ON, ACLS, RMBS, AOSL, CAMT, ICHR, ONTO, SUMCO, and more!

SUMCO was the best call I read this quarter. There were many great bits of information but I want to start with the stat that really shocked me.

First of all, with regard to the LTAs out to 2026 and whether we did make progress in the last 3 months, that is correct. In the last 3 months, we were ultimately able to fully lock in LTAs for all of the capacity.

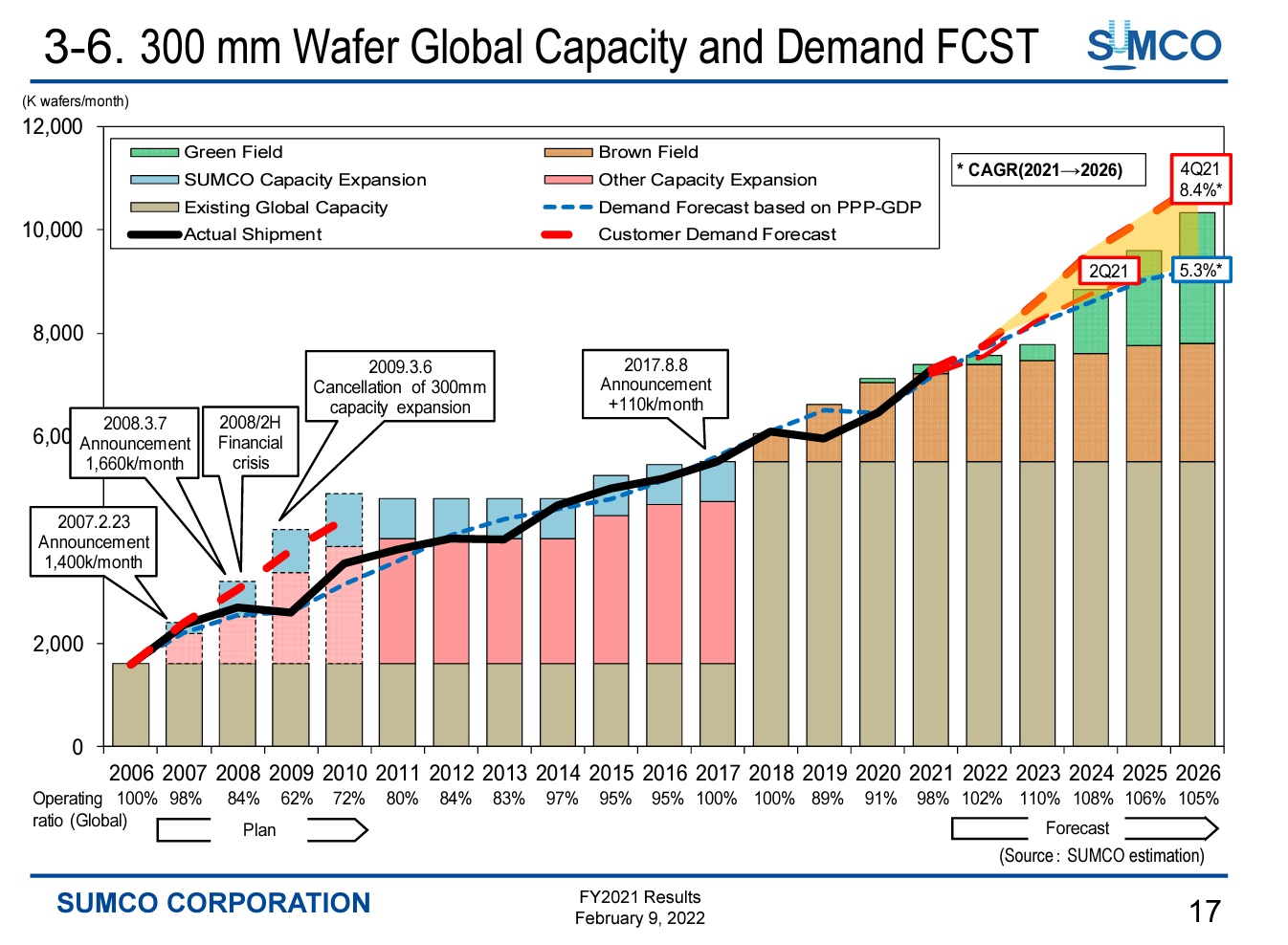

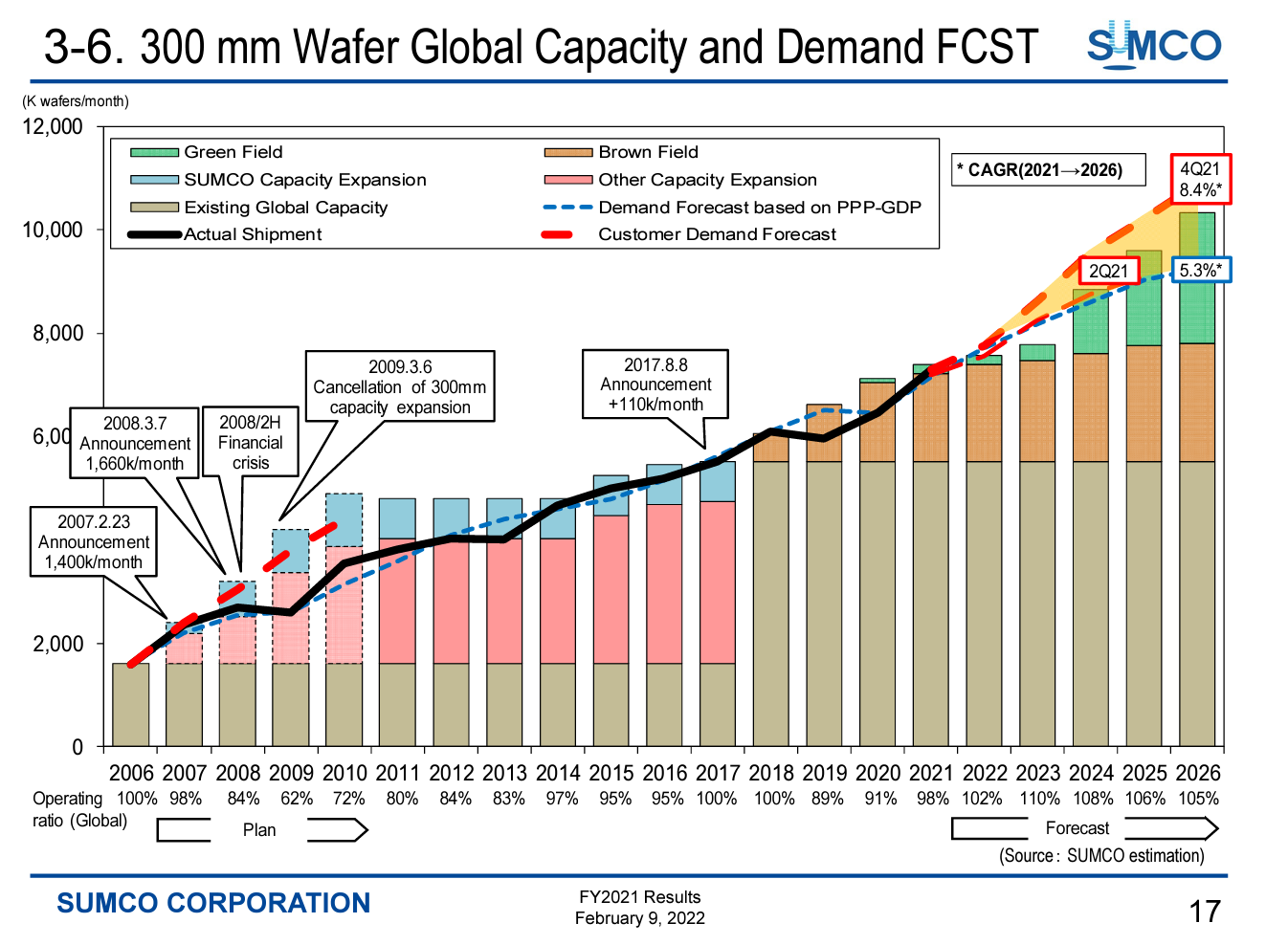

Additionally, both SUMCO and Global Wafers were extremely adamant that supply couldn’t be brought on immediately as they are missing key tools to add capacity and they believe that output won’t start ramping until 2023. They will continue to ramp their new factory until 2025, but that won’t be enough to satisfy wafer demand.

Until then the thing that will continue for wafer companies is price raises. These price rises are yet another part of why semiconductor costs are rising everywhere. SUMCO’s price raises are 10% annually until 2024, mostly to offset the increasing rise of deprecation for their capacity ramp.

The thing that was so confusing is if they are raising prices 10% a year, adding capacity, and most of their operating profit growth was primarily from price raises, why aren’t they pushing more capacity ASAP? Part of it seems to be an oligopoly decision from Shin-Etsu, Global Wafers, and SUMCO, but another part is it truly seems like they cannot. They are having the same lead time problem as the rest of the fabs.

Sadly, there are many individual processes to fabricating a wafer at SUMCO. So regardless of the price of the equipment, the absence of even a single piece of equipment will prevent us from completing the wafer fabrication process.

The next part that gave me pause was they believe that their demand model is booked out to 2026, inclusive of industry capacity additions. Given there really are only 3 wafer suppliers, I candidly have to ask what the hell is going on? Will we be talking about wafer shortages 2 years from now?

Part of the problem is that ramping greenfield investment is something that SUMCO said was extremely challenging for them in 2017, and this will be challenging to ramp greenfield again.

Unfortunately, the lack of experience meant that we really struggled in 2017 and 2018. We have since focused on learning from our mistakes, and mistakes often create the biggest opportunity for learnings. As a result, this time around, our workforce is much more experienced and prepared.

And as an organization, because of our previous struggles, we now have a deeper bench of experienced workers. This is why we believe we can undertake this kind of large-scale expansion. That is my view.

I would also say that equipment operators require significant accumulated experience. These are not the kind of jobs, where you can pick up the skills very easily over a short period of time.

