This is the sixth in the series of “20 Questions with Wally Rhines”

From the earliest days of my childhood, I was always trying to find ways to make money – paper routes, lawn mowing, coke sales at football games – I did it all. And, except for a motorcycle I bought during junior high school when, at age 14, I could get a driver’s license in Florida, I saved most of the money. During high school, I bought my first publicly traded stock, Eastman Kodak, and fortuitously profited from the introduction of the Kodak Instamatic Camera six months later, instilling me with the dangerous idea that I had some sort of intuition for investments despite the random nature of the luck.

So it should be no surprise that, as I worked on challenging research projects in the Central Research Laboratory of Texas Instruments, I also became deeply involved in trading standardized stock options when the Chicago Board Options Exchange opened during my first year at TI. Pretty soon I was doing “butterfly spreads”, “ratio writes” and even selling “naked calls”.

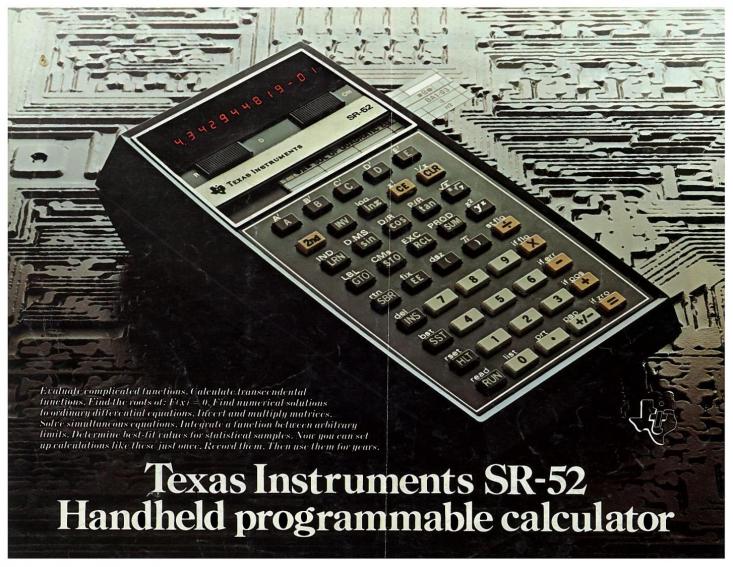

This activity stepped into high gear with the introduction of the SR-52 programmable calculator, as TI tried to catch up with the HP 65 programmable calculator that was already in the market. I went to work writing programs to improve returns and reduce risk in my stock option investing program. Not long before this, Fisher Black and Myron Scholes published an article in the “Journal of Political Economy” providing a mathematical derivation to calculate the intrinsic value of a stock option. Myron Scholes later won the Nobel Prize and founded a company, Long Term Capital Management, which experienced a blowup so big that Alan Greenspan writes about the threat it posed for worldwide financial stability in his book, “The Age of Turbulence: Adventures in a New World”. I went to work implementing the Black Scholes formula on the SR-52. The formula is a complex equation so it required some effort to squeeze it into the limited memory of the SR-52 (The SR-52 cost $395 on release in 1975 which is roughly $1,847 in 2018).

Volatility data was not generally available for most stocks so my use of the Black Scholes model focused on comparisons of options with different strike prices and expiration dates, where the volatility assumed in the equation would be constant. And then I began using it for trading. My broker at Merrill Lynch became fascinated and soon many of the brokers in his office had SR-52’s.

One day I became aware of a request from the management of the Professional Calculator Department at TI for sample programs written for the SR-52 that could be used as examples to attract customers, especially for applications other than engineering. I went to a meeting and met Rob Wilmot and Peter Bonfield (now SIR Peter Bonfield, who I’ve been associated with ever since). They were excited by my options trading program and decided to run a full page add in the Wall Street Journal offering customers a free copy of the program. It was a big success and I seriously began considering a career move into financial analysis software.

As Steve Jobs said in his commencement address at Stanford, connecting the dots that will be important to your career is difficult looking forward. In this case, the connection with Robb and Peter in the Calculator Products Division, or CPD, had an interesting consequence. Later that year, a decision was made to move CPD to Lubbock, Texas because the Division was growing so fast that space needs couldn’t be accommodated in Dallas. For people like Robb and Peter, who came from the UK, both Dallas and Lubbock were near the edge of civilization so they could easily adapt to the new environment in Lubbock. But for most of the employees in Dallas, a move to Lubbock didn’t sound attractive. Lots of management slots opened up, including the job of Engineering Manager for the Division, supervising 150 engineers who designed the chips and plastic cases for calculators. I am told that someone in the Calculator Division suggested, “Wasn’t that guy who wrote the Black Scholes program some type of chip design manager in the Central Research Lab? I wonder if he would be willing to move to Lubbock?” And that’s all it took. A few weeks later, I inherited responsibility for a group of people who had to be convinced that moving to Lubbock would be a good experience.

