Intel’s ability this week to raise $6B in debt at rock bottom interest rates should give one a moment to pause and consider what this portends for the future of the company and whether it remains in public hands. We live in extraordinary times where a fiscally excessive government can sell 10 year treasuries at 1.6% and the largest of firms can tap the markets at will for rates that are not much higher. Is it possible that Intel will go private by the choice of management or even by way of a Leveraged Buyout? When one steps back and examines Intel’s financials it is easy to see how its current valuation, even with the ARM threat in mobile is in no way reflective of the cash flows that can be generated by the growing Data Center that overcomes a declining PC group and the future untapped leading edge process capacity coming on stream. It leads me to believe that Intel management is in deep discussion not only about the future of the x86 chip business but also how it can maximize its valuation for the executives and employees. As they say: better to figure out your own business or someone else will do it for them

Intel’s ability this week to raise $6B in debt at rock bottom interest rates should give one a moment to pause and consider what this portends for the future of the company and whether it remains in public hands. We live in extraordinary times where a fiscally excessive government can sell 10 year treasuries at 1.6% and the largest of firms can tap the markets at will for rates that are not much higher. Is it possible that Intel will go private by the choice of management or even by way of a Leveraged Buyout? When one steps back and examines Intel’s financials it is easy to see how its current valuation, even with the ARM threat in mobile is in no way reflective of the cash flows that can be generated by the growing Data Center that overcomes a declining PC group and the future untapped leading edge process capacity coming on stream. It leads me to believe that Intel management is in deep discussion not only about the future of the x86 chip business but also how it can maximize its valuation for the executives and employees. As they say: better to figure out your own business or someone else will do it for them

