As we have been warning for months the China trade issue continues to grow and accelerate. As we are approaching the June 30th cliff (when export sanctions will be announced) it seems as if the administration has given the industry a kick so we fly even further. The US will also restrict Chinese investment in US tech companies. The … Read More

Tag: amat

Semiconductor Cycles Always End the Same Way

It appears the current cycle has rolled over? The reason is memory & could be worsened by trade Figuring out length, depth and impact of the downturn? We had said that AMAT “called” the top of the cycle on their last conference call even though they may not think so. Semiconductor cycles always ends the same way. The… Read More

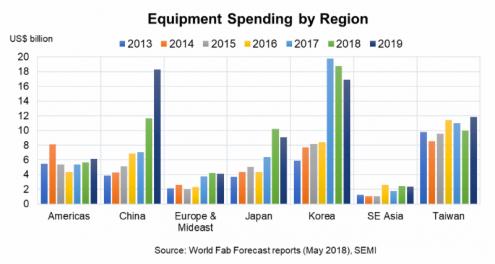

Chip Equipment where to from here?

We may know the top, do we know the bottom? What is the downside in NAND, DRAM, Foundry. Can China help or is risk worse than upside?

It would appear that our concerns in our preview piece prior to the AMAT call came true as the stock now has a “4” handle, NAND is in question and display is down.

However its not like business … Read More

AMAT has OK Q2 but Q3 flat to down

“Puts & Takes” “Reduced NAND Expectations” 2019 to be down from 2018. Applied Materials reported a good quarter coming in at $1.22 EPS and $4.567B in revenues versus street of $1.14 and $4.45B.

However if we back out the buy back of 4% it would have been around $1.17 so a slight beat. Guidance was for … Read More

TSMC Adds Negative Semiconductor News

TSMC warns soft phone/crypto & flat capex!

Does this impact DRAM?

Can Intel keep Apple?

We love Tesla (Model 3)!… Read More

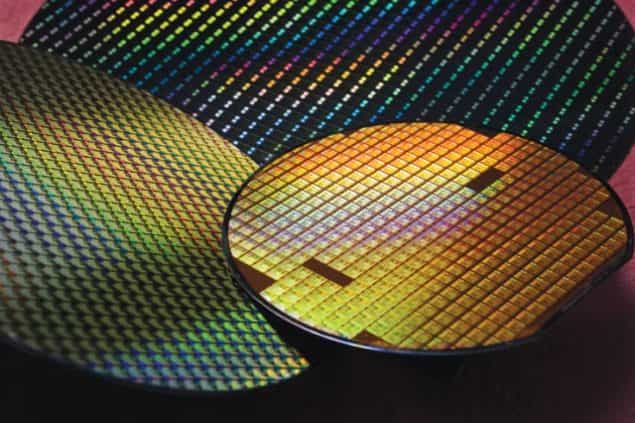

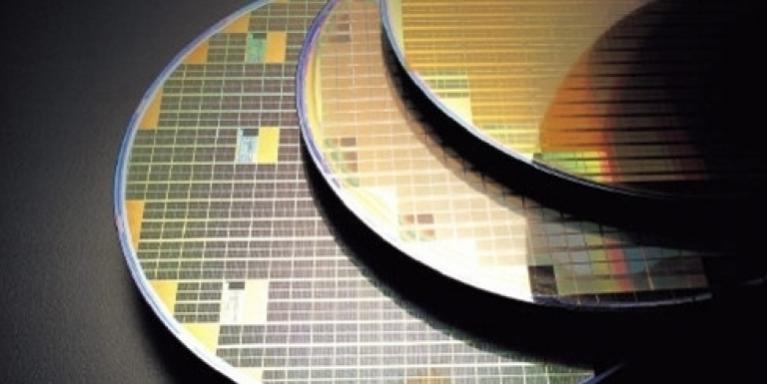

Choosing the lesser of 2 evils EUV vs Multi Patterning!

