This article previews Nvidia’s earnings release and will be updated during and after the earnings release. As usual, we will compare and contrast the Nvidia earnings with our supply chain glasses to identify changes and derive insights. Please return to this article, as it will be updated over the next week as we progress with our analysis.

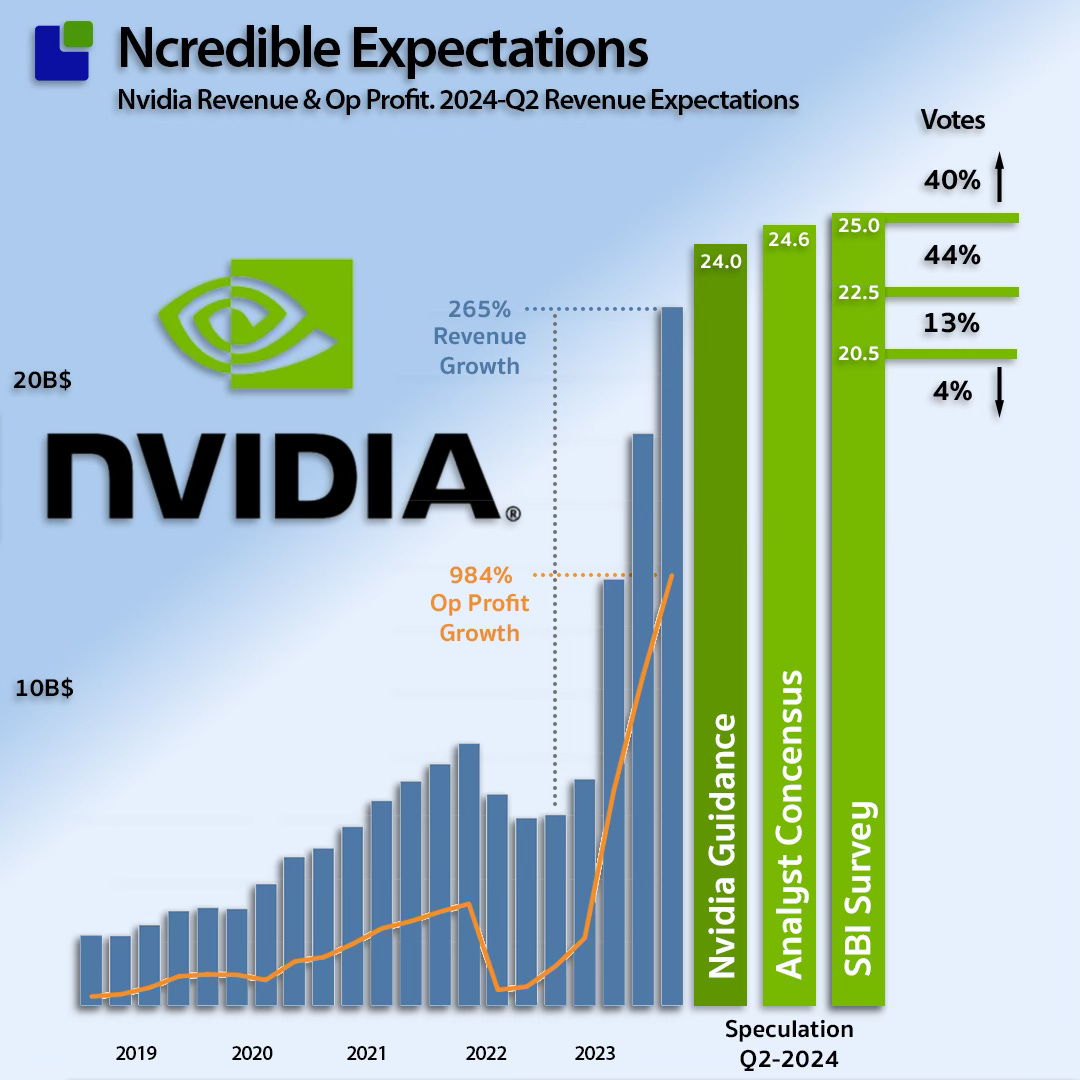

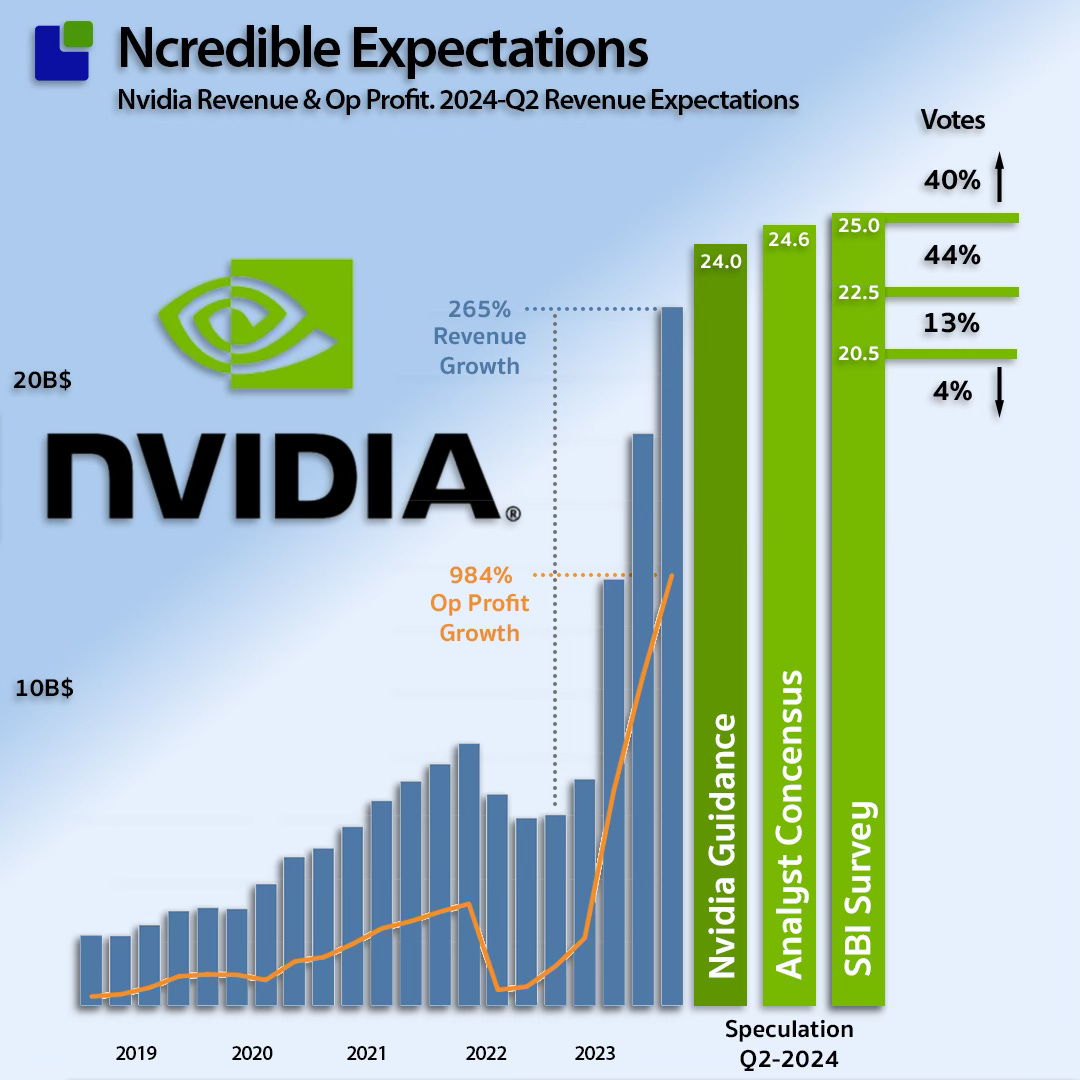

After three insane quarters, Nvidia’s guidance suggests that this quarter will be calmer. I am not sure the stock market can handle growth rates like Nvidia is enjoying once more without going insane. The analysts’ consensus is slightly above Nvidia’s at $24.6B. Our survey shows that the industry expectations are somewhat more optimistic.

From humble beginnings as a graphics company adored by hardcore gamers only, Nvidia is now the undisputed industry champion and has made the industry famous far beyond us wafer nerds.

When people hear you are in the semiconductor industry, they want to know what you think of Nvidia’s stock price (which is insane but could be even more insane). Obviously, this is driven by the irresistible hunger for AI in the data centre, but this is not our expertise (we recommend Michael Spensers: AI Supremacy for that). We will also refrain from commenting on stock prices and concentrate on the business and supply chain side of the story.

