Gross Profit Margin Percent Provides a Measure of Product Value

The difference between what customers will pay for a physical product and what it costs to make or acquire it is a good measure of differentiation. This difference divided by the revenue is the gross profit margin percent or GPM%. Once a product has an established market share, difficulty of switching to another product usually maintains or enhances the GPM% even if the product differentiation diminishes.

At the time the Apple iPhone was introduced in 2007, it was priced at $749 “unlocked” (i.e. without service provider subsidy) compared to commodity cell phones that sold for $15 at the same time (Figure 1). Why would anyone pay fifty times more for a product that did the same thing – made phone calls and sent text messages? Apple proved that there was much more differentiation possible.

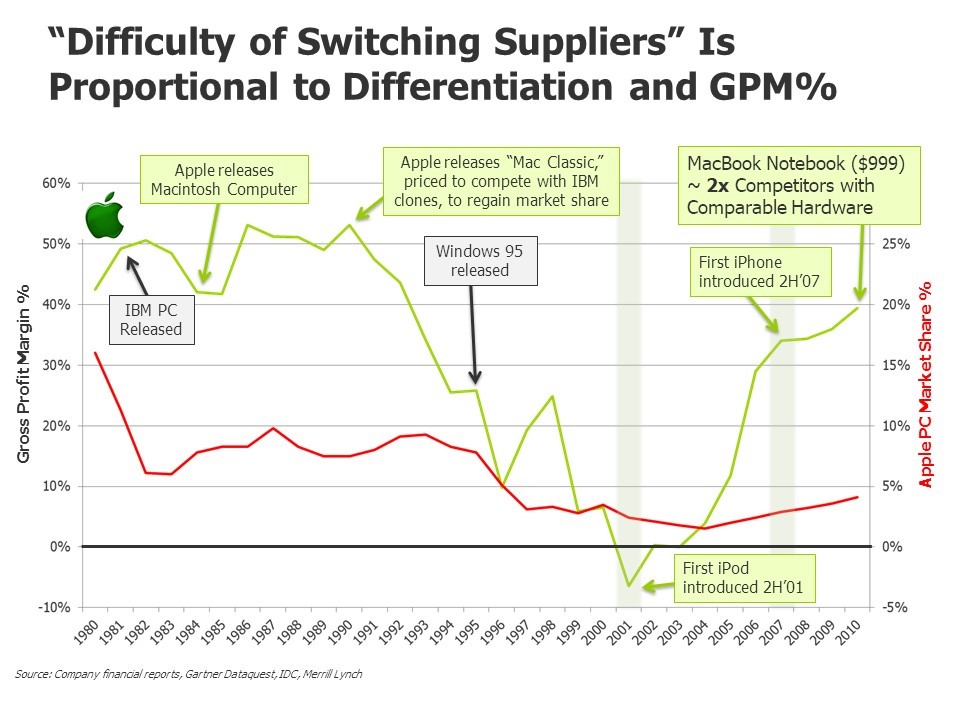

Apple’s previous attempts with differentiation encountered some difficulties (Figure 2). Before the IBM personal computer was introduced, Apple was able to capture one third of the PC market and maintain a GPM% between 40% and 50%. After the Macintosh introduction, Apple returned to 50% GPM for a while but its market share had dropped to about 20%. Apple then introduced the Mac Classic priced to compete with IBM. This and the introduction of Windows 95 by Microsoft drove Apple’s GPM% down to 10% along with its market share. As Apple’s market share subsequently declined to 5% shortly after 2001, GPM% became negative. The iPod and iPhone reversed this corporate trend, bringing the MacBook along with them and resulting in a corporate GPM% of 40% in 2010 and a $999 price for a MacBook that was roughly twice the price of equivalent IBM-compatible PCs. Even today, Apple PCs sell for nearly double the price of the IBM-compatible PC of “equivalent” capability.

