It was a generation ago when Intel, less than three years old, created the three fundamental building blocks of the compute era: the DRAM, the EPROM and the Microprocessor, an incredible feat of innovation by any measure. Manufacturing yield, not power or performance determined success of failure and in the first two Continue reading “The Morphing of Intel’s Monopoly”

IP Quality: Foundation of a Successful Ecosystem

Talking about Design IP (I mean successful Design IP) lead you to quickly pronounce the two magic key words: Quality and Ecosystem. Those who remember the IP emergence in the mid 90’s know very well why Quality has to be a prerequisite when dealing with Design IP, as they probably have paid the price of mediocre IP quality at that time. More recently, business analysts have realized that the foundation for a successful IP based business was linked to building a complete Ecosystem, just think about the 1000 ARM partners…

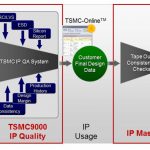

As a matter of fact, some of these partners are heavyweight, like Taiwan based TSMC, that any IP vendor would like to count within it IP Ecosystem. That’s why TSMC has created, back in 2000, the TSMC9000 program as one of the pillar of Open Integration Platform (OIP) ecosystem. TSMC9000 clearly defined goal is to check for, assess and audit the quality of Design IP part of OIP ecosystem. TSMC9000 is not only based on cleaver communication, but on a very rigorous process! Don’t forget that any of this Design IP function will end up into a very concrete piece of Silicon, an Integrated Circuit, and that both TSMC (who process it into Wafer Fab) and the Fabless customer who plan to sell it, expect this IC to run first time right. As an IP vendor, you submit to TSMC (in fact to “IP Portfolio, Design Infrastructure Division”) the functional IP you have developed, from USB PHY to DDR Memory Controller, LVDS I/O to DSP and many more. TSMC9000 Quality Assurance system consists to run successively:

- DRC/LVS (if you submit Hard IP)

- Data Consistency check

- ESD tolerance verification

- Design margin verification (Shmoo plot)

- Then generate Silicon reports (on Test chips) and store production history when it’s relevant.

Your IP will hopefully be sold to customer, integrated into a design data base by this customer who will finally submit the final DB for Tape Out. At this stage, TSMC will use “IP Master” tool, running “Tape Out consistency checks” versus the previously generated data in IP9000 IP Quality.

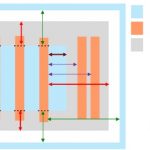

You may wonder that TSMC9000 IP qualification process only applies to very complexes or very specific or “exotic” Design IP… In fact, if you take a look at the above picture, you realize that TSMC9000 apply to ALL the Libraries, Memories or IP, including Hard and Soft IP. How many IP would you guess? Are we talking about 500 Design IP, or 1000, maybe 2000? Just take a look at the statistics listed below…

There are no less than 8917 active IP coming from the IP Alliance for a total of almost 10, 000 IP in TSMC 9000! Another figure is surprising: almost 200 Design IP are being reviewed every month by TSMC. This means that TSMC has built a specific team 100% dedicated to run IP9000 QA Process, a 30 people team in charge of IP Port-Folio validation (and selection). As an IP vendor, you probably better understand why TSMC has to be highly selective when accepting new IP… Are you still in IP vendor shoes? Just look at the failed TSMC 9000 IP count: 1,452!!

Even if a dummy density violation or some Silicon corner out of specification can be accounted for a failure, out of these 1,452 IP, as high as 373 can generate potential fatal failure. Fatal simply means that a Tape Out including such IP would have led to a redesign. Thus, if you go now into Fabless shoes, you will just thank your foundry supplier for being so selective!

