Hello! The most important semiconductor company in the world reported earnings last night. It’s been something of a tradition to post Taiwan Semiconductor Company (TSMC) earnings posts not behind my paywall, and I think that I’m going to continue that to kickoff each earnings season.

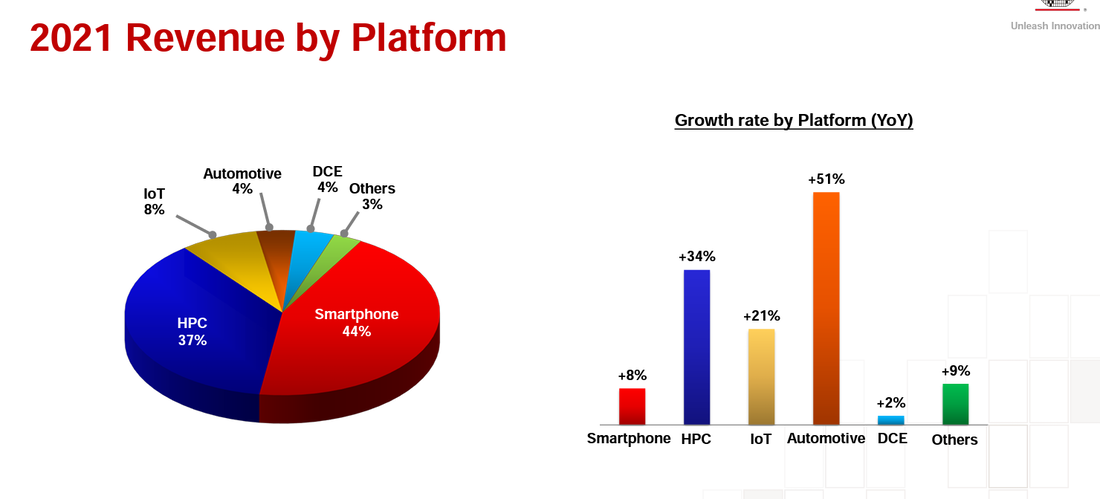

There are so many threads in the TSMC call that I want to talk about, but the big one that I think we will look back on 2022 for TSMC is that this is the year HPC will become the largest part of the business. Let’s expand.

Smartphones and HPC are neck and neck in the largest buckets for TSMC, but HPC is growing faster. The reason for sluggish smartphone growth was laid out pretty well by TSMC, and that’s volume growth in smartphones has topped out.

Yes, I think — let me add. The global smartphone unit growth last year is about 6%. So some of the — you see some of the company smartphone revenue may grow, it could be due to the pricing. But we — our pricing strategy, as you understand, is strategic, not optimistic. So we’ll grow with the smartphone units in our business.

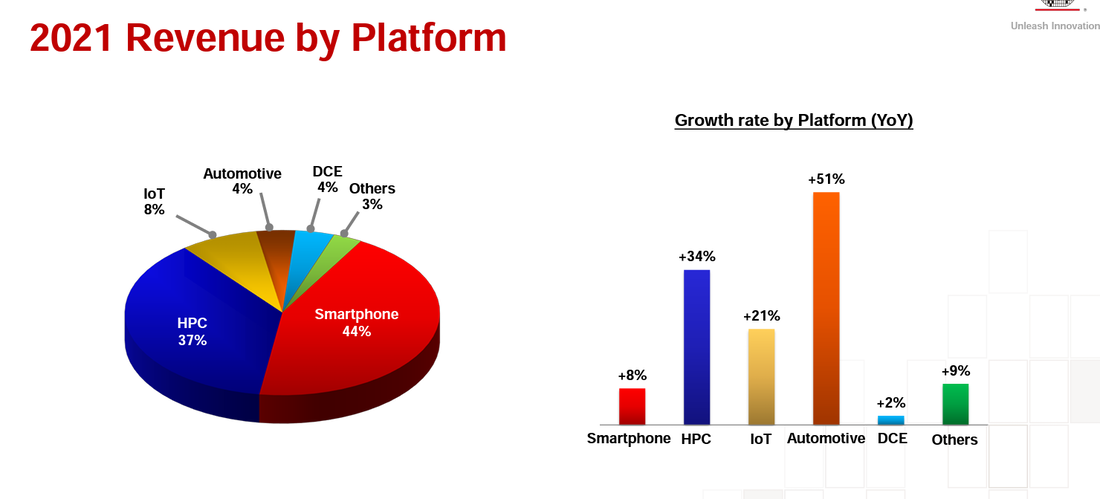

Well TSMC just guided for “high 20s” growth, and long-term growth of 15-20% CAGR. They additionally guided to an accelerating 2022, and strong sequential growth into Q1. Given that they think that their business will grow in-line smartphone units, the only logical growth driver is HPC. I did some pretty simple math to back out what the HPC segment should look like given their assumptions on growth.

Let me answer the platform question. In 2022, we expect the HPC and automotive to grow faster than the corporate average. IoT, similar. Smartphones close to the corporate average. That’s the platform growth.

