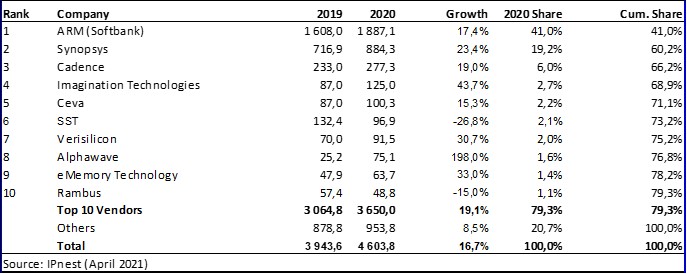

Design IP Sales Grew 16.7% in 2020, to reach $4.6B and this is the best growth since year 2000!

The main trends shaking the Design IP in 2020 are very positive for the Top 3 IP vendors, each of them growing more than the market and confirm the importance of the wired interface IP market, aligned with the data-centric application, hyperscalar, datacenter, networking or IA.

ARM is again a solid #1, with more than 40% market share, and, important to notice, 17.4% growth, slightly more than the IP market. Does this growth rate indicate that ARM’s trouble with Chinese management has been cleared, or simply shows that ARM’s sales behavior is online with the IP market? It’s difficult to answer, but ARM’s IP royalty sales grow by 16% and IP license sales by 19.9%.

This high growth in IP license sales is incredibly positive for the future. It indicates that, if RISC-V still generates strong interest and communication, the industry accepts to pay license fee to benefit from ARM products, and ARM has released enough new products to attract customers in high-end markets, CPU and GPU for smartphone, CPU v9 for AI, security and computing and more. ARM being the undisputed CPU and GPU IP leader for application processor for smartphone, royalty sales have reached a maximum for these applications. The next big markets to target are automotive and datacenter or AI if we consider that IoT or MCU are real, but too fragmented to represent the same large opportunities. It took some time to ARM’s management to come to this conclusion, that they did when transferring IoT ARM to Softbank. There is certainly room for significant license and royalty sales increase if ARM can be successful when targeting these automotive and datacenter application – or for whoever will acquire the company, Nvidia being on top of the list.

Now, let’s have a look at the various IP vendors who have been successful, as well as IP categories growing share of the IP market.

Synopsys and Cadence, respectively #2 and #3, are growing respectively by 23.4% and 19%. This trend confirms the validity of one-stop-shop model, at least for large company benefiting from a wide sales organization. If you want to understand why Synopsys had better sales growth than Cadence, the answer is first linked with the wired interface IP category. Synopsys had 55% market share (Cadence 12.2%) in this category which grown by 22.4%, and IP sales have grown by an impressive 28% when for Cadence it was 20%. But Synopsys has been successful in many other categories, namely Analog & mixed-signal, Library & I/O, memory compiler or Others memory compiler. That’s why in 2020, Synopsys has confirmed his leader position for IP license sales with 30% market share, before ARM with 25.5%, and was strong #2 in IP sales with 19.2%.

We will see that the other winners in the IP market are, at the opposite, companies being extremely focused and able to be technical leaders on their segment or sub-segment. Let’s mention a few examples.

- Alphawave, created in 2017 by a serial entrepreneur, Tony Pialis, enjoyed $25 million sales in 2019, based on advanced SerDes. In 2020, Alphawave sales has been multiplied by X3 to reach $75 million! We think that this incredible success is linked with their support of the most advanced interface IP protocols, PCI Express, 112G SerDes for Ethernet or D2D. These which are extensively used in hyperscalar, datacenter, networking or AI accelerators.

- Silicon Creations, leader of the Analog Mixed-Signal (AMS) category in 2019 and 2018, and again in 2020, the company being about ten years old is now #1, just before Synopsys, with almost 35% growth.

- Arteris IP with the Network-on-Chip (NoC), joining the Top 15 in 2019 is now #12 after the acquisition of Magillem with revenues above $40 million in 2020

- Moortec was a good example, being focused on on-chip monitoring IP for IC on advanced technology node. So good that Moortec has been acquired in 2020 by Synopsys!

