones, industrial automation, aerospace, and other industries. Hence, there is no single market for “legacy semiconductors,” as there is for products like EVs and PVs. This makes “overcapacity” an inappropriate lens through which to view the issue. For example, aggregating capacities for fabs in a particular country based on process node does not account for the diversity of applications and requirements that semiconductors manufactured at a particular node actually cover.

Second, most mature semiconductor node capacity globally resides with so-called integrated device manufacturers (IDMs), while in China the capacity for mature node production is dominated by companies engaged in foundry services, which includes a high degree of specialization. Foundries build semiconductors based on designs provided by their customers. These are contracted levels of production and depend on market demand as determined by the customer of the foundry, not the foundry itself. Company-designed semiconductors are closely aligned with the demand in their particular sector, and they seek to carefully balance supply and demand. In fact, their business models are designed to avoid “overcapacity,” meaning overproduction that has tended to be more common with IDMs. Foundries tend to be highly specialized, and often each fab facility that is operated by a company will be set up to address a very specific client product. Hence, aggregating capacity numbers at specific nodes does not indicate the supply and demand function for specific types of semiconductors produced at those nodes. In China, based on the author’s discussion with industry officials, the expansion of manufacturing capacity at mature nodes by 2030 will be dominated by foundries—in 2023 the foundry/IDM split was roughly 60/40 and is projected to be 64/36 in 2030.

Third, because it is difficult for foundries, which for mature-node semiconductors operate on very thin profit margins, to rapidly switch production lines, foundries and customers prefer to engage in long-term contract arrangements to lock in supply for a specific type of semiconductor. This holds, in particular, for industries with long product life cycles, and high levels of safety requirements necessitating stringent qualification of product quality and reliability, such as medical devices and automotive applications.

Fourth, and perhaps most important, is the often overlooked or misunderstood concept within the industry of “economic overcapacity.” This refers to the idea that the global industry actually views a certain amount of excess supply as desirable and critical to smoothing out anticipated and common perturbations in supply and demand. Some of these risks include tool downtime, which is unpredictable; natural disasters, such as the Fukushima earthquake, which affected front-end manufacturing and materials suppliers; the winter freeze in Texas that impacted Samsung; and other accidents such as fires at key facilities that have occurred over the past several years. Some in the industry hold that an optimal level of overproduction is around 15-20 percent! Even after the major chip shortages during the pandemic, there continue to be rolling shortages for some mature nodes, and the health of the overall system requires some level of economic overcapacity.

Finally, focusing on things like fab utilization rates may not be a good proxy for considering where there might be overcapacity that could translate into the potential for dumping, which is defined as exporting products at prices lower than they are sold in the domestic market. Fabs involve a lot of complex tools operating at high speed, and require a lot of maintenance, for example. Utilization rates can vary from 70-90 percent, depending on the node and critically, on demand. During the chip shortages during the pandemic, some fabs were working at 99 percent utilization rate—they were running tools too hard, too fast, and for too long, a condition which is not normal or desirable. But the circumstances required it. But this situation did not lead to overcapacity or dumping. Only if a fab is say running at 99-100 percent utilization for 2-3 years without a broader global supply chain crisis should government officials be worried about a high utilization rate leading to potential dumping.

China and the Worries about Overcapacity

Understanding what is driving the expansion of China’s foundry capacity is critical to getting at the issue of whether overcapacity is likely to happen in mature semiconductor production. A number of factors at play highlight the difficulty of a situation where Chinese companies, either foundries or IDMs, could “flood the market” and drive down prices, disrupting markets.

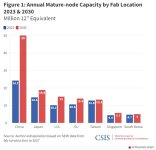

Currently, Chinese firms account for a growing share of global front-end manufacturing for mature semiconductors. This market share differs by node, with around 27 percent for 28-65 nm process node production, falling to around 20 percent for 90-180 nm. If the current announced fab capacity expansions are realized over the next 2-5 years, then by 2030 Chinese companies may hold a larger share of global capacity, but it is hard to be sure since there will also be major capacity expansions for both mature and advanced node semiconductors in the United States, Japan, Taiwan, South Korea, and Europe.

