Over the last decade, automobiles have been morphing from stand-alone mechanical objects to highly connected systems with ever-increasing usage of electronics. Semiconductor supply disruptions (OEM factory shutdowns) caused by the recent situation with Covid and the political tensions and China have demonstrated the deep dependence of automobile industry on semiconductors. While these events are transitory in nature, they have exposed deeper underlying tectonic shifts in the fundamental nature of the automotive supply chain. A previous article ”Automotive OEMs And the New Normal (forbes.com),” discussed the psychological shift required in the halls of power in the automotive industry to come to grips with the new situation. This article takes a more technological perspective in explaining the problem as well as the strategic vectors required for a solution.

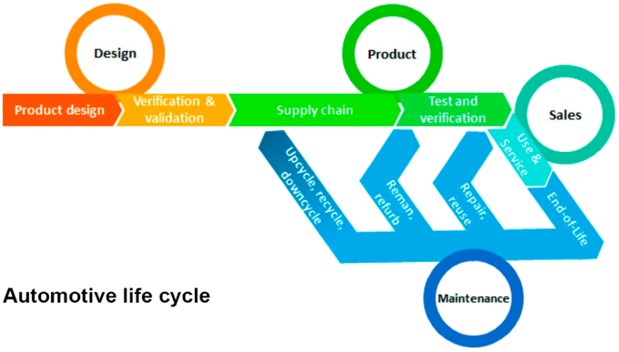

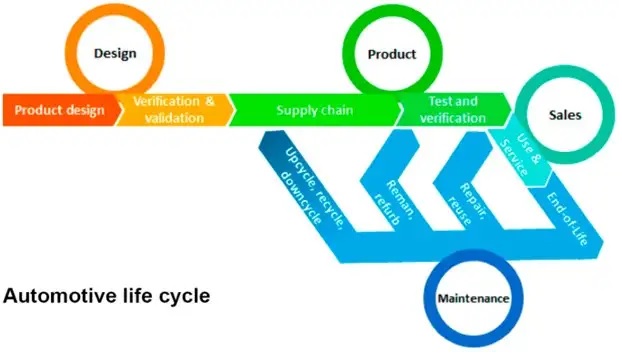

Fig. 1 below shows the traditional automotive lifecycle which consists of design, verification & validation, maintenance, and end-of-life cycle. Design focuses on issues such as functional definition, manufacturing cost, reliability, and maintainability. In an ideal flow, the specification is captured in a higher-level language and through a process of successive refinements components are selected to fill out the system function. For electronic systems, semiconductor components are assembled to complete an overall system. All along the way, the integration of the specification with designed components imposes discipline on the newly integrated pieces to ensure faithful implementation which meets the intended performance metrics.

Understanding the Traditional Automotive Design Ecosystem

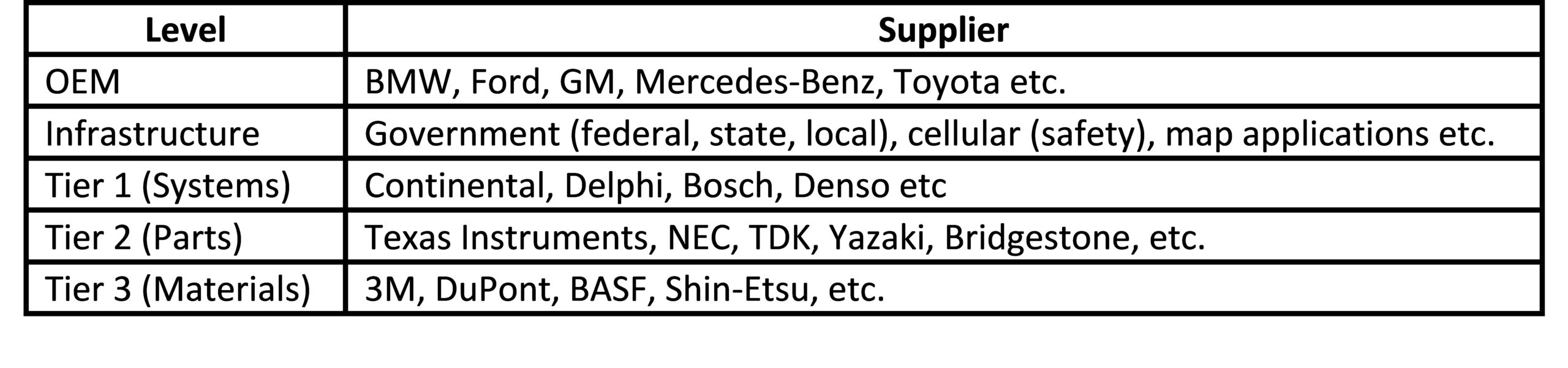

As the automobile industry has matured, the supply and development infrastructure has also reached a level of standardization and maturity. Table 1 outlines the well-known supplier structure for the automotive industry with original equipment manufacturers (OEMs), Tier 1, Tier 2, and Tier 3 suppliers. Table 2 shows the high-level structure development ecosystem which supports the supply chain. A deeper more technical analysis of the current electronic design chain can be found in “Unsettled Topics Concerning Automated Driving Systems and the Development Ecosystem.”