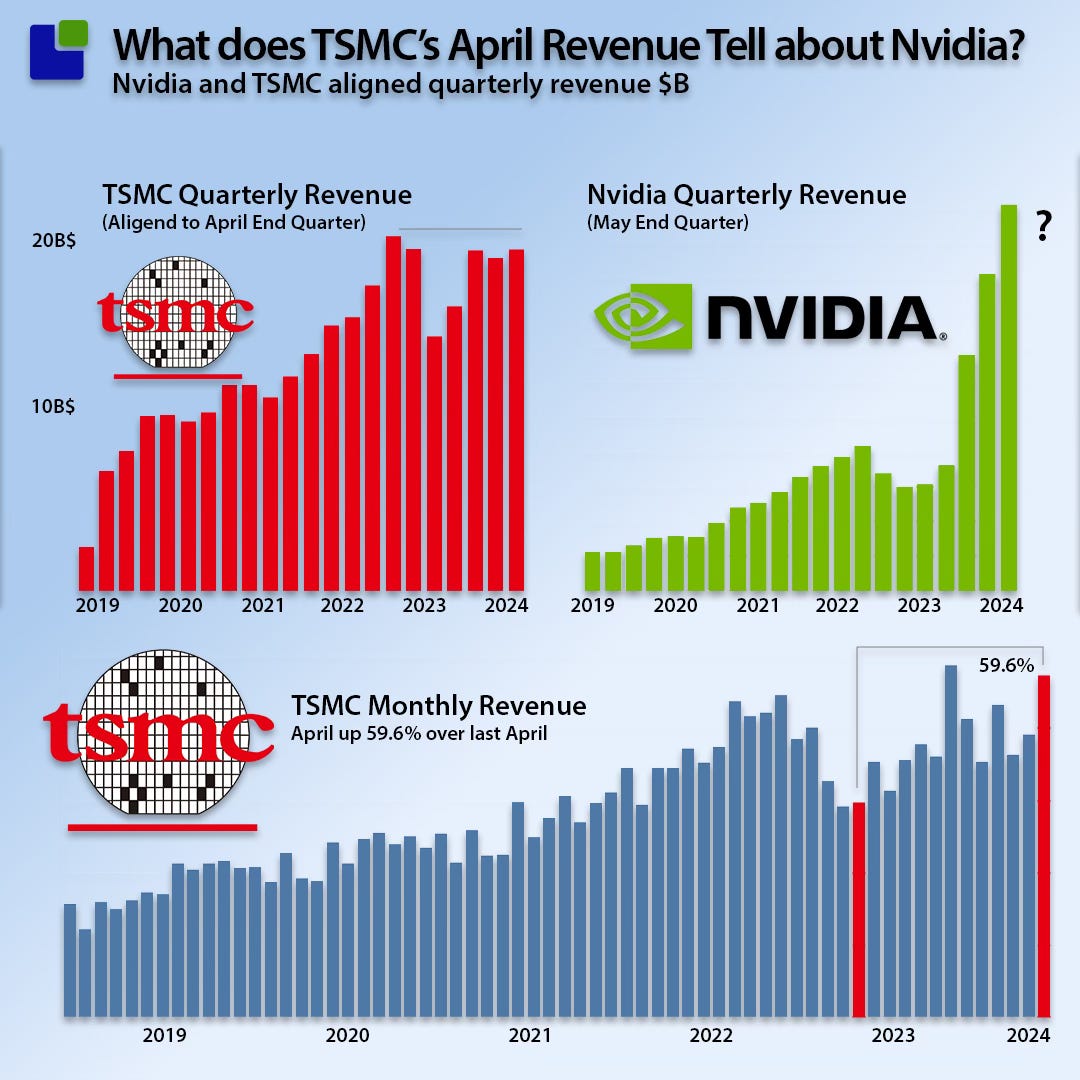

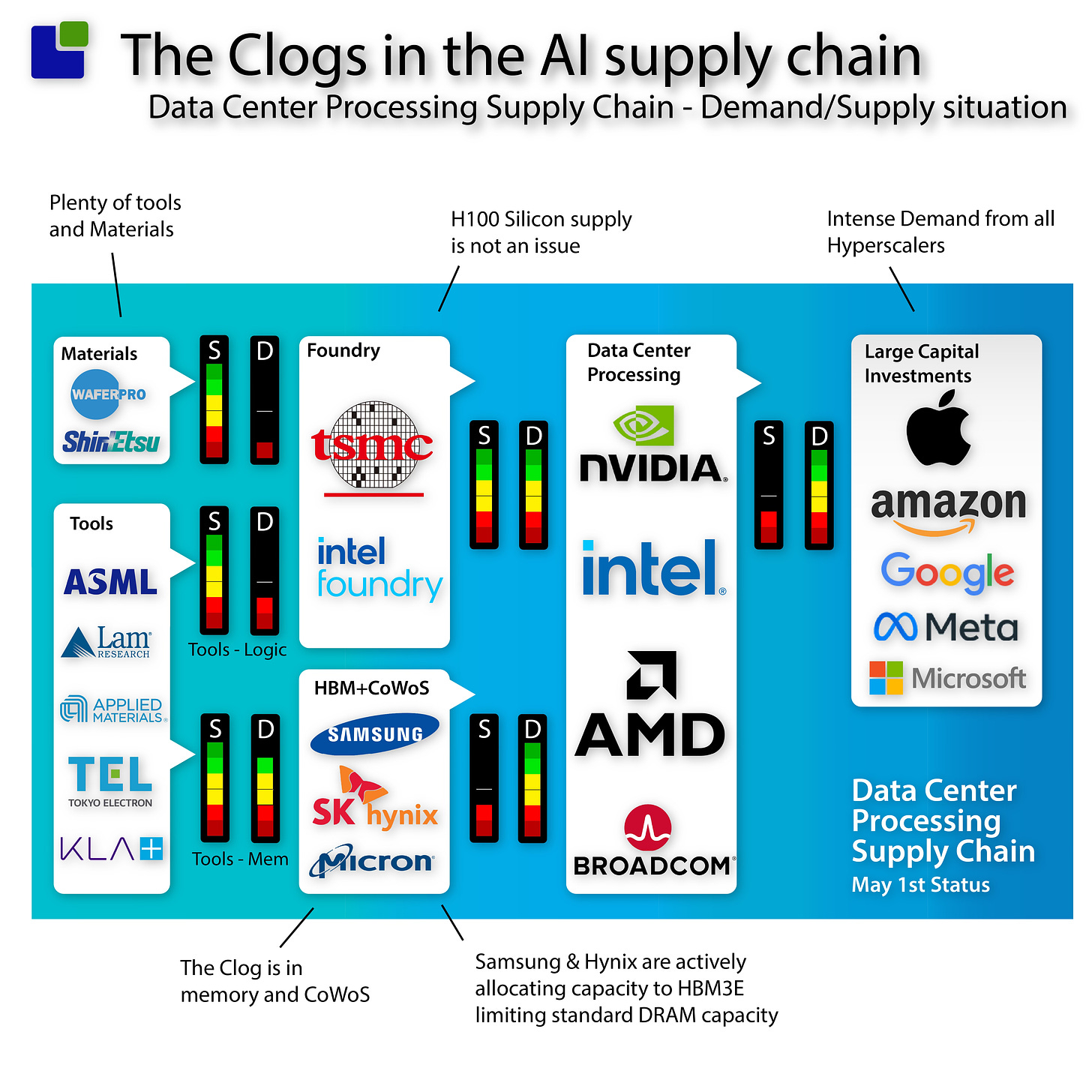

The supply chain has already created a frenzy amongst analysts as TSMC reported April Revenue up almost 60%. Our analysis of the TSMC revenue numbers aligned to an April quarter end shows that the TSMC trend is relatively flat and does not reveal much about Nvidia’s numbers. However, TSMC’s revenue numbers do not have to change much for Nvidia’s numbers to skyrocket. The value is not in the silicon right now as we will be diving into later.