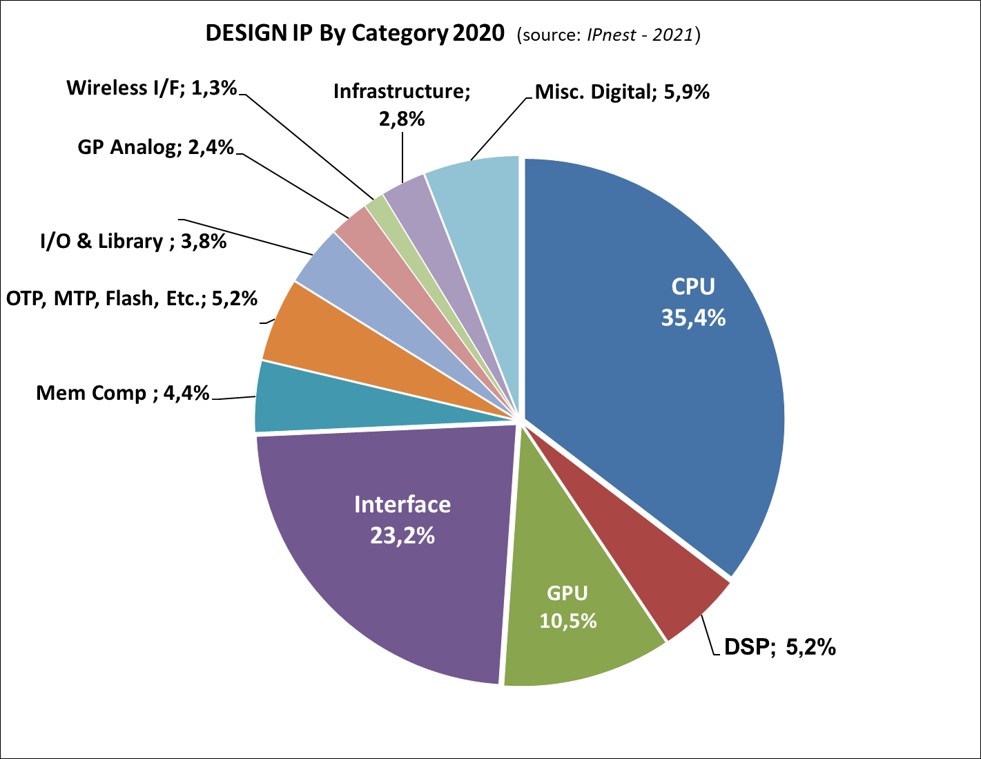

The next picture shows the weight of the various IP category in 2020. The main trend shown last year, the relative importance of wired interface growing more than all the other categories, is confirmed. Which is new is that the CPU category has stopped decreasing in 2020, like it did in 2019, 2018 and 2017.

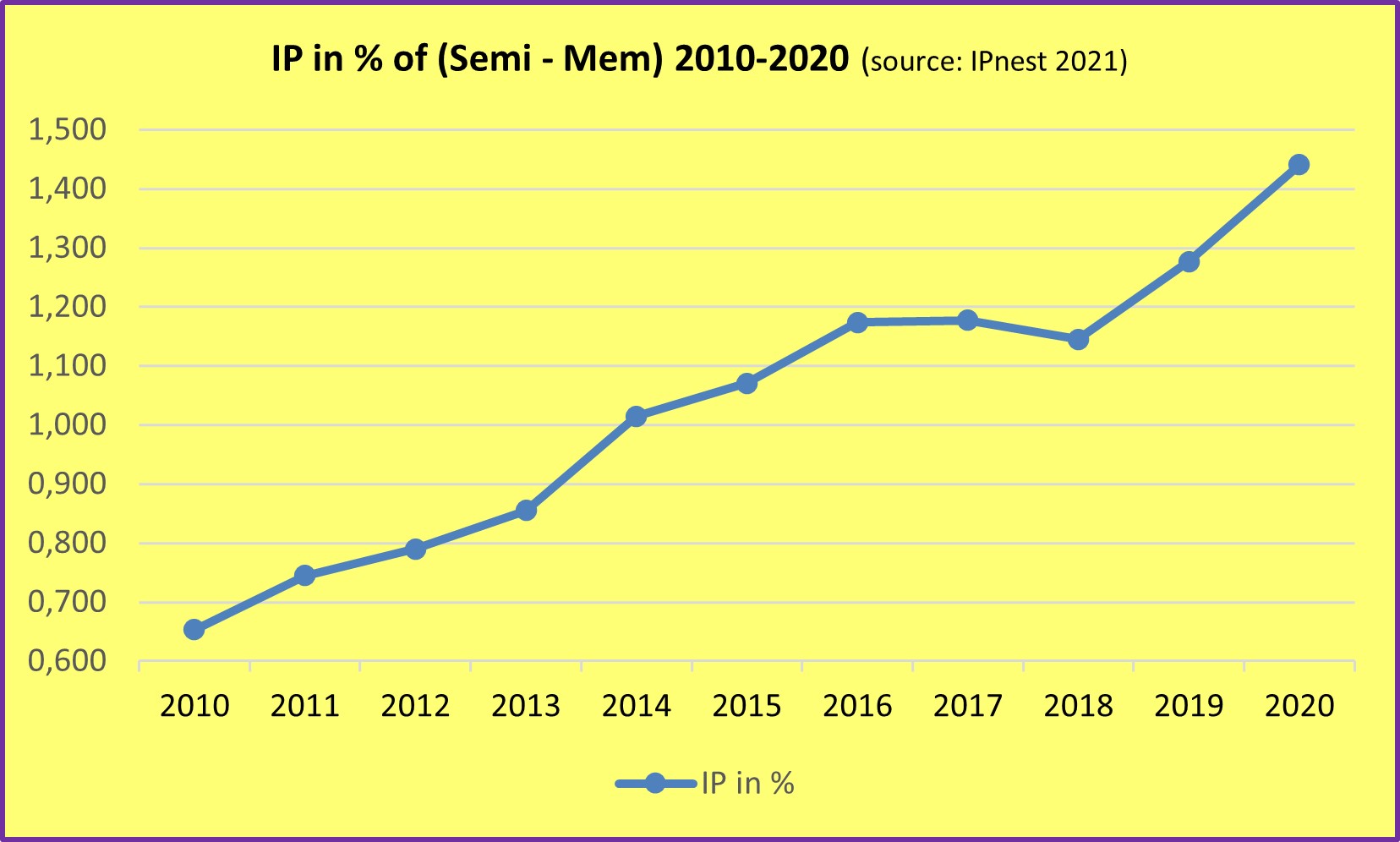

Another interesting point to highlight is the percentage of IP business compared to the semiconductor business (less the memory business, DRAM and Flash). When the semiconductor (less memory) grew from $302B to $322B, or 6.8%, IP grew by 16.7%, almost 10% more than the semiconductor market.

We will see that this trend has been constant during the last 10 years (except in 2017 and 2018):

Eric Esteve from IPnest

To buy this report, or just discuss about IP, contact Eric Esteve (eric.esteve@ip-nest.com)

Also Read:

How SerDes Became Key IP for Semiconductor Systems

Interface IP Category to Overtake CPU IP by 2025?

Design IP Revenue Grew 5.2% in 2019, Good News in Declining Semi Market

Share this post via:

Flynn Was Right: How a 2003 Warning Foretold Today’s Architectural Pivot