The stock market hates uncertainty most of all. In the absence of the known, the market will assume the worst or close to it. Right now there is a lot of uncertainty that continues to have more downside beta than upside beta. Everybody we spoke to at Semicon wakes up in the morning wondering what tweet was sent at 5AM that will impact their… Read More

Tag: amat

AMAT talks long term AI but short term is ugly

We attended Semicon West Monday and Tuesday, the annual show for the semi equipment industry. Its very clear from discussions with all our sources in the industry that confirm that Samsung has put the brakes on spending on memory and that message was reinforced by declines in their expected profitability due to weaker memory pricing.… Read More

China Trade war is accelerating with First Blood in Chips

China didn’t wait around for the US to announce more tariffs or export restrictions, instead it went on the offensive and put an injunction in place to prevent Micron from shipping product into China. Although our view is that Micron will see little impact from this action, the headlines caused the semiconductor sector stocks… Read More

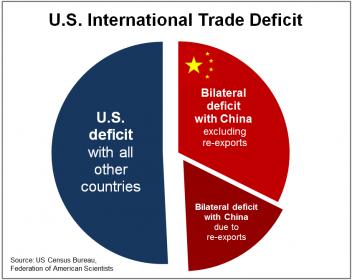

The Technology China Trade Growing Snowball

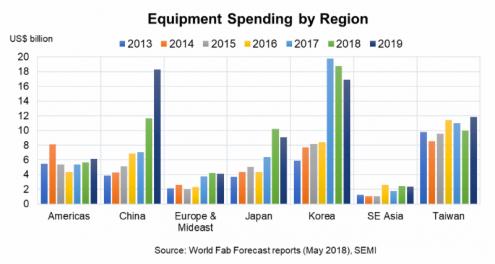

As we have been warning for months the China trade issue continues to grow and accelerate. As we are approaching the June 30th cliff (when export sanctions will be announced) it seems as if the administration has given the industry a kick so we fly even further. The US will also restrict Chinese investment in US tech companies. The … Read More

Semiconductor Cycles Always End the Same Way

It appears the current cycle has rolled over? The reason is memory & could be worsened by trade Figuring out length, depth and impact of the downturn? We had said that AMAT “called” the top of the cycle on their last conference call even though they may not think so. Semiconductor cycles always ends the same way. The… Read More

Chip Equipment where to from here?

We may know the top, do we know the bottom? What is the downside in NAND, DRAM, Foundry. Can China help or is risk worse than upside?

It would appear that our concerns in our preview piece prior to the AMAT call came true as the stock now has a “4” handle, NAND is in question and display is down.

However its not like business … Read More

AMAT has OK Q2 but Q3 flat to down

“Puts & Takes” “Reduced NAND Expectations” 2019 to be down from 2018. Applied Materials reported a good quarter coming in at $1.22 EPS and $4.567B in revenues versus street of $1.14 and $4.45B.

However if we back out the buy back of 4% it would have been around $1.17 so a slight beat. Guidance was for … Read More

TSMC Adds Negative Semiconductor News

TSMC warns soft phone/crypto & flat capex!

Does this impact DRAM?

Can Intel keep Apple?

We love Tesla (Model 3)!… Read More

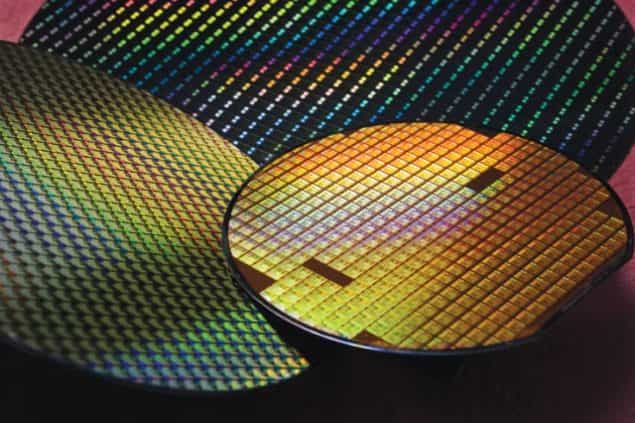

Choosing the lesser of 2 evils EUV vs Multi Patterning!

For Halloween this week we thought it would be appropriate to talk about things that strike fear into the hearts of semiconductor makers and process engineers toiling away in fabs. Do I want to do multi-patterning with the huge increase in complexity, number of steps, masks and tools or do I want to do EUV with unproven tools, unproven… Read More

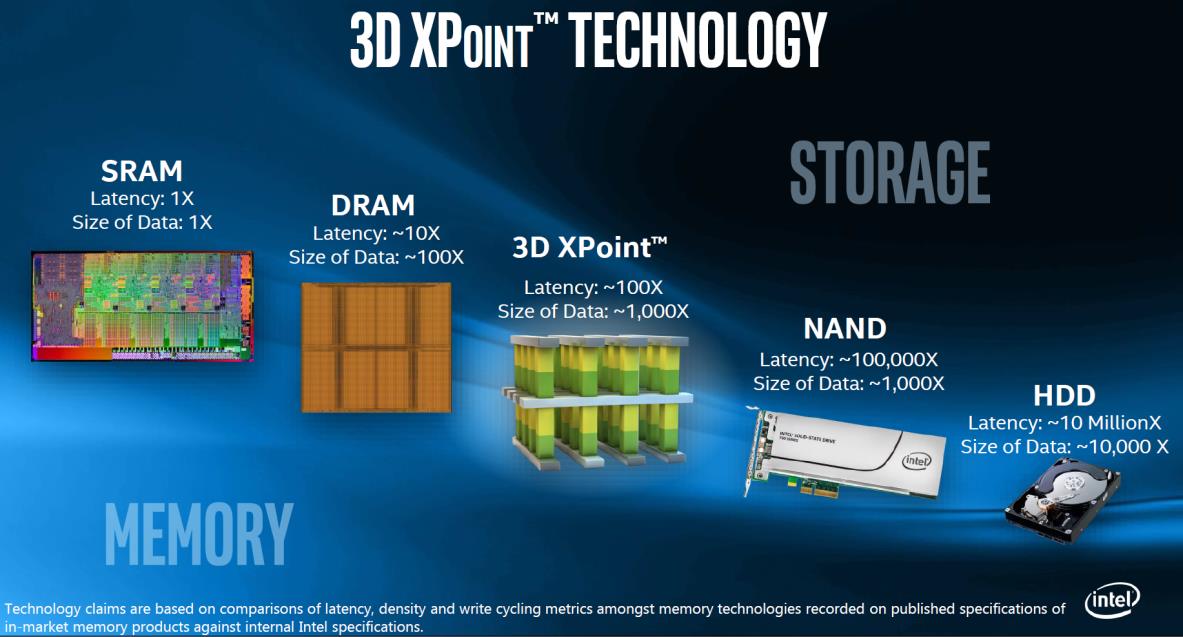

Do investors understand the new memory paradigm?

Micron put up a great quarter beating both quarterly expectations and guidance. Even though the stock was up 8% and we still think it has a long way to go as investors have not fully embraced the upside ahead in the memory market.… Read More