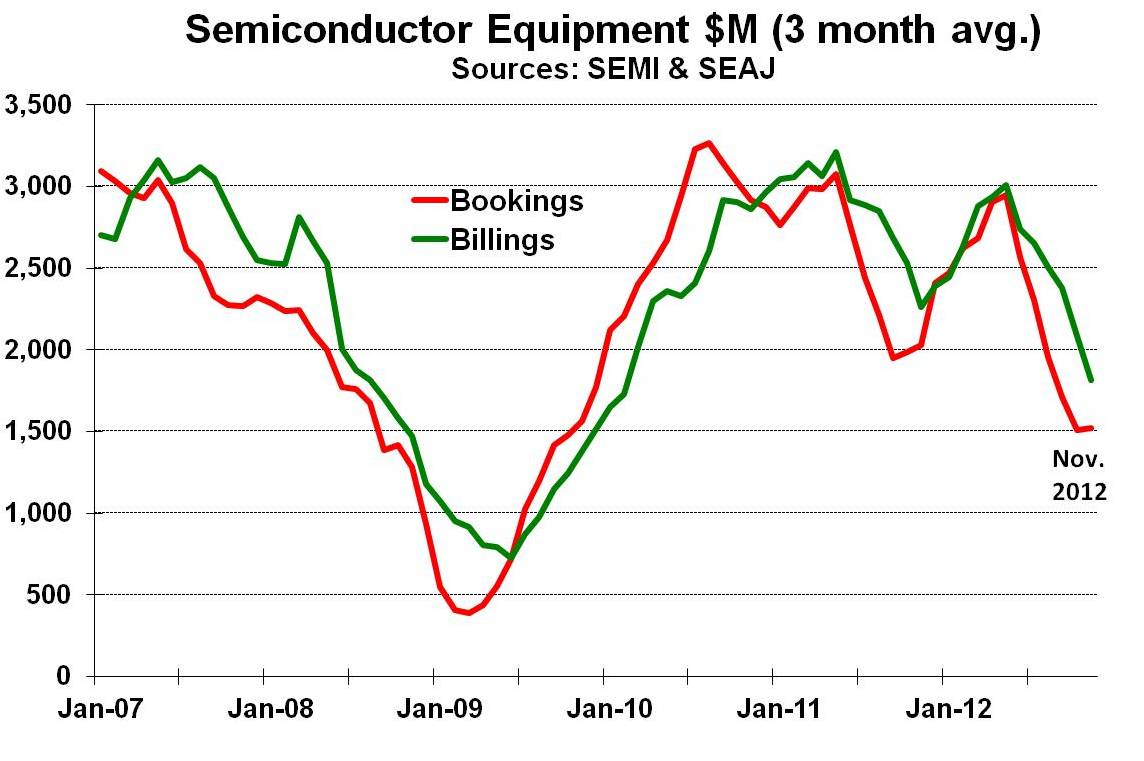

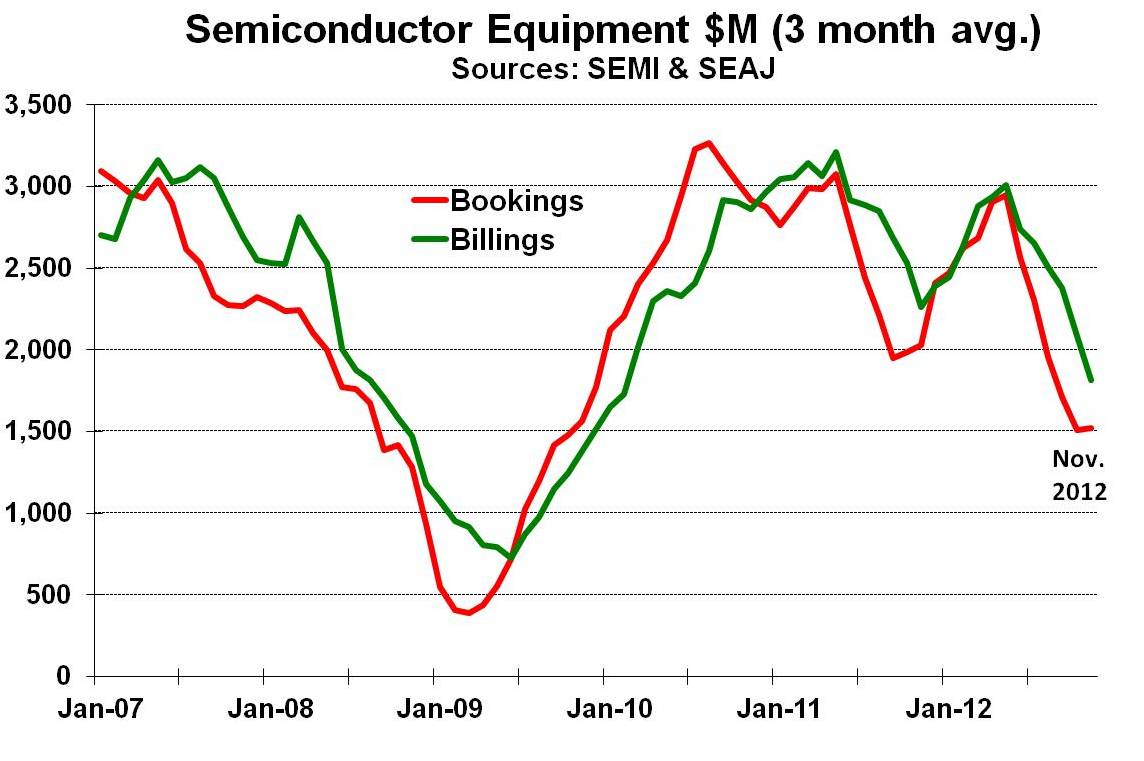

Shipments of semiconductor manufacturing equipment have been trending downward since June 2012, based on combined data from SEMI for North American and European manufacturers and from SEAJ for Japanese manufacturers. The market bounced back strongly in late 2009 and in 2010 after the 2008 downturn to return to the $3 billion a month level. Bookings and billings fell in the latter half of 2011 and recovered to the $3 billion level in the first half of 2012. The latest downturn is more severe than in 2011, falling below the $2 billion a month level. However the downturn may be bottoming out, with November 2012 three-month-average bookings up 1% from October.

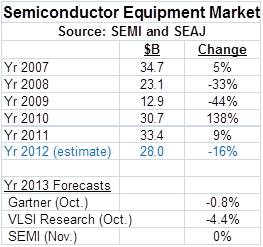

Total semiconductor manufacturing equipment shipments in year 2012 will be about $28 billion, down 16% from 2011, based on data through November. Recent forecasts for 2013 range from a decline of 4.4% from VLSI Research to flat from SEMI. However the largest foundry company, TSMC, is bucking the trend. According to Digitimes, TMSC plans to increase capital spending in 2013 by 8% to $9 billion.

What does this mean for the semiconductor market in 2013? Since the demise of SICAS, no accurate industry capacity utilization data is available. We at Semiconductor Intelligence estimate utilization is currently in the low to mid 80% range, down from the 90% to 95% range for 2010 and 2011. Thus the semiconductor market has room to grow in the near term without significant capacity additions. Our forecast is for 9% semiconductor market growth in 2013. Semiconductor market growth will probably accelerate in 2014 to the 10% to 15% range, requiring increased capacity. Thus the semiconductor equipment market should return to healthy growth in 2014.

TSMC vs Intel Foundry vs Samsung Foundry 2026