For Halloween this week we thought it would be appropriate to talk about things that strike fear into the hearts of semiconductor makers and process engineers toiling away in fabs. Do I want to do multi-patterning with the huge increase in complexity, number of steps, masks and tools or do I want to do EUV with unproven tools, unproven… Read More

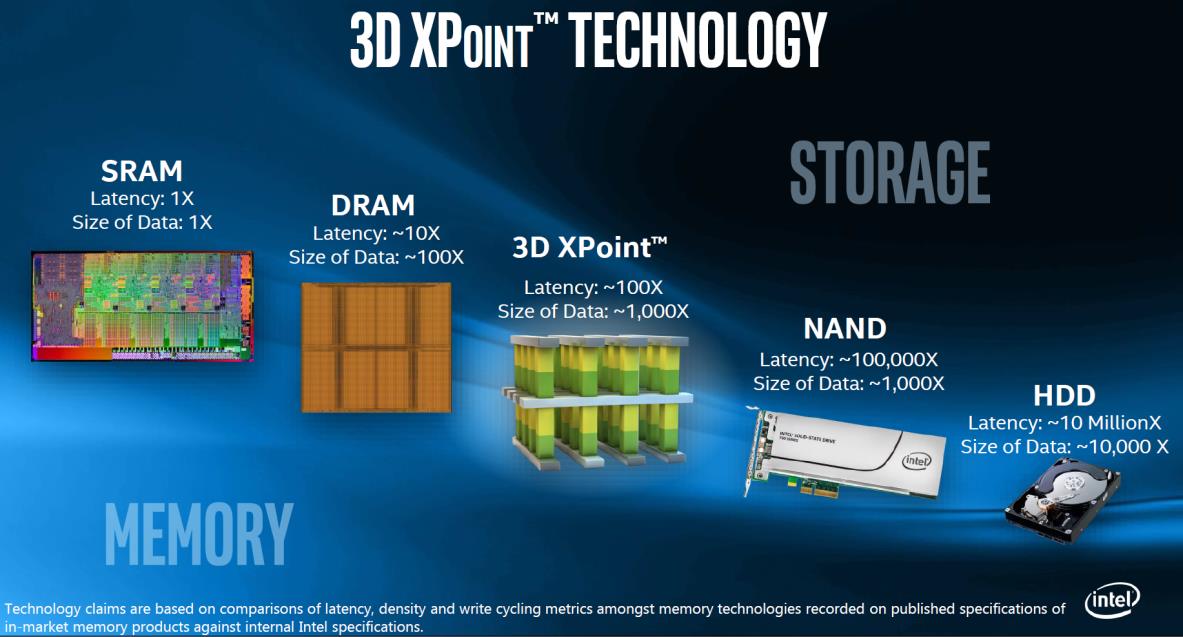

Do investors understand the new memory paradigm?

Micron put up a great quarter beating both quarterly expectations and guidance. Even though the stock was up 8% and we still think it has a long way to go as investors have not fully embraced the upside ahead in the memory market.… Read More

Samsung Sloppy Sailor Spending Spree!

Last week, TEL (which is the Japanese equivalent to AMAT & LRCX) reported a June quarter which saw revenues drop to 236B Yen from March’s 261B Yen and saw earnings drop from March’s 47B Yen to June’s 41B Yen, a respective 9.3% decrease and a 12.8% decrease in earnings.

We don’t think this is attributable… Read More

Semicap Thoughts: ASML AMAT INTEL SAMSUNG TSMC MICRON

ASML reported results in line and slightly ahead of expectations which helped push ASML and the other semicap stocks back to their original valuations prior to the two step pull back that lasted about a month. We are now back to relatively high, record valuations not seen or ever seen previously (at least for a long time) by many companies.… Read More

The post election Semicap bubble just burst in one day

Back to a more normal reality… Market gets”De-Fanged”… Where to from here? The “Icarus” Effect… Much of the market, and especially Tech & “FANG” (Facebook, Amazon, Netflix & Google) stocks gave back most all of their post election day gains in one session.… Read More