You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please,

join our community today!

WP_Term Object

(

[term_id] => 24

[name] => TSMC

[slug] => tsmc

[term_group] => 0

[term_taxonomy_id] => 24

[taxonomy] => category

[description] =>

[parent] => 158

[count] => 619

[filter] => raw

[cat_ID] => 24

[category_count] => 619

[category_description] =>

[cat_name] => TSMC

[category_nicename] => tsmc

[category_parent] => 158

[is_post] =>

)

WP_Term Object

(

[term_id] => 24

[name] => TSMC

[slug] => tsmc

[term_group] => 0

[term_taxonomy_id] => 24

[taxonomy] => category

[description] =>

[parent] => 158

[count] => 619

[filter] => raw

[cat_ID] => 24

[category_count] => 619

[category_description] =>

[cat_name] => TSMC

[category_nicename] => tsmc

[category_parent] => 158

[is_post] =>

)

First let me tell you that I have nothing but respect for Intel. I grew up with them in Silicon Valley and have experienced firsthand their brilliance and the many contributions they have made to the semiconductor industry. In fact, I can easily say the semiconductor ecosystem would not be what it is today without Intel.

But no company… Read More

The semiconductor industry has never been more exciting than it is today and that is a mouthful given what we have accomplished over the last 50 years. From mainframe computers to a supercomputer in our pockets or on our wrists. Even if you don’t believe in miracles, semiconductor technology comes really close, absolutely.

U.S.… Read More

At the recent TSMC OIP Ecosystem Forum and Technology virtual events, TSMC re-affirmed their previous prediction that 5G is going to be a multi-year silicon mega-trend with the biggest drivers being the ramp up of 5G handsets, supporting infrastructure and the continued growth of high performance computing (HPC).

We all want… Read More

When USB initially came out it revolutionized how peripherals connect to host systems. We all remember when Apple did away with many separate connections for mouse, keyboard, audio and more with their first computers supporting USB. USB has continued to develop more flexibility and more throughput. In 2015 Apple again introduced… Read More

Recently, TSMC held their 26th annual Technology Symposium, which was conducted virtually for the first time. This article is the last of three that attempts to summarize the highlights of the presentations. This article focuses on the technology design enablement roadmap, as described by Cliff Hou, SVP, R&D.

Key Takeaways… Read More

TSMC held their very popular Open Innovation Platform event (OIP) on August 25. The event was virtual of course and was packed with great presentations from TSMC’s vast ecosystem. One very interesting and relevant presentation was from Dolphin Design, discussing the delivery of high-performance audio processing using TSMC’s… Read More

Recently, TSMC held their 26th annual Technology Symposium, which was conducted virtually for the first time. This article is the second of three that attempts to summarize the highlights of the presentations. This article focuses on the TSMC advanced packaging technology roadmap, as described by Doug Yu, VP, R&D.

Key… Read More

Designers spend plenty of time analyzing the effects of process, voltage and temperature. But everyone knows it’s not enough to simply stop there. Operating environments are tough and have lots of limitations, especially when it comes to power consumption and thermal issues. Thermal protection and even over-voltage protections… Read More

Recently, TSMC held their 26th annual Technology Symposium, which was conducted virtually for the first time. This article is the first of three that attempts to summarize the highlights of the presentations.

This article focuses on the TSMC process technology roadmap, as described by the following executives:

…

Read More

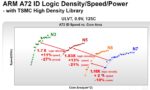

This comparison of smartphone processors from different companies and fab processes was originally going to be a post, but with the growing information content, I had to put it into an article. Here, due to information availability, Apple, Huawei, and Samsung Exynos processors will get the most coverage, but a few Qualcomm Snapdragon

…

Read More