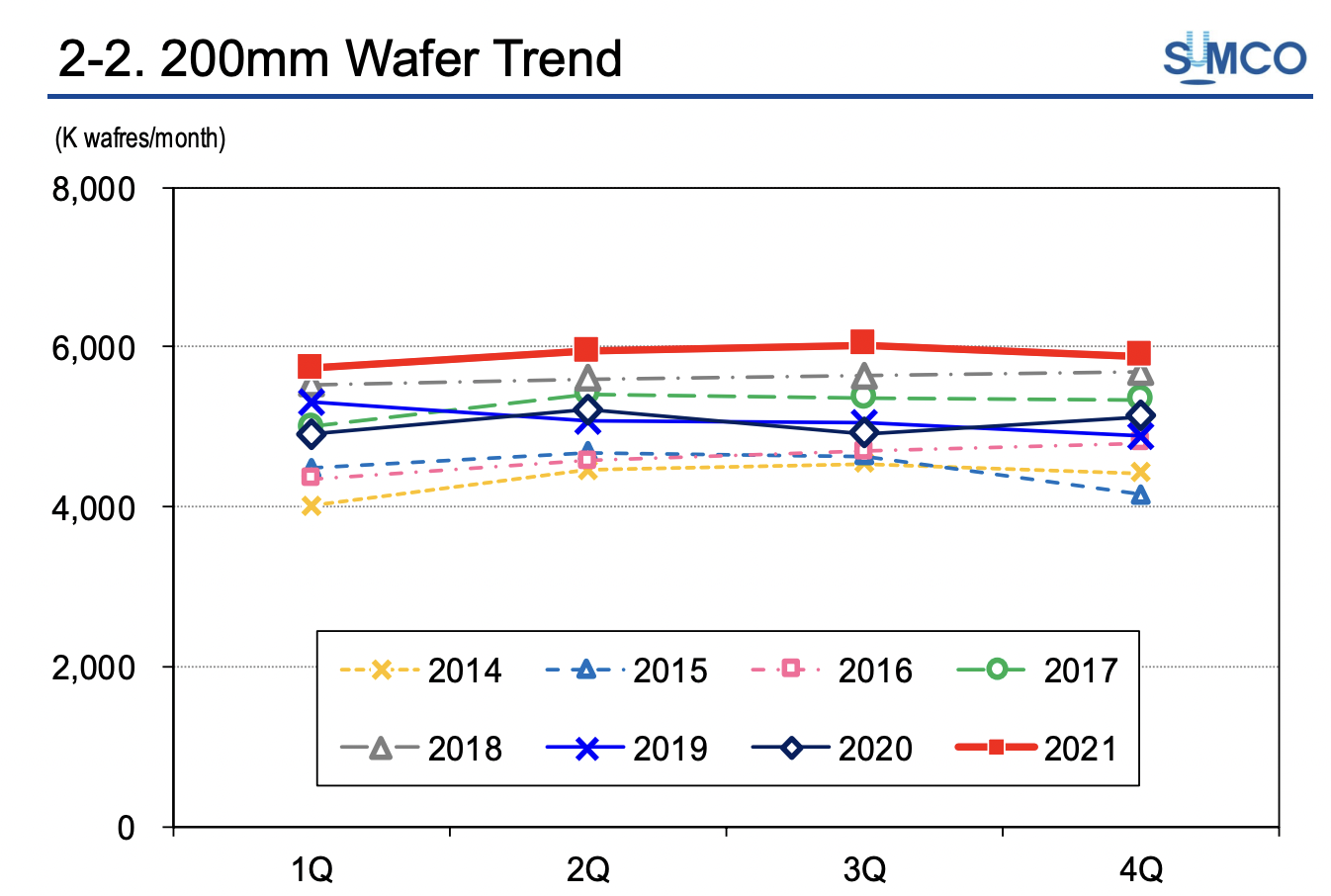

Another part of the wafer shortage story that made me ask “WTF” out loud once again was the 200mm wafers. SUMCO said that they would never add 200mm wafers and that there is no way to increase 200mm wafers. All of their supply improvements have been brownfield expansion and according to SUMCO, the 2021 capacity additions are the end of their brownfield ability to expand. The equipment no longer exists.

It is possible that 200-millimeter prices could continue to rise over time. Equally, you could see a pause in the rise in prices. There is no way to increase 200-millimeter volume. The equipment is no longer available and older facilities that have been idled, are obsolete. So increasing volume is not possible.

As good as it’s going to get

The trailing edge looks like it will be the worst impacted by price raises, especially 150mm and 200mm wafers. Price raises will likely continue as long as there are mission-critical and qualified products that are unlikely to swap over. Think of automotive analog and other products. Meanwhile, 200mm wafers will never see additions of capacity. This is a bit reminiscent of the Fortran programming shortage.

Anyways I want to talk about the other slides they had in their deck, particularly their demand graphs and their customer inventory graphs.