The golden goose

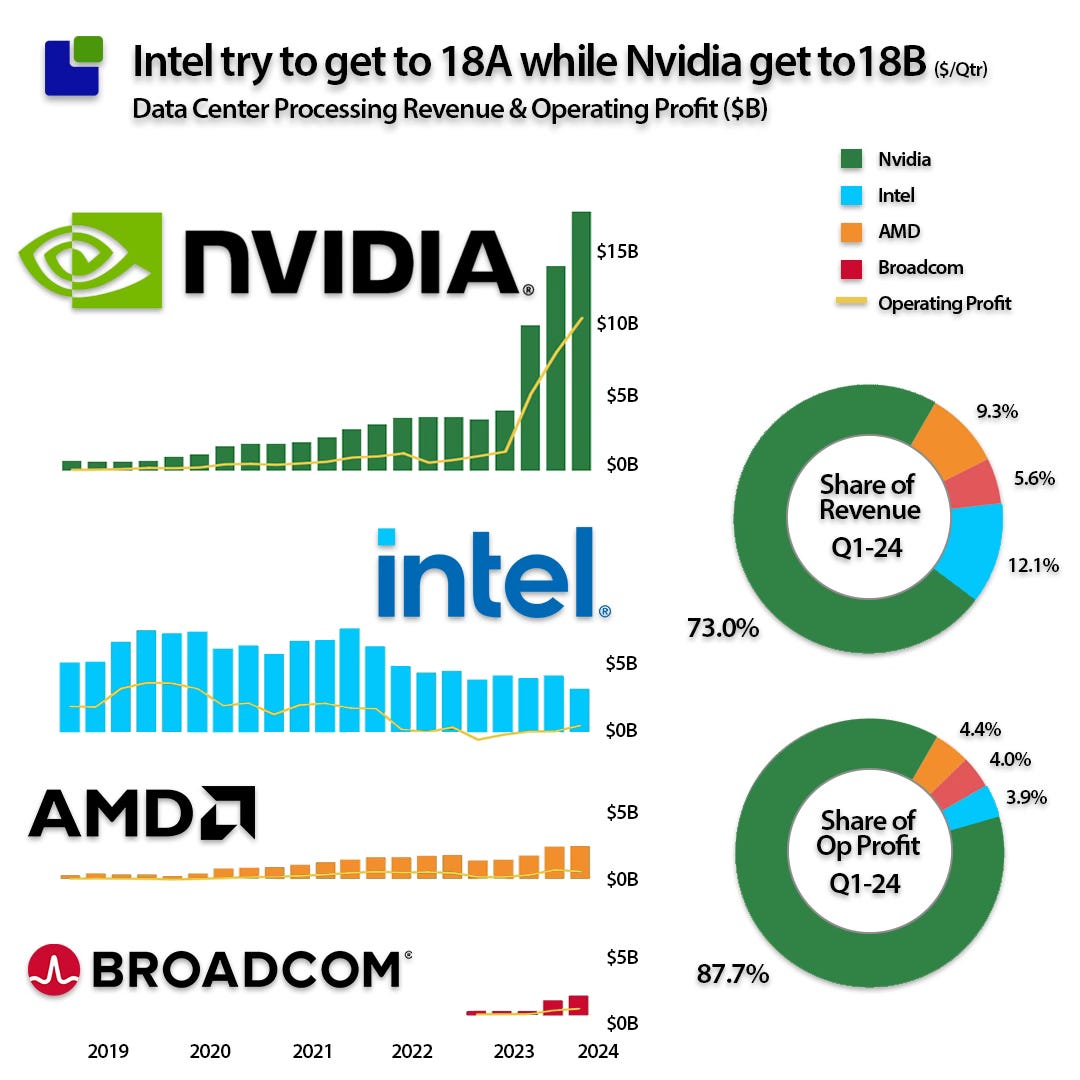

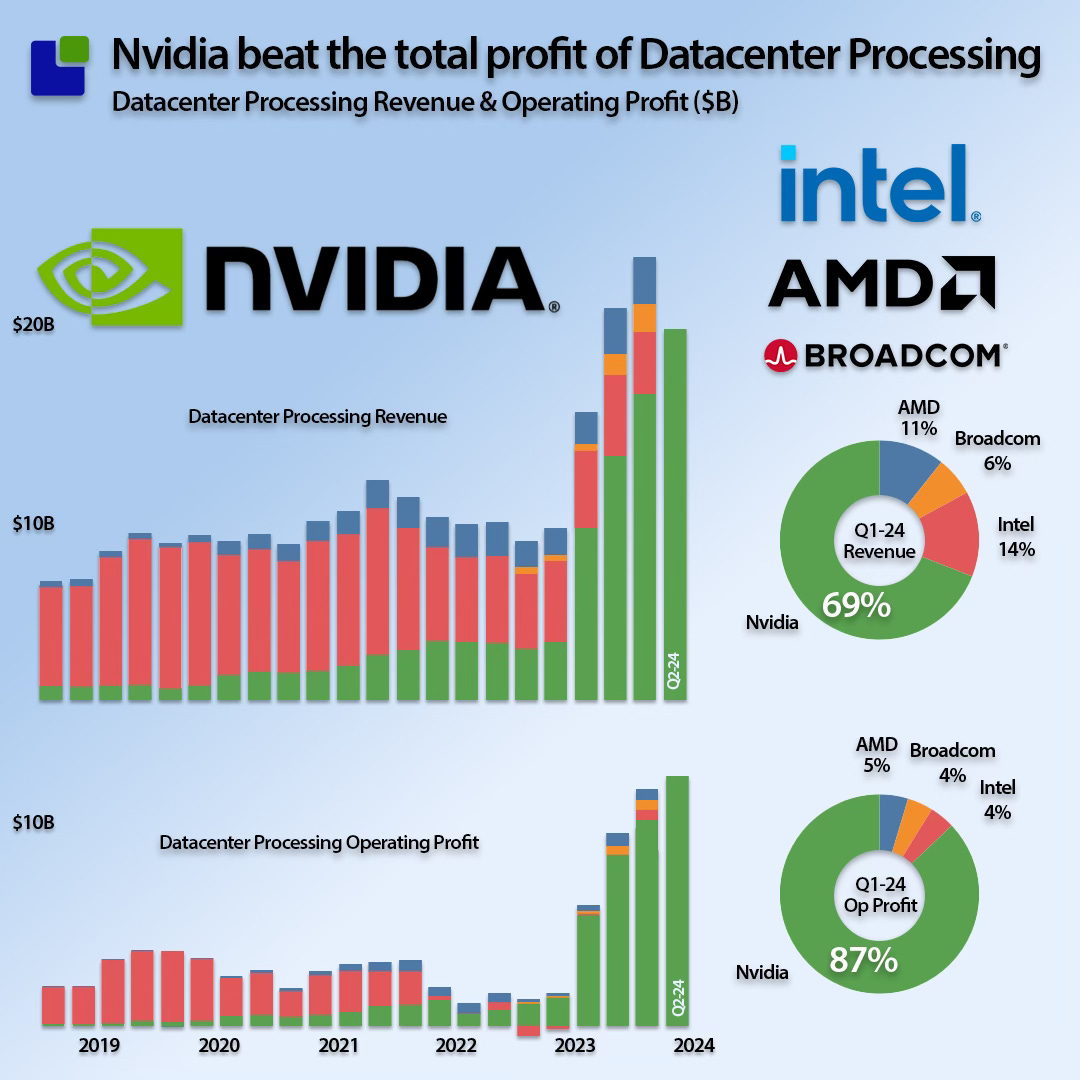

The most important market for Nvidia is the data center and its sky-high demand for AI servers. Over the last couple of years, Nvidia and AMD have been chipping away at Intel’s market share until three quarters ago, when Nvidia’s Datacenter business skyrocketed and sucked all value out of the market for the other players. Last quarter Nvidia capture over 87% of all operating profit in the processing market.

This has faced in particular Intel with a nasty dilemma:

Nvidia has eaten Intel’s lunch.

