You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please,

join our community today!

ASML reported a more or less in line quarter as expected, coming in at EUR3.14B in revenues and EPS of EUR1.87. However, guidance was worse than most analysts were expecting with Q1 revenues expected to be EUR2.1B or down about one third.

This cut is something we have been talking about for a while as we have expected sharp memory CAPEX… Read More

On the first day of trading in the new year Apple just announced, after the close, that revenues will be lower than previously expected coming in at $84B versus the expected range of $89B to $93B and analyst estimates of the current quarter at $91.5B. Ugly….. The blame was laid squarely on China as slowing sales and trade tensions… Read More

Given that the semiconductor industry is clearly in the midst of a down cycle (even though there are cycle deniers, also members of the flat earth society…), most investors and industry participants want to know the timing of the down cycle and the shape of the recovery as we want to know when its safe to buy the stocks again. … Read More

Could this be more bad news for semicap spend? Negative for US chip independence & AMD costs ? Rumors of Global Foundries dropping out of the 7NM race have been increasing rapidly. What could be a fatal blow to the GloFo 7NM program was AMD deciding to go with TSMC for 7NM first for one product and finally for its next generation CPUs.… Read More

“Puts & Takes” “Reduced NAND Expectations” 2019 to be down from 2018. Applied Materials reported a good quarter coming in at $1.22 EPS and $4.567B in revenues versus street of $1.14 and $4.45B.

However if we back out the buy back of 4% it would have been around $1.17 so a slight beat. Guidance was for … Read More

TSMC warns soft phone/crypto & flat capex!

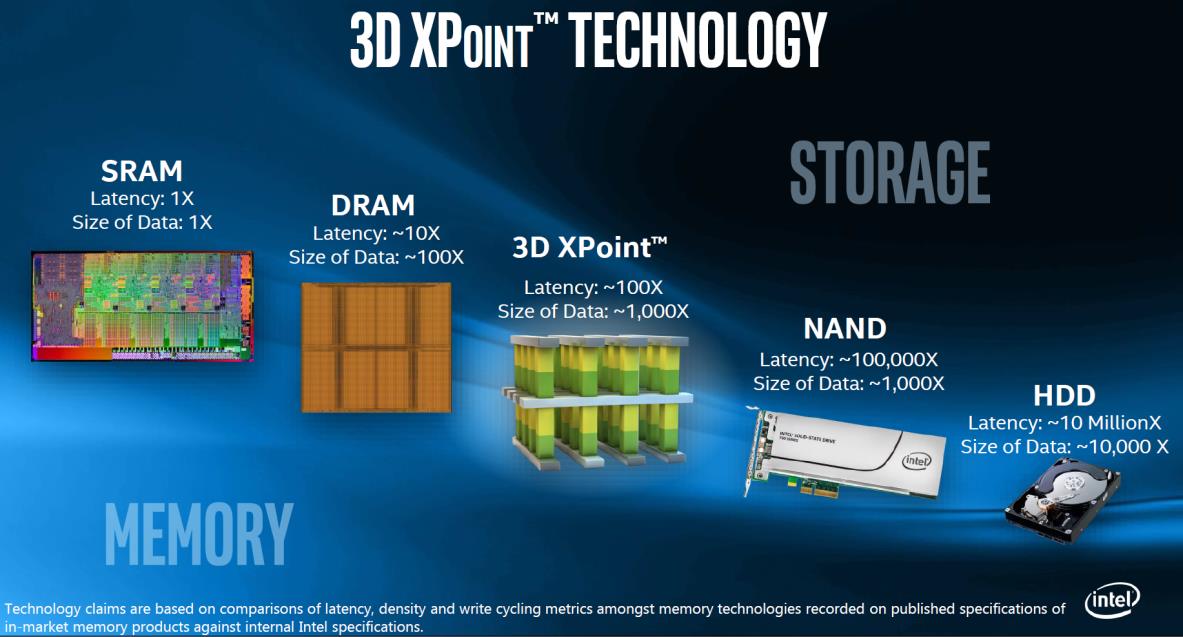

Does this impact DRAM?

Can Intel keep Apple?

We love Tesla (Model 3)!… Read More

ASML put up good results with revenues of Euro2.285B versus street of Euro2.22B and EPS of Euro1.26 versus street of Euro1.17. Guide is for Euro2.55B versus street of Euro2.46B but EPS of Euro1.16 versus street EPS of Euro1.35 on lower gross margins, slipping from 48% to 43%.

A couple of EUV systems have slipped out. This is not surprising… Read More

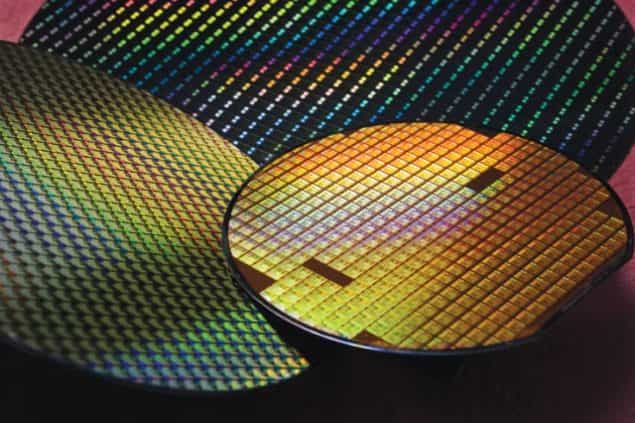

Micron put up a great quarter beating both quarterly expectations and guidance. Even though the stock was up 8% and we still think it has a long way to go as investors have not fully embraced the upside ahead in the memory market.… Read More

Last week, TEL (which is the Japanese equivalent to AMAT & LRCX) reported a June quarter which saw revenues drop to 236B Yen from March’s 261B Yen and saw earnings drop from March’s 47B Yen to June’s 41B Yen, a respective 9.3% decrease and a 12.8% decrease in earnings.

We don’t think this is attributable… Read More

Lam & Applied talked about “sustainable” growth Both expect share gains & growth in a flattish market. We examine the “new, lower, cyclicality”. Although Applied and Lam are fierce competitors , coming at things from different directions, they sounded awfully similar last week.

… Read More