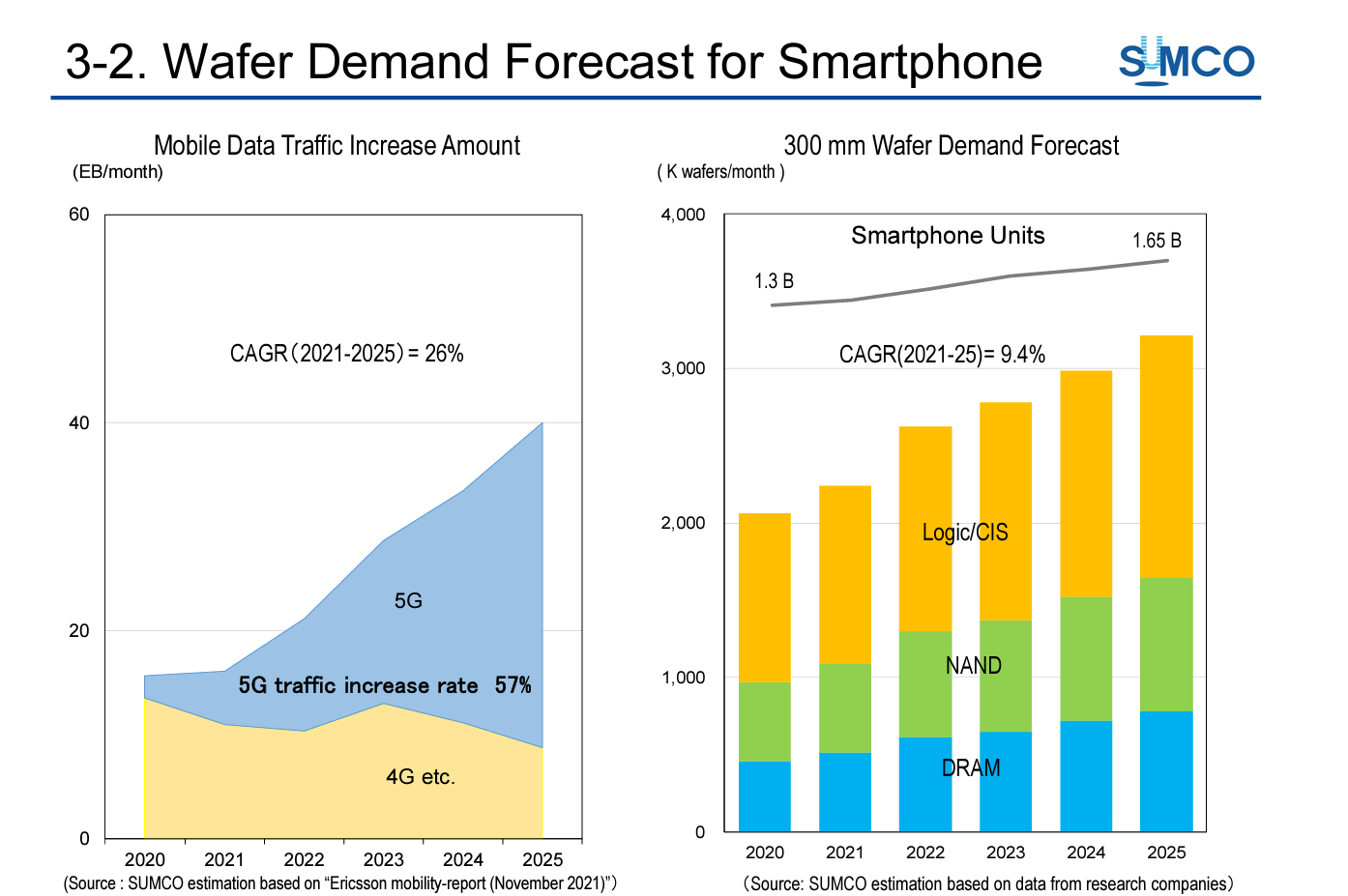

First, let’s talk about their demand builds. They expect Smartphone units to increase at a 4.9% CAGR from 1.3 billion units to 1.65 billion units, but starting points matter. From 2019 at 1.48 billion units this is only a 1.9% unit CAGR. So the real differential is content increases, they expect approximately 4.5% annual content increases in smartphones. That sounds correct to me.