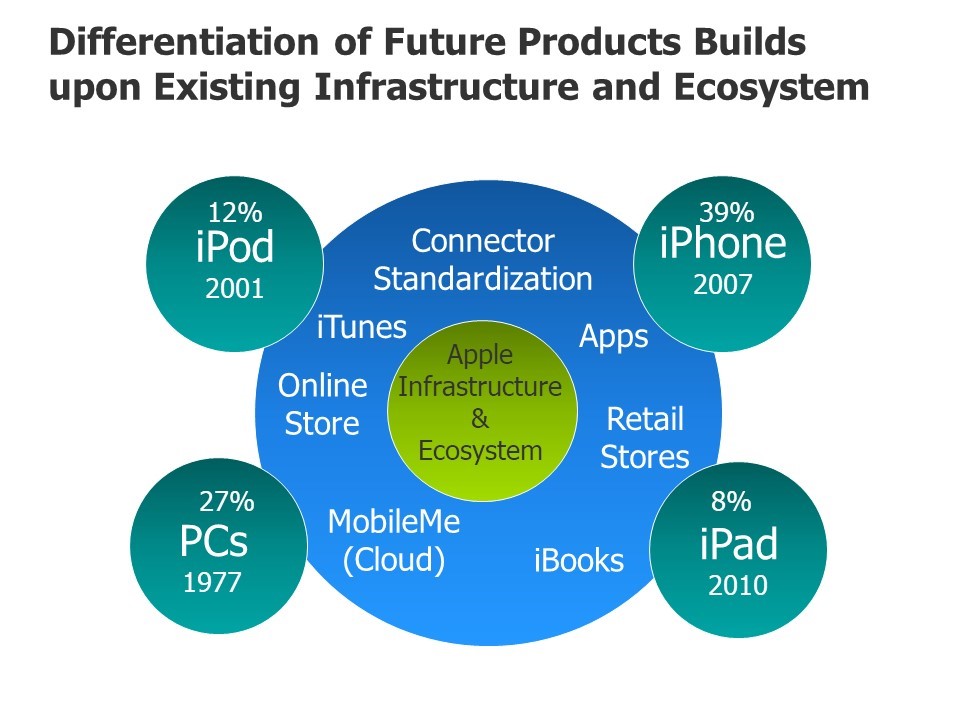

Apple’s differentiation after 2001 came from more than just the products themselves. Apple built an interdependent ecosystem that made it difficult to switch suppliers if you committed to any part. The infrastructure included iTunes, Apple stores, Genius Bars and MobileMe/Cloud. But the best part of any ecosystem is the part that isn’t paid for by the supplier. In Apple’s case, that meant the connectors in cars and hotels, the third-party apps on the iPhone and Mac, the peripheral devices, and many more (Figure 3).