If you ever surfed on a foundry web site, you probably remember the “Bronze”, “Silver” and “Gold” denomination for Design IP. If you look at the above picture, these denominations look a little bit obsolete: before a Design Hard IP can be validated for volume production, it has to pass through no less than ten or more verification phases, before the Design IP can reach a high enough confidence level. If we consider advanced nodes, the Hard IP has to pass through 13 various checking phases, from DRC, LVS, ERC and Antenna checks up to Split Lot Silicon Assessment, testing results audits by TSMC test lab to finally go to production. In fact, Quality assessment is a never ending process, when the ASIC or ASSP is in volume production, the IC yield is continuously traced… probably up to the product End Of Life!

I didn’t know that Quality could be a fascinating topic (to be honest, I thought it was not), but we are working in such demanding industry that even Quality becomes part of the dream: I have today in my pocket a gaming station from the 2000’s, a phone from the 90’s, a color TV from the 80’s and a Supercomputer from the 70’s, all of these almost in a single chip!

lang: en_US

How To Design a TSMC 20nm Chip with Cadence Tools

Every process node these days has a new “gotcha” that designers need to be aware of. In some ways this has always been the case but the changes used to be gradual. But now each process node has something discontinuously different. At 20nm the big change is double patterning. At 14/16nm it is FinFET.

Rahul Deokar and John Stabenow of Cadence and Jason Chen from TSMC will present, “20nm Design Methodology: A Completely Validated Solution for Designing to the TSMC 20nm Process Using Cadence Encounter, Virtuoso, and Signoff tools.” Well, I think my title gets to the point a bit quicker!

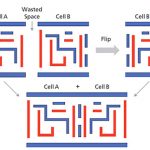

Double patterning has been forced on us by limitations in lithography. We still use 193nm light even though we are now drawing features that are 20nm (actually there isn’t really anything on a 20nm chip that measures 20nm). If we try and draw all the polygons on the lower layers of the process, the features are too close to print correctly. So instead we have to separate them onto two separate masks, so the polygons in effect alternate. Not all layout can be split in this way, which is usually called coloring since it is basically a graph-coloring algorithm, so routers and designers need to be careful not to create uncolorable layout.

Sometimes, even (say for analog), the designer wants to color the polygons manually. Why would they do that? At this process node, the two masks are not self-aligning. They are aligned by the vestigials on the wafer that the stepper detects, just like any other mask (actually reticle) but the two polygon layers have some slop in their alignment. This means that there is much tighter control of parasitics between polygons on the same mask (which are automatically self-aligning) and different masks (which are not).

There are self-aligned double patterning techniques. They use a sacrificial spacer (where both sides of the spacer eventually get whatever is being created on that layer) but they are more expensive. If you want to get a few chapters ahead, we will need to use these approaches to build transistors at the 10nm node (and maybe the lower levels of interconnect) but at 20nm we are not. I’m not sure about 16nm.

The layout rules for 20nm are very much more restrictive, even without worrying about double patterning. There is a lot less flexibility about what can go where, and weird features like dummy gates that we started to see at 28nm (where an extra poly is required on the end of a gate that is not electrically significant, to ensue that the gate prints and behaves correctly). We also have layout dependent effects (LDE) where the transistor circuit level performance depends on how close the transistor is to other features on the die, especially well boundaries. And even design rules that depend on electrical details. There is also local interconnect that appears between the transistors and the lowest level of true metal, with all its own rules.

A little more detail on what you will learn:

- How in-design double patterning technology (DPT) and design rule checking (DRC) can improve your productivity

- How both colored and colorless methodologies are supported, and data is efficiently managed in front-to-back design flows

- How local interconnect layers, SAMEMASK rules, and automated odd-cycle loop prevention are supported

- How mask-shift modeling with multi-value SPEF is supported for extraction, power, and timing signoff.

The webinar is being given twice on May 23rd at 9am Pacific (early evening in Europe) and at 6.30pm Pacific (morning in Asia). Details here. Registration here.