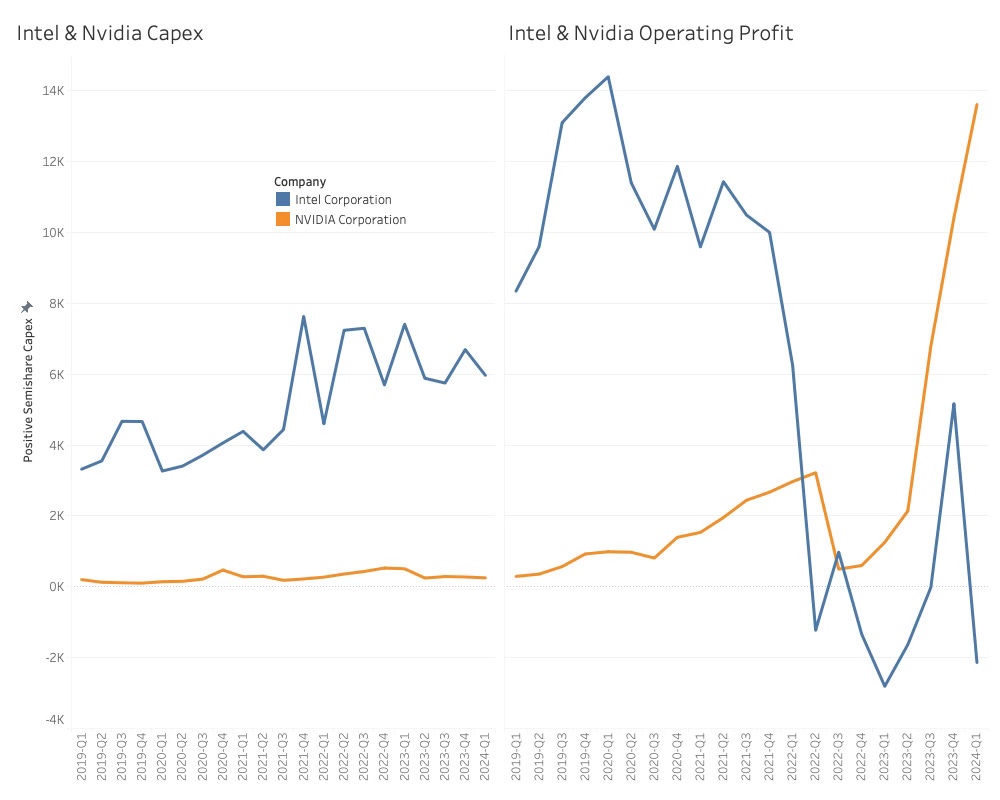

Intel has recently unveiled a bold and promising strategy, a testament to its resilience and determination. However, this strategy comes with significant financial challenges. As illustrated in the comparison below, Intel has historically been able to fund its approximately $4B/qtr Capex as its Operating profits hovered around $11B. But as the market changed, Intel’s operating profit is now approaching zero while its CapEx spending is increasing as a result of the new strategy of also becoming a foundry ased to the area of $6B$/qtr. The increased spending is now approximately $6M and is not a temporary situation but a reality that will persist

Intel can no longer finance its strategy through retained earnings and must engage with the investor community to obtain financing. Intel is no longer the master of its destiny.

Intel is hit by two trends in the Datacenter market:

- The transition from CPU to GPU

- The transition from Components to Systems.

Not only did Intel miss the GPU transition business, but it also lost the CPU business because of the system transition. Nvidia GPU systems will use their CPUs, Intel is not invited.

The revolution of the semiconductor supply chain

There are two main reasons the AI revolution is changing the data center part of the supply chain.

One is related to the change from standard packaged DRAM to High-Bandwidth Memory (HBM), and the other is related to new packaging technologies (CoWoS by TSMC). Both are related and caused by the need for bandwidth. As the GPU’s computational power increases, it must have faster memory access to deliver the computational advantage needed. The memory needs to be closer to the GPU and more of it, a lot more.

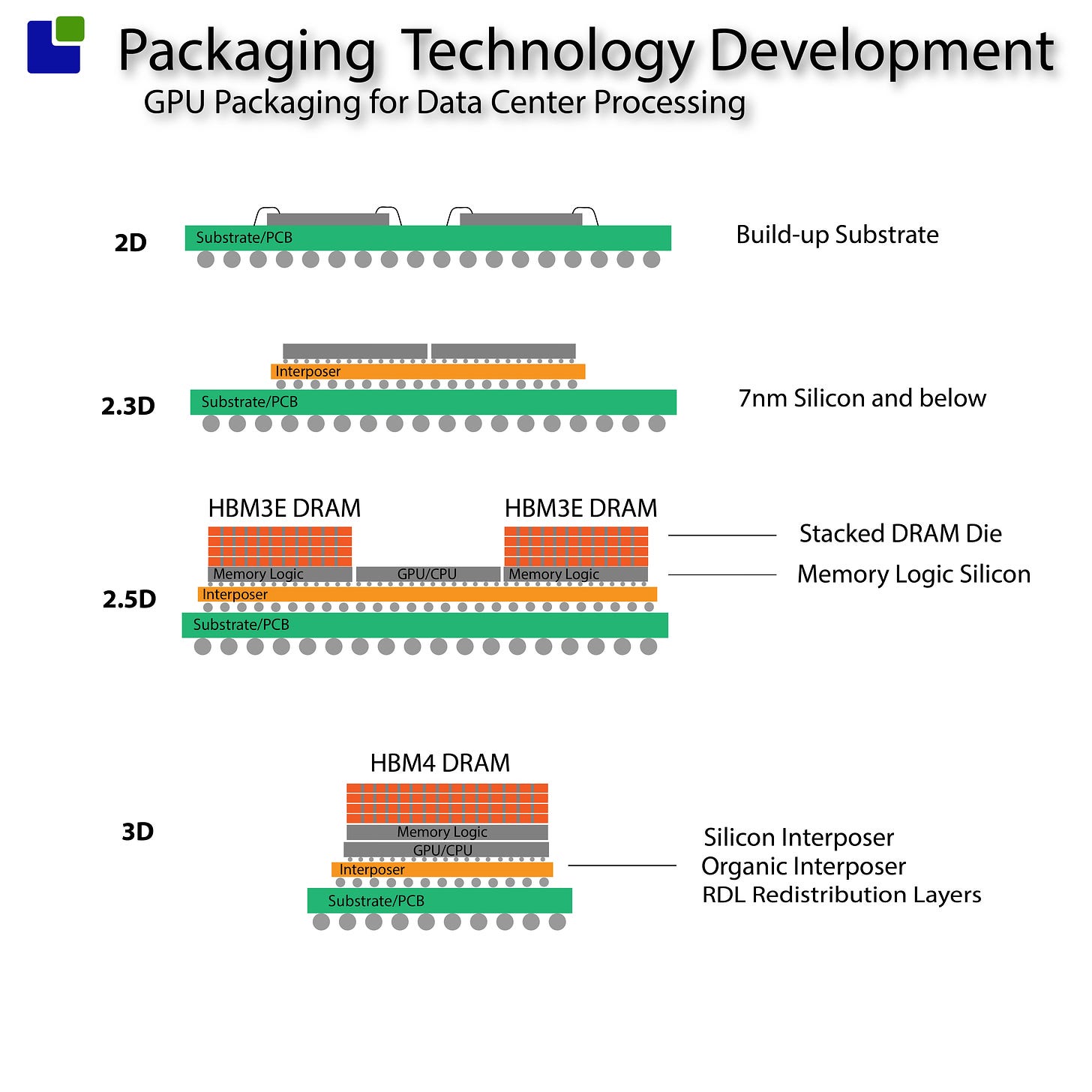

A simplified view of the relevant packaging technologies can be seen below:

The more traditional packaging method (2D) involves mounting the die on a substrate and connecting the pads with bond wires. 2.3D technology can bring the chips closer by flipping them around and mounting them on an interposer (often Silicon).

