Releasing a new protocol like ThunderBolt, HDMI or SuperSpeed USB has not only to do with bandwidth performance or form factor of the connector as a guarantee of success. Some non-scientific parameters also play a role in the alchemy, that’s why forecasting the success of a certain protocol is such a hard task, and can’t be reduced to a feature list comparison table. That’s why, even if good marketing campaign can help (in fact is a necessary condition), properly marketing a technically attractive protocol is not sufficient to make it successful in the mass market. Do I know the magic recipe to cook an interface protocol generating high penetration in the mass market? I would be rich if I knew it! But I can try, at least, to understand which protocols are the winners in 2011, demonstrating high market penetration (and becoming “de facto” standard in certain market segments), or fast growing penetration (which is even more useful if you want to grow your business, developing around this protocol). Then, if we can identify winners, some losers should exist as well…

The winners in 2011

HDMIis certainly the most successful protocol, both in term of market penetration in the Consumer/HDTV segment and in term of pervasion in various segments like PC, Wireless Handset (smartphone), Set-Top-Box, DVD players and recorders, Digital Video Camera and more. Analyst consensus is that 2 billion HDMI ports have been shipped since the inception (2004 for the protocol definition, 2006 for the first devices shipped in the market). That’s huge number, and very fast growth rate, as 250 million ports have been shipped in 2007 and we can reasonably expect 1 billion ports to be shipped this year. If we look at the protocols in competition with HDMI, we find DisplayPortand, to a certain extent, SuperSpeed USB.

DisplayPort has been defined at the same time than HDMI, by the Video Electronic Standard Association (VESA) a non-profit organization. The important word here is profit: when Silicon Image was developing a worldwide and very aggressive strategy to push HDMI standard, creating subsidiaries like HDMI Licensing (to license the technology) and Simplay Labs (to offer testing and certification capabilities, in fact a mandatory step to get the HDMI stamp), as the company wanted to be in a position to get the maximum benefit from the technology they had developed, VESA was… very quiet!

Things are changing now, as DisplayPort is starting to see a real momentum, this is why the protocol is in the winner list. Effectively, DisplayPort adoption has strongly grown in 2011, for various reasons: at first, the protocol is well tailored for interfacing a PC and a screen, that’s naturally here that the adoption is high. The second reason has to see with the marketing effort made by two heavyweight of the electronic industry: Intel and Apple. Apple is using DisplayPort for some time now, and Intel has created a strong buzz around DisplayPort, not directly, but when promoting ThunderBolt(defunct Light Peak), multiplexing DisplayPort and PCI Expressin the same link. Anyway, the result is there: DisplayPort technology start to be used, the Verification IP for the protocol are selling well (which is a sign, in advance from the mass market real sales, that developments are occurring, leading to product launch a few quarter later). SuperSpeed USB or USB 3.0 has been mentioned in this paragraph, in fact it is “a contrario” (I like Latin words, it make me feel highly educated), as USB 3.0 should be ranked in the losers, no doubt about it, as we will see in the next paragraph.

Another protocol is seeing a wide adoption, and very fast growing IP sales: DDRn. Even if it can be questionable to rank it in the Interfaces Protocol, DDRn is a mean to interconnect a SoC with memory, using a digital part (Controller) and a physical media access (PHY), so it’s built like every other modern high speed serial technology, even if it’s still parallel, “scricto sensu”. As we have shown in the “Interface IP Survey”, DDRn adoption is now a matter of fact for any SoC design, the key point is that design team tend now to source it externally, one of the reasons being the growing difficulty to manage higher speed transfer rate (up to 2 GT/s for DDR4). IPNEST has forecasted DDRn IP sales to be the largest, when compared with the other Interface IP, passing $100M in 2013.

MIPIis a specification (not a standard according with the MIPI Alliance) that smartphone users are probably running everyday (every second), but they don’t know it. I don’t think we will ever see a marketing campaign labeled “MIPI inside”, as MIPI is more like a commodity, allowing various IC to speak together inside the handset, for now, and other mobile electronic devices in the near future, than a flagship technology. Even if the technology is very smart, allowing to standardize many different interfaces with IC controllers for Camera, Display, Flash, RF or audio.

So far, IPNEST evaluation is that 700 million IC supporting MIPI have been shipped in 2011, exclusively in the handset/smartphone segment (more than 400 million smartphones have been shipped over the same period). Looking at the IP sales for MIPI is a bit disappointing, as these are far to be at the level of HDMI in 2011, the reason is simply that the first MIPI adopters, the Application Processor chip makers, have probably used internally designed IP rather than source it to IP vendors. This will certainly change when the Tier 2 chip makers for Application Processor and the companies targeting other market segments like PC and Media Tablet or Consumer (Mobile) Electronic Devices will adopt MIPI. Which is funny here is that the end user will probably never know that he is using MIPI, when he certainly knows that his device support HDMI or USB.

Still in the winner list, but at a lower extent, we can rank PCI Expressand SATA. PCI Express pervasion has been strong in almost every segment (except in Wireless handset, Consumer electronic or Automotive), generating growing IP sales year after year to reach $40M in 2010, when SATA is obviously staying strong in storage equipment, but only here. Five years back, some people thought that SATA could be replaced by other protocols (USB 3.0 or PCI Express) but this will not happen. Which is likely to occur is the merger between SATA and PCI Express, to generate something called SATA Express, to serve the new needs generated by Flash based storage.

And now the losers…

To me, one of the most disappointing events of 2011 was the take off absence of SuperSpeed USB. This coming after the same disappointment in 2010… and in 2009. The technology was ready (back in 2008), proven (at least the PHY, very similar to PCI Express gen-2) and expected by the market. But Intel decided to delay, over and over, the support of USB 3.0 in their PC chipset, expected now to come in April 2012! It seems that, five or six years back, the USB-IF has strongly missed their mission. The market was expecting high speed interface protocol, that they could use to download or exchange video. At that time, HDMI was just about to be launched and High Speed USB was already five years old. It was the right time to launch SuperSpeed USB, with an attractive slogan “10 time faster than USB HS”. What did USB-IF? They launch USB On-The-Go, which maybe is a nice to have feature, but far to be revolutionary! More like an engineer’s dream than a marketing vision if you prefer.

I am afraid that, even if USB 3.0 will certainly see a wide adoption in 2012 and 2013, seeing IP sales doubling in 2012, USB standard has missed the right window, and will never recover (in term of penetration) as in the meantime HDMI has became the “de facto” standard for imaging. Because integrating too many connectors is prohibiting in term of cost on the consumer market, OEM will have to make a choice and you can guess that they will not get rid of HDMI connector (even if they are hungry to pay 4 cent per port to Silicon Image). SuperSpeed USB market will survive and generate IP sales, but will never reach the level of ubiquity that USB has reached in the past.

I realize that I did not talk about ThunderBolt, but what to say about it? It has been adopted by Apple, to be used in the high end PC segment and some Digital Still Camera makers will propose it. But, as of today, ThunderBolt controller can’t be integrated into a SoC, it can’t be sold as an IP function, this means it will be more difficult to build an ecosystem around it. It’s perceived as an Intel/Apple “proprietary” function, this may not be the best way to a wide adoption (think about FireWire).

There is still some high speed serial, differential, protocol standards that I did not mentioned: Serial RapidIO, Hyper Transportor Infiniband. If you don’t know it, if you don’t use it now, you can keep in peace, as all of these should stay in their niche, or even disappear…

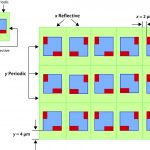

Eric Esteve – from IPNEST– Above graphic extracted from “Interface IP Survey” available here