Electronic Paradigm Shift in Automotive Design

Even before the advent of AVs, the automotive sector had been rapidly increasing the level of electronic content with drive-by-wire, Advanced Driver Assistance Systems (ADAS), and infotainment systems. Thus, electronics effectively forms the muscular nervous system of modern vehicles. Two significant trends are adding electronic content at an accelerating rate.

- Enterprise Functions: The automobile sits inside a broad set of technology flows which engages with the infrastructure on functions such as maintenance, ecommerce, traffic management, and more. The combination of access to automotive data and remote control of the automobile enables higher level business flows which generate significant value. Indeed, just the data services from automobiles are projected to be a significant source of income for automotive OEMs from companies such as Otonomo and Wejo. SAE research report on the Transportation Ecosystem provides a comprehensive view of this ecosystem.

- Autonomy Functions: Autonomy at its various levels from ADAS to level 5 AV promises the value of safety, access, and enablement of system level automation.

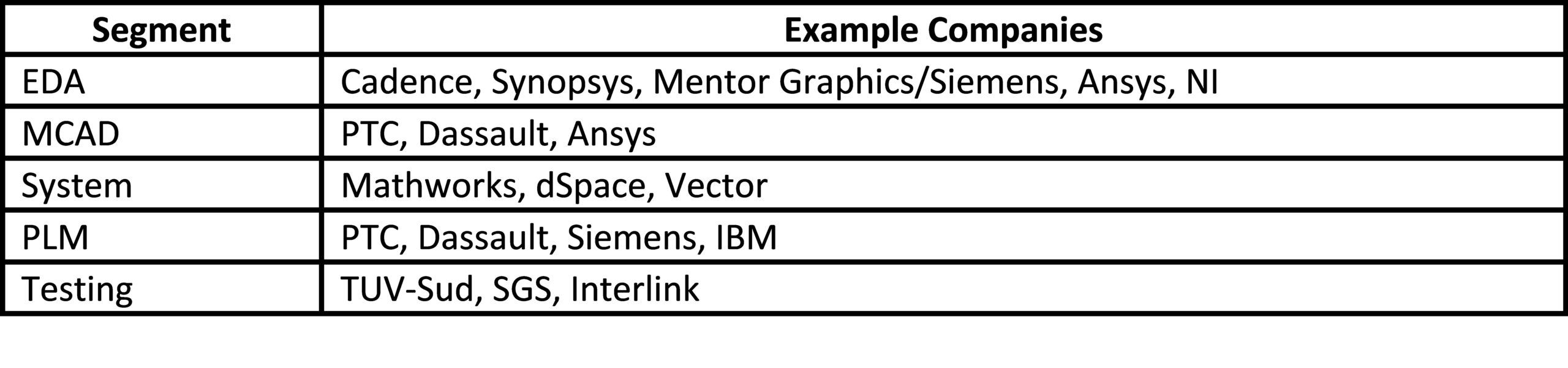

This shift in the fundamental DNA of an automobile is illustrated in the Figure 2 below.