The current NVIDIA GPUs are made with 2.5D technology. The GPUs are flanked by stacks of DRAM die controlled by a base Memory Logic Die.

3D technology will bring memory to the top of the GPU and introduce many new problems for intelligent semiconductor people to solve.

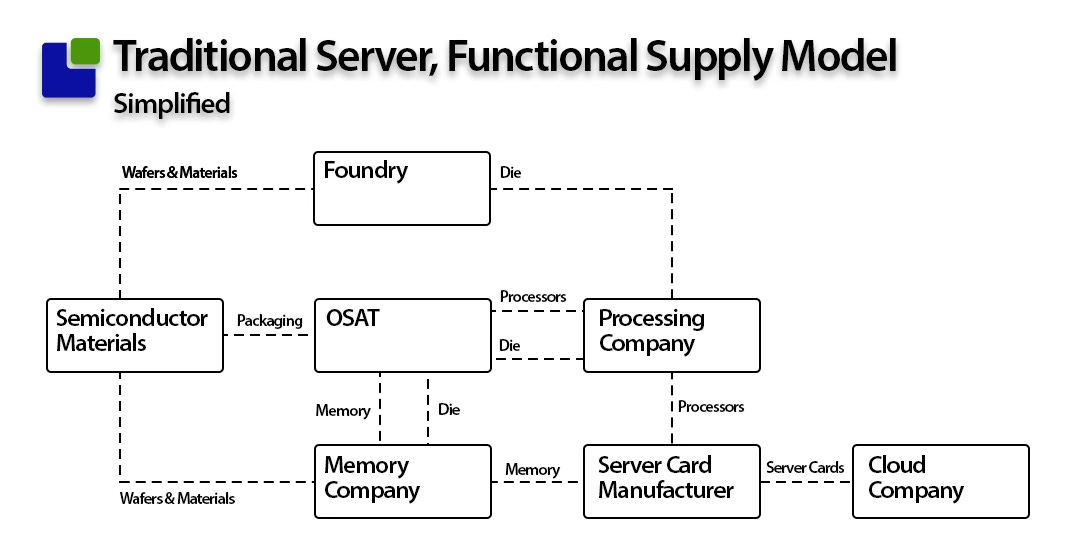

This new technology is dramatically changing the supply chain. In the traditional model standard of the rest of the industry, the server card manufacturer procured all components from the suppliers individually.

The competition between the Processing, Memory and the Server companies kept pricing in check for the cloud companies.

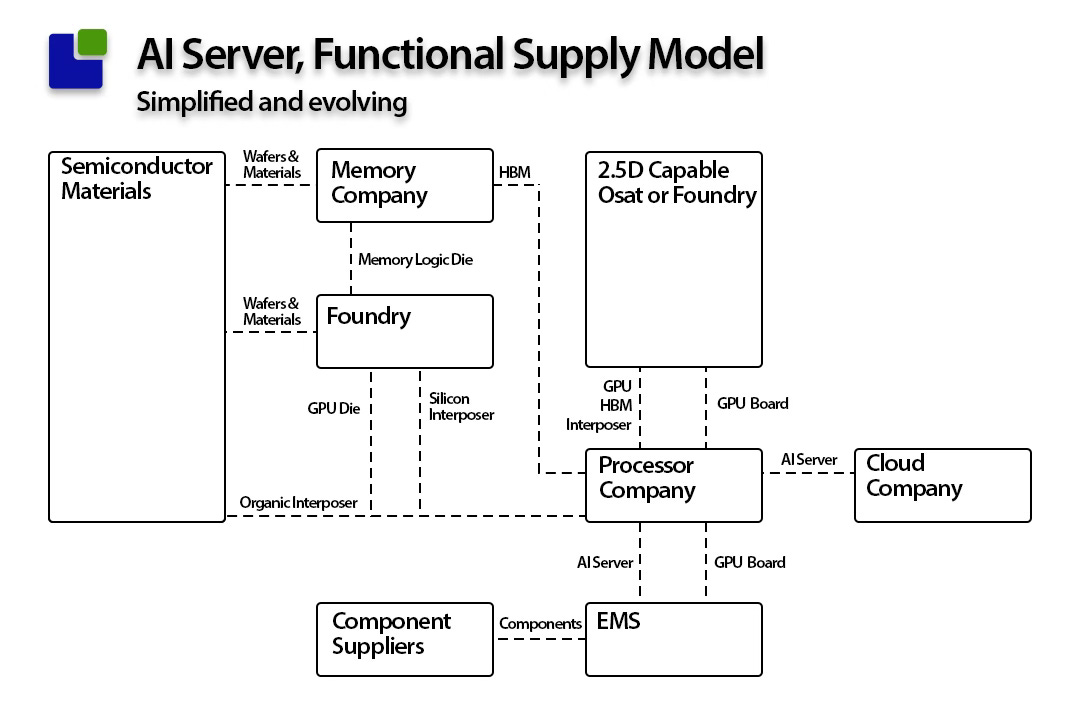

Much has become more complex in the new AI server supply chain, as seen below.

This change again makes the Semiconductor supply chain more complex, but complexity is our friend.

What did Nvidia report, and what does it mean?

Nvidia posted $26B$ revenue, significantly above guidance and below the $27.5B we believed was the current capacity limit. It looked like Nvidia could squeeze the suppliers to perform at the maximum.

