AI explosion is clearly driving semi-industry since 2020. AI processing, based on GPU, need to be as powerful as possible, but a system will reach optimum only if it can rely on top interconnects. The various sub-system parts (memory, processor, co-processor, network) need to be connected with interface links with ever more bandwidth and lower latency: DDR5 or HBM memory controller, PCIe and CXL, 224G SerDes and so on. When you design a supercomputer, raw processing power is important, but the way you access memory, latency and network speed optimization will allow you to succeed. It’s the same with AI, that’s why interconnects protocols are becoming key.

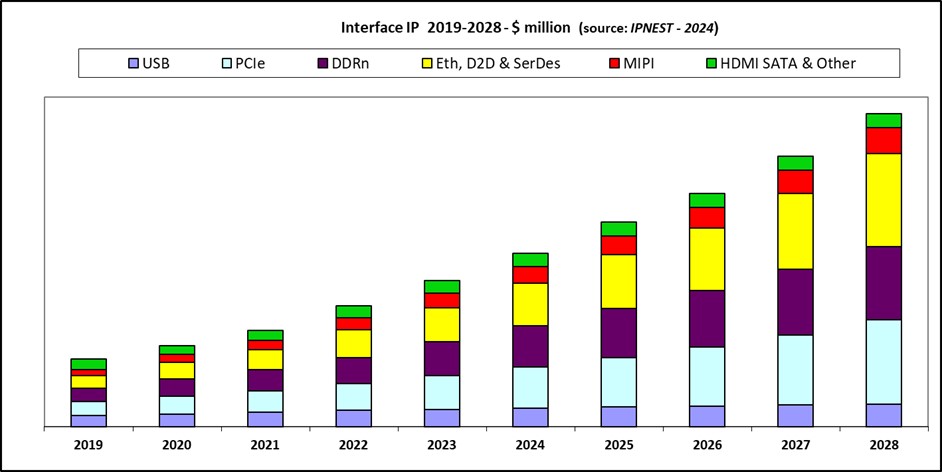

In 2023, the semiconductor market declined, but the interface IP segment grew by 17%. Our forecast shows stronger growth for years 2024 to 2028, comparable to 20% growth in the 2020’s. AI is driving the semiconductor industry and Interconnect protocols efficiency are fueling AI performance. Virtuous cycle!

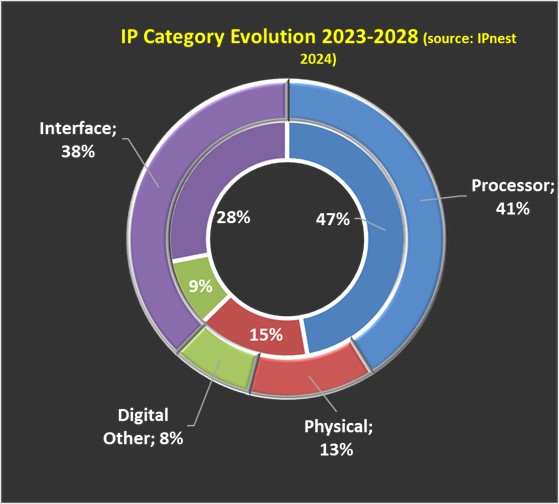

The interface IP category has moved from 18% share of all IP categories in 2017 to 28% in 2023. In 2024, we think this trend will amplify during the decade and Interface IP to grow to 38% of total (detrimental to processor IP passing from 47% in 2023 to 41% in 2028).

