You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please,

join our community today!

ASML great QTR but supply chain will limit acceleration

Products are most complex with most extensive supply chain

Long term position fantastic but investors will be nervous

300M pushouts in DUV with EUV still on track

Good quarter but yellow caution flag is out for supply chain concerns

ASML reported great revenues of Euro5.2B… Read More

ASML in line QTR with big Orders

Near term slippage w long term upside

Logic is strong but memory recovery unknown

EUV is finally a reality/commercialized

In line quarter- supplier slippage expected in Q4

Results were revenues of Euro 3B and EPS of Euro 1.49, more or less in line with earnings estimate if a tad bit light in revenue. … Read More

Reports of increasing TSMC 7NM lead times

There have been a number of increasing media reports about lengthening leads times for TSMC 7NM process. From what we have been able to determine its not due to TSMC having a yield bust or other production issues, it is simply one of stronger than expected demand.

There have been reports of … Read More

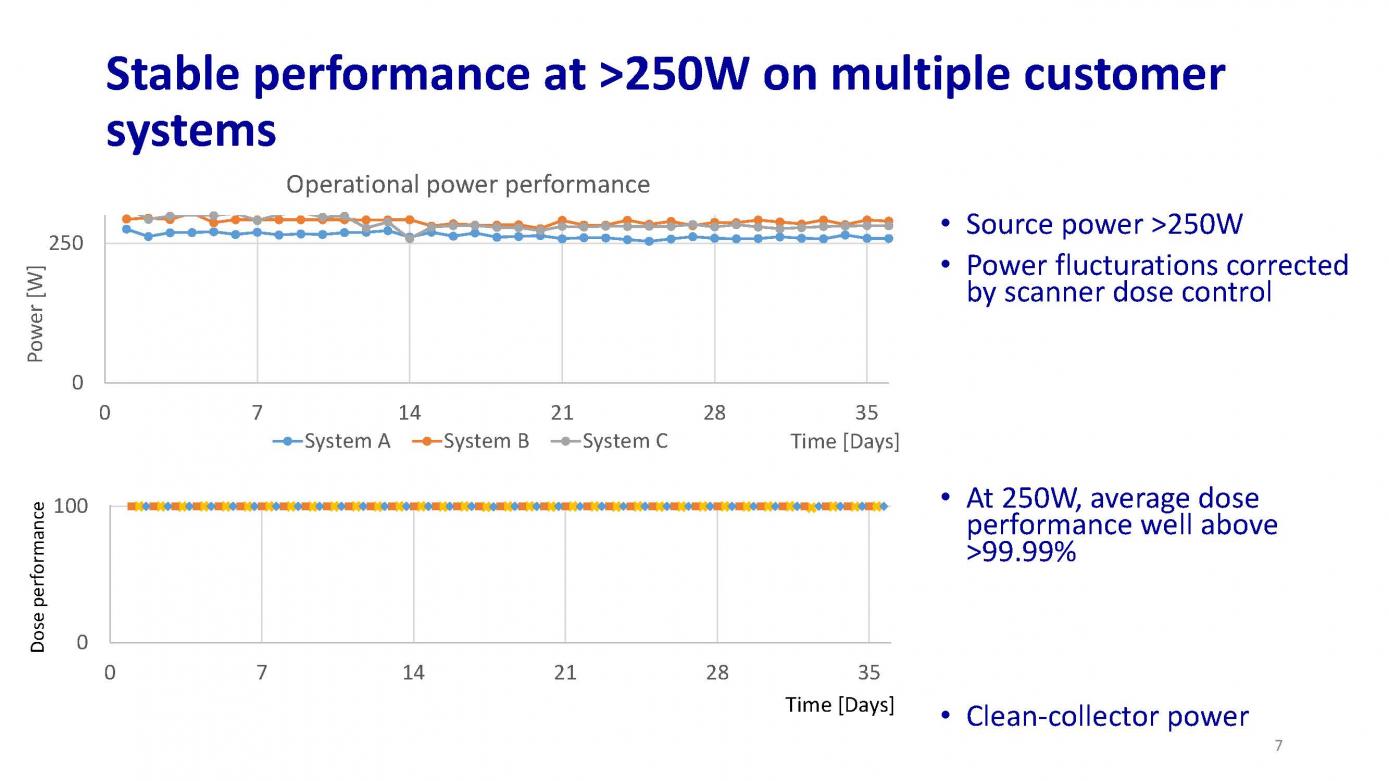

At IEDM last week Anthony (Tony) Yen, Vice President and Head, Technology Development Centers Worldwide for ASML presented a paper entitled “EUV Lithography at Threshold of High-Volume Manufacturing” authored by Anthony Yen, Hans Meiling, and Jos Benschop. At IEDM I had a chance to sit down with Tony and discuss the paper and … Read More