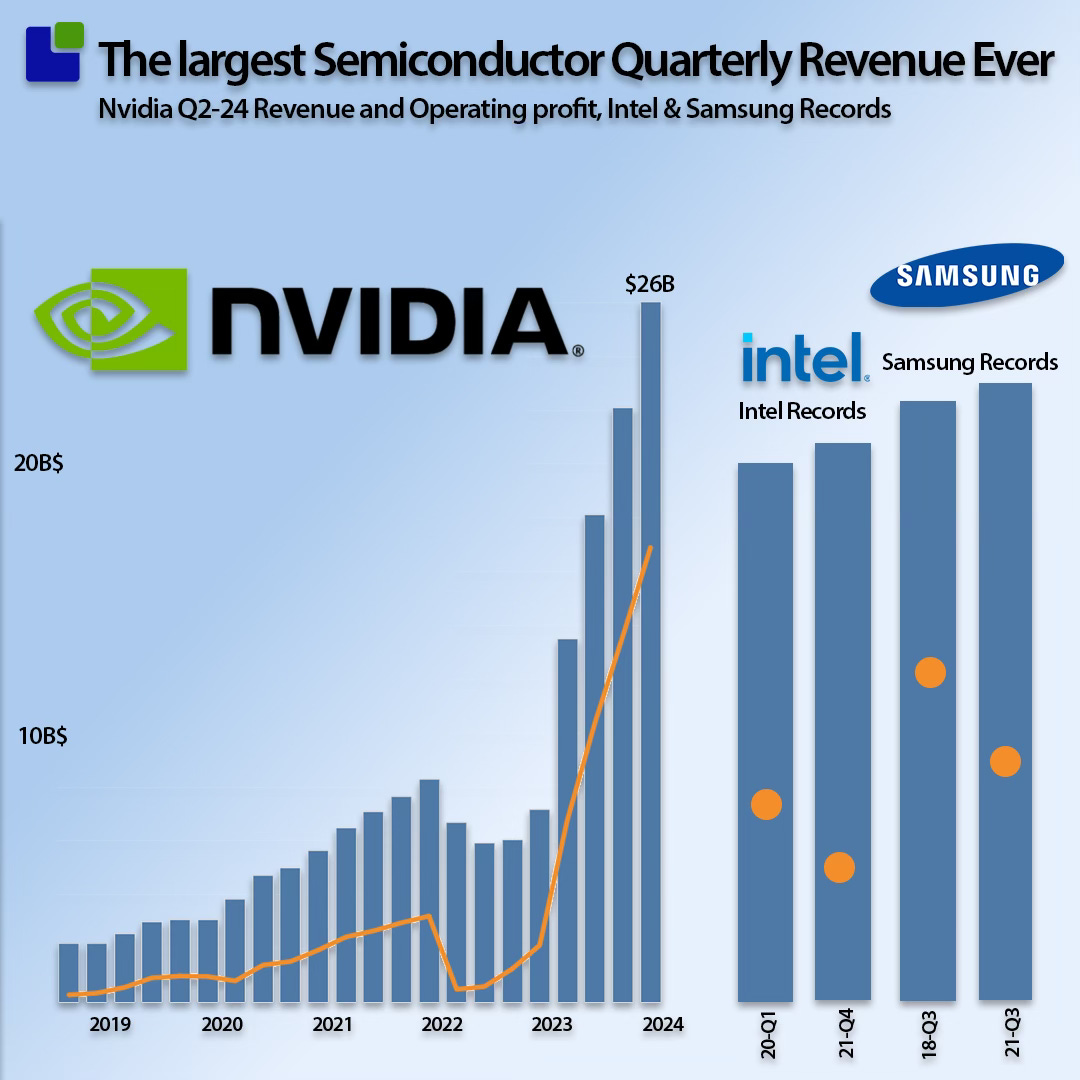

The result was a new record in the Semiconductor industry. Back in ancient history (last year), only Intel and Samsung could break quarterly records, as can be seen below.

