Semiconductor stocks have had another significant down leg as the bad news continues to pile on. Bad news in this case doesn’t come in threes , it comes in droves. TI is perhaps very scary news as it is a rather broad based supplier of semiconductors that has fared better than more pure play chip suppliers. TI gave weak guidance… Read More

Tag: amat

ASML most immune to slow down due to lead times Not LRCX

ASML reported EUR2.78B in revenues with EUR2.08B in systems. 58% was for memory. EUV was EUR513M with 5 systems. Importantly orders were for EUR2.20B in systems at 64% memory and 5 EUV tools. This was likely better than expectations given the overall industry weakness. EPS of EUR1.60 was more or less in line with expectations. Guidance… Read More

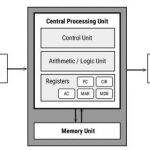

Advanced Materials and New Architectures for AI Applications

Over the past 50 years in our industry, there have been three invariant principles:

- Moore’s Law drives the pace of Si technology scaling

- system memory utilizes MOS devices (for SRAM and DRAM)

- computation relies upon the “von Neumann” architecture

The Shape of Semiconductor Things to Come

Given that the semiconductor industry is clearly in the midst of a down cycle (even though there are cycle deniers, also members of the flat earth society…), most investors and industry participants want to know the timing of the down cycle and the shape of the recovery as we want to know when its safe to buy the stocks again. … Read More

More Negative Semiconductor News

The amount of negative news and information about the semiconductor industry seems to be increasing at a faster rate. Micron put up a better quarter than expected but more importantly guided less than expected. We are surprised that the street is surprised as the decline in memory pricing is well known and Micron has been clear about… Read More

Is the Q4 Bounce Back now a 2009 Recovery?

Last week saw a unique confluence of events that continue the negative news flow in semicap following the story about GloFo. At a financial conference, Micron’s CFO said NAND prices were declining, this was on top of an analyst note in the morning about the same issue. Even though this should be no surprise as memory has had … Read More

GloFo dropping out of 7NM race?

Could this be more bad news for semicap spend? Negative for US chip independence & AMD costs ? Rumors of Global Foundries dropping out of the 7NM race have been increasing rapidly. What could be a fatal blow to the GloFo 7NM program was AMD deciding to go with TSMC for 7NM first for one product and finally for its next generation CPUs.… Read More

AMAT down 10% as expected Foundry spending slow down unexpected

Applied reported a more or less in line quarter, slightly beating weaker expectations. As we had projected, the October quarter is expected to have revenues down 10% which is at the low end of our expected 10-15% drop in business. Applied services helped partially make up for some of the equipment sales weakness. Revenue came in … Read More

Chip Stocks have been Choppy but China may return

Applied Materials (AMAT) is batting clean up in a quarter that has not been pretty. Lately semi stocks seem to have been hit by not only stock specific issues but continued and increasing memory concerns coupled with more macro issues. On top of all this, China trade issues which have in the meantime taken a back burner to other issues… Read More

KLAC gets an EUV Kicker

KLAC put up a great quarter coming in at revenues of $1.07B and EPS of $2.22. Guidance is for $1.03B to $1.1B with EPS of $2 to $2.32. Both reported and guided were at the high end of the range and above consensus. We had suggested in our preview notes that KLAC would be the least impacted of the big three (AMAT, LRCX & KLAC) semi equipment… Read More