Figure 1. iPhone differentiated value versus commodity cell phones

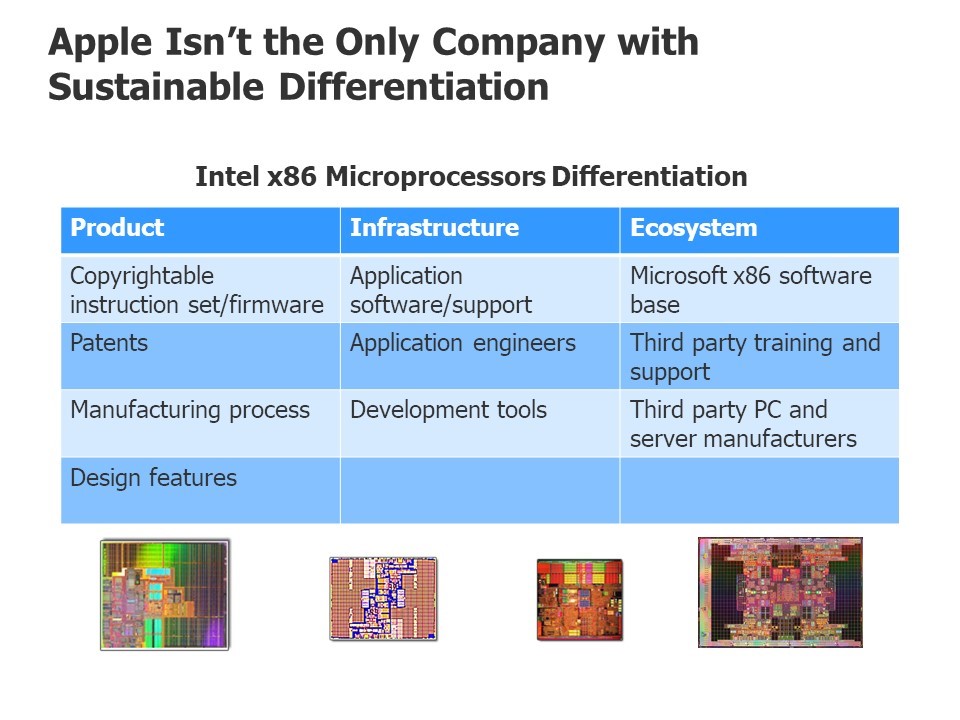

End product companies are not the only ones who have achieved differentiation that translates into GPM%. Even component suppliers can do this (Figure 4). Intel’s 8088 16-bit microprocessor was arguably the worst of its generation. Clearly superior products were introduced (within a year) by Motorola and Zilog. Combining “first to market advantage” with some legal protections through extension of copyright law to semiconductor photomasks, Intel was able to create a highly differentiated dynasty of products with high switching costs that today dominate the computer server business.

Figure 2. Apple GPM% and market share

Figure 3. Building an ecosystem to make switching more difficult for existing users

Figure 4. Intel component differentiation

Can a Commodity Product Be “De-commoditized”?

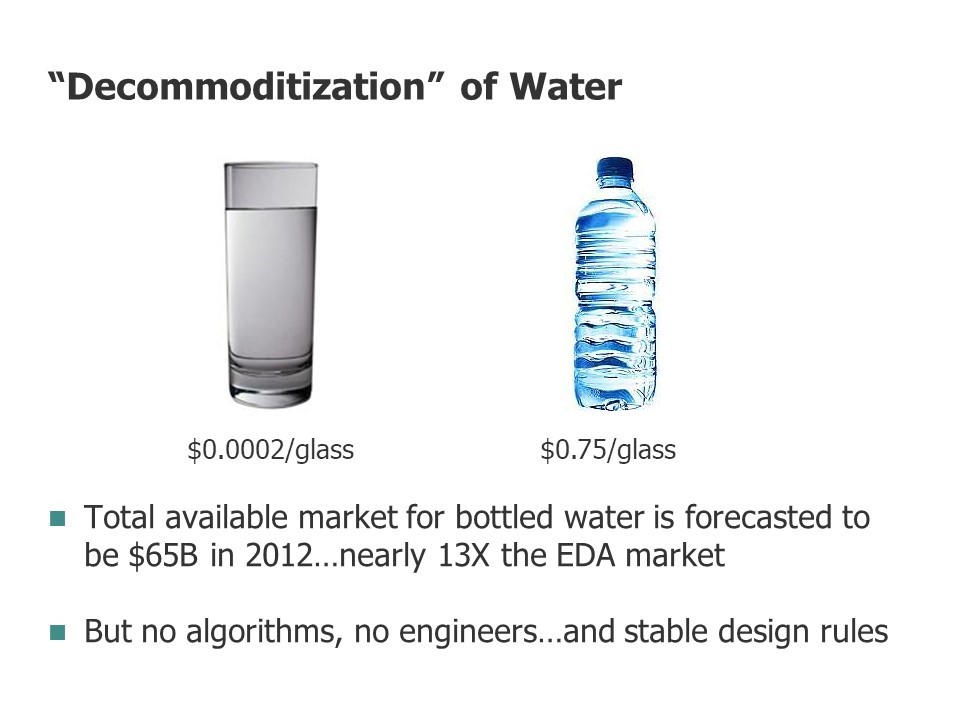

Before all the suppliers of “commodity” products become depressed, let’s consider the question of “de-commoditization”. Don’t give up hope. There are lots of examples. Consider Figure 5. Water is generally available for $0.0002 per glass. Yet, in the last few decades, innovative companies have found ways to sell water for $0.75 per glass. A similar, but less extreme, scenario could be described for coffee.