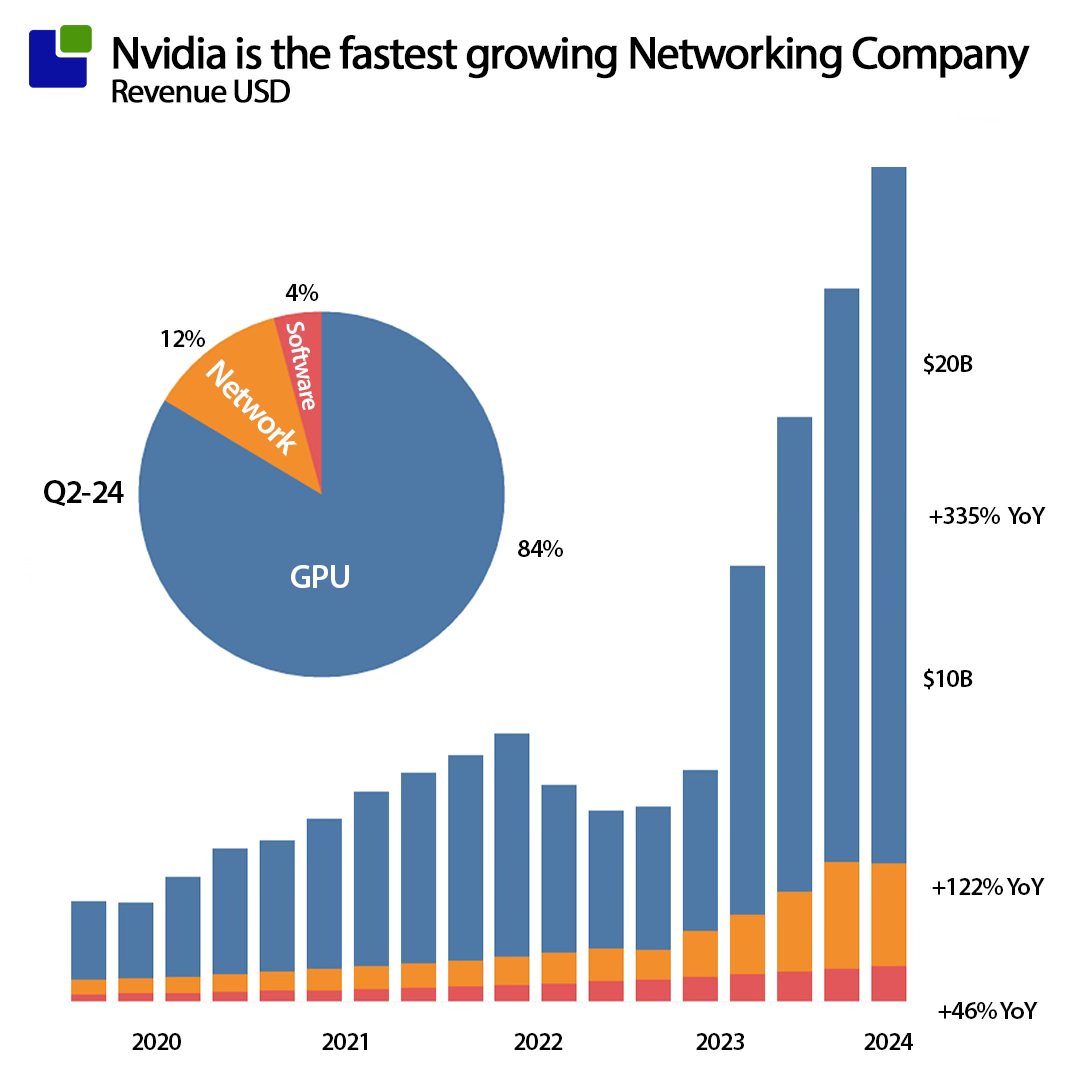

Nvidia also disclosed their networking revenue for the first time, through the earlier calls we had a good idea of the size but now it is confirmed.

As we believe almost all of the networking revenue is in the data center category, we expected it to grow as the processing business but networking revenue was down down just under 5% quarterly suggesting the bill of material is shifting in the AI server products.

Even though the networking revenue was down, the growth from same quarter last year was up, making Nvidia the fastest growing networking company in the industry. More about that later.

The most important market for Nvidia is the data center processing market and its rapid uncontrolled disassembly of the old market structure. From being a wholly owned subsidiary of Intel back in 2019, the painful story unfolds below.

In Q1-2024, Nvidia generated more additional processing revenue in the data center than Intel’s total revenue. From an operating profit perspective, Nvidia had an 87% market share and delivered a new record higher than the combined operating profit in Q1-24.

