You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please,

join our community today!

2020 capex likely down at least 20% vs 2019 DRAM & NAND price drops versus slowing capacity. Investors happy cause it could have been worse.

Micron reported $1.05 in Non-GAAP EPS beating street consensus of $0.79 by $0.26. While this looks like a big beat, we would remind investors that estimates for the quarter were about… Read More

We had warned in our May 10th note about the rare earth element risk. It is one of the few remaining leverage points that China has left that has a potentially strong impact on the US much similar to the US’s impact on Huawei and perhaps even worse. Cutting the US off from rare earth elements is clearly worse than cutting Huawei

…

Read More

Nice numbers despite the cycle bottom

KLA put up EPS of $1.80 versus street of $1.67 on revenues of $1.097B versus street of $1.08B. However guidance was weaker than the street was hoping for with a range of $1.21B to $1.29B in revenues generating between $1.55 and $1.85 in non GAAP EPS. This is compared to current street estimates … Read More

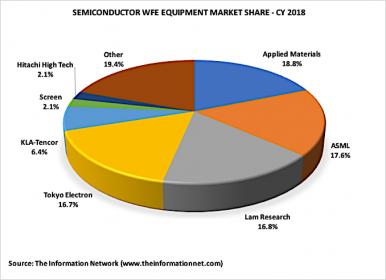

The semiconductor equipment market grew 37.3% in 2017 on the heels of capex spend by memory companies in order to increase bit capacity and move to more sophisticated products with smaller nanometer dimensions. Unfortunately these companies overspent resulting in excessive oversupply of memory chips. As memory prices started… Read More

Micron Buries the Hatchet with China

Micron has a very long history of counter cyclical investing, buying the assets of vanquished competitors when the memory industry is at the bottom of the cycle, such as it is right now.

Over the weekend, Micron announced that it had an agreement to acquire the assets of the now stalled Jinhua memory… Read More

ASML reported a more or less in line quarter as expected, coming in at EUR3.14B in revenues and EPS of EUR1.87. However, guidance was worse than most analysts were expecting with Q1 revenues expected to be EUR2.1B or down about one third.

This cut is something we have been talking about for a while as we have expected sharp memory CAPEX… Read More

TSMC reported an in line quarter, as expected and also reported down Q1 guidance, also as expected. The only thing some investors may have been caught off guard about is the magnitude of the expected drop, 14%, from $9.4B to $7.35B. This is the largest quarter over quarter drop for TSMC in a very long time. Importantly for TSMC, 7NM … Read More

We attended the Needham Growth Conference which is one of the first conferences of the year and in the quiet period before most companies reported so even though there was no “official” comment from most companies on the quarter, the surrounding commentary spoke volumes:

- The down cycle (and everyone admits its a cycle

…

Read More

On the first day of trading in the new year Apple just announced, after the close, that revenues will be lower than previously expected coming in at $84B versus the expected range of $89B to $93B and analyst estimates of the current quarter at $91.5B. Ugly….. The blame was laid squarely on China as slowing sales and trade tensions… Read More

Applied Materials reported a just “in line” quarter but guidance was well below street expectation. AMAT reported EPS of $0.97 and revenues of $4.01B versus street of $0.97 and $4B. Guidance missed the mark by a wide margin with revs of $3.56 to $3.86 and EPS of $0.75 to $0.83 versus already reduced street expectations… Read More