You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please,

join our community today!

Hours after agreeing to build a fab in US TSMC will stop selling to Huawei- Repercussions will reverberate through all tech: Semis, semi equip, chip customers, all collateral damage.

It has been reported by Nikkei and other sources that TSMC has stopped taking orders from Huawei in order to comply with US export controls.

HUAWEI… Read More

Is TSMC the real target, not just collateral damage?

Is equipment embargo threat to bring TSMC to heel?

Is an embargo a “Trifecta” of US strategic goals?

Maybe TSMC is a real target of chip equipment embargo not just potential collateral damage

It occurs to us when we talk about TSMC being caught in the middle between … Read More

AMAT reported a more or less in line quarter with revenues of $3.75B and Non-GAAP EPS of $0.81 versus street expectation of $0.79 and revenues of $3.71B. Guidance came in well below the street with revenues expected between $3.33B to $3.63B and Non-GAAP EPS from $0.62 to $0.70 versus expectations of $3.66B and $0.77. The company … Read More

It should come as no big surprise that Samsung will miss its Q4 numbers. The company pre announced that profits will be 10.8T KWON (about $9.7B ) versus the 13.2T KWON analysts had predicted, close to a 20% miss. This number is also down about 39% sequentially. Revenue at 59T KWON instead of expected 62.8T KWON and down about 10%. The… Read More

At the recent trade talks in South America, the US and China both kicked the can down the road as neither one were obviously willing to do a deal nor had done any background work to get a deal done. Instead we have a bunch of empty promises and vague and conflicting descriptions of what was not really even agreed to.

Essentially worthless… Read More

Applied reported a more or less in line quarter, slightly beating weaker expectations. As we had projected, the October quarter is expected to have revenues down 10% which is at the low end of our expected 10-15% drop in business. Applied services helped partially make up for some of the equipment sales weakness. Revenue came in … Read More

It appears the current cycle has rolled over? The reason is memory & could be worsened by trade Figuring out length, depth and impact of the downturn? We had said that AMAT “called” the top of the cycle on their last conference call even though they may not think so. Semiconductor cycles always ends the same way. The… Read More

Maybe OMEC is the new OPEC? A bargaining chip in June trade show down?

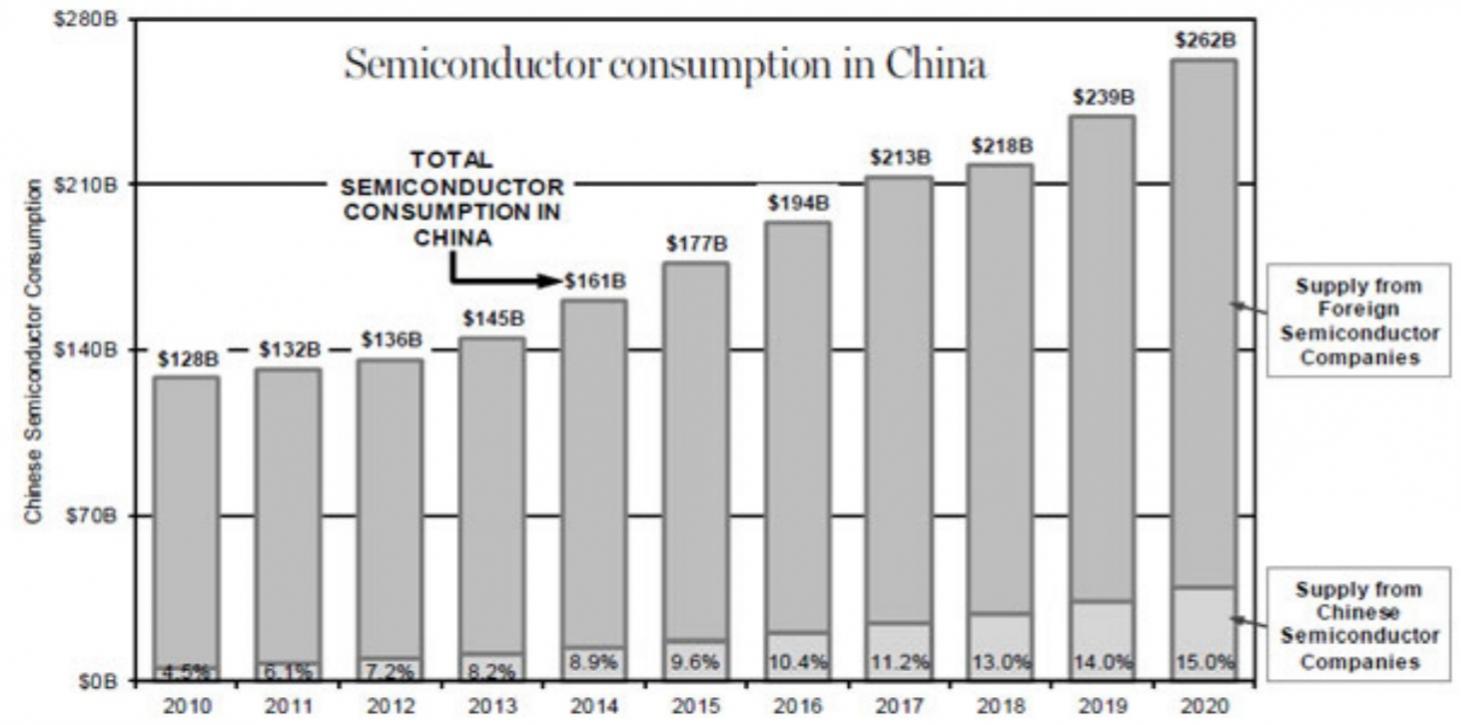

China has started an apparent investigation into pricing of DRAM memory with Samsung, Micron and SK Hynix as targets. We find this somewhat coincidental given the current trade issues. Memory pricing has been unusually strong for a very long time. Much longer … Read More

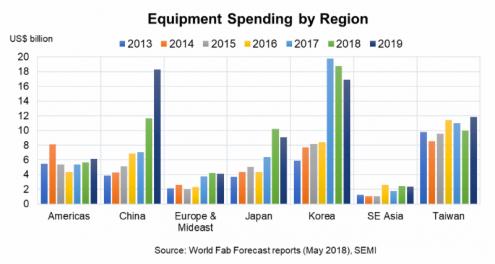

Three critical China issues; Trade, Taiwan & Technology. China is a “double edge sword” of risk & opportunity. These issues greatly impact stock valuations. We have recently given a presentation at both the SEMI ASMC conference in Saratoga Springs and The Confab conference in Las Vegas. Both conferences… Read More

For Halloween this week we thought it would be appropriate to talk about things that strike fear into the hearts of semiconductor makers and process engineers toiling away in fabs. Do I want to do multi-patterning with the huge increase in complexity, number of steps, masks and tools or do I want to do EUV with unproven tools, unproven… Read More