A funny thing happens when you let car makers make cars and car dealers sell cars – people start buying cars. With the U.S. economy at least partially re-opening nationwide car buyers have returned to the market and, finding a limited supply of new cars and disappointing incentives, have turned, in part, to used cars. This remarkable outcome stands in stark contrast to the demise of cars messaging arising from transportation visionaries and surveys of remote workers.

Welcome to the world of COVID-19 uncertainty. In this world, all potential current and future realities are true simultaneously. It’s a big reason why a V-shaped recovery may be out of reach for the United States as economists, investors, car dealers, and car buyers have been left scratching their heads as stimulus measures wane and unemployment continues to climb. What will happen to vehicle demand?

In the midst of the uncertainty, visionaries have tried to grasp at wisps of good news wafting on the winds of change. There are multiple threads for the hopeful to pull. The two most prominent are A) The end of cars (in cities)!; and B) U.S. workers want to stop commuting and work from home!

The New York Times drove the “end of cars” narrative with a special section two weeks ago painting a picture of cityscapes ruled by pedestrians with lanes for cars narrowed or eliminated and on-street parking banished in favor of two-wheeled transportation and public transit.

The New York Times; “The End of Cars”

Morning Consult, meanwhile, published a survey purporting to show that one third of remote workers will not return to the office until a COVID-19 vaccine is made available – in the context of an overwhelmingly positive assessment of and preference for remote working. The “obvious” conclusion of journalist responses to the survey being that the shift to remote working will have a dramatic downward impact on commuting.

Morning Consult: “How the Pandemci Has Altered Expectations of Remote Work”

These two narratives combine to paint a picture of fewer cars, less traffic, fewer highway fatalities and clearer skies. Not surprisingly, reality is something quite different – both the reality we are living and the reality we can anticipate – even with a large dollop of uncertainty.

The car-free city is about as likely as the paperless bathroom. Cars are broadly being discouraged and de-prioritized in many European cities, but the dependence on individual vehicles for mobility is likely to endure indefinitely. It is possible that self-driving cars will emerge during the next five to 10 years, but forbidding the use of cars in cities is unlikely. Sanctioning and limiting, yes, but complete removal, no. In fact, cities are increasingly collaborating with ride hailing operators to fill in gaps created by public transit cutbacks – and car sharing services are thriving.

As for remote working, the early returns suggest that productivity is up along with overall employee well-being – though not without exceptions. But the calls to return to the office are already going out – vaccine or no. Workers hesitant to return out of health concerns will likely face hard choices, not unlike those faced by workers in meat processing facilities, health care, and automotive plants: Get back to work or stay home…permanently and unemployed.