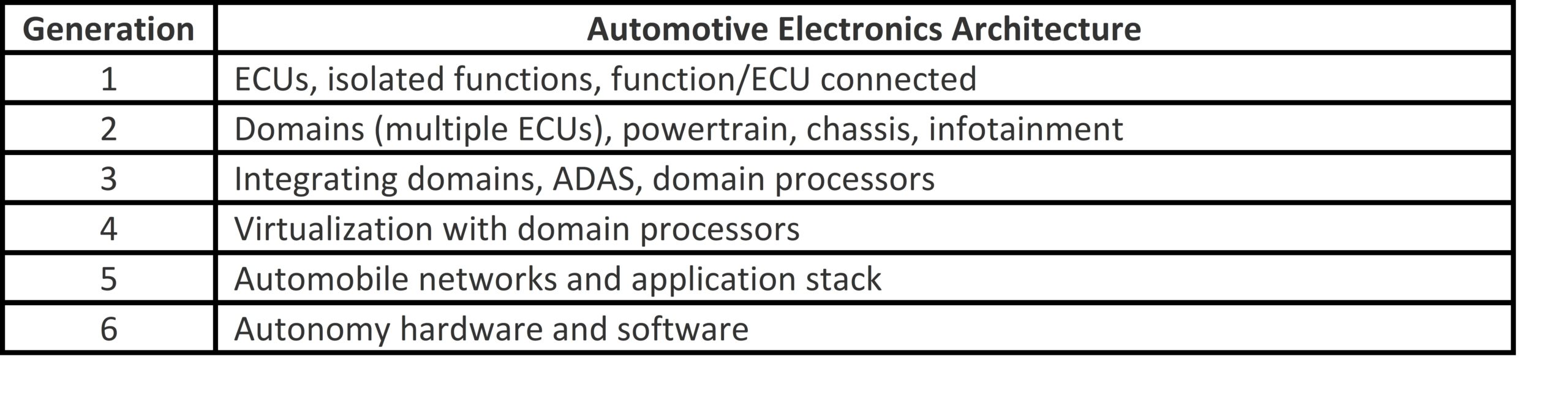

Table 3 above shows the generational evolution of automotive electronics from an electronics technology infrastructure perspective. Several observations can be made on these electronic systems:

- Semi Supply Dependency: The older generation of functionality generally source semiconductors from older generations of semiconductor processes.

- Safety Critical and Real Time: The automobile is a multi-ton vehicle which can cause a great deal of harm. Thus, the electronics systems which closely manage the automobile dynamics have a high safety standard and must operate in real time. This often argues for dedicated and isolated electronic systems.

- Advanced Digital Processing: Functionality ranging from infotainment to autonomy requires significant digital processing and massive amounts of software. To support this class of computing, the most advanced semiconductor process nodes are required.

Any particular automobile product is a collection of these systems where system designers are making active trade-offs between reuse of older subsystems, safely adding new functionality, performance, and overall cost. In other words, an incredibly complex situation with an incredibly large number of semiconductor part skews with associated software components.

Meanwhile, the semiconductor industry has its own set of strategic vectors:

- Manufacturing Costs: Leading edge fabs are very expensive and require very large volumes to be viable. Older fabs require less volume as compared to newer fabs due to capital requirements.

- Consumer Marketplace: Today, the only industry which can generate sufficient volumes to justify these investments is the consumer marketplace. The consumer market churns products once every 18 months to 24 months.

- Moore’s Law: Moore’s law drives the cost per transistor down exponentially while simultaneously increasing performance and reducing power. The result of all these magical characteristics is that it is almost always better to use the latest process node chip because it is not only cheaper but has much better performance characteristics. This is often the case even if chips from older process nodes are available for “free” because the operational costs (power/performance) of the older chips have worse characteristics as compared to the next generation.

Key Challenges in Automotive Electronic System Design

Overall, the semiconductor industry follows the rhythm of the consumer marketplace, and this contrast in strategic vectors generates critical challenges for all non-consumer markets such as automotive. The critical challenges manifest themselves around three specific topics: new product production, warranty support, and platform relevance.

New Product Production:

For new product production, traditionally the automotive industry has focused on concepts of lean manufacturing & JIT (Just In Time) inventory management which prioritizes minimizing inventory levels at all stages of production. In a world dominated by OEM driven demand, this paradigm worked reasonably well. However, with the accelerated usage of electronics, automotive OEMs increasingly find themselves managing a supply chain where they are the minority drivers for demand.

Further, much like US DoD, traditionally automotive companies require chips which require automotive grade certification. Automotive-grade components require stringent compliances (passive components need AEC Q200, ASILI/ISO 26262 Class B, IATF 16949 qualification while active components (including automotive chips) should be compliant with AEC Q100, ASILI/ISO 26262 Class B, IATF 16949 standards. However, these requirements are not embraced by the much bigger consumer marketplace, and the divergence imposes a large constraint on the automotive supply chain. As explained in “Solutions for Défense Electronics Supply Chain… – SemiWiki,” US Department of Défense responded to this reality with an aggressive Commercial Of the Shelf (COTS) approach.

Warranty Support:

Unlike consumer devices, automobiles have a much longer and more elaborate warranty model. This results in a much broader maintenance commitment (as compared to consumer). This dichotomy between the consumer and automotive marketplace generates significant issues in two specific situations: reliability and obsolescence.