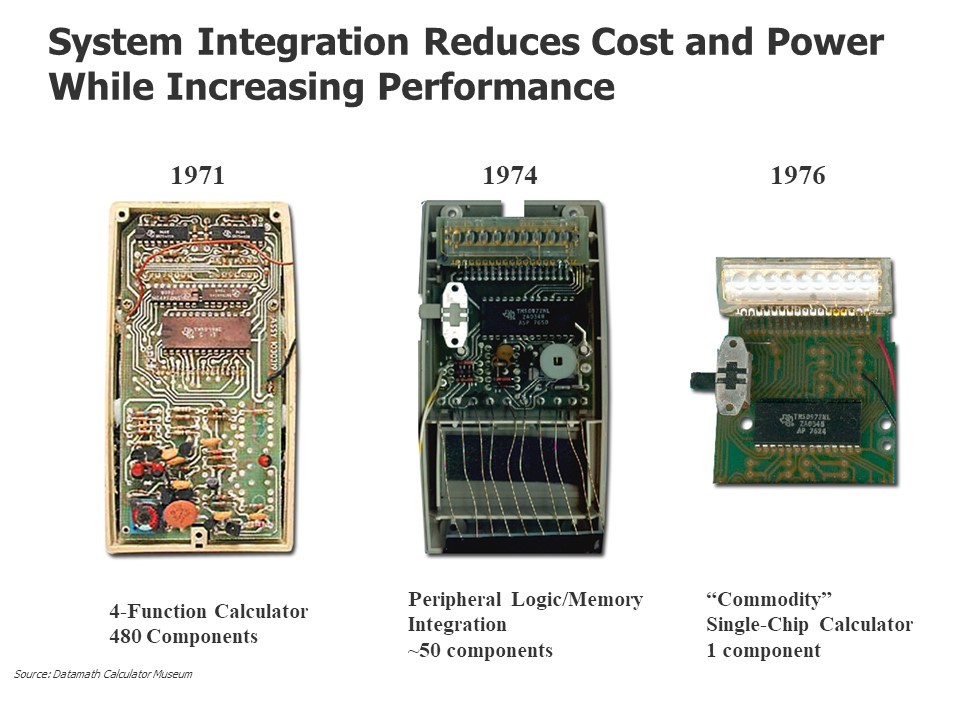

I was personally involved in one of the more notable cases of de-commoditization in electronics. In 1977, I was Engineering Manager for Texas Instruments’ (TI) Consumer Products Group. TI had aggressively reduced the component count of a basic four-function (add, subtract, multiply, divide) calculator from 480 components in 1971 to a single chip in 1977 (Figure 6).

Pretty impressive, don’t you think? TI must have made a lot of money from those innovations? Actually, no, they didn’t. The four-function calculators continuously lost money although the scientific calculators made up for much of the loss.

Figure 5. De-commoditization of water

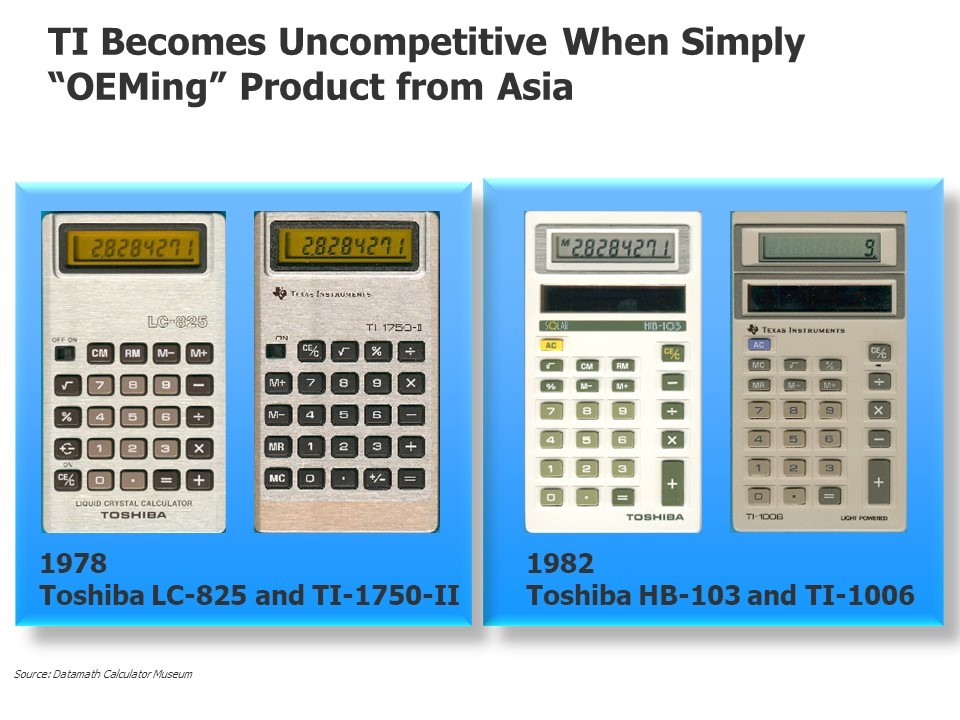

The losses became so painful that TI finally resorted to OEMing (selling calculators manufactured by other companies) as shown in Figure 7.