Solido CEO on 20nm/16nm TSMC and GLOBALFOUNDRIES Design Challenges

EDA needs more CEOs like Amit Gupta. Solido, which is now profitable, is his second AMS EDA company. The first, Analog Design Automation (ADA), was purchased by Synopsys for a hefty multiplier. Prior to becoming an EDA entrepreneur, Amit was product manager for the wireless group at Nortel and a hardware engineer for the RF communications group at Harris Corporation. I like the Q&A blogs Daniel and Paul do on SemiWiki so here is my first one:

Q: What are the specific custom IC design challenges your customers are facing?

We segment the challenges our customers are facing in the following areas:

[LIST=1]

As you can see, the common theme is that the number of SPICE simulations required to get complete design coverage is exploding, which is leading designers to compromise accuracy to get their designs out sooner, or compromise design time to get accurate results.

Our customers are facing these challenges when doing memory, standard cell, lower power and analog/RF design.

Q: What does Solido Design do?

Solido provides variation analysis and design software for custom IC’s so that our customers can achieve maximum yield and performance in their designs. Solido’s product, Variation Designer, boosts SPICE simulator efficiency while increasing design coverage. Solido Variation Designer is being used by top semiconductor companies to design memory, standard cell, analog/RF and low power custom IC designs at leading design nodes including TSMC and GLOBALFOUNDRIES 40nm, 28nm, 20nm, 16nm.

Q: Why did you start Solido?

This is the second EDA startup I founded – I really enjoy entrepreneurship and the process of starting and building a business to address user challenges. I co-founded Solido in 2005 after my previous company, Analog Design Automation, was acquired by Synopsys. We talked to many companies about upcoming challenges they were facing, and quickly realized that variation in custom IC design was a common theme. We then raised about $10 million in investment capital and worked very closely with lead companies in developing the v1.0 alpha of our product – Solido Variation Designer. Now, we are releasing Solido Variation Designer v3.0 which is in use by top semiconductor companies and qualified by the top foundries.

Q: How does Solido help with your customers’ custom IC design challenges?

Our customers use the following capabilities in our Variation Designer product:

[LIST=1]

Overall, while SPICE simulator companies are focused on improving speed, accuracy and capacity of their tools, Solido is complementarily focused on intelligently figuring out what to simulate giving better design coverage in a reduced number of simulations than brute force.

Q: What are the tool flows your customers are using?

Our customers use Solido Variation Designer with their SPICE simulator of choice. Variation Designer is integrated with Cadence Spectre/SpectreRF/APS, Synopsys HSPICE/HSIM/FineSim/XA, Mentor Eldo, BDA AFS, Agilent GoldenGate. Through our partnership with Cadence, Solido Variation Designer is integrated with Analog Design Environment (ADE), or alternatively our customers input designs through the command line. Variation Designer is integrated with Platform LSF, Oracle Grid Engine and Runtime Design Automation NetworkComputer to run 10’s or 100’s of simulators in parallel. Finally, Solido is qualified in the TSMC, GLOBALFOUNDRIES and STARC reference flows for variation analysis and design.

Q: What is the roadmap for Solido?

We’ve developed a rich custom IC design software platform:

[LIST=1]

Going forward we will continue to work with customers and foundries to address advanced node custom IC design challenges. Having a custom IC design software platform allows us to build new capabilities very quickly and efficiently by leveraging our existing software integrations and enhancing, adapting and inventing algorithmic engines.

Q: Will you be at the Design Automation Conference this year?

Yes, we will be exhibiting at DAC. Readers can sign up here for a Solido Variation Designer demo: http://www.solidodesign.com/

Q: Where can readers get more information?

Some sources of more information:

[LIST=1]

TSMC ♥ Solido

Process variation has been a top trending term since SemiWiki began as a result of the articles, wikis, and white papers posted on the Solido landing page. Last year Solido and TSMC did a webinar together, an article in EETimes, and Solido released a book on the subject. Process variation is a challenge today at 28nm and it gets worse at 20nm and 16nm so you had better be ready.