I’m a bit more bearish on smartphones growing 20%+ unit growth so let’s say smartphones grow at 15% next year, and DCE / Other grows at 10% as well. I grew automotive at 50% and IoT at ~28% – and the result is that HPC revenue crosses over smartphones in 2022. I use HPC revenue as the plug to then hit the ~28% revenue number. It looks like this is the year HPC is finally larger than Smartphones at TSMC.

For the longest time, I have believed that the largest incremental dollar pool of revenue growth will be HPC. It’s nice to see it come true and TSMC confirms that this is their belief as well. I first wrote about when I suspected meaningful growth in the data center in 2022 after Facebook’s earnings. I got it confirmed shortly thereafter by AIchip’s results. I had a suspicion that data center would be strong, but hearing the largest fab in the world expect something akin to ~40%+ growth in this segment is pretty mind-boggling even to a huge bull like me.

Another point to the leadership of the data center going forward is that HPC is starting to adopt the smaller nodes faster than smartphones, which used to be the premier first adopters of TSMC’s newest node. In the past, HPC would adopt the newest node a year after smartphone, but now HPC is in the driver seat and will be adopting N3 at the same time smartphone is. Beyond just node adoption, I’m pretty bullish on data center exposed stocks like Marvell and Nvidia.

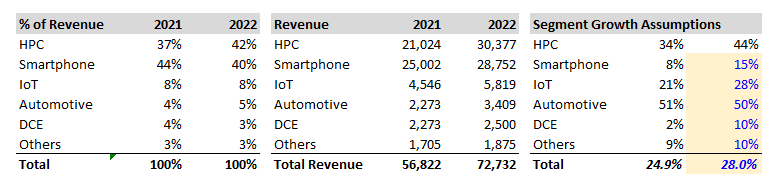

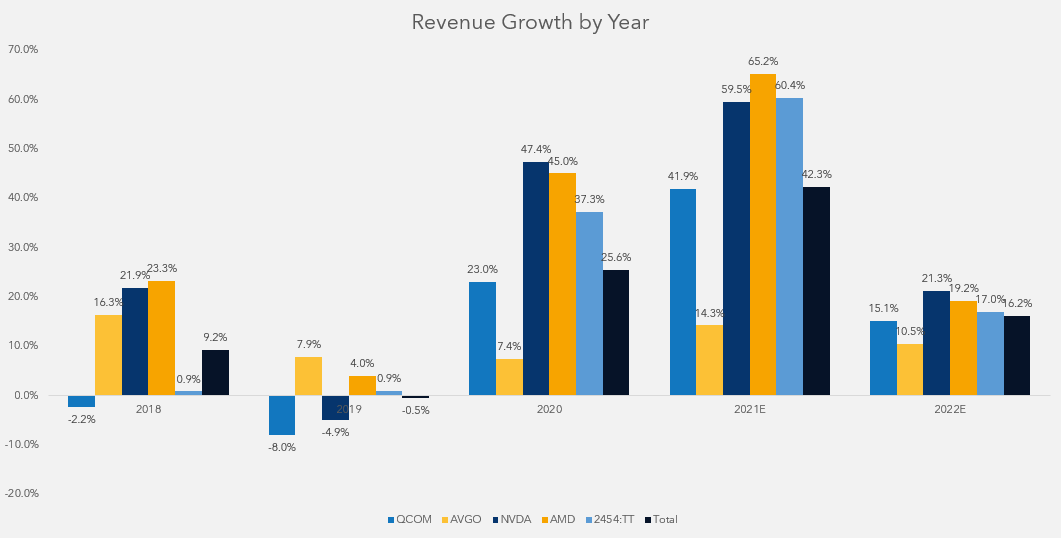

Speaking of Marvell and Nvidia one of the questions on the call was “how can you grow your revenue faster than your fabless customer’s expected revenue growth”. TSMC answered that they believe it’s pricing and share gains.

This is C.C. Wei. Actually, the growth in 2022 is all the above you just mentioned. It’s a share gain, it’s the pricing and also its a unit growth. Did I answer your question?

Part of this is that Intel is starting to outsource to TSMC and that foundry likely will grow faster than memory this year. But I have a hard time believing another obvious answer is that the fabless estimates are too low.

Given that TSMC just guided to accelerating revenue (25% 2021 growth to 28%+ 2022 growth) and has over 50% of global market share, I have a hard time believing that the industry is going to meaningfully decelerate while TSMC revenue explodes. The numbers don’t reconcile. And that is why I believe that the fabless companies’ revenue estimates are likely a bit too low. Also that their 9% industry growth number is likely too low. Getting the theme here?

I believe that 2022 is going to be another strong year, and that almost every fabless company’s numbers will be revised higher. Let’s turn next to the capex side of the equation.

TSMC Expects to Spend $40-44B on Capex

Not only was growing faster for longer a surprise but the $40-44b capex was a real shocker. For context, the most bullish estimate on the street was at ~$40 billion. The upside is now the new downside case. Given that WFE grew by ~40% last year, and TSMC grew capex by ~77% in 2021 over 2020, this is pretty meaningful growth. In absolute terms, they are adding more spending in 2022 than in 2021. But of course, this is a deceleration on a larger base.