De-commoditization wasn’t easy. But TI had an example to follow from early history with a product called the “Little Professor” which was designed to teach arithmetic. It had a life of its own. Unlike other calculators, the sales continued despite recessions and obsolescence. We learned that parents will pay whatever is required to give their children an advantage in school.

Figure 6. Innovation reduced component count of electronic calculators from 480 to one component in five years

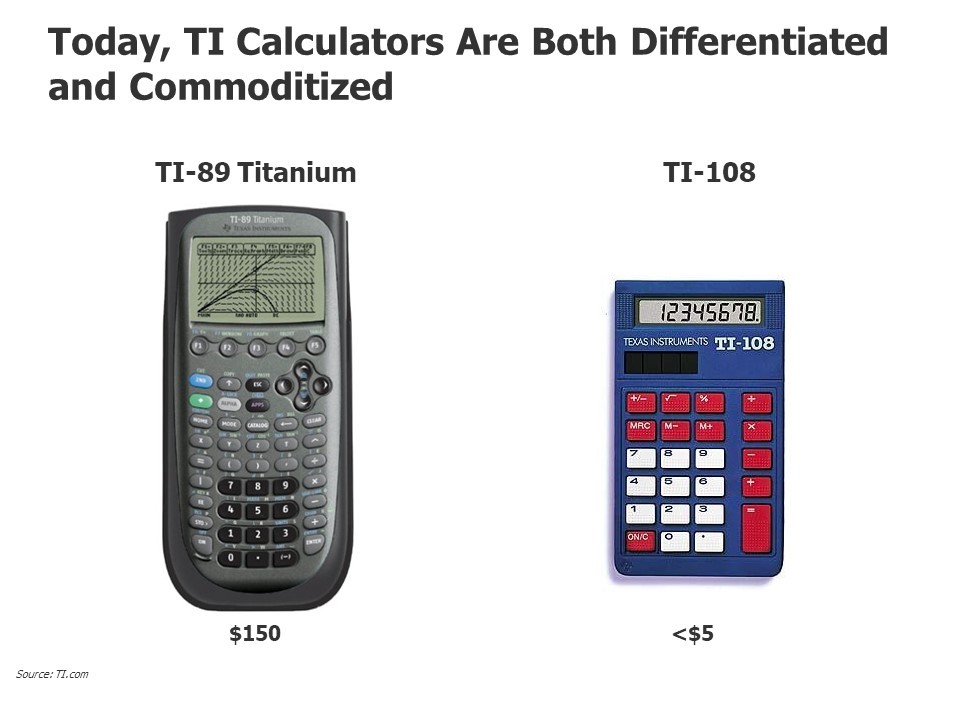

Armed with this history, the TI Consumer Products Group focused on the education market. Over the next two decades, they worked with teachers, school boards, educators, course developers and the entire educational ecosystem to develop a program geared to their graphing calculators. Figure 8 shows TI calculators that are both differentiated and commoditized. The TI-89, shown on the left, sells for $150. I have personally bought six of these. My two daughters lose them, loan them to friends, break them or require different versions for different classes. TI probably OEMs them for less than $20 each.