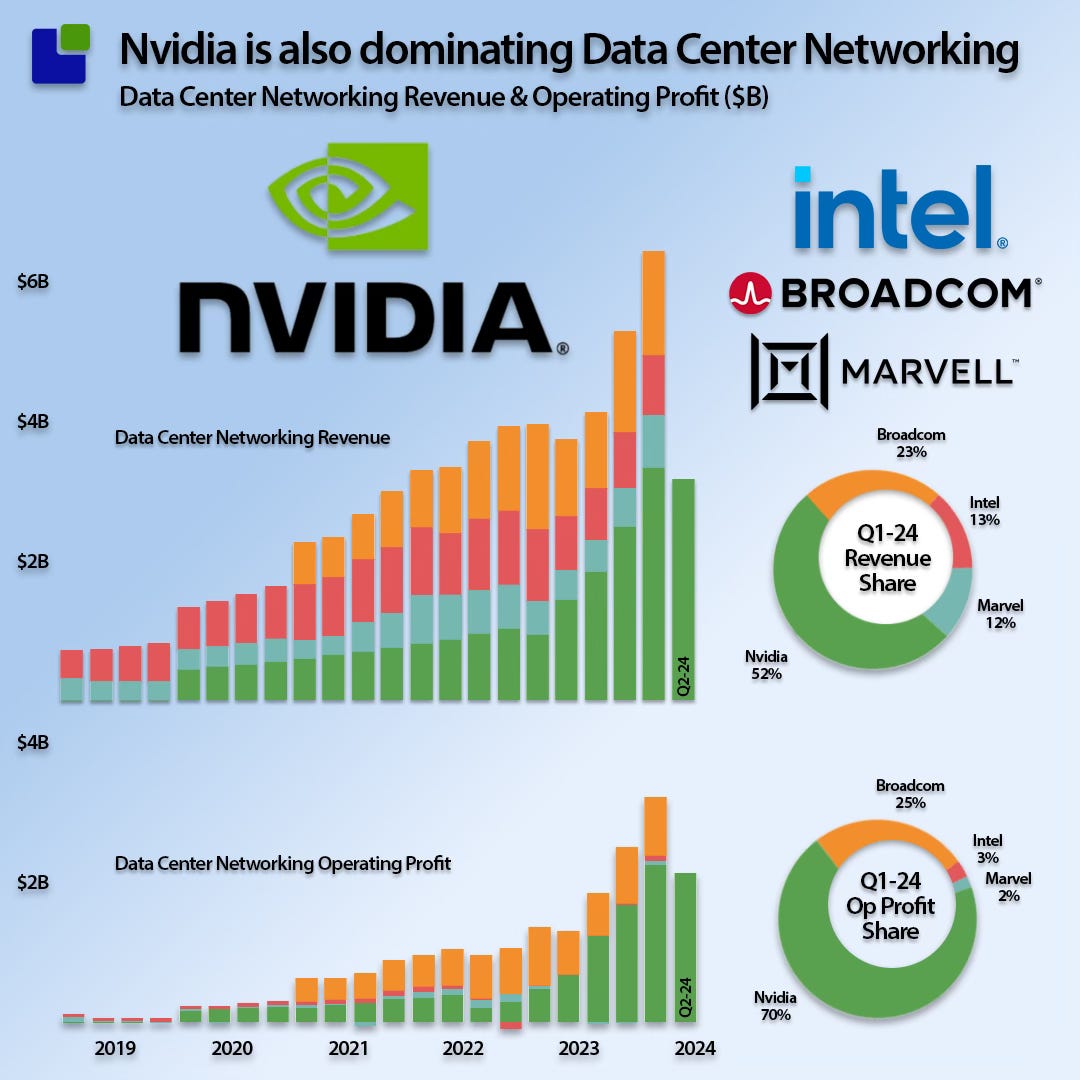

Although Nvidia reported flat networking revenue, the company’s dominance is spreading to Data center networking. Packaging networking into server systems ensures that the networking components are not up for individual negotiation and hurts Nvidia’s networking competitors. It also provides an extraordinary margin.

We have not yet found out what is behind the drop in networking, but it is likely a configuration change in the server systems or a change in categorization inside Nvidia.

Nvidia declared a 10-1 stock split.

Claus Aasholm @siliconomy Spending my time dissecting the state of the semiconductor industry and the semiconductor supply chain. “Your future might be somebody else’s past.”

Also Read:

Tools for Chips and Dips an Overview of the Semiconductor Tools Market

Oops, we did it again! Memory Companies Investment Strategy

A Century of Miracles: From the FET’s Inception to the Horizons Ahead