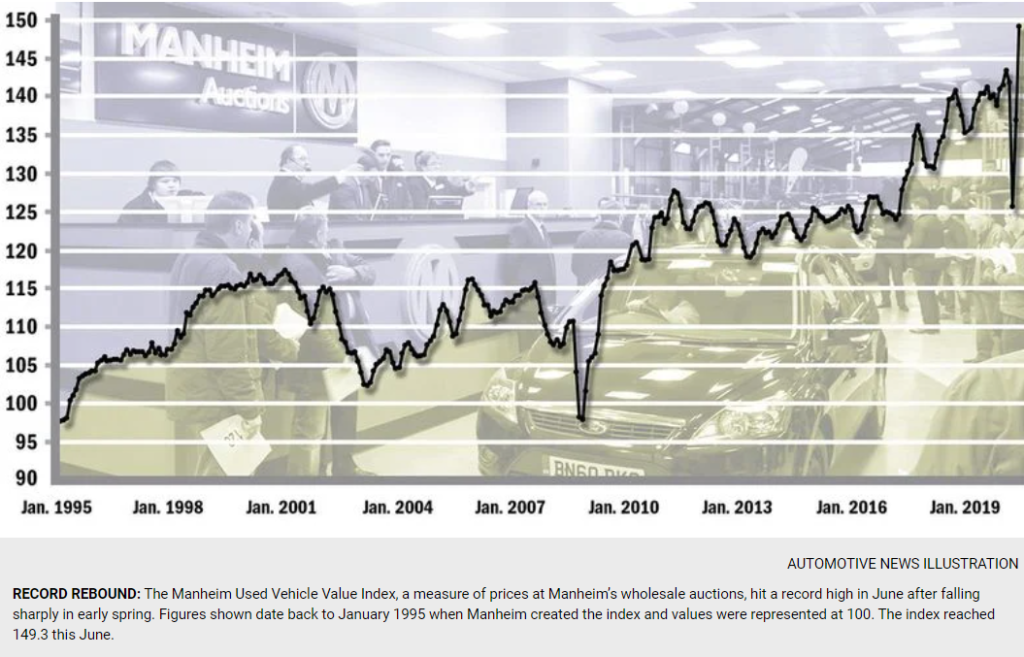

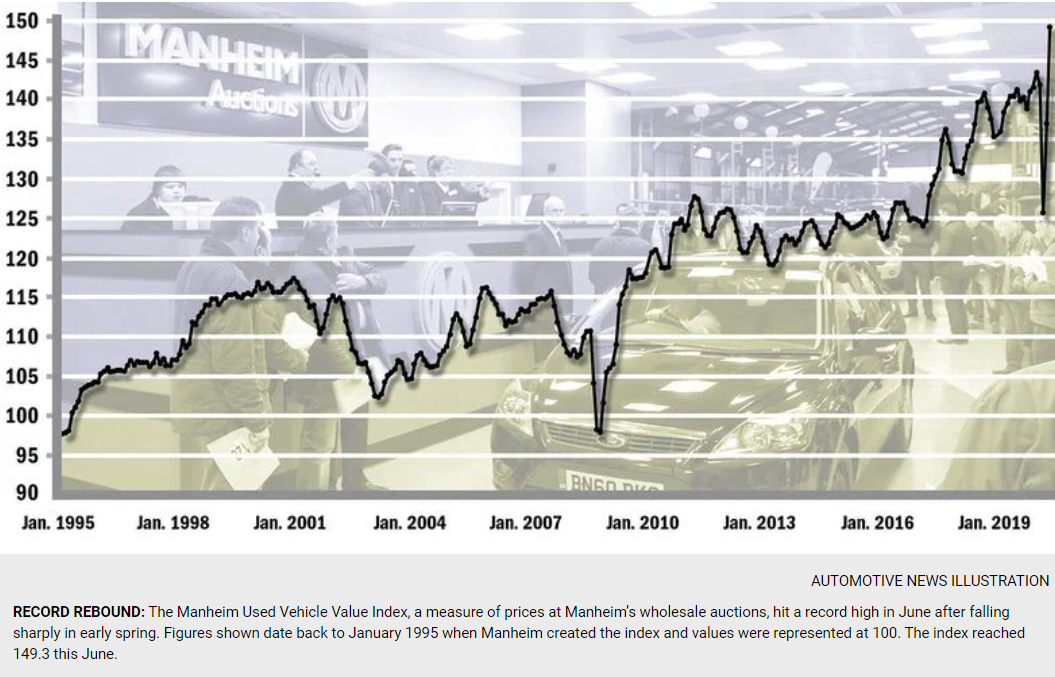

The underlying problem is the COVID-19 Uncertainty Principle – which applies with particular force to the ever-so-essential automotive industry. It is best embodied in the analysis of rising used vehicle values – as noted by used car auction operator Manheim.

The Automotive News reports spiking used car prices and plunging used car inventory as car buyers have flooded back into the market. While some of the demand is attributable to limited new car inventory and incentives – the rise in interest in used cars reflects buyers with a need for transportation – in other words, not those making a discretionary purchase.

Automotive News: “Tough Time for Dealers Seeking Inventory as Wholesale Values Soar”

What’s happening? Is there an enduring trend here?

Dealers and wholesalers tell the Automotive News that the slide in used car prices and jump in inventory that occurred in April has been completely reversed as the economy has re-opened. But some counseled caution. Asbury Automotive Group’s CEO said his organization didn’t sell into the fire sale pricing in April and refuses to overpay in July.

Trying to make sense of market trends is a challenge for all. Multiple indicators are pointing toward increased vehicle demand including people moving out of cities and public transit operations shedding passengers. Remote workers may not be commuting, but there’s a good chance that the old commute was on public transit – remote workers may find they need to add a car or two.

COVID-19 may have temporarily emptied cities revealing a deserted transportation landscape suitable to be reconceived in favor of two wheel and two leg options – but it makes no difference if the tax base has moved to the suburbs. Trees may be favored over traffic lights, but the real world will continue to lean toward four wheels. Sadly, the funds for reconceiving transportation infrastructure on a massive scale simply don’t exist – especially after the devastation of the coronavirus.

What is vastly underestimated by the visionaries anticipating a car-less wonderland is the mounting wanderlust building among cooped up consumers and workers. We’ve seen the ill-advised gatherings at beaches and parks and bars and restaurants. People are dying to get out (no pun intended) and nothing is associated more intensely with escape than the personally owned car.

In fact, the organizations most committed to eliminating personal car ownership and use – ride hailing operators like Uber, Lyft, and Yandex – are struggling to restore revenue and operations to pre-COVID-19 levels. Here, too, consumers may be opting for personally owned transportation over a shared transit solution.

It seems clear that predictions regarding the demise of the automotive industry will once again prove premature. The industry is changing – for sure. Internal combustion vehicles will be replaced by electric vehicles. Human driven vehicles may some day be entirely replaced by robot drivers. Owned cars may be replaced by shared cars. But, in the end, there will be cars. Get used to them. And get used to uncertainty for the foreseeable future.

Share this post via:

TSMC N3 Process Technology Wiki