I think that the preliminary read-through is that WFE is going to have yet another good year. I believe that WFE likely is more to the tune of 20% growth than to 10% growth. Speaking of 10% growth – this estimate by SEMI came out on January 11th called for 10% growth and after TSMC’s spending estimates it already seems like this will be false. 2 days and it’s already out of date! The true number is going to be higher.

As we discussed on the VLSI semicap comparison of numbers bottom-up to top-down, it seems like estimates need to move higher. I think this is great for semicap broadly (surprise!). If you’re a long-time reader of the substack, one of the core beliefs is that the rising capital intensity of making a semiconductor accretes to fabs and even more so to semicap companies (ASML, LRCX, AMAT, KLAC, TOELY, etc).

This is just another indication that the thesis is correct given that Capex is growing faster than revenue. Which brings me to an interesting question – how could TSMC ever support this kind of spending indefinitely? The answer is that they are either utterly wrong about their growth and are going to throw the entire market into overcapacity, or that demand is still being underestimated. I believe that it’s the latter, as I wrote in my cyclical to the secular thought experiment. I believe that TSMC believes this as well, and given how they are investing and guiding, I want to call this TSMC’s bold bet.

Growing for Longer – TSMC’s Bold Bet

A recurring theme of the analysts calls with TSMC is that every quarter analysts pepper management with “how can you maintain the margin with this investment?” and “you’re spending a lot on capex will this ever normalize?” questions. The answer that TSMC answers each quarter is somewhere along the lines of “We are going to grow trust us”. This first long-term guidance in a while is an indication of that.

We expect our long-term revenue to be between 15% and 20% CAGR over the next several years in U.S. dollar terms, of course, fueled by all 4 growth platform which are smartphone, HPC, IoT and automotive.

The staggering thing I want to point out to you is their 10-year revenue growth CAGR is 14%. That’s the kind of growth that got them to the largest fab in the industry, yet their long-term revenue guide is now actually a call that their revenue will accelerate on a larger base. It’s impossible for them to gain share at the rate they used to so the only answer is the entire industry must accelerate as well.

TSMC is probably one of the best management teams in the entire industry with the most credibility you can ask for. They are prudent, ROIC focused, conservative in their node shrinks yet aggressive in their capital spending. Simply put they do not miss. If they are investing in larger amounts for accelerating growth they believe will come, I am going to believe them.

This is the definition of long-term thinking and bold bets. They are pushing forward at an even faster pace at the peak of their dominance in order to ensure they continue to hold share. And everything is pointing to the diversity and strength of the entire semiconductor ecosystem, and I think that the answer is clear. The 2020s are going to be a better decade than the one before it for the entire semiconductor ecosystem.

Passing Price

I want to briefly mention the gross margin part of the equation. Every quarter there is a lot of hang wringing about the sustainability of the gross margin at TSMC. Last quarter analysts got really hung up on “51% or greater” long-term margins and asked in as many ways as possible if that margin was sustainable.

This quarter of course they put up 53% gross margin and now are guiding to “53% or greater” margin longer term. The bar of course has shifted higher. The right answer and framing around the gross margin sustainability debate are that TSMC really is one of the only games in town, and the demand for their capacity is intense. I mentioned briefly that TSMC can just pass price as much as they want in the Rising Tide of Semiconductor Costs and I think that will continue.

No matter how much capex spend is required and how much depreciation and amortization will grow as a part of TSMC’s cost, TSMC is simply not a price taker. They will raise prices and pass their costs onto their customers, and in this case, it seems like they are able to pass on more than just the cost they take. If they can maintain 53%+ margins against rising CoGs, this means that customers will be taking price raises on the chin. Because what other choice do they really have? Intel’s Foundry business is still more of an idea more than a meaningful business, and Samsung is growing but relatively small. TSMC will get the money that they are due.

There’s a lot more in the transcript itself, which I recommend reading if you have some time. TSMC continues to believe I think that the continued prepayments by their customers are another indication that the fabless companies get it as well. They want more capacity because their businesses are well but they are capacity constrained.

An interesting idea I had was that the capacity precommitments in order to secure capacity feels a bit like the ASML investment by INTC / TSMC. It’s clearly a greater good, there is really only one company that can achieve it, and it’s going to cost a lot of money. In order for the economics to work at TSMC will need a lot of money.

Anyways that’s it for today. I just wanted to cover these points for now, and I’ll be posting a lot more content like this but for the ~100s of other semiconductor companies that will be reporting in the next month. I just always love to start with the biggest and baddest first.

From Fabricated Knowledge Subscribe now

Let’s learn more about the world’s most important manufactured product. Meaningful insight, timely analysis, and an occasional investment idea.

Share this post via:

Emerging NVM Technologies: ReRAM Gains Visibility in 2024 Industry Survey