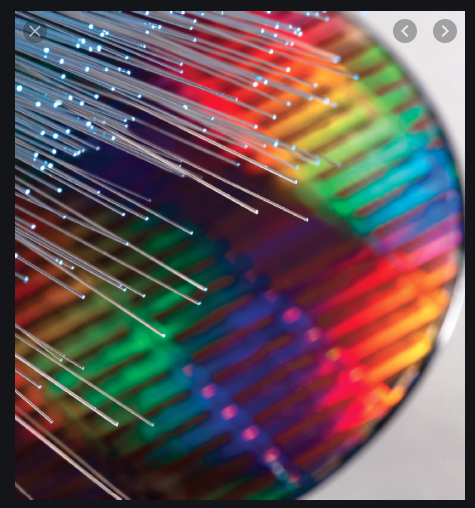

In the past, I’ve focused my annual predictions on electronics – ICs and EDA – but recently I’ve turned my focus to photonics, so my 2020 predictions are primarily in this area.

Historically, photonics has been the Gallium Arsenide of technologies; it was, is and always will be the technology of the future. Analysts have forever predicted the rise of photonics; that next year as Moore’s Law ends or slows in electronics, photonics will assert itself, entering the hockey stick phase of its growth. While photonics is playing a constantly greater role in our technology ecosystem with an impressive growth rate, the predicted explosive growth hasn’t yet happened.

Why not? There are a few reasons. First, photonics doesn’t adhere to Moore’s Law: The wavelength of light is the wavelength of light. It is a constant; it just doesn’t halve every two years, so the phenomenal gains in electronics driven by Moore’s Law just don’t apply to photonics.

Next, as always, engineers are clever. Engineers constantly breach barriers in electronics once considered insurmountable. So, applications where photonics were projected to replace electronics remain filled by more and more clever electronic designs instead. The replacement of electronics by photonics may still be inevitable, but the timeline keeps moving out.

Finally, the photonics ecosystem has not yet evolved sufficiently to support a large scale commercial market. Whereas electronics have evolved over the past >half century to become the sophisticated, well-oiled design and manufacturing ecosystem of today, this evolution has not yet occurred in photonics. Today’s photonics ecosystem still most closely resembles the electronics ecosystem of the early 1980s.

2019 saw the acquisition of the major photonics suppliers by even more major players, such as Cisco’s acquisition of Luxtera, and now Acacia Communications, along with II-VI’s acquisition of Finisar, the world’s leading supplier of optical communications products, and Broadcom’s reacquisition of their optical transceiver assets from Foxconn. Many see this trend as an acknowledgment of the coming of age of photonics, and the need for major telecommunications providers to offer leading photonics solutions.

What about this year? Will photonics come into focus in 2020? I’ll leave the hockey stick inflection point predictions to analysts who are paid for this sort of thing, but I will predict several trends with impact to the timing of that inflection point.

Photonics is becoming relevant, then prevalent, and finally dominant at shorter and shorter distances. Today, telecommunications delivered over kilometers to your home and business travel via fiber optics, an application dominated by photonics. Now photonics has moved into the data center. Massive hyperscale data centers across the globe struggle with power consumption and cost, heat, bandwidth, and data latency. Replacing copper wire with fiber optics addresses all these issues. Compared to copper, fiber is cheaper, faster, lower latency, higher bandwidth, and consumes less power, thus lowering heat and power costs.

The takeover of fiber optics between racks in the data center is largely complete, and fiber has moved onto interconnecting servers in the same rack. So photonics has already moved from dominance at kilometer distances, to prevalence at ten of meters distances, to relevance at single meter distances. In 2020, Photonic Integrated Circuits (PIC) will become more commonly commercially available, making photonics relevant at millimeter distances. Work is underway to integrate the photonics, including the laser, on-chip with electronics, moving photonics relevance down to microns.

As Ethernet data transmission speed continues its migration from 100G to 200G in 2020, photonics becomes more attractive in the transceivers required at either end of the optical fiber. The build-out for 100G is largely complete. In 2020 the transition to 200G will be well underway, with early adopters moving onto 400G. With clever engineering, electronics can deliver at 100G, but photonics is competitive here, and many 100G photonics transceiver designs are available on the market. We’ll see more cleverness from IC designers, but at 400G, electronics will lose more of its grip in the transceiver market and photonics will begin its move from relevance to prevalence. By the time we reach 800G and 1T (well past 2020), photonics will be in full dominance, with nary an electronics transceiver to be found.