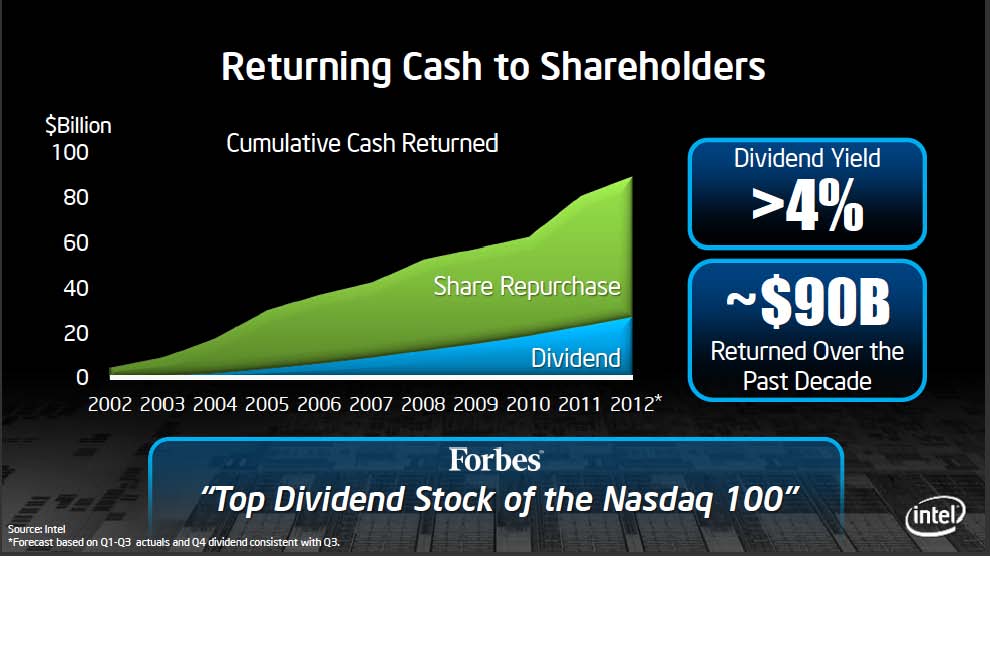

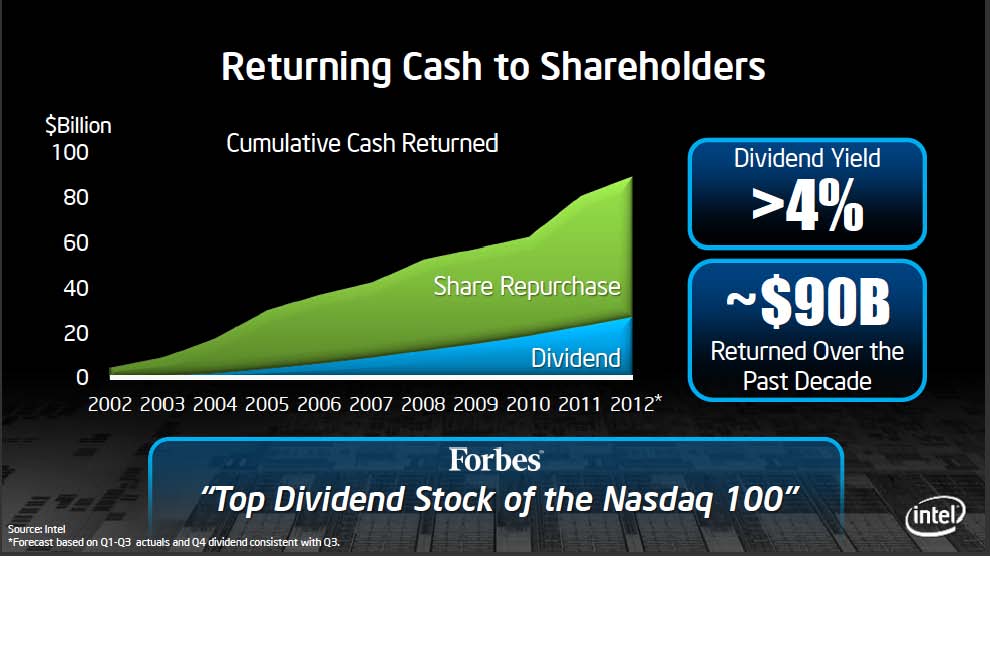

Until last fall, when they raised $5B in the debt markets, Intel had avoiding what is seen in the markets as a mark of death for growth companies. Debt is for consumer oriented, slow growth companies as a means to lower capital costs especially as it offsets profits through the reduction of corporate tax. However, the Walmart’s of the world can prove to the capital markets that its revenue and cash flows will be consistent unlike tech companies. But the low P/E valuations of Microsoft, Intel and even Apple are at the opposite extremes of what occurred in 2000. Therefore to satisfy investors in this time of global uncertainty, the tech giants have had to borrow money in order to buy back stock and increase dividend yields. Intel now offers a 4.5% dividend yield and as the chart above shows has spent $90B in the past decade to buy back stock and payout dividends. Another $90B and the company will just about have a complete buyout covered.

If we assume that Intel’s Data Center business grows to $20B in 2016 from roughly $10B in 2011, then given its 50% operating margins it can offset a reduction of the PC processor business by roughly a third, from $35B to less than $25B. This number obviously depends somewhat on the ASPs and margins of the client group. Long term I see it as a larger, more profitable version of what IBM put in place with their legacy mainframe business in the Gerstner Era of the 1990s.

In terms of comparison, last year a Server processor had an average ASP of $500 while a PC socket was near $100. The former had gross margins exceeding 80% while the PC processors came in at just under 60%. The two x86 processor families are diverging in terms of die sizes and power requirements as servers deliver more ASP as they get larger and can consumer over 110W max. The PC processors are headed towards smaller die sizes and lower voltages in order to scale eventually down to sub 5W max. This will shift the mix inside the fabs as the server chips begin to dominate the number of wafers shipped. It is easy to imagine that the combined x86 groups consuming roughly the same amount of wafers from three dedicated fabs. Thus the need to fill the extra fabs with anything that is high volume.

Intel’s ability to generate a huge amount of cash has been overlooked by many analysts and is probably due to the high outlay of capital equipment these past two years, the stock buybacks and the rich dividend. If Intel scales its CapEx back from $12B to $7B (along average historical outlays) and excludes the stock buyback, then they would be able to generate roughly $17B annually in cash at the runrate of the last four quarters. As a side note, for 2011 Intel generated $6B in free cash after spending $18.4B on stock buy backs and dividends. And for all that the stock is below $20, which is well below the $70 high of 2000.

Therefore in a scenario I outlined above, with Data Center Revenue rising to $20B in 2016 and Client Revenue dropping to $25B in the same timeframe, it is possible to see how Intel generates enough cash to buy itself out in 6-7 years at todays stock price. I am of course assuming that CapEx is scaled back to $7B and some amount of Operating expenses are reduced to reflect a company with lower growth potential. This scenario, however, does not even account for the addition of Foundry Revenue that three 14nm fabs could offer. Perhaps then a buyout is possible in 5 years. By comparison, Apple’s cash flow would require over 10 years for a buyout.

Intel’s new $6B debt has an average interest rate of 2.38% vs the current 4.5% dividend yield. When taxes are figured in, the cost of the debt being used to buyback stock will actually increase Intel’s cash flow by over $160M a year (by reducing dividend outlays). This opens up the question as to how much debt, Intel could secure that would enable management to run it for the benefit of themselves. I consider this an opening round and someone on Wall St. will pick up a pencil and start playing with some possibilities now that debt is free and equity is expensive. A private buyout of Intel to tap its enormous cash flow is something that no one could have imagined in 2000 or even last year. This is how far Fear has taken over the market.

Full Disclosure: I am Long AAPL, INTC, ALTR, QCOM

Share this post via:

Comments

0 Replies to “Intel Taps The Debt Market: Should They Go Private?”

You must register or log in to view/post comments.