Solido and TSMC recently completed qualification of Solido Variation Designer for 20-nm memory and standard cell designs. Solido’s software provides accurate, scalable and verifiable 6-sigma design coverage on TSMC 20-nm designs in orders-of-magnitude fewer simulations than Monte Carlo analysis.

Memory bitcells and sense amps are the first design blocks to take advantage of each shrink in process technology. Transistors are now so small that atomic variances directly impact design variation. Monte Carlo, as the standard for statistical analysis, has not been able to scale to the demands of memory design. Alternate solutions are inaccurate, scale poorly and are difficult to verify.

Consider a 256 Mb SRAM design, which consists of 256M bitcells and 64k sense amps. For the SRAM to yield, the bitcell yield would need to be 6-sigma, and sense amp yield would need to be 4.5-sigma. However, verifying to this sigma would need billions of Monte Carlo samples which is far too slow.

Solido’s High-Sigma Monte Carlo (HSMC) was shown to overcome the key drawbacks of traditional Monte Carlo analysis, providing:

- Significantly fewer simulations

- SPICE and Monte Carlo accurate results in the regions of interest

- Scalable support on all design blocks used in memory design

- Verification, for high confidence in results

Solido’s System Monte Carlo adds yield analysis capability at the array level:

- Providing fast 3-sigma analysis across the array

- Leveraging probability density function (PDF) data from cell-level analysis

- Reporting tradeoffs between performance and yield

- Fast enough to enable exploration of different array configurations

Results of running Solido on TSMC 20-nm memory design:

- Measured bitcell performance to 6.15 sigma

- Analyzed 12.8 billion Monte Carlo samples in only 5355 simulations

- Measured sense amp performance to +/- 4.5 sigma

- Analyzed 3.2 Million MonteCarlo samples in only 2727 simulations

- Extracted probability density function (PDF) of bitcell and sense amp

- Measured Monte Carlo based yield on a 64Mb array for 6 different read speeds in 1.5 hours

- Improved memory specs by 11% to 52%

Retargeting standard cell libraries to new technologies is expense. It takes lots of simulator licenses and design time, layout has become part of the design loop, and increasing variability makes it difficult to size cells optimally for yield and performance. High-sigma analysis is necessary for the latest process technologies, but needs too many Monte Carlo samples to achieve accuracy and extrapolation with fewer samples is unreliable and inaccurate.

Cell Optimizer adds automation for sizing standard cells, providing:

- Full script-based operation

- Design sizing across multiple corners and testbenches

- Support for pre- and post-layout netlists

- Simulator independence

On the initial TSMC 20-nm standard cell design, 3 out of 4 measurements failed to meet the specification. After sizing, all measures met specification.

Signup for a DAC demo here:

Solido Design Automation Inc. is a leading provider of variation-aware custom integrated circuit design software. Solido Variation Designer and application packages are used by analog/RF, IO, memory and standard cell digital library designers to improve design performance, parametric yield and designer productivity. Solido has pioneered a proprietary and patent-pending set of algorithms forming the core of its technology.

lang: en_US

Morris Chang on Altera and Intel

If you want to know why I have written so much about TSMC in the past five years here it is: TSMC executives are approachable, personable, answer questions straight on, and have yet to lead me astray. If you want an example of this read the Chairman’s comments on the TSMC Q1 2013 earnings call transcript.

“On 16-nanometer FinFET, we have said several times that this is a change in cadence in our new technology introduction. It used to be 2 years per node and in the case of 16-nanometers FinFET, it follows just 1 year, by 1 year, the 20 SoC. So it is a quickening of cadence and that is because of market request, market requirements, customers’ requests.”

Call it Taiwan culture, or maybe that TSMC executives are highly technical people (experts in their fields), as a result, the flow of information is excellent for people who know what questions to ask. I’m not talking about press releases that professional PR people do for them with PR speak. I’m talking about unscripted Q&A sessions like the ones in the conference calls.

“The second point I want to make is that we have been collaborating with our customers and ecosystem partners for more than 15 years. Through the ecosystem OIP, TSMC’s technology has been collaboratively optimized for SoC development.”