The dominance of photonics in the data center will be hastened by the FANGs (Facebook, Amazon/Apple, Netflix, Google) building photonic design teams focused on photonic transceivers tuned to their own specifications, a new trend in 2020. Operating massive data centers, they will benefit tremendously by photonic designs crafted to their own specific needs, just as we have seen as the FANGs design their own ICs. We may not see fruit of this activity in 2020, but it will significantly increase the world’s photonic design capacity and hasten the evolution of the commercial photonics ecosystem.

Dominated by small niche commercial or R&D fabs such as SMART Photonics, LionX, Ligentec, imec, Leti, and AIM, today’s photonics foundries are generally geared toward R&D or providing MPWs, rather than large commercial runs. While solid foundries, advanced in their photonics offerings (such as Indium Phosphide for lasers), these fabs do not today have the capacity to drive a large commercial market, and they have not yet had the opportunity to develop the extreme customer support processes that large semiconductor foundries have built over decades.

The FANGS are key customers of the world’s leading semiconductor foundries. These foundries are taking notice of the increased photonic design activity and have entered or are contemplating entering the photonics business. This will hasten it’s commercialization as these fabs apply their production knowledge and experience and skills in building mature ecosystems.

Over the last couple of years, leading semiconductor foundries such as TowerJazz and GlobalFoundries commenced servicing the photonics business. 2020 will see other major semiconductor foundries (beyond those whose name is two words run together) entering the photonics business. The new entry of these foundries will serve to legitimize silicon photonics as a commercial business. One attractive advantage that photonics offers semiconductor foundries is the lack of need for leading-edge technology, so there is no requirement for the massive R&D and capital investment of electronics. Instead, photonics makes use of fully capitalized semiconductor fabrication equipment to return impressive margins.

One indicator of the maturing of photonics is the emergence of process development kits (PDKs) from foundries. The first photonic PDKs emerged about two years ago, and they are starting to become prevalent as foundries deliver PDKs targeting a variety of design tools. These PDKs tend to be primitive in comparison to libraries delivered by semiconductor foundries, but they are a significant and important step in the maturing of the commercial photonics ecosystem requiring a strong partnership between foundries and photonic design automation (PDA) companies. Together, they are producing new PDKs and advancing the state of existing PDKs. As more PICs are manufactured and measured, sufficient data is becoming available for statistical analysis. 2020 will see the emergence of statistical-based PDKs, enabling Monte Carlo and corner statistical analysis in more advanced PDA simulation tools. This will lead to more robust designs, with a new focus on manufacturability, another requirement for the commercialization of photonics.

The established EDA vendors are taking note of the emerging photonic-electronic market. They are delivering design tools targeted to this market and forming key alliances with the leading PDA companies to provide a complete integrated design flow. Last year, Mentor introduced LightSuite Photonic Compiler while leveraging their Tanner tools to provide schematics and layout. Cadence introduced curvilinear capability via CurvyCore to enable its industry-leading custom design platform, Virtuoso for photonics. Both Mentor and Cadence have integrated their design flow with the leading photonic simulation provider, Lumerical. For example, Cadence has provided co simulation capabilities, enabling the entire design flow to be driven through the Virtuoso cockpit. Synopsys has pursued more of a go-it-alone strategy.

I predict that the entry of the major EDA vendors portends higher price tags for PDA tools. Average Selling Prices for popular EDA tools are magnitudes higher than for PDA tools. This imbalance is not sustainable long term, as it will hold back needed investment in PDA and the ability of the PDA companies to compete in the new EPDA environment. Though the change won’t be sudden, it will be consistent.

While integrated Electronic-Photonic Design Automation (EPDA) flows emerged last year, in 2020 they will become more sophisticated with the addition of statistical and design for manufacturing (DFM) capabilities. Statistical considerations will require far more compute power, so in 2020 we will also see High Performance Computing applied to PDA, with Amazon AWS and Microsoft Azure becoming significant players delivering photonics in the cloud by making use of all those photonics in their data centers.

In contrast to electronics, a photonic design consists of just a few meticulously crafted components. Many of these components can be found in the PDKs delivered by foundries, but each leading edge photonic design will always include some critical components that the more generalized foundry PDKs cannot deliver. This creates an opportunity for a few well-positioned companies to establish a photonic IP (PIP) business. Well managed companies with extreme photonic design capability and focus, and inexpensive access to design tools are likely to spearhead the emergence of this market. With their unrelenting focus on photonic design, these companies will deliver superior designs. Companies looking to deliver leading-edge photonic designs will engage these PIP providers to outsource their component design in order to focus their own resources on other value-added areas such as the overall PIC design. In it’s infancy, the PIP business will likely hold serval similarities to custom design services.

