You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please,

join our community today!

- ASML has strong quarter lead by great Taiwan and EUV

- EUV “crossed over” DUV as revenue leader- signaling new era

- Taiwan doubles, China grows, Korea weaker, US further behind

ASML hits great numbers

ASML reported revenues of Euro 4B, with income of Euro 2.54EPS, both beating estimates handily. Ten EUV systems were … Read More

The semiconductor industry has never been more exciting than it is today and that is a mouthful given what we have accomplished over the last 50 years. From mainframe computers to a supercomputer in our pockets or on our wrists. Even if you don’t believe in miracles, semiconductor technology comes really close, absolutely.

U.S.… Read More

SMIC Cut Off = Worst case scenario

SMIC is on US gov “no fly” list for US Equipment Companies

Will likely lead to loss of all of China- 25% to 50% of revenues

Retaliation by China will worsen situation

SMIC cut off from US technology (Chip Equip)

It has been reported in the Wall St Journal and many news outlets that the US government… Read More

When USB initially came out it revolutionized how peripherals connect to host systems. We all remember when Apple did away with many separate connections for mouse, keyboard, audio and more with their first computers supporting USB. USB has continued to develop more flexibility and more throughput. In 2015 Apple again introduced… Read More

Recently, TSMC held their 26th annual Technology Symposium, which was conducted virtually for the first time. This article is the second of three that attempts to summarize the highlights of the presentations. This article focuses on the TSMC advanced packaging technology roadmap, as described by Doug Yu, VP, R&D.

Key… Read More

Designers spend plenty of time analyzing the effects of process, voltage and temperature. But everyone knows it’s not enough to simply stop there. Operating environments are tough and have lots of limitations, especially when it comes to power consumption and thermal issues. Thermal protection and even over-voltage protections… Read More

Recently, TSMC held their 26th annual Technology Symposium, which was conducted virtually for the first time. This article is the first of three that attempts to summarize the highlights of the presentations.

This article focuses on the TSMC process technology roadmap, as described by the following executives:

…

Read More

TSMC’s Open Innovation Platform’s main objective is to create and promote partnership for producing chips. This year’s OIP event included a presentation on the joint efforts of Silicon Creations, Mentor, a Siemens business and TSMC to produce essential PLL IP for 5nm and 3nm designs. The relentless push for smaller geometries… Read More

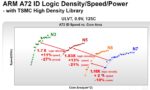

This comparison of smartphone processors from different companies and fab processes was originally going to be a post, but with the growing information content, I had to put it into an article. Here, due to information availability, Apple, Huawei, and Samsung Exynos processors will get the most coverage, but a few Qualcomm Snapdragon

…

Read More

While Alchip is speeding its way down the TSMC process technology roadmap I am reminded how important services are to the semiconductor ecosystem. We can thank ASIC companies like Alchip for the heavy investment systems companies have made into semiconductors. We covered this in our book “Fabless: The Transformation of the Semiconductor… Read More