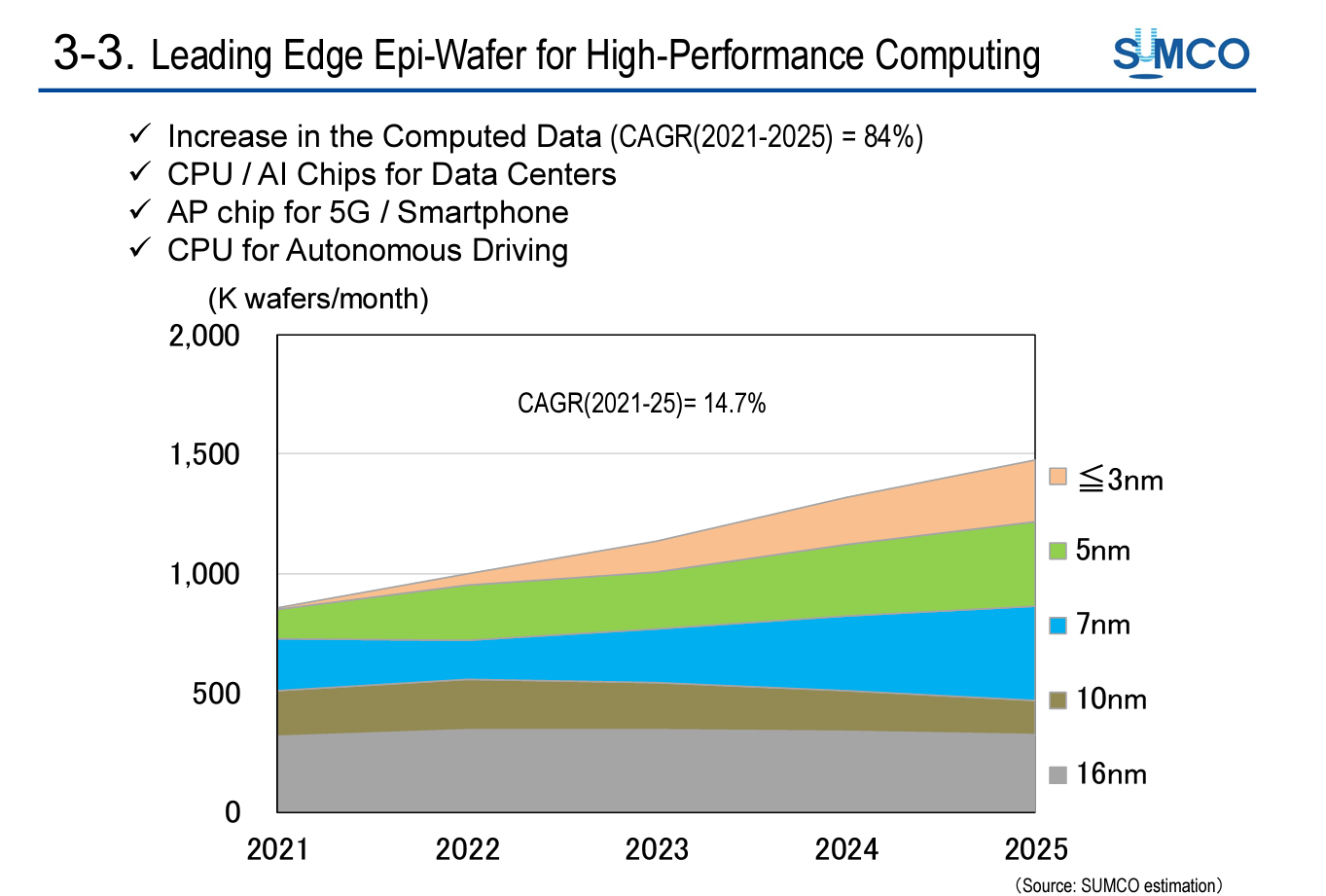

Next, they talk about HPC demand, and I really liked this unit analysis because I have never seen anyone take a crack at it before.

They believe that HPC will be approximately a ~14.7% CAGR in unit growth, and given its the largest incremental growth market I believe that this is correct. I believe that value will likely outgrow this, but something like a mid-double-digit value CAGR plus ~15% unit CAGR will net us to a 20%+ growth market.