Breakthroughs in photonics design methodology will provide higher quality, more manufacturable designs and will lower the barrier so that photonic design no longer requires a PhD in physics. Better designs will push forward the applications that photonics can compete in and win at. More qualified designers will result in a greater ability for companies to staff their photonics design team, resulting in greater competition leading to better products and faster evolution.

Already we are seeing the impact of Photonic Inverse Design from sources like Stanford, and Lumerical co operating with the open source community. We are starting to see component design completed much more simply with much improved Figures of Merit, over much shortened design cycle (days compared to months).

We are seeing improvements even on the best published designs, often completed in a matter of days. We are seeing orders of magnitude improvements in components. Photonic Inverse Design’s simplified, automated design methodology will replace today’s manual, iterative process, and will be applied to wide variety of photonic components in 2020. Photonic Inverse Design ‘s impact to photonics will be similar to the impact of logic synthesis to IC design in the 1980s. It will widen the circle of qualified photonics designers and hasten time to market for photonics designs. I think of the transisition to Photonic Inverse Design as analogous to raising the level of abstraction that designers work at. Just as raising the level of abstraction of IC design unleashed a torrent of IC designer productivity, I expect to see similar improvements in the productivity of photonics designers.

Applications:

Transceivers: 2020 will continue the trend of photonics’ takeover in the data center. In 2020, this will become more pronounced at we move from 100G to 200G and onto 400G Ethernet transmission speeds.

LiDAR: In 2020, we will see the introduction of multiple photonics-driven LiDAR designs. LiDAR is a key technology for autonomous vehicles, but it’s not feasible to mount onto everyday passenger cars those rotating cans seen on today’s prototype autonomous vehicles, and its not feasible to pass the thousands of dollars cost of those rotating cans onto the future everyday buyers of autonomous passenger cars. A large number of startups are focused on reducing the size (to a deck of cards) and cost (by an order of magnitude) of LiDAR, and several of them will reveal their designs in 2020. Additionally we will see a photonics-based LiDAR design from at least one established, leading LiDAR company.

LiDAR is another application impacted by the cleverness of engineers. The position of Tesla’s Elon Musk (or is it Elon Musk’s Tesla?) is that radar+cameras will be good enough for autonomous vehicles, so there is no need for LiDAR. The driving question is a race between lowering the cost & size of LiDAR vs. improving the capabilities of radar+camera. The winner of this race will determine the fate of a volume driver of photonics in autonomous vehicles. The checkered flag will be waved well past 2020.

5G: In 2020, we will see the build out of 5G in earnest. This will drive volume in PICs as new photonics-friendly technologies such as NG-PON2 are deployed in both the front haul and the back haul. There will be a hockey stick inflection in 5G also as the second part of 5G, the millimeter wave for short range within buildings, is deployed. This more extensive 5G buildout will not occur in earnest in 2020.

Sensors: Boring perhaps, but an application where photonics is making steady progress, and that progress will continue through 2020. Medical is a particularly interesting area for sensors with strong opportunity for photonics. The progress in medical will be paced more by legal regulations than by technology, and 2020 will not see a breakthrough in this area.

AR/VR: With some credibility, it is said that the easiest way to predict our technology future is to watch Star Trek. All of Star Trek’s technology will eventually come to pass. That’s good news for photonics. If we are ever to cavort in the holodeck, photonics will play a big role.

Quantum computing: Quantum is another application that will drive photonics adoption. Quantum is challenging to predict (I can’t tell whether it is here or there. . . ). 2020 will NOT be the year of Quantum, but I do I predict there will be at least one important quantum announcement that will blow everyone’s mind. The announcement will exist at both a large established company and a start up in both places at the same time.

Summary:

Photonics, the technology of the future, will see solid advancement in 2020. Growth rate will be impressive, with abundant applications coming into focus. Growth will be tethered by the cleverness of engineers extending electronics, and the evolution of the photonics ecosystem. Signs of maturity are becoming more prevalent as commercial foundries join the fray and design automation matures. 2020 is the year that the commercialization of photonics comes into focus.

Facing the Quantum Nature of EUV Lithography