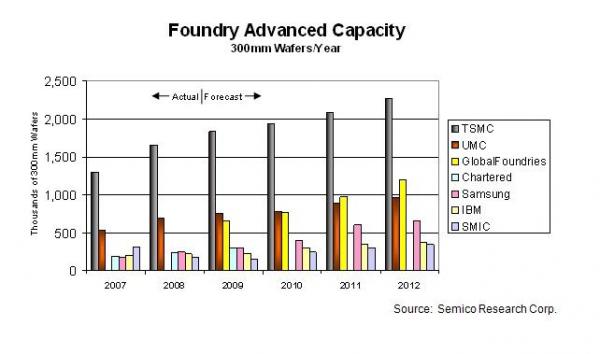

The big news last week was Global Foundries’ (GFI) agreement to acquire Chartered Semiconductor (CHRT) for $3.9B, but what does it really mean to the semiconductor world in total?

CurrentlyTSMC has 11 fabs producing wafers, 8 in Taiwan, 1 in Shanghai, 1 in Singapore, and 1 in Washington State. After the acquisition, Global Foundries will have Chartered’s 6 fabs in Singapore, AMD’s fab in Dresden with 1 more fab under construction in Dresden and another under construction in upstate New York, so 9 fabs in total.UMC has 10 fabs, 8 in Taiwan, 1 in Japan, and 1 in Singapore, and SMIC has control of 11 fabs in China. The ranking numbers above are clearly disjointed, UMC is #2 with 10 fabs, while SMIC is #4 with 11 fabs?

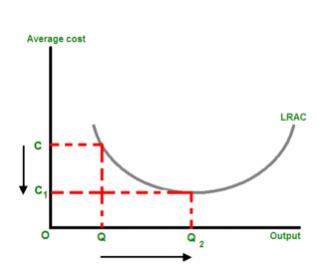

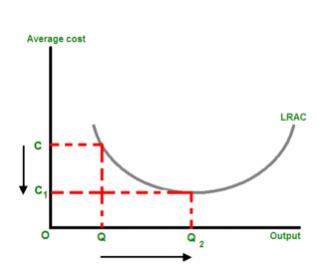

Unfortunately capacity does not guarantee economies of scale: TSMC owns 50% of the foundry market revenue and 80% of the profits, UMC is second with 12%, GFI, SMIC, and CHRT have yet to show a profit. Why are these numbers disjointed you ask? Wafer yield (good die per wafer) is important of course, yield is secret however, but from personal experience, TSMC is the top yielding foundry and these numbers support that.

Just as important is foundry wafer pricing, which, interestingly enough, is determined by the customer, more often than not. TSMC is considered a first source for semiconductor manufacture, UMC, CHRT, and SMIC are considered second sources, meaning that leading fabless semiconductor companies work with TSMC first, then replicate manufacturing at the other foundries. TSMC has the most advanced process technologies and the most skilled people so they are an easy first choice, reducing the risk of introducing a new product, and getting it to market as early as possible. Once the product is ramped on a TSMC process, wafer price becomes the central issue and the cutthroat negotiation with other fabs begin. Second and third sourcing also has fault tolerance built in, just in case Taiwan has a natural or unnatural disaster.

The foundry business challenge is to make their manufacturing processes sticky, focusing on customer retention, enabling a premium pricing strategy. Believe me, this is a key part of TSMC’s overall corporate strategy, a very deep customer loyalty program. Examples include:

- Semiconductor design enablement programs, TSMC spends millions of dollars every year ensuring Semiconductor Design and Manufacture Predictability.

- TSMC has spent $500M+ developing TSMC branded Semiconductor IP that is provided at no extra charge to TSMC customers.

- TSMC has a closely coupled services group in Global Unichip Corporation, which competes with the fabless ASIC companies mention in my blog: EDA is Dead.

Can GFI compete head-to-head with TSMC? Not now, and probably not ever. GFI’s United Arab Emirates based financial backing is a key selling point, deja vu of SMIC which is backed by the Chinese government but has yet to show a profit. GFI’s competitive advantage today is that they are not TSMC, for those who fear a foundry monopoly. Who knows what tomorrow will bring but based on my knowledge of the GFI executive staff, expect an innovative and sticky approach to the foundry business.

Share this post via:

Flynn Was Right: How a 2003 Warning Foretold Today’s Architectural Pivot