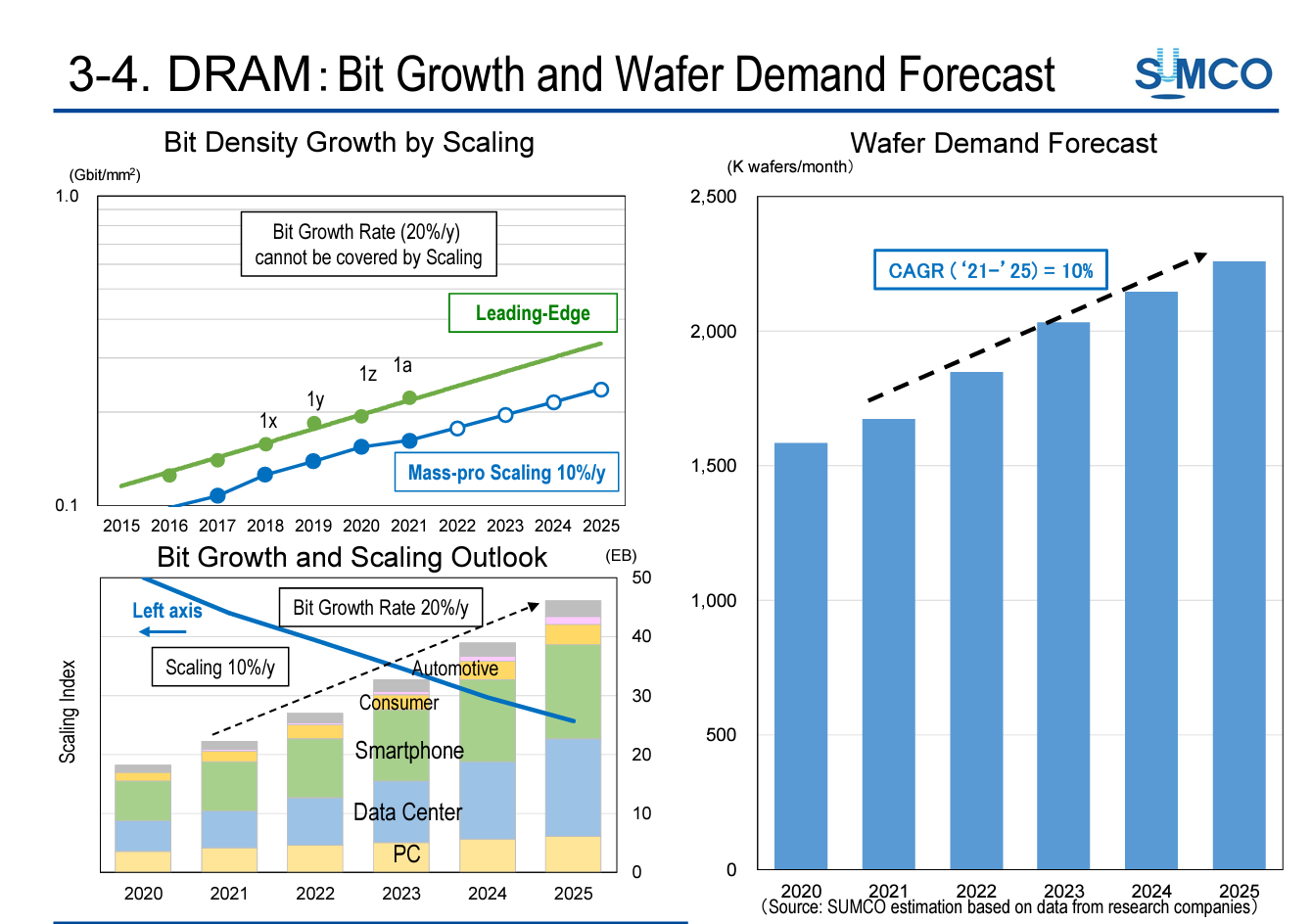

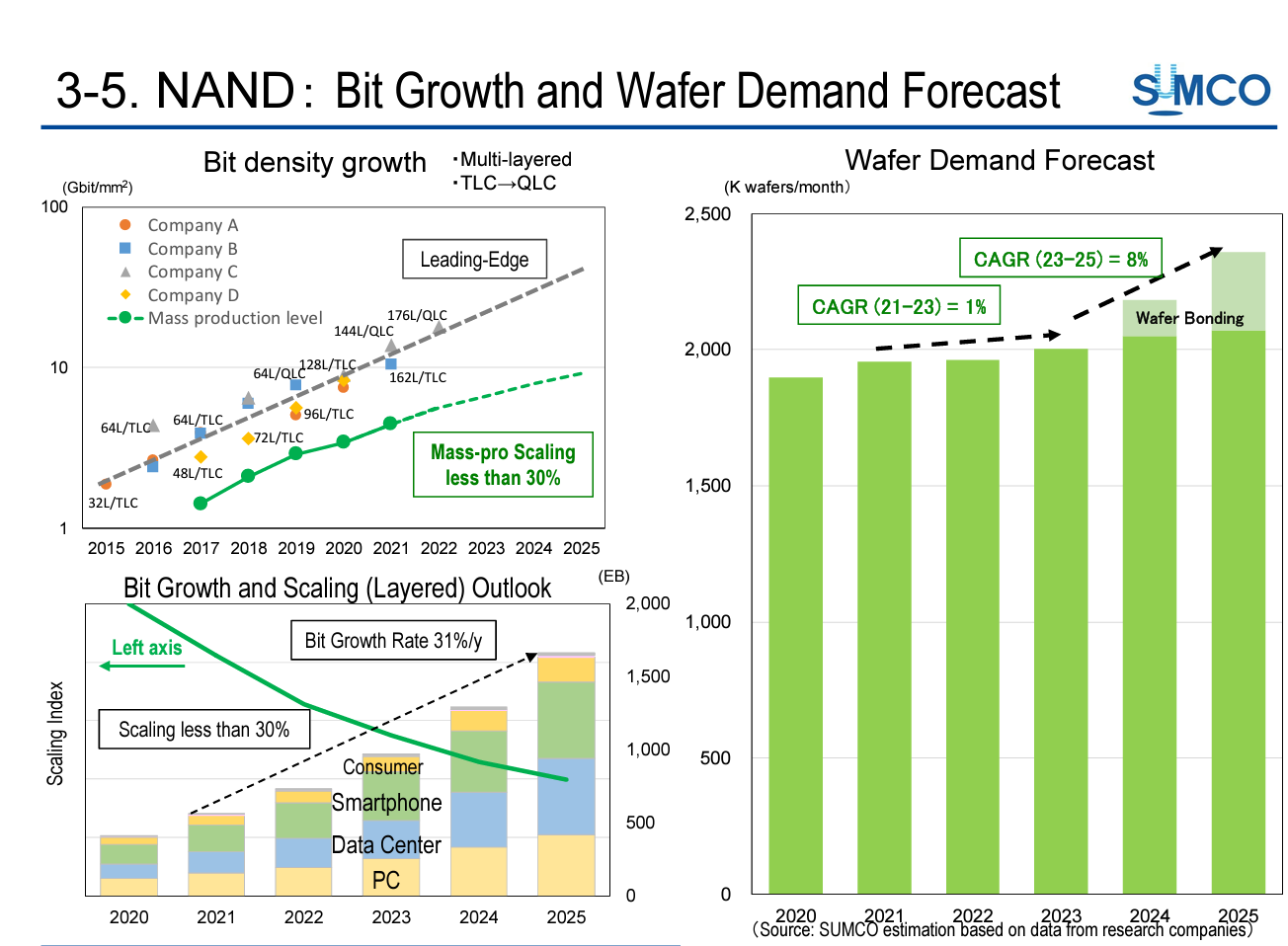

On to DRAM and NAND. They expect DRAM bit growth rate to be approximately 20% and scaling to be 10%, so wafer volume growth will be the differential at 10%.

