For 20 years the concept of emergency response has been one of the most tired, uninteresting sectors of the automotive industry. General Motors introduced OnStar automatic crash notification 26 years ago and that application has long been considered the end of the story.

The shutoff of 3G wireless networks and the resulting loss of automatic crash notification built into cars from multiple brands has suddenly changed everything. Emergency response is now a red hot topic – and auto makers are scrambling to respond. (A similar scenario is unfolding in Europe where automatic crash notification – called “eCall” – was mandated beginning four years ago.)

Of course, OnStar was not the end of the story. The onset of the smartphone introduced the prospect of smartphone-based emergency calling while simultaneously negating the perceived need for “built-in” automatic crash detection and notification.

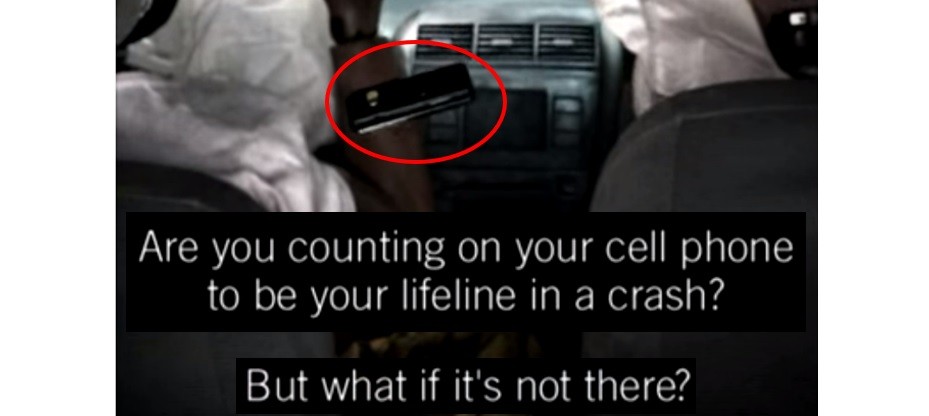

More importantly, the arrival of the smartphone removed the “fear factor” marketing methods in support of a built-in system that was capable of summoning emergency assistance in the event of a crash (after detecting an airbag deployment). In fact, the arrival of the smartphone introduced smartphone-based usage-based insurance and indirect driver distraction detection.

The introduction of smartphone-based usage-based insurance also brought forth the use of smartphones for insurance claims management including the uploading of pictures from crash scenes and the use of artificial intelligence to streamline the claims process. The latest innovation, though, is the detection of crashes by the smartphone further eliminating the need for the built-in system, or so it seems.

The vision of an entirely smartphone-based crash detection and claims management solution has insurers drooling with anticipation. This is especially true in view of the post-pandemic explosion in car crashes and highway fatalities.

More car crashes means big bucks and potential market share increases for car insurers in an otherwise mature and slowly evolving sector. Nothing short of a revolution is set to sweep the industry as insurers target smartphone-centric insurance capable of serving consumers at home, in their cars, and anywhere on the go.

One of the latest developments is the partnership of ADT and Agero to deliver the Sosecure application for smartphone-based emergency response suitable to all circumstances. There is no question that this concept will be leveraged across the insurance sector as soon as the underwriters can eliminate all foreseeable liability drawbacks.

Apple and Google are already on board. Android-based phones are already capable of detecting car crashes via the Android Auto platform. Apple’s own CarPlay automotive platform can be expected to follow quickly – while Apple is already advertising the automated emergency calling now available on its phones.

It’s not completely clear that either Apple or Google are interested in taking on the insurance opportunity in its entirety. Google already dipped its toe in once, and quickly withdrew.

What is clear is that auto makers are at risk of being excluded from a critical customer bonding experience if built-in systems are not enhanced and advanced to compete with these handheld invaders. Smartphone-based emergency response is an important tool, but it diminishes the value of built-in systems capable of transmitting vital information to first responders including the identity and condition of drivers and passengers, the severity and nature of the crash, and so much more.

The sudden industry-wide recognition of the importance of built-in automatic crash notification in cars has been highlighted by the shutdown, this month, of AT&T’s 3G wireless network. Millions of cars were sold in the U.S. with built-in 3G connections for emergency crash notification – including cars from luxury makes such as Audi, Mercedes-Benz, BMW, and Lexus. Those systems will be instantly disabled when those networks are shutoff.

With crashes and fatalities on the rise in the U.S., the importance of a rapid response to a crash scene with accurate location, severity, and driver condition information is more important than ever. Do drivers and passengers really want to rely on a smartphone-based solution? Do auto makers really want to abdicate their responsibility for customer care?

Let’s remember: The interest of auto makers in providing a robust built-in emergency response system is not founded on altruism. A reliable on-board emergency response system, a la OnStar, serves the auto maker’s vital brand building and customer retention needs. Thousands of lives are at stake, but also, billions of dollars and all-important market share.

I’ve said it before and I’ll say it here again: A customer in a car crash is at a low point of customer satisfaction and a high point of customer defection. The industry can’t afford to leave those customers in the lurch or, worse, in the hands of Apple, Google, State Farm, Allstate, Geico, or Progressive.

Also read:

Waymo Collides with Transparency

Apple and OnStar: Privacy vs. Emergency Response

Musk: Colossus of Roads, with Achilles’ Heel

Share this post via:

An AI-Native Architecture That Eliminates GPU Inefficiencies