You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please,

join our community today!

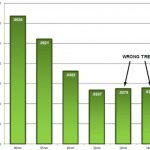

Everyone knows Moore’s Law: the number of transistors on a chip doubles every couple of years. We can take the process roadmap for Intel, TSMC or GF and pretty much see what the densities we will get will be when 20/22nm, 14nm and 10nm arrive. Yes the numbers are on track.

But I have always pointed out that this is not what drives… Read More

Black Swan Events are not to be embraced, they are to be feared, if conventional wisdom holds true. And yet, the 2011 Black Swan that slammed the PC market (i.e. the Thailand Floods that wiped out a large part of the disk drive market) has turned out to be the key catalyst for reshaping the semiconductor industry in 2012 and 2013. Instead… Read More

Perhaps the most pertinent comment raised by an analyst at Intel’s Investor Forum last week came from Dan Hutcheson of VLSI Research to Brian Krzanich, the COO and head of global manufacturing and supply chain. He said: “I think you sold yourself short on Trigate, the benefit of fully depleted vs. planar and the impact on leakage.”… Read More

Listening to the Intel earnings call yesterday and then reviewing the transcript last night, I came away with two thoughts that I think are key to understanding where the PC and mobile industry… Read More

Since November of 2011 when Intel preannounced it would come up short in Q4 due to the flooding in Thailand that took out a significant portion of the HDD supply chain, the analysts on Wall St. have been in the dark as to how to model 2012. Intel not only shorted Q4 but they effectively punted on Q1 as well by starting the early promotion… Read More

As many analysts have noted, it is difficult to imagine what Intel’s foundry business will look like one, two or even three years down the road because this is all new and what leading fabless player would place their well being in the hands of one who is totally new at the game. I would like to suggest there is a strategy in place that will… Read More

Will they or won’t they convert the MAC Air to the A6 processor this year? That is the question that intrigues many analysts and prognosticators who want to see if a competitive ARM ecosystem… Read More

Since the introduction of Apple’s iPhone and then the follow on iPAD, it has been Wall Streets frame of reference that Intel would be playing defense as the PC market slid into oblivion and therefore a Terminal Value should be placed on the company. Intel’s Q4 2011 earnings conference call provided a nice jolt to the analysts as Paul… Read More

It’s just a matter of time – perhaps just a few months – before the greatest mystery of the semiconductor industry is revealed and the peaceful co-existence of the Fab vs Fabless world is blown apart. An arms race was started by Intel to challenge TSMC and Samsung on who would control not only the high valued processor but soon… Read More

Immediately following Intel’s announcement that they expected Q4 revenue to come up short by $1B, Rory Read the new CEO of AMD, countered that they were on track to meet their original guidance (see article). Furthermore, “In 1Q and 2Q, maybe you see some manifestations, but I wouldn’t bet against the supply chain,”… Read More