NAND’s bit growth has essentially kept in line with the demand rate, with a slight differential that shows up in wafer demand (1%). But going forward bit growth will start to decelerate and one of the ways to solve this is to bond wafers together, and this will be a new incremental wafer demand.

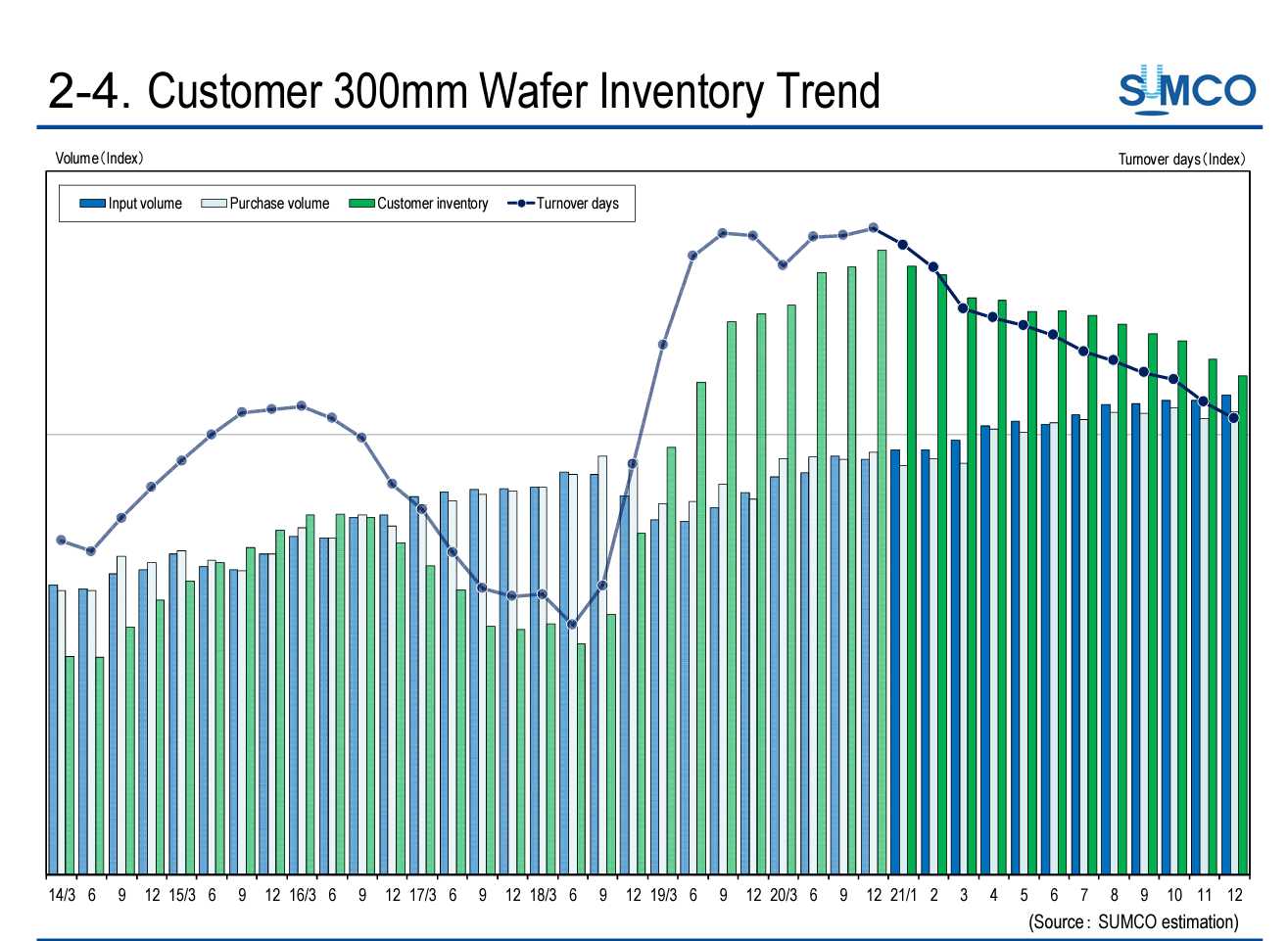

Last but not least I want to talk about their inventory graphs. I really don’t know how to read the graphs, and I interrupted this as colored as their estimates and the trailing as historical quarterly inventory builds. Are the forward estimates monthly or quarterly? The number scheming implies monthly.