Figure 7. TI begins “OEMing” calculators made by foreign manufacturers

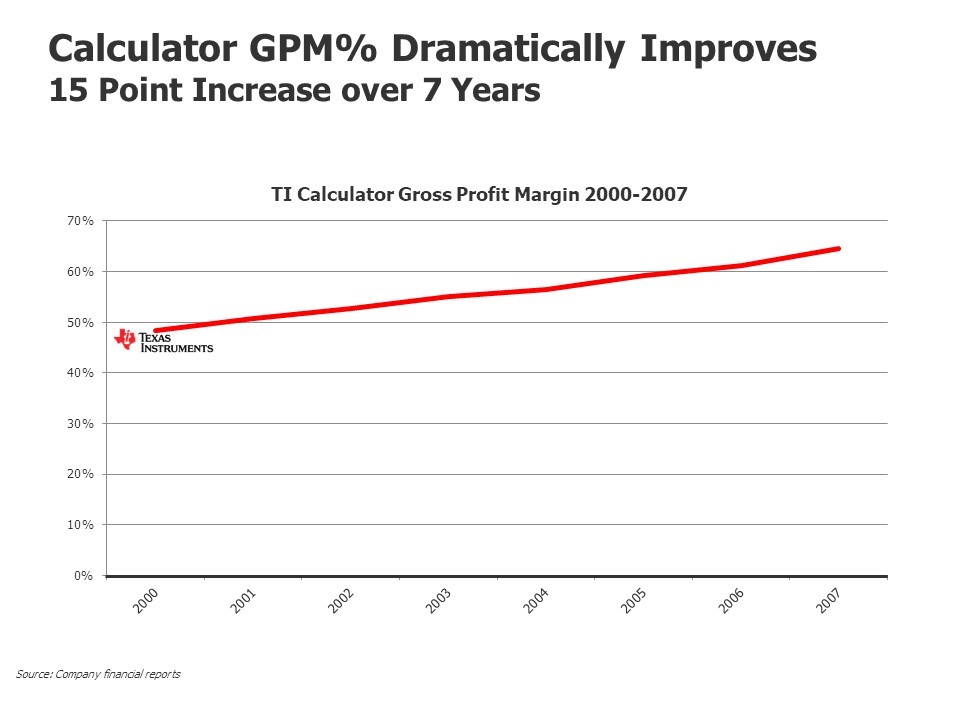

For TI, a money losing calculator business has now become one of its most profitable businesses. Figure 9 shows the reported segment profit for TI calculators. In 2007, GPM % for TI calculators had reached 65%, at which point TI stopped reporting this segment. As a former TI executive, I have concluded that the reason TI stopped breaking out the reporting of this segment is that it became embarrassingly profitable – more so than the semiconductor component businesses of TI.

Figure 8. Differentiated and commoditized TI calculators

Figure 9. TI’s education focus leads to an Increasingly profitable calculator business

What about semiconductors? Historically, the industry grew with very limited differentiation. Faster, better germanium transistors were quickly matched by competitors because the original AT&T licensing program created a level playing field for semiconductor patents. TI gained a two-year advantage with the silicon transistor but that was soon matched as well. Integrated circuit designs were easily copied and customers had sufficient power to force semiconductor suppliers to have an alternate source of supply for their designs before the customer would “design in” the product.

Over time, semiconductor companies found ways to create differentiation. The most common type is the differentiation that comes with analog components because they can be differentiated by both the design and the manufacturing process. As a result, pure analog companies like Analog Devices and Maxim have demonstrated consistently high GPM%. Most knowledgeable people are surprised to learn that analog components are not the highest consistent GPM% products — Field programmable gate arrays, or FPGAs are. Like analog components, FPGAs carry high switching costs once they are designed into a product (Figure 10). FPGAs have an additional barrier to switching suppliers that extends across the entire component product line — differences in the way different manufacturers’ FPGAs are programmed creates a barrier for designers to switch suppliers. In addition, libraries of proven reusable blocks of a design are built up in a company over time and are difficult to re-create.

![]()

Figure 10. FPGAs have consistently provided the highest GPM% in the semiconductor industry

Next highest GPM% among major semiconductor categories, after FPGAs and analog, is the microprocessor. These can be differentiated by their computer architectures and embedded software microcode that can be copyrighted. Patents in the semiconductor industry are difficult to enforce because most large companies are cross-licensed and, even when a patent lawsuit is successful, the precedents for royalties are small, usually less than 5%, assuming the licensee doesn’t have any patents that can be used as bargaining chips against the licensor.