My favorite Morris Chang story is when I saw him at the Royal Hotel in Hsinchu last year. I came in the same time he did and he beat me up the three flights of stairs to the lobby. Not kidding. This man has me beat by 30 years and 3 steps. I’m training on a Stairmaster now so I will be ready for him next time!

“CapEx will be between $9.5 billion and $10 billion this year. This is an increase from the last guidance we gave, which was about $9 billion. Basically, we have stepped up the preparation for the ramp-up of 20-nanometer and 16-nanometer. We have pulled some of the capital in because we want to be — to have as high yields as possible when we do start ramp-up, volume ramp-up. And of course, we are continuing to build up 28-nanometer capacity. Therefore, approximately 90% of the capital expenditures are for 28-nanometer, 20-nanometer, 16-nanometer, both building facility and equipment. Another 5% is for R&D and that’s mainly for 10-nanometer, 7-nanometer, et cetera.”

The best part of the call was in the Q&A with a question about Altera moving to Intel. Generally speaking the analyst questions are pretty dull but every once in a while they come up with a good one.

“I very much regret Altera’s decision to work on the 14-nanometer with Intel even though the financial impact is relatively small and Altera remains a major and valued partner of TSMC’s. We have gained many customers in the last few years but I really hate to lose even a part of an old one. We want them all, really. I regret it and because of this, we have thoroughly critiqued ourselves. If there was a thing like an investigative commission on what happened, we had it. And there were, in fact, many reasons why it happened and we have taken them to heart. And it’s a lesson to us and I don’t think that we — at least, we’ll try our very best not to let similar kinds of things happen again.”

In my opinion there was nothing TSMC could have done. Altera left TSMC because of Xilinx. Xilinx is a fierce competitor on all fronts: financial, marketing, sales, technology, ecosystem, etc… so there is no way Altera can outrun Xilinx on a level playing field. TSMC is open to all customers and does not do exclusive partnerships so Intel was a smart choice for Altera.

The question is: Can Intel be a good foundry partner for Altera? My guess is yes they can, as long as the new Intel CEO is on board with it and Altera does not need ARM (ARM and Intel do NOT mix). Not great news for Intel’s other FPGA partners though (Achronix and Tabula). They must really be steaming over the “exclusive” Altera deal!

lang: en_US

Cadence ♥ TSMC

TSMC has been investing in the fabless semiconductor ecosystem for 25+ years and that is why they are the #1 foundry and lead this industry (my opinion). I’m a big fan of joint webinars. Not only is it collaboration open to the masses, it is a close collaboration between the two sponsoring companies. Having worked on the TSMC AMS reference flows for the past four years I can tell you that these webinars are definitely worth your time.

Enhance your expertise with two new webinars from TSMC and Cadence!

Addressing Layout-Dependent Effects: At 9am and 6:30pm PDT on April 25, Manoj Chacko and Bala Kasthuri of Cadence and Jason Chen from TSMC will present, “Variation-Aware Design: Detecting and Fixing Layout-Dependent Effects Using the Cadence® Virtuoso® Platform, Part II, a sequel to Variation-Aware Design, Part I. You’ll learn about:

- The solutions jointly developed by Cadence and TSMC, to provide a complete layout-dependent effect (LDE) flow for circuit and layout designers working at 28nm and below

- When, why, and how you should incorporate TSMC’s LDE-API with Cadence Virtuoso tools into an analog, custom, or mixed-signal design flow to achieve the most efficient design cycle time

Register Now: https://www.secure-register.net/cadence/TSMC_Q2_2013

Managing Design Complexity at 20nm: At 9am and 6:30pm PDT on May 23, Rahul Deokar and John Stabenow of Cadence and Jason Chen from TSMC will present, “20nm Design Methodology: A Completely Validated Solution for Designing to the TSMC 20nm Process Using Cadence Encounter®, Virtuoso, and Signoff tools.” You’ll learn about:

- The TSMC-Cadence solutions in the TSMC 20nm Reference Flow, tools certification, and Cadence tools and methodology to enable 20nm design with double patterning technology (DPT)-aware capabilities, to reduce design complexities and deliver required accuracy

- How in-design DPT and design rule checking (DRC) can improve your productivity

- How both colored and colorless methodologies are supported, and data is efficiently managed in front-to-back design flows

- How local interconnect layers, SAMEMASK rules, and automated odd-cycle loop prevention are supported

- How mask-shift modeling with multi-value SPEF is supported for extraction, power, and timing signoff

Register today: https://www.secure-register.net/cadence/TSMC_Q2_2013

Cadence enables global electronic design innovation and plays an essential role in the creation of today’s integrated circuits and electronics. Customers use Cadence software, hardware, IP, and services to design and verify advanced semiconductors, consumer electronics, networking and telecommunications equipment, and computer systems. The company is headquartered in San Jose, Calif., with sales offices, design centers, and research facilities around the world to serve the global electronics industry. More information about the company, its products, and services is available at www.cadence.com.

lang: en_US

Altera, Intel, TSMC, ARM: the Plot Thickens

Vince Hu of Altera presented us her at the GlobalPress Electronics Summit on their process roadmap. Since just a month or two ago they announced that Intel would be their foundry at 14nm, everyone wanted to get a better idea of what was really going on.

At 28nm, Altera use 2 processes, TSMC 28HP (for high end Stratix-5 devices) and TSMC 28LP for mid-range, low-cost devices.

The next generation will use 3 processes. At 20nm their partner remains TSMC. TSMC’s 20nm is a planar process (FinFET starts at 14nm). At 14nm their foundry is Intel, with their TriGate process (their name for FinFET) which they will use for the highest performance devices. And they will also use TSMC’s 55nm process with embedded flash to make hybrid devices that are a bit like a PLD and a bit like and FPGA.

One interesting thing Vince said, just as an aside, was that 20nm will be lower power, higher performance and lower cost. Since there have been a lot of rumors that TSMC 20nm may not be cheaper than 28nm, that was an interesting datapoint. Altera will be announcing products here later this year.

So we started to ask questions.

Microprocessors? ARM is a great partner, at 20nm we are committed to ARM. What about 14nm? Is Intel going to manufacture ARM? Is Altera going to put Atoms on FPGAs? Too soon to comment but there may be an announcement soon. So my guess would be that Intel isn’t going to be building ARMs into Altera arrays and some sort of Altera/Intel processor deai will be announced in the future.

What about TSMC’s 14nm FinFET process? When that is available is Altera going to use it? Not discussing at this point.

How about 3D? TSV? Not ready to talk about it yet.

Vince, master of the cryptic remark, did say they are looking at what comes after, especially in the cost-sensitive space. They may even look at process technologies that are already out today. My guess would be that they might design lower cost arrays into 28nm once 28nm is no longer leading edge and wafer costs drop.

So FinFET is focused on Intel but they remain committed to TSMC. ARM is a strong partner but it remains to be seen what that means at 14nm. The future is a bit murky out there.

Two New TSMC-Cadence Webinars for Advanced Node Design

Foundries and EDA vendors are cooperating at increasing levels of technical intimacy as we head to the 20nm and lower nodes. Cadence has a strong position in the EDA tools used for IC design and layout of custom and AMS (Analog Mixed-Signal) designs. They have created a series of webinars to highlight the design challenges and new approaches required. In 10 days you can learn about addressing Layout-Dependent Effects (LDE) as part II. See my blog on the part I webinar.

Interested in advanced node designs? Enhance your expertise with two new webinars from TSMC and Cadence.

Continue reading “Two New TSMC-Cadence Webinars for Advanced Node Design”

TSMC Responds to Samsung!

