Last week saw a unique confluence of events that continue the negative news flow in semicap following the story about GloFo. At a financial conference, Micron’s CFO said NAND prices were declining, this was on top of an analyst note in the morning about the same issue. Even though this should be no surprise as memory has had … Read More

Tag: klac

Chip Stocks have been Choppy but China may return

Applied Materials (AMAT) is batting clean up in a quarter that has not been pretty. Lately semi stocks seem to have been hit by not only stock specific issues but continued and increasing memory concerns coupled with more macro issues. On top of all this, China trade issues which have in the meantime taken a back burner to other issues… Read More

KLAC gets an EUV Kicker

KLAC put up a great quarter coming in at revenues of $1.07B and EPS of $2.22. Guidance is for $1.03B to $1.1B with EPS of $2 to $2.32. Both reported and guided were at the high end of the range and above consensus. We had suggested in our preview notes that KLAC would be the least impacted of the big three (AMAT, LRCX & KLAC) semi equipment… Read More

Chip Equipment where to from here?

We may know the top, do we know the bottom? What is the downside in NAND, DRAM, Foundry. Can China help or is risk worse than upside?

It would appear that our concerns in our preview piece prior to the AMAT call came true as the stock now has a “4” handle, NAND is in question and display is down.

However its not like business … Read More

Samsung has another record quarter in chips

Samsung throws further gas on the fire of weak handset and CAPEX not set but will be down versus 2017. Samsung reported revenues of KRW 60.56 Trillion and KRW 15.64 Trillion operating profit ($56B and $15B). Chips accounted for whopping KRW 11.55 Trillion in operating profit on revenues of KRW 20.78 Trillion ( $11B and $19B)….a… Read More

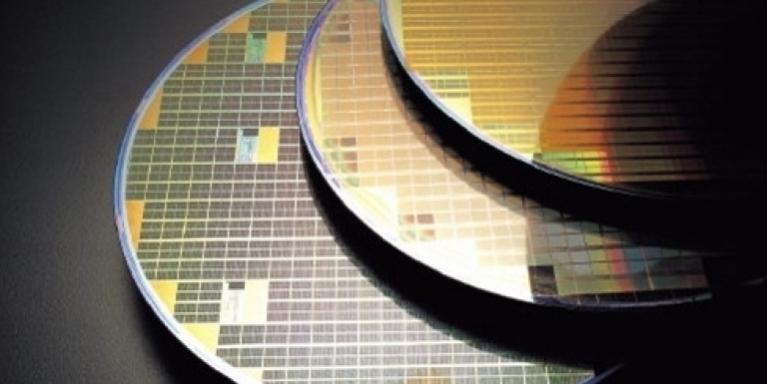

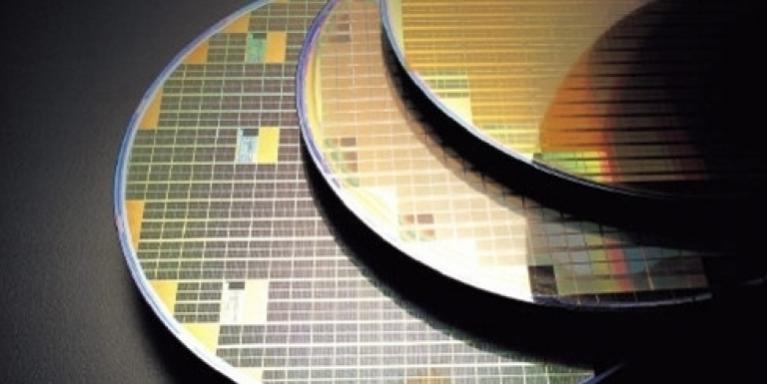

Choosing the lesser of 2 evils EUV vs Multi Patterning!

For Halloween this week we thought it would be appropriate to talk about things that strike fear into the hearts of semiconductor makers and process engineers toiling away in fabs. Do I want to do multi-patterning with the huge increase in complexity, number of steps, masks and tools or do I want to do EUV with unproven tools, unproven… Read More

Samsung Sloppy Sailor Spending Spree!

Last week, TEL (which is the Japanese equivalent to AMAT & LRCX) reported a June quarter which saw revenues drop to 236B Yen from March’s 261B Yen and saw earnings drop from March’s 47B Yen to June’s 41B Yen, a respective 9.3% decrease and a 12.8% decrease in earnings.

We don’t think this is attributable… Read More

EUV transition comes into focus

We attended ASML’s analyst day in New York on Halloween. We were very impressed with the quality, content and clarity of the presentations and thought it was one of the best strategic positioning presentations we have seen in the semi industry. We also had an opportunity to meet with several members of senior management after… Read More

Foundry is Majority of KLAC Business!

As we had projected, with KLA having the highest exposure to foundry/logic of any tool company, they are seeing the most near term strength as foundries (read that as TSMC) spend big for 10NM and 7NM. In addition the first tools you buy are yield management/metrology tools which KLA is the king of.

KLA put up numbers well above estimates….Generating… Read More

Foundry CAPEX Jumped from 17% to 37% of LAM Business

Lam- in line qtr but guides above street over near term. As with ASML, foundry is driver with subdued memory, The Math implies biz peaking-Looking for DRAM in 2017.

Lam reported another great, record quarter, more or less in line with expectations with revenues coming in at $1.632B and shipments of $1.708B, generating EPS of $1.81.… Read More