Lam Research (NASDAQ:LRCX) will announce its quarterly earnings on October 23, 2019, and Applied Materials (NASDAQ:AMAT) the following month on November 14, 2019. Both companies make equipment used to manufacture semiconductor devices. While private and institutional investors often own both individual stocks, this article presents a comparative analysis of both companies.

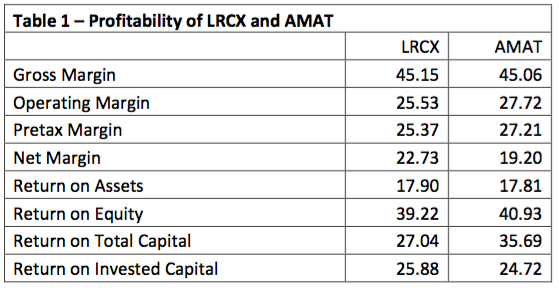

Table 1 shows that both companies have comparable profitability, with LRCX reporting better net margins. Since these figures are a percentage of revenue, my focus of this article is on revenues, which are based on the technological prowess of the company. This, in turn, is a function of management abilities to devote R&D to making “best-of-breed” equipment that stand up to the demands of semiconductor manufacturers as they move to next technology nodes.

Applied Materials competes in six major WFE (wafer front end) equipment sectors, while Lam Research competes in three. I’ll discuss these later. Of these sectors, the two companies compete in only two sectors – deposition and etch. According to The Information Network’s report “Global Semiconductor Equipment: Markets, Market Shares, Market Forecasts,” the deposition sector is comprised of several subsectors, including Epitaxy, CVD, PVD, and ECD. To complicate matters, the CVD sector is further divided into PECVD, LPCVD, APCVD, and ALD.

Deposition Sector

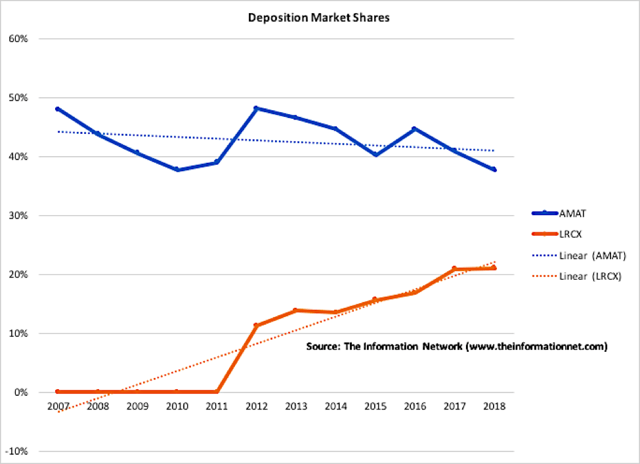

Although AMAT and LRCX don’t compete directly in all subsectors, Chart 1 shows market shares for the overall deposition sector from 2007 to 2018, with data obtained from The Information Network’s above-mentioned report. Chart 1 shows that AMAT’s share of the deposition sector decreased from 48% in 2007 to 38% in 2018. The blue trendline clearly shows market share erosion.

Conversely, LRCX’s share has been increasing since 2011, when the company acquired deposition equipment supplier Novellus.

A critical issue with the deposition sector is that it is the largest of the WFE market, representing 22% of revenues in 2018. YoY growth of the sector was 7%. Bottom line is that AMAT is losing market share in the largest sector of the market, while LRCX is gaining.

Etch Sector

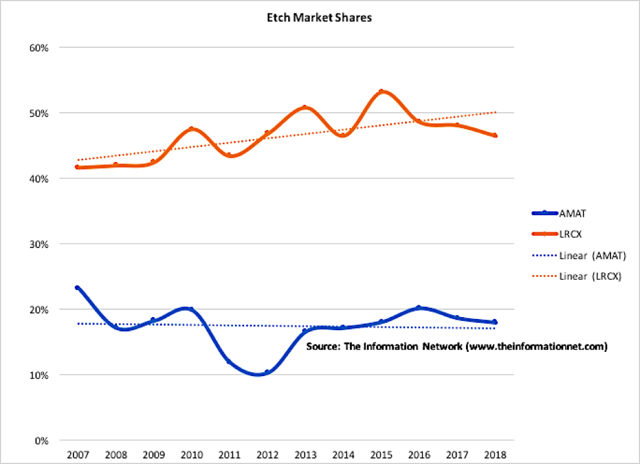

AMAT and LRCX compete in the etch sector. Chart 2 shows a similar situation to the deposition sector. AMAT’s share dropped from 22% in 2007 to 18% in 2018 while LRCX’s share increased from 42% in 2007 to 47% in 2018. The trendlines clearly show its growth.

