You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please,

join our community today!

-KLA sings same cautionary song as LRCX (with Intel Chorus)

-Sees similar softening of WFE & second half

-Same Government “notice” on China/14NM – Same supply ills

-We remain concerned about share loss in patterning

Deja Vue, all over again- Great QTR & Guide amid caution & softening

KLAC reported… Read More

-Lam reports record QTR and great guide amid growing anxiety

-Weakness has not yet trickled down to Lam’s order book

-Company contacted by US government on new China restrictions

-Combination of supply issues/China/economy cut WFE view

Numbers are great

Lam reported revenues of $4.64B and EPS of $8.83 which represented… Read More

-If you can’t beat them, embargo them

-It has been reported US wants ASML to halt China DUV tools

-US obviously wants to kill, not just wound China chip biz

-Is this embargo the alternative to failed CHIPS act?

-Hard to say “do as I say, not as I do”- but US does anyway

First EUV ban now DUV ban? Are process & yield… Read More

-Micron reports weak outlook for fiscal Q4

-2023 capex to be down versus 2022 capex of $12B & Q3’s $2B

-Company keeping inventory off street to support pricing

-Memory is usually the first shoe to drop in a down cycle

Sharp drop in demand at end of Q3…..

Micron reported a sharp drop in demand at the end of its fiscal Q3,… Read More

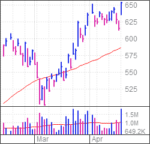

-KLA has another great QTR in face of overwhelming demand

-Supply chain issues obliterated by backlog

-Longer term technology leadership concerns are increasing

-We see limited upside near term & remain cyclically cautious

Another great quarter- demand remains super strong

KLA’s performance remains great as does… Read More

-Production constraints push backlog up $1.3B to $8B

-Looks like $100B in WFE 2022 VS $80B in 2021

-Almost sold out for 2022- Could lead to continued growth 2023

-Insp/metrology up 68% Y/Y- Expect steady growth in 2022

Can’t keep up with demand….

Revenue came in at $6.27B and NonGAAP EPS of $1.89. A very slight beat of … Read More

-KLAC – great QTR & calendar year but supply chain impacted

-Management feels supply chain to improve after March Q

-Demand remains strong, driven by foundry/logic

-Process management is next best place in industry after litho

Great end to calendar year

KLA reported revenues of $2.53B with non GAAP EPS of $5.59 nicely… Read More

KLA- great quarter driven by continued strong foundry/logic

No supply chain hiccups- Riding high in the cycle

Wafer inspection remains driver with rest along for the ride

Financials remain best in industry

A superb quarter

There was little to complain about in the quarter. Revenues of $2.1B and EPS of $4.64, both nicely beating… Read More

Taiwan and Korea represented 43% and 44% respectively with China at 15% and Japan and the US in the far distance.

ASML a tidal wave of orders

On the call management talked about logic potentially being up 30% in 2021 and memory being up potentially 50%. While we thing foundry/logic will clearly be on fir we think memory will lag a bit.… Read More

-KLAC- Solid QTR & Guide but flat 2021 outlook

-Display down & more memory mix

-KLAC has very solid Dec Qtr & guide but 2021 looks flattish

-Mix shift to memory doesn’t help- Display weakness

-Despite flat still looking at double digit growth

-EUV driven business may see some slowing from digestion

As always, … Read More