Most amazing was the group of managers who agreed to move. Those of us reporting to Ron Ritchie, the Division VP, included:

- Rob Wilmot – Later became CEO of ICL (the largest computer company in Europe)

- Peter Bonfield – Later became CEO of ICL, then CEO of British Telecom and subsequently served on boards including TSMC, Astra Zeneca, Ericsson, Sony and nine other public companies including Mentor Graphics. He has 11 honorary degrees and is currently in the news because he is Chairman of the Board of NXP. He is now Sir Peter.

- Tommy George – Later became CEO of Motorola Semiconductor

- Kirk Pond – Later became CEO of Fairchild Semiconductor

- Jim Clardy – Later became CEO of Harris Semiconductor and then CEO of Crystal Semiconductor which became Cirrus Logic

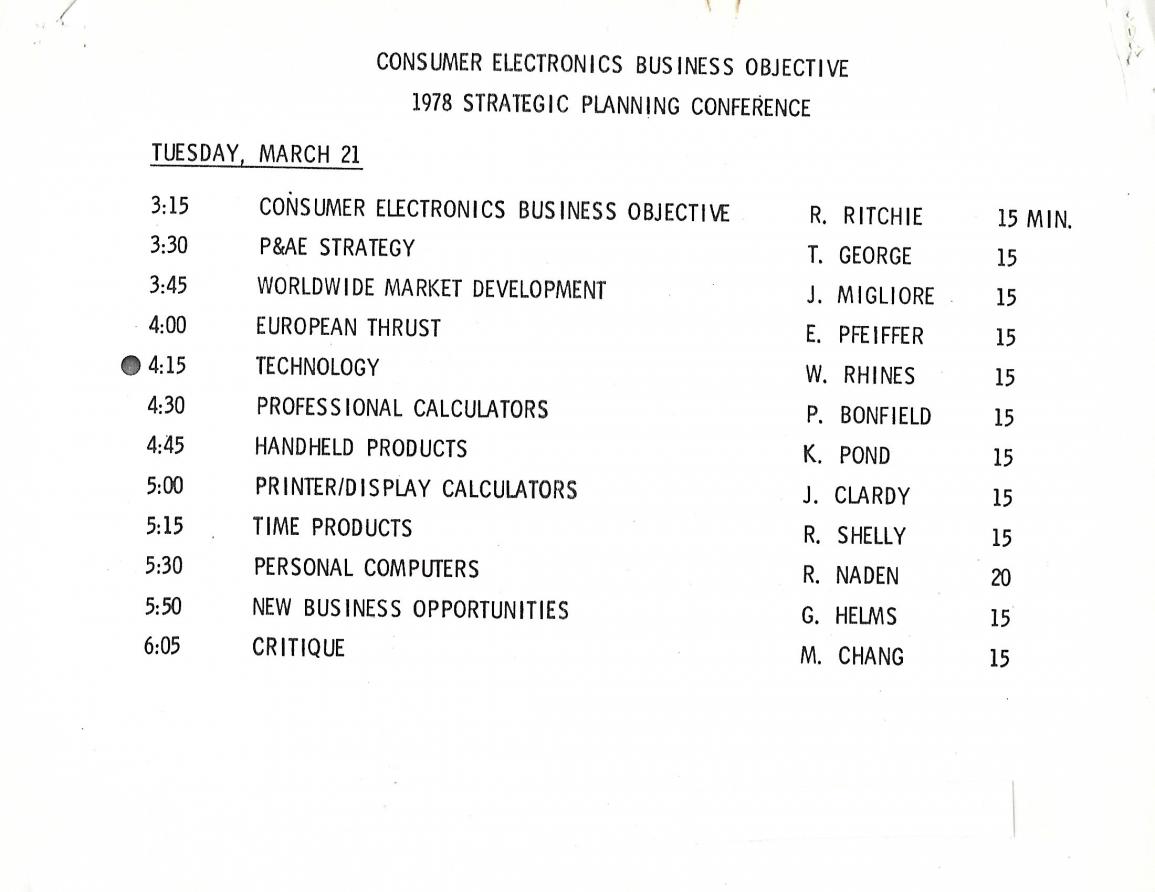

The Figure above is the agenda for the Consumer Products Group part of the annual TI Strategic Planning Conference held in 1978. The “M. Chang” on the agenda is now well known to most everyone in the semiconductor industry. E. Pfeiffer is Eckhard Pfeiffer who later became CEO of Compaq Computer.

The Figure above is the agenda for the Consumer Products Group part of the annual TI Strategic Planning Conference held in 1978. The “M. Chang” on the agenda is now well known to most everyone in the semiconductor industry. E. Pfeiffer is Eckhard Pfeiffer who later became CEO of Compaq Computer.

The 20 Questions with Wally Rhines Series

Share this post via:

Podcast EP332: How AI Really Works – the Perspectives of Linley Gwennap