They believe that wafer inventories are falling massively right now, as depletion is starting to take customers below 1 month of inventory.

This chart shows estimated customer inventory for 300-millimeter wafers. You can clearly see the sharp decline in customer inventories. This is for 300-millimeter wafers as a whole. We believe that customer inventory has dropped to 1 month. If inventories drop below the 1-month level, it creates a precarious situation for the customers.

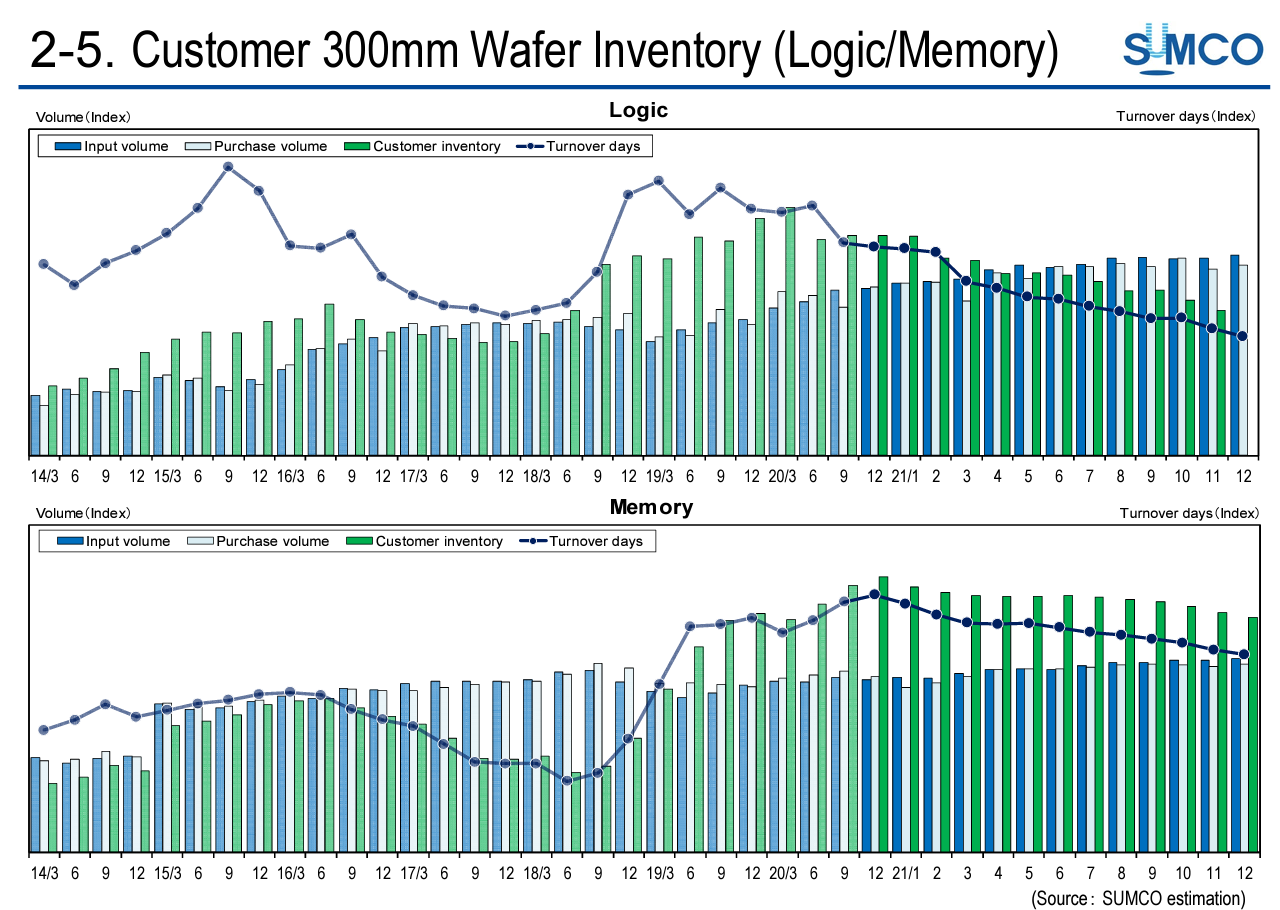

If we then look at the next slide, Slide 11, which breaks out customer 300-millimeter wafer inventory between logic and memory, you can see that logic is already at 0.7 months, while memory is around 1.2 months. So as you can see, the shortages are particularly acute for logic.

I am unsure what to make of this, but they essentially believe that memory customer inventory spiked during the 2019 cycle, remained high until 2021, but now are going to systematically decrease. I thought the inventory charts in general brought more questions up than answered. Inventories are clearly down at Logic (makes sense) but up in memory and rising (that is bearish!) but should come down soon (good!).

Maybe the context of their entire capacity being booked until 2026 paired with falling inventories is the point they were trying to make. There is information for both the bears and bulls in this chart.

The rest of the earning update is behind a paywall, I just thought everyone should read the SUMCO update.

Also read:

The Rising Tide of Semiconductor Cost

How France’s Largest Semiconductor Company Got Stolen in Plain Sight

Facing the Quantum Nature of EUV Lithography