Intel’s de facto standard 808X microprocessors would probably be commodities today if Intel hadn’t followed a unique path, i.e. enlisting the forces of the U.S. government to extend copyright legislation to the photomasks for semiconductor components in 1984. The act of copying physical objects that are copyrighted had always been protected before 1982. If you saw a building you liked, you could build one just like it and incur no liability unless you stole the plans from the architect or owner. Intel’s “Semiconductor Chip Protection Act” of 1984 prohibited direct physical copying of chips, even though it had been standard practice in the industry until that time. This limited competing 808X microprocessor suppliers to the Intel-licensed source, Advanced Micro Devices (AMD), and companies that utilized Intel cross-licensed companies like TI for manufacturing. Cyrix was one example of a company that circumvented Intel’s barriers by using a licensed manufacturer, TI . In addition, Intel was careful to keep their pricing near the learning curve so that competitors like AMD could be held to a small market share.

![]()

Figure 11. 2009 – 2010 GPM% for major semiconductor component categories

Figure 11 shows the GPM% of major semiconductor product categories. There is GPM% differentiation within each category due to other factors such as existing market share. Categories with high switching costs, like FPGAs and microprocessors, tend to have one or two suppliers at the high end of GPM% and others below.

Commodity products like memory and discrete devices are more difficult to differentiate partly because their commodity nature is core to the value perceived by customers. Most customers wouldn’t design in a DRAM that has no “pin compatible” alternate sources.

Increasing Semiconductor Component Differentiation

What can semiconductor companies do to increase their average GPM%? Figure 12 offers some suggestions.

![]()

Figure 12. Other ways that semiconductor component companies can enhance GPM%

Semiconductor companies have a difficult time differentiating on price, quality of support, sales distribution and many approaches that work in other industries. In general, even manufacturing process differentiation is difficult to sustain for more than one technology generation. Design offers more opportunities to differentiate, especially with “system on a chip”, or SoCs, that are sourced by only one supplier. If they incorporate complex algorithms and copyrightable microcode, so much the better. Combinations of process and design, as with analog, RF and power devices, is even better. This benefit accounts for the general movement of companies like TI, NXP and others to an analog-rich portfolio.

Reusable IP blocks are becoming commoditized. There is still an opportunity, however, to develop proprietary IP blocks, as companies like Qualcomm have done, to facilitate superior performance or time to market.

Finally, the best differentiation is that created and paid for by customers. ARM is a successful example of a company that built a niche in low power embedded microprocessors for wireless handsets and then expanded to a variety of other applications. Third parties provide a wide variety of assistance, interfaces to other IP, endorsements, etc.

Another example is the effectiveness of open sourcing of a product that increases the value of a proprietary one. Adobe did this with Acrobat. In semiconductors, one of the most impactful moves was from TSMC. Until the late 1980s, silicon foundries kept their “design rules” secret. Customers signed non-disclosure agreements just to find out the information needed to evaluate the viability of a particular foundry for the capabilities the designer needed. TSMC management was frustrated by the share of their business that came from designs that were developed using someone else’s design rules, forcing TSMC to tweak their process to match the results provided by the other foundry. Compass Design Automation, a subsidiary of VLSI Technology, even provided a design library called “Passport”. It was popular with designers because, if you used the cell libraries in Passport, multiple foundries had a manufacturing flow that would accommodate the design and produce the same results as the simulated ones. TSMC went one step further by removing secrecy restrictions on their design rules. Compass found it easier to adopt the TSMC design rules for their library, thus solving TSMC’s problem. Now all the other foundries had to tweak THEIR processes to match the TSMC results. Effectively, a large share of the foundry customer base became standardized on TSMC’s design rules and process.

For the future, the biggest differentiation challenge of the semiconductor industry comes with the Internet of Things. IoT sensors, actuators and controllers are projected to sell in very high volumes at very low prices. Achieving reasonable GPM% is difficult. In the world of IoT, the profit goes to the owners of the information collected from the network of sensors and data collection sites rather than to the providers of the IoT components. As a result, companies like Google, Amazon, automotive OEMs and others are designing their own chips to deploy in information collecting networks. In these environments, the same company can design and own the IoT sensors and the information collected. Semiconductor companies with IoT component businesses are trying to figure out how to couple their design and manufacture of the components in a joint venture with those who analyze the data. This is a difficult sale so it’s likely that we will see continued entry of systems companies into the world of SoC design.

Information and figures in this Chapter are covered in greater detail in a You Tube video entitled “Value From Differentiation” presented at the ARM TechCon in 2011 (below).

Share this post via:

An AI-Native Architecture That Eliminates GPU Inefficiencies