The latest reliability report from Consumer Reports which dumped on domestics and rained glory upon Asian imports highlighted a conundrum facing car makers. The more effort car makers put into innovation, the greater the risk of consumer confusion, system failure and lousy reliability scores.

The latest reliability report from Consumer Reports which dumped on domestics and rained glory upon Asian imports highlighted a conundrum facing car makers. The more effort car makers put into innovation, the greater the risk of consumer confusion, system failure and lousy reliability scores.

The picture is even worse if one takes into account key areas of innovation sweeping the industry including: electrification, connectivity, autonomous operation and car sharing. The one attribute all of these value propositions have in common is low consumer demand.

Strategy Analytics surveys of consumer car buying priorities typically show an interest in reliability, fuel efficiency and safety while the industry responds with complexity. The technology laggards in Japan and South Korea walk away with the bouquets year after year.

Factor in the prevalence of smartphones and the onset of digital assistants and the bulk of high tech auto gear is regarded as irrelevant or prohibitively expensive by consumers. This means that all of the billion dollar investments that the auto industry is making in startups, acquisitions and in-house development are targeting low demand, high cost applications.

Two applications, in particular, stand out: connectivity and car sharing. Car makers feel compelled to embrace connectivity for safety reasons (eCall mandate in Europe for automatic crash notification), cybersecurity protection, software updates and vehicle diagnostics. But consumers are less than enthusiastic.

Given the high cost of adding an embedded wireless connection, auto makers are desperate to recover their investments with subscription-based services or marketing platforms. The most egregious example of this effort by car makers to directly monetize vehicle connections is GM’s Marketplace – a privacy violating, driver distraction quatch being foisted on unsuspecting consumers.

Marketplace is redundant and irrelevant. The auto industry is poised on the threshold of an app-less future. Driver and passenger interactions with on-board and off-board content, services and applications will be driven by AI-infused voice interfaces not on-screen icons.

Connectivity remains a hard sell because car makers continue to demand a price rather than including it in the cost of the vehicle. Even wireless carriers – such as Deutsche Telekom and Verizon – are losing interest in the subscription-based model and abandoning the connected car market to the likes of AT&T, Vodafone, KDDI and T-Mobile.

The other application with a weak market pulse is car sharing. Car makers and some rental companies have tapped into rivulets of consumer interest, but a true groundswell remains elusive. The muted response is readily attributable to the fact that the market leaders are ruled by their legacy car rental and vehicle sales operations.

There is a lot of talk of the rise of mobility services and transportation-as-a-service platforms – but market fragmentation and an attention deficit means crucial advertising and marketing dollars are directed toward selling and renting cars, not toward sharing cars. Where’s Clay Christensen when you need him?

The only creative destruction underway in transportation is coming from pure play ride hailing companies like Gett, Uber, Grab, Lyft and others. A simple message of a cheap, convenient transportation alternative translates into rapid adoption and market penetration.

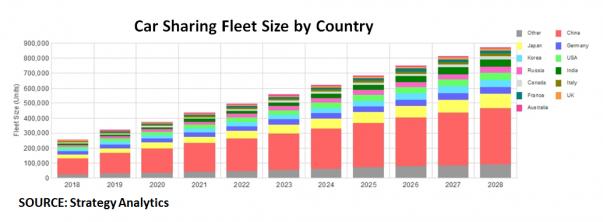

After more than 20 years of car sharing (some might say 50 years) only 260,000 cars globally are available as part of car sharing programs large and small, free floating and station based. Is the sector ripe for transformation and rapid growth? Perhaps.

What could change the demand scenario for connected and shared cars? Two things. Car companies need to build in connectivity and make connectivity an intrinsic element of owning, sharing, renting or simply operating a car. The onset of 5G technology will help.

As for car sharing? It may take the rise of pure play car sharing startups like Mevo (Australia), Zazcar (Brazil) or Car2Go (Israel) to shake things up. Car buyers are telling car makers they’re pretty content with the status quo. It’s going to take a marketing jolt or a fundamental business model shift to alter the underlying market dynamics. If legacy car makers can’t deliver, startups (like Tesla) will step in – rather, are stepping in.

Share this post via:

TSMC vs Intel Foundry vs Samsung Foundry 2026