The TSMC OIP Forum was very upbeat this year and now we know why. It wasn’t long ago that some media outlets and a competitor said 7nm would not be a popular node because it is too expensive blah blah blah. People inside the fabless semiconductor ecosystem however know otherwise. As I have said before, 7nm will be another strong node … Read More

The amount of negative news and information about the semiconductor industry seems to be increasing at a faster rate. Micron put up a better quarter than expected but more importantly guided less than expected. We are surprised that the street is surprised as the decline in memory pricing is well known and Micron has been clear about… Read More

Micron put up a great quarter beating both quarterly expectations and guidance. Even though the stock was up 8% and we still think it has a long way to go as investors have not fully embraced the upside ahead in the memory market.… Read More

Although the rejection of the Lattice deal was expected, it none the less has an impact on a number of dynamics in the chip industry and further M&A and consolidation. Freezing out China removes a “catalyst” in the market which help bid up values and add fear to both potential targets or those left out. Cross border… Read More

ASML reported a quarter that was slightly below expectations coming in at Euro 1.815B in revenues and Euro 0.93 EPS. Orders were a bit soft at Euro 1.4B but well within the normal quarterly variation of a lumpy business. Euro 28M was lost in a currency adjustment associated with the Hermes acquisition.

The guidance for Q4 was between… Read More

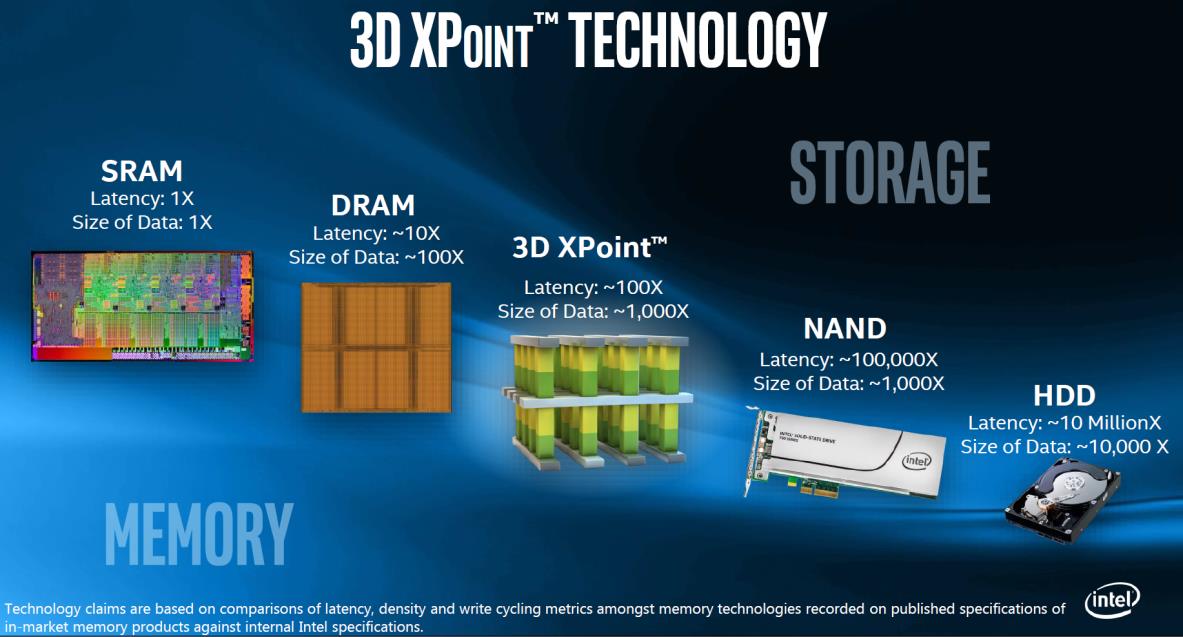

The leading edge semiconductor logic landscape has in recent years collapsed to just four companies. The following is a summary of what is currently known about each company’s plans and how they compare. ASML has analyzed many logic nodes and developed a formula that normalizes processes to a “standard node”.… Read More