There are three reasons why overcapacity concerns are either exaggerated or misunderstood as emanating uniquely from China:

First, production expansion goals are different. The goal for Chinese firms expanding capacity, such as SMIC, Huahong, Grace, Hua Li, Si’en, and many others, is to supply primarily domestic demand. With China still importing a huge majority of its domestic semiconductor consumption needs, there are commercial drivers for expanding domestic capacity. U.S. export controls have also accelerated this trend, both by preventing companies like SMIC from being able to focus on advanced node production and by spurring the Chinese government to encourage companies in China to seek domestic alternatives to foreign suppliers for both hardware and software across a range of government organizations and industrial sectors. SMIC, for example, has gone from having 60 percent of its production for foreign customers 5 years ago to nearly 80 percent of capacity now used for domestic customers. Close to 80 percent of Huahong production is also for domestic customers. This is very different from PVs, for example, where the target from the beginning was the export market.

Second, demand is key. Most of the commentary on China and the potential for overcapacity in mature semiconductors focuses on the supply side, that is, extrapolating the capacity expansion that will result when all the mature node fabs under construction are completed within the next 3-5 years. But the key question for semiconductors is demand. Domestic demand in China remains high and will only increase substantially through 2030. Projections of demand based on specific sectoral applications—servers, PCs, mobile devices, autos, industrial sectors, etc.—matched against capacity at specific process nodes (28, 40, 65, 90, 180 nm) provide a way to assess whether and when signs of overcapacity could become real. One non-public industry study seen by the author, for example, showed that by 2030 (assuming all of the announced fabs in China are actually built and operating by 2030) domestic capacity will be able to cover around 90% of domestic demand, including Chinese OEMs, and foreign OEMs with factories in China. This number was around 37 percent in 2020.

Third, the benefits of government support are not starting to show yet. Concern about China and mature-node semiconductors centers on how the potential benefits of Chinese government subsidies could accrue to Chinese foundries and the potential for this to contribute to overcapacity. In assessing this issue, it is important to note that for leading Chinese foundries such as SMIC and Huahong, their margins, capex, and depreciation compare favorably with industry averages. With the global semiconductor industry just emerging from a major downturn, for example, all foundries (with the notable exception of TSMC production at advanced nodes for products like Nvidia GPUs) are experiencing low utilization rates, are trimming prices to gain orders, building fabs with high levels of depreciation, and experiencing low margins. Again, SMIC and Huahong’s financial performance levels are generally consistent with industry averages, so it is difficult to say that SMIC is cutting prices because the firm is receiving government subsidies or that they have a higher margin because of government subsidies.

In addition, even if under some circumstances Chinese foundries could offer below-market prices for mature-node semiconductors, the cost of these semiconductors is already relatively low, so there would be little incentive for domestic or foreign companies to boost ordering from China-based foundries. This also holds because semiconductors are intermediate products, purchased by original equipment manufacturers (OEMs), unlike EVs or PVs. In addition, domestic OEMs are not likely to be responsive to slightly lower prices offered by SMIC or to Chinese government exhortations to source semiconductors domestically. Most, but not all, Chinese OEMs are market-driven and globally competitive, and they are also interested in other factors such as reliability and quality. Foreign OEMs may be responsive to lower prices and government-driven local sourcing requirements, as they must compete with Chinese semiconductor firms and local OEMs. Here the “in China for China” approach is a trend for foreign players. In addition, the quality of mature-node semiconductors from Chinese foundries for specific end-uses varies considerably: products from these foundries are getting more competitive for some consumer electronics applications but remain significantly less reliable for end-use applications such as automobiles. Here, foreign firms like NXP, Infineon, Renesas, and Texas Instruments will continue to hold dominant positions in the China market—Chinese domestic firms are becoming more competitive in some auto industry semiconductor segments, such as powertrains, but lag significantly in other areas like ADAS platforms. Finally, while Chinese foundries do lower prices in ways that put pressure on non-China-based foundries—PSMC, for example, does compete directly with Chinese foundries in areas like specialty memory and display ICs—lower prices are not only a direct result of government subsidies but are more likely to result from things like better cost control. In addition, some fabless firms and OEMs welcome lower prices and diversified manufacturing sources driven by healthy competition.

Looking Ahead: U.S. and EU Concerns about China........

Legacy Chip Overcapacity in China: Myth and Reality | Trustee China Hand | CSIS

Paul Triolo writes that as policymakers consider the issue of Chinese mature-node semiconductor production and the potential for overcapacity, they must understand the complexities of Chinese companies' position in the global market structure and domestic value chains.