- Reliability: Semiconductor fabs are built based on the economics of the consumer marketplace. Building semiconductors with the required reliability characteristics for the automotive market becomes increasingly expensive.

- Obsolescence: In the “new normal” where automotive OEMs can no longer influence the semiconductor supply chain, managing semiconductor obsolescence becomes an increasingly difficult issue. Furthermore, obsolescence is not just limited to hardware in the electronics domain. Rather, it extends to software components, Electronic Design Automation (EDA) software which is used to design/maintain electronic systems.

Platform Competitiveness:

As automobiles go from “a car with some electronics” to “a server which happens to move” automobiles start inheriting the advantages and disadvantages of computing platforms. Much like the automobiles of today, computing platforms started as vertically integrated HW/SW systems, but over time progressed to be architectural platforms with clear interfaces to enable a much broader partner network. By leveraging the partner network, computing platforms could provide a massive amount of functionality. Indeed, today’s software industry, which eclipses the current automotive and hardware computing industry, is a result of this model.

Popular computing platforms include the ecosystems connected with computer architectures such as x86, ARM, Nvidia, and now RISC-V. Associated with these computer architectures are operating systems such as Microsoft Windows, UNIX, and Apple OS. Finally, a significant player in the world of software is the role of open-source development model. Open source platforms such as Linux and Android allow for the crowd sourcing of innovation in a model which accelerates innovation. A much deeper treatment of Open-Source and Automotive can be found at: “Unsettled Issues Regarding Autonomous Vehicles and Open-source Software.”

The growth of an automobile as a platform generates open strategic questions:

- How does one compete at the platform level? Collaborate or compete with existing computing platforms? Is Open-Source an answer?

- In a networked car situation, how does one handle product updates safely as well as cybersecurity issues ?

Current Status and Strategic Ways Forward:

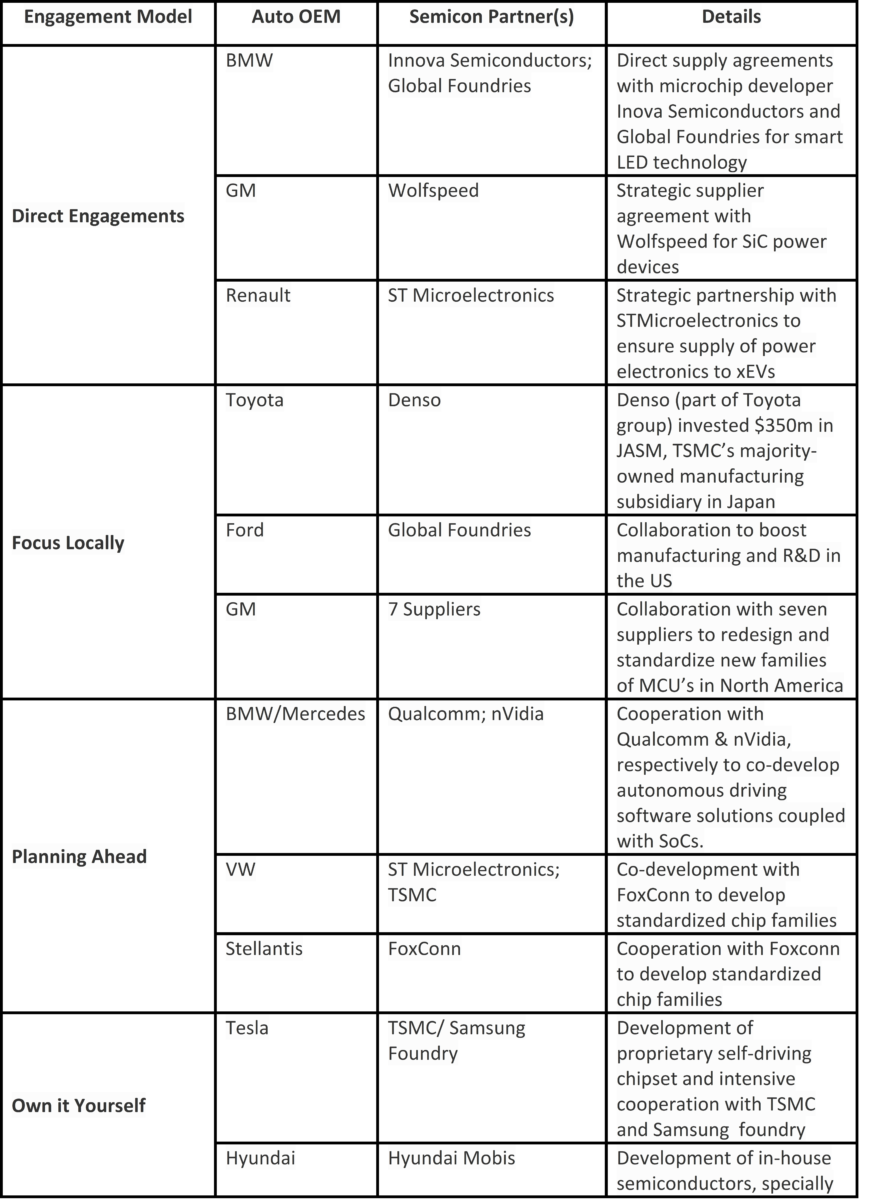

Given the significance of the problem, there is a great deal of recent activity between automotive OEMs and the electronics supply chain. Table 4 (BCG Report) above provides a sampling of the activity. It is not clear whether these efforts will succeed because to solve the deep underlying issues, a broader industry wide effort is likely to be required. What would be the outlines of a solution? They will revolve around three specific topics: System Level Abstractions, Semiconductor Platform Development, and EDA functionality. Let us discuss each:

System Level Abstractions:

As the first major electronics mega market, computing actively faced the churn caused by semiconductors for over forty years. To manage this situation, very strong abstraction levels were generated to build interfaces which allow for preservation of intellectual property even in the context of underlying hardware churn. Examples of these abstraction levels include:

- Computer Instruction Set Architectures: Since the IBM 360, the concept of an ISA has allowed software developers to build significant capabilities towards an abstract standard while the underlying hardware churned at the pace of Moore’s law. X86, ARM, and now RISC-V are examples of the multi-billion-dollar franchises which are supported by this abstraction.

- Operating Systems/Browsers/Development languages: Operating systems such as Windows or Linux, Browsers such as Google Chrome and Microsoft Edge, and development languages such as JAVA or C++ offered other important abstraction points which supported broader ecosystem.

- Communications: In the world of communications, networking stacks and wireless standards-built abstractions which supported multi-billion-dollar industries.

The automotive industry must build similar abstraction standards which can support a separation of concerns from higher level functions to their actual implementations. The current standards from the computing world will invariably be useful, but higher level automotive specific abstractions and associated standards will be required. It is especially important that these standards address the critical issues with automotive: low level low latency actuation, real-time operations, cybersecurity interfaces, and finally the key building blocks of autonomy.

Semiconductor Platform Development:

With clear abstractions around core components of an automotive system design, the next task is to build electronic systems which implement these abstractions. Today, the vast majority of automotive solutions are fixed function hardware and software systems which generate large number of supply chain dependencies. However, it is very likely that the ultimate solution will involve the development of automotive specific programmable fabrics. A methodology focused on programmable fabrics has the distinct advantages of:

- Parts Obsolescence: A smaller number of programmable parts minimize inventory skews and the aggregation of function around a small number of programmable parts raises the volume of these parts and thus minimizes the chances for parts obsolescence.

- Redundancy for Reliability: Reliability can be greatly enhanced using redundancy within and of multiple programmable devices. Similar to RAID storage, one can leave large parts of an programmable fabric unprogrammed and dynamically move functionality based on detected failures.

- Future Function: Programmability enables the use of “over the air” updates which update functionality dynamically. This is critical for building strong aftersales business models and remote maintenance.

EDA functionality:

Finally, to manage the connection between the system abstractions and the interconnection of programmable fabrics, there is the requirement for the next generation of EDA tooling and associated run-time IP. The EDA systems are the critical assets which automatically manage the mapping process and the associated run-time updates for function. For a deeper discussion of the EDA issues, please check out www.anew-da.ai

Conclusions:

The automotive industry is in the middle of major transition from a primarily focus on the mechanical to an intense focus on the electrical (HW/SW/AI). In terms of strategy, both the environmental assessment and internal analysis stages will have to absorb the implications of this shift. Further, while incremental updates to design and supplier management may work for the short term, in the longer term, it is very likely that an automotive specific architecture (common chips specs) with associated SW/AI/EDA abstraction levels will need to be built at an industry level.

Acknowledgements: Anurag Seth for co-authoring this article.

Also Read:

Solutions for Defense Electronics Supply Chain Challenges

Are EDA companies failing System PCB customers?

The Increasing Gap between Semiconductor Companies and their Customers

The Increasing Gaps in PLM Systems with Handling Electronics

The Growing Chasm in Electronic System Design

The Coming Evolution in Electronics Design Automation

Share this post via:

Moore’s Law Wiki