After 8 SemiWiki years, 4,386 published blogs, and more than 25 million blog views, I can tell you that IP is the most read semiconductor topic, absolutely, and that trend continues. Another correlating trend (from IP Nest) is the semiconductor IP revenue increase in relation to the semiconductor market (minus memory) which more… Read More

ASML and Memory Loss 2019

ASML reported a more or less in line quarter as expected, coming in at EUR3.14B in revenues and EPS of EUR1.87. However, guidance was worse than most analysts were expecting with Q1 revenues expected to be EUR2.1B or down about one third.

This cut is something we have been talking about for a while as we have expected sharp memory CAPEX… Read More

DAC 2019 Will Be Even More IP Friendly!

DAC 2019 will take place in Las Vegas (June 2-6) this year before moving back to San Francisco in 2020 and for the next 5 years. Considering the various rumors about merging the conference, or even the end of DAC, this is a very good news! Not only for Design Automation, but, as we will see, for the IP industry.

In fact, if we look at the exhibitor… Read More

TSMC and Apple Aftermath

TSMC reported an in line quarter, as expected and also reported down Q1 guidance, also as expected. The only thing some investors may have been caught off guard about is the magnitude of the expected drop, 14%, from $9.4B to $7.35B. This is the largest quarter over quarter drop for TSMC in a very long time. Importantly for TSMC, 7NM … Read More

Needham Growth Conference Notes 2019

We attended the Needham Growth Conference which is one of the first conferences of the year and in the quiet period before most companies reported so even though there was no “official” comment from most companies on the quarter, the surrounding commentary spoke volumes:

- The down cycle (and everyone admits its a cycle

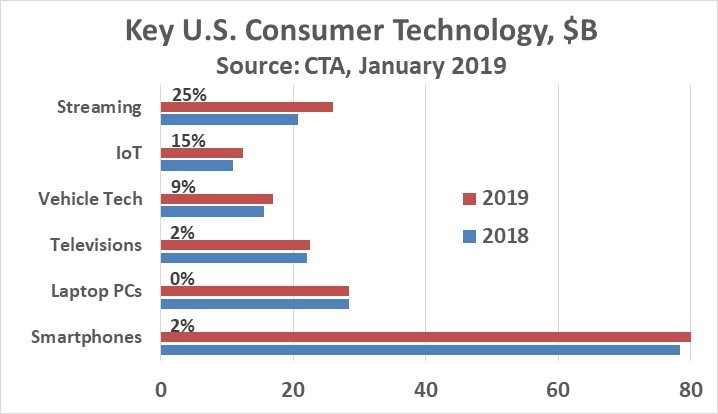

CES 2019 A New Era

CES 2019 was held this week in Las Vegas and had over 4500 exhibiting companies and over 180,000 attendees. Over 6500 media and industry analysts attended (including yours truly of Semiconductor Intelligence). CES 2019 includes a broader industry than just electronics, which led to the show being renamed CES (previously the … Read More

Samsung pre-announces miss on weak memory and phones

It should come as no big surprise that Samsung will miss its Q4 numbers. The company pre announced that profits will be 10.8T KWON (about $9.7B ) versus the 13.2T KWON analysts had predicted, close to a 20% miss. This number is also down about 39% sequentially. Revenue at 59T KWON instead of expected 62.8T KWON and down about 10%. The… Read More

2018 Semiconductor Year in Review

Strong Overall Market Growth but a Slowdown Looms

After six years of single digit percentage growth in the overall semiconductor market, 2017 saw almost 22% growth and 2018 year-to-date is up roughly 17% (based on numbers published by the world semiconductor trade statistics). The big growth driver the last two years has been … Read More

Apple as Apex of chip industry portends weaker 2019

On the first day of trading in the new year Apple just announced, after the close, that revenues will be lower than previously expected coming in at $84B versus the expected range of $89B to $93B and analyst estimates of the current quarter at $91.5B. Ugly….. The blame was laid squarely on China as slowing sales and trade tensions… Read More

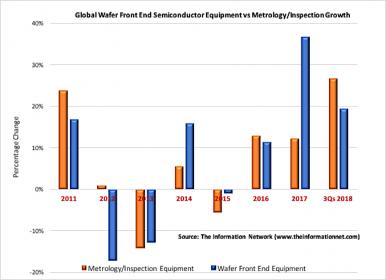

Semiconductor Metrology Inspection Outpacing Overall Equipment Market in 2018

As uncertainties mount about the near-term semiconductor industry from companies in Apple’s supply chain and the significant drop in memory chip prices, the semiconductor industry has consistently grown each year since the great recession of 2009. Semiconductor revenues have consistently outpaced semiconductor equipment… Read More

Memory Matters: Signals from the 2025 NVM Survey