A critical issue with the etch sector is that it is the second largest of the WFE market, representing 21% of revenues in 2018. YoY growth of the sector was 13%. Bottom line is that AMAT is losing market share in the second largest sector of the market, while LRCX is gaining.

Other Sectors

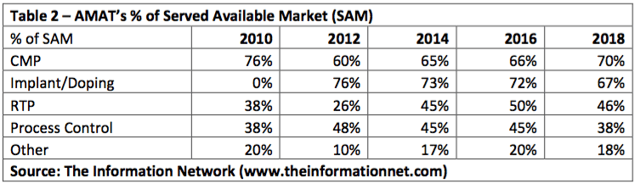

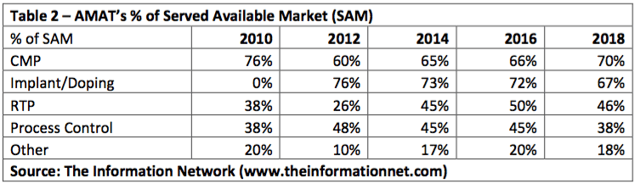

Table 2 shows AMAT’s share of its SAM (served available market) between 2007 and 2018 (excluding deposition and etch in Charts 1 and 2). There are three takeaways from Chart 1:

- AMAT’s share of the CMP sector is 70% and growing, but it essentially competes with only one other company, Japan’s Ebara. The CMP sector represented only 3% of the WFE market in 2018. YoY this sector dropped 0.1%.

- AMAT’s share of the Implant/Doping sector was 67% in 2018. But it has been decreasing since 2012 when the company acquired implant equipment company VSEA, and along with it, its current CEO Dickerson. The Implant/Doping sector represented only 3% of the WFE market in 2018 as the sector’s revenues grew 14% YoY in 2018.

- AMAT’s share of the RTP (3% of WFE) and Process Control (11% of WFE) decreased between 2016 and 2018.

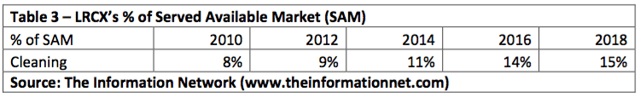

Table 3 shows LRCX’s share of the cleaning sector, which has been growing consistently from 8% in 2010 to 15% in 2018. This sector represented 7% of the WFE market.

Total WFE Market

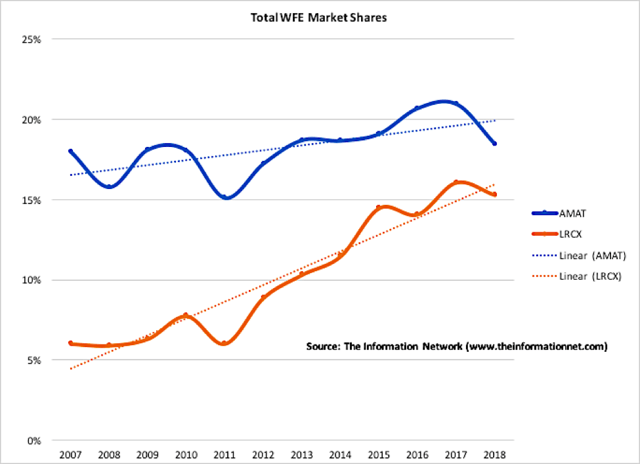

Chart 3 shows total revenues for AMAT and LRCX of the overall WFE market. AMAT’s share has grown from 17.9% in 2007 to 18.4% in 2018. If we include only share since the VSEA acquisition debacle, share has grown from 15.1% in 2011 to 18.4% in 2018.

LRCX’s share has more than doubled, growing from 6.0% in 2007 to 15.3% in 2018. If we include only share since the Novellus acquisition, LRCX’s share has grown from 8.9% in 2012 to 15.3% in 2018.

Share this post via:

Advancing Automotive Memory: Development of an 8nm 128Mb Embedded STT-MRAM with Sub-ppm Reliability