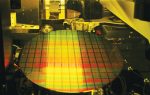

TSMC puts up solid QTR, Capex increase for 5NM and capacity increase, 5G/mobile remains driver- HPC good 7NM, 27% of revs- Very nice margins!

In line quarter-Good guide

TSMC reported revenues of $9.4B and EPS of $0.62 , more or less in line with expectations, perhaps a touch below ” whisper” expectations which had been… Read More