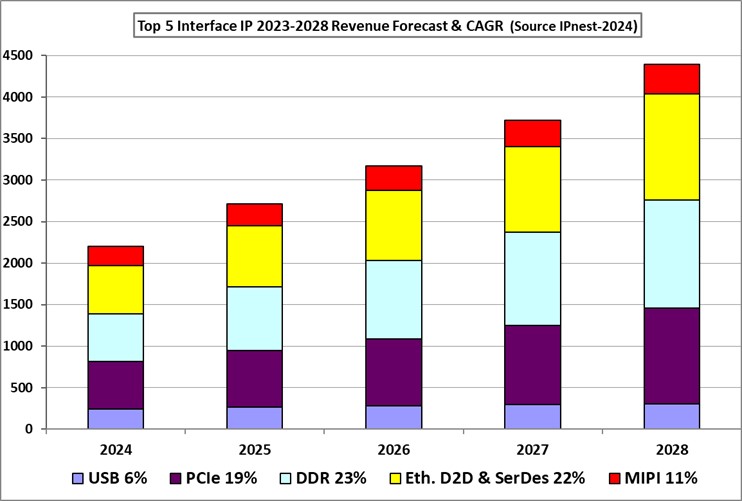

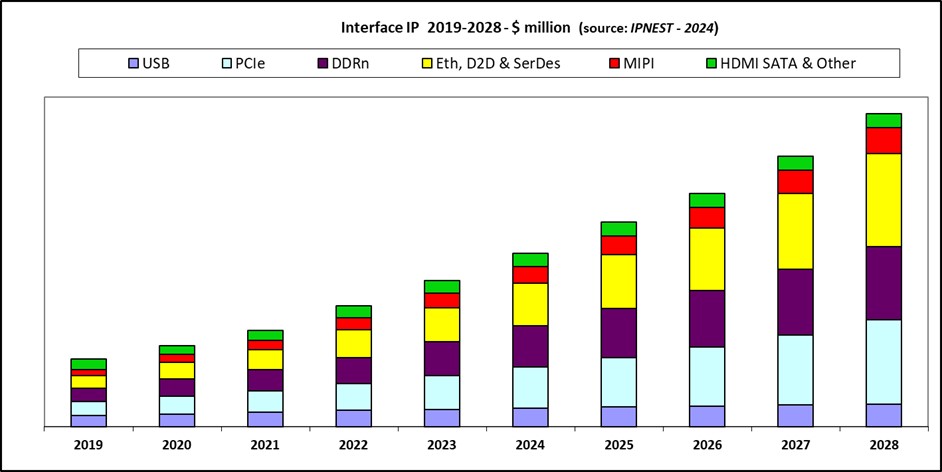

As usual, IPnest has made the five-year forecast (2024-2028) by protocol and computed the CAGR by protocol (picture below). As you can see on the picture, most of the growth is expected to come from three categories, PCIe, memory controller (DDR) and Ethernet & D2D, exhibiting 5 years CAGR of resp. 19%, 23% and 22%.

It should not be surprising as all these protocols are linked with data-centric applications! If we consider that the weight of the Top 5 protocols was $1820 million in 2023, the value forecasted in 2028 will be $4390 million, or CAGR of 19%.

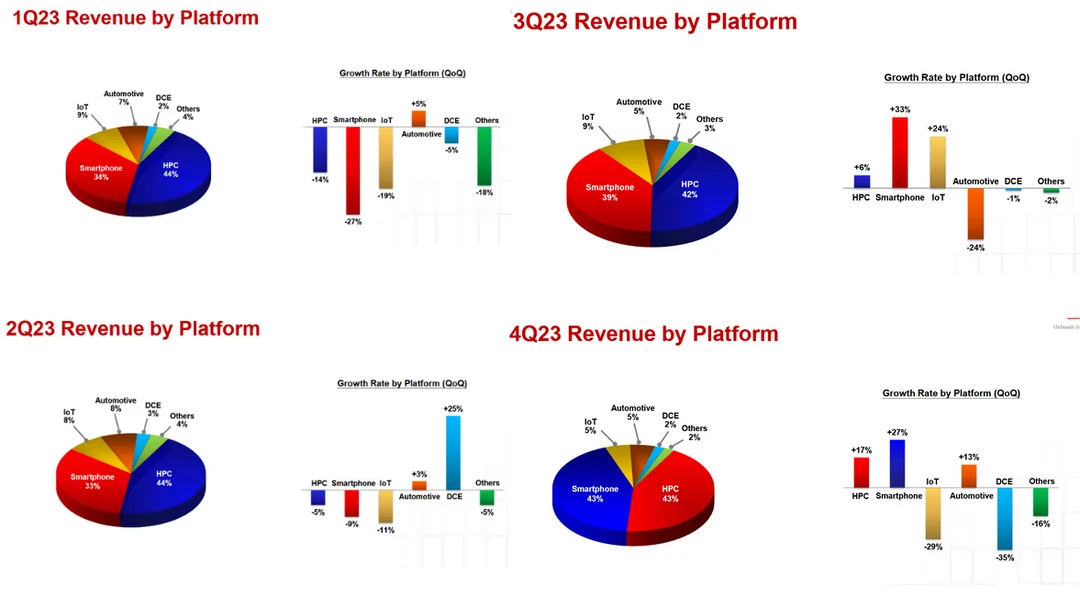

This forecast is based on amazing growth of data-centric applications, AI in short. Looking at TSMC revenues split by platform in 2023, HPC is clearly the driver. This has started in 2020, we expect this trend to continue up to 2028, at least.

Conclusion

Synopsys has built a strong position on every protocol -and on every application, enjoying more than 55% market share, by doing strategic acquisitions since the early 2000’s and by offering integrated solutions, PHY and Controller. We still don’t see any competitor in position of challenging the leader. Next two are Cadence and Alphawave, with market share in the 12%, far from the leader.

In 2024, we think that a major strategy change will happen during the decade. IP vendors focused on high-end IP architecture will try to develop a multi-product strategy and market ASIC, ASSP and chiplet derived from leading IP (PCIe, CXL, memory controller, SerDes…). Some have already started, like Credo, Rambus or Alphawave. Credo and Rambus already see significant revenues results on ASSP, but we will have to wait to 2025, at best, to see measurable results on chiplet.

This is the 16th version of the survey, started in 2009 when the Interface IP category market was $250 million (in 2023 $1980 million), and we can affirm that the 5 years forecast stayed within +/- 5% error margin!

IPnest predict in 2024 that the interface IP category in 2028 will be in the $4750 million range (+/- $250), and this forecast is realistic.

If you’re interested by this “Interface IP Survey” released in July 2024, just contact me:

Eric Esteve from IPnest

Also Read:

Semi Market Decreased by 8% in 2023… When Design IP Sales Grew by 6%!

Interface IP in 2022: 22% YoY growth still data-centric driven

Design IP Sales Grew 20.2% in 2022 after 19.4% in 2021 and 16.7% in 2020!

Share this post via:

The Name Changes but the Vision Remains the Same – ESD Alliance Through the Years