Nice numbers despite the cycle bottom

KLA put up EPS of $1.80 versus street of $1.67 on revenues of $1.097B versus street of $1.08B. However guidance was weaker than the street was hoping for with a range of $1.21B to $1.29B in revenues generating between $1.55 and $1.85 in non GAAP EPS. This is compared to current street estimates … Read More

Tag: asml

An old IP theft gets a new Chinese label

The Dutch financial newspaper Financieele Dagblad (FD) reported on the past theft of ASML technology after doing some investigative digging. It now appears that a number of Chinese nationals and ASML employees, in ASML’s Santa Clara office stole key technology back in 2015. Though ASML talked about it at the time, little… Read More

Moore’s Law extended with new "gateless" transistor

Micron Buries the Hatchet with China

Micron has a very long history of counter cyclical investing, buying the assets of vanquished competitors when the memory industry is at the bottom of the cycle, such as it is right now.

Over the weekend, Micron announced that it had an agreement to acquire the assets of the now stalled Jinhua memory… Read More

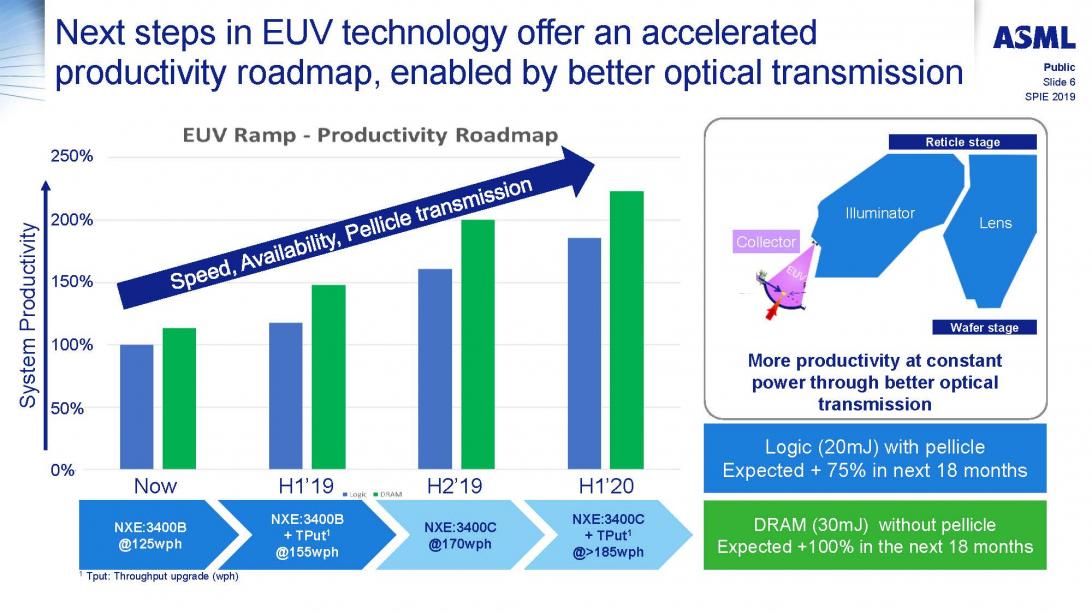

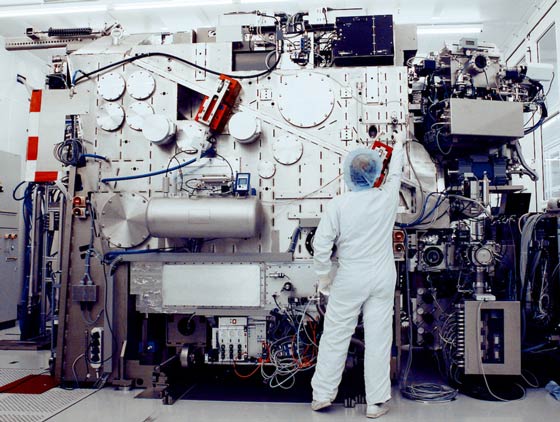

SPIE Advanced Lithography Conference – ASML EUV Update

At the SPIE Advanced Lithography Conference ASML gave an update on both the current 0.33NA system and the 0.55 high-NA system development. I saw the presentations and got to sit down with Mike Lercel (Director of Strategic Marketing).… Read More

SPIE Advanced Lithography Conference 2019 Overall Impressions

Last week I attended the 2019 SPIE Advanced Lithography Conference. I gave two presentations, attended dozens of papers and conducted three interviews. I will be doing some detailed write ups particularly on EUV but I am waiting for the presentations from several of the papers. In the mean time I thought I would put some overall … Read More

Report from SPIE EUV Update 2019

Not as much new – No breakthrough announcements, 300 watts is better than 250 watts – Pellicle Problems, TSMC is EUV king – Third times a charm? We attended this years SPIE Lithography convention in San Jose as we have for many years. Although the show was quite enthusiastic and EUV was the central topic, as it has… Read More

ASML and Memory Loss 2019

ASML reported a more or less in line quarter as expected, coming in at EUR3.14B in revenues and EPS of EUR1.87. However, guidance was worse than most analysts were expecting with Q1 revenues expected to be EUR2.1B or down about one third.

This cut is something we have been talking about for a while as we have expected sharp memory CAPEX… Read More

Needham Growth Conference Notes 2019

We attended the Needham Growth Conference which is one of the first conferences of the year and in the quiet period before most companies reported so even though there was no “official” comment from most companies on the quarter, the surrounding commentary spoke volumes:

- The down cycle (and everyone admits its a cycle

Samsung pre-announces miss on weak memory and phones

It should come as no big surprise that Samsung will miss its Q4 numbers. The company pre announced that profits will be 10.8T KWON (about $9.7B ) versus the 13.2T KWON analysts had predicted, close to a 20% miss. This number is also down about 39% sequentially. Revenue at 59T KWON instead of expected 62.8T KWON and down about 10%. The… Read More

Apple as Apex of chip industry portends weaker 2019

On the first day of trading in the new year Apple just announced, after the close, that revenues will be lower than previously expected coming in at $84B versus the expected range of $89B to $93B and analyst estimates of the current quarter at $91.5B. Ugly….. The blame was laid squarely on China as slowing sales and trade tensions… Read More