This was the 19[SUP]th[/SUP] annual TSMC Symposium and by far the best I have attended. Finally tired of the misinformation that plagues our industry, TSMC set the record straight with wafer and silicon correlated data. TSMC shipped more than 88 MILLION logic wafers in 2012, more than any other semiconductor company, that gives them significant bragging rights which they rarely exercise. It was standing room only (I counted 1,200+ chairs) not including the 48 ecosystem partner companies manning the booths next door.

The one thing that was not mentioned was the Apple move from Samsung to TSMC starting at 20nm. Considering Apple is responsible for an estimated 70% of Samsung’s foundry business this product shift is devastating. Several ecosystem partners told me that Samsung is cutting budgets for their ecosystem (tools and IP) in preparation for the Apple loss. TSMC on the other hand has 850 people building their ecosystem with an annual shared budget of $1.5B. This ecosystem delivers silicon accurate tools, reference flows, and IP blocks (5k+) for each and every process node. The Chairman (Dr. Morris Chang) calls this, appropriately enough, the Grand Alliance! Interesting notes from the Chairman:

- Semiconductor industry contracted 2-3% in 2012

- TSMC customers outperformed the PHLX Semiconductor Sector (SOX)

- Semiconductor industry to grow 4% in 2013

- Fabless companies will grow 9% in 2013

- TSMC will grow “in the teens” again in 2013 (TSMC grew 19% in 2012)

One thing you have to realize about mobile SoCs is that they only have a one year shelf life. The most recent Samsung based Apple A6 SoC will die a very quick death when the TSMC based A7 starts shipping next year. This is a new experience for us as semiconductor professionals. This is changing the way we buy and sell wafers. Don’t get me wrong, price will always be important but the mobile customers also buy technology road maps: What can be delivered when, at what capacity, and at what confidence level. It’s all about setting customer expectations and exceeding them and that was the focus of this symposium.

Dr. Jack Sunreminded us that TSMC is the only foundry to successfully ramp 28nm according to the road maps. 20nm is ramping now three months ahead of schedule and 16FF will start to ramp next year which is half the time it usually takes between nodes. This correlates to what I blogged about before with “Wrights Law” which states that “We learn by doing” or that the cost of a unit decreases as a function of the cumulative production. Other interesting notes:

- 20nm is ahead of schedule (production starting in 2013)

- 16nm FF is yielding ahead of plan based on 128MB SRAM test chip data

- 10nm FF is in process with a 2[SUP]nd[/SUP] generation FinFET (GePMOS)

- COWOS is in production with multiple tape-outs @ > 95% yield

Dr. Cliff Hou talked about the design challenges from 65nm (low power), 40nm (HKMG), 20nm (double patterning), 16nm (FinFets), and 10nm (multi patterning and spacer). Cliff is a great speaker, very smart, and very personable. If I had to pick the next TSMC CEO it would be Cliff. The most interesting slide he presented for me was the design rule comparisons per node:

- 700 rules @ 90nm

- 800 rules @ 65nm

- 1,200 rues @ 40nm

- 1,900 rules @ 28nm

- 3,000 rules @ 20nm

- 3,400 rules @ 16nm

Now look at the DRC deck size comparisons per node:

- Just under 20,000 @ 90nm

- Just over 20,000 @ 65nm

- Just under 30,000 @ 40nm

- Just over 40,000 at 28nm

- Right on 80,000 at 20nm

- Just under 100,000 @ 16nm

Using this data and a very complex algorithm would put 10nm rules at 5,000 and DRC deck size at 250,000. Are we really prepared for this kind of complexity with our current DRMs in PDF formats?

J.K. Wangfollowed Cliff with some very interesting data on building fabs. Paul McLellan did a nice blog on it already: How Long Does it Take to Go From a Muddy Field to Full 28nm Capacity? J.K. is one of the original TSMC employees so you can bet he can build a fab.

If I had to sum up the conference in one sentence here it is:

The question is